Market Overview

The Australia Hovercraft Market is valued at approximately USD ~ million in 2024, based on extensive analysis of historical market data, including domestic demand and supply trends. This market is primarily driven by the increasing demand for hovercraft in defense, border patrol, and offshore transport. The need for versatile, high-speed transportation systems that can operate on diverse terrains, such as wetlands, rivers, and coastal areas, has accelerated market growth. Hovercrafts are becoming an essential part of military modernization efforts, particularly for amphibious operations and disaster relief activities, where conventional vehicles cannot reach. Additionally, commercial operators in the tourism and transport sectors are increasingly adopting hovercrafts for their ability to navigate challenging environments.

Australia remains one of the dominant regions for hovercraft operations, particularly in cities like Sydney, Melbourne, and Brisbane, owing to their proximity to coastal areas, waterways, and offshore industries. The strategic location of these cities, with easy access to maritime zones, has boosted demand for hovercrafts used in coastal patrols, rescue operations, and commercial maritime services. Furthermore, key defense forces located in southern and northern Australia also contribute to the dominance of hovercrafts, as these regions are vital for military operations requiring rapid, amphibious deployment in various coastal environments.

Market Segmentation

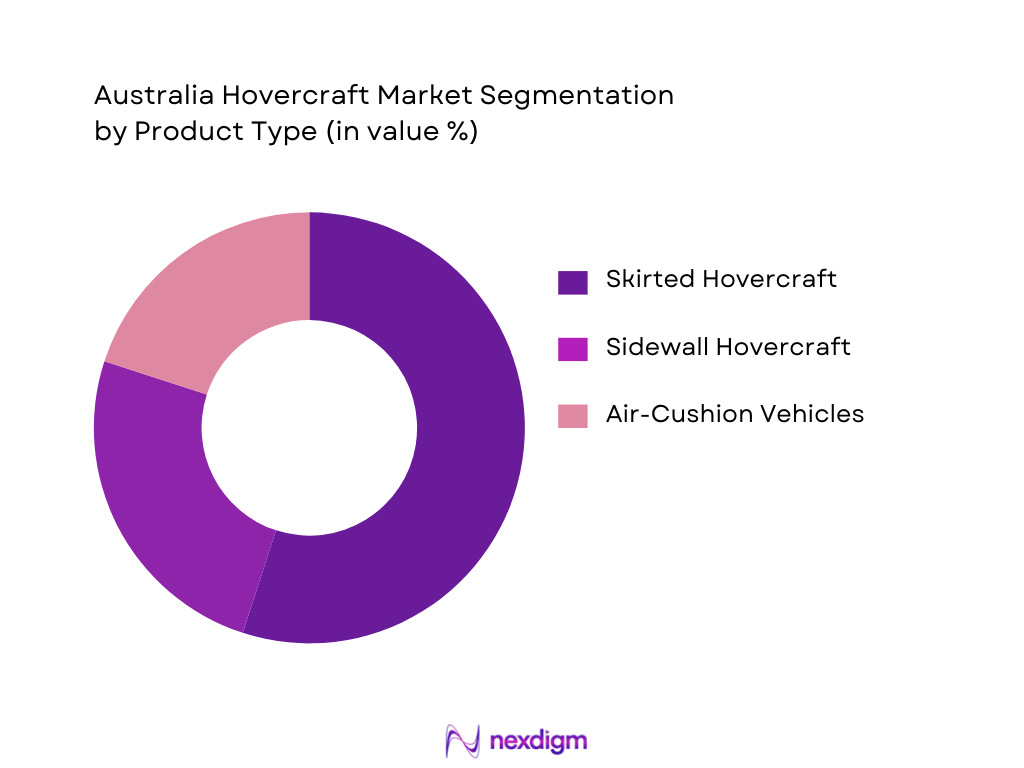

By Product Type

The Australian hovercraft market is segmented into skirted hovercraft, sidewall hovercraft, and air-cushion vehicles (ACV). Skirted hovercrafts have a dominant market share due to their versatility and ability to operate in a variety of conditions, including water, land, and ice. They are particularly favored for both military and civilian use because of their robust design and multi-terrain capabilities, making them ideal for flood zones, coastal areas, and rescue operations. This product type continues to see growing adoption due to advancements in propulsion systems that enhance their performance in rough terrains.

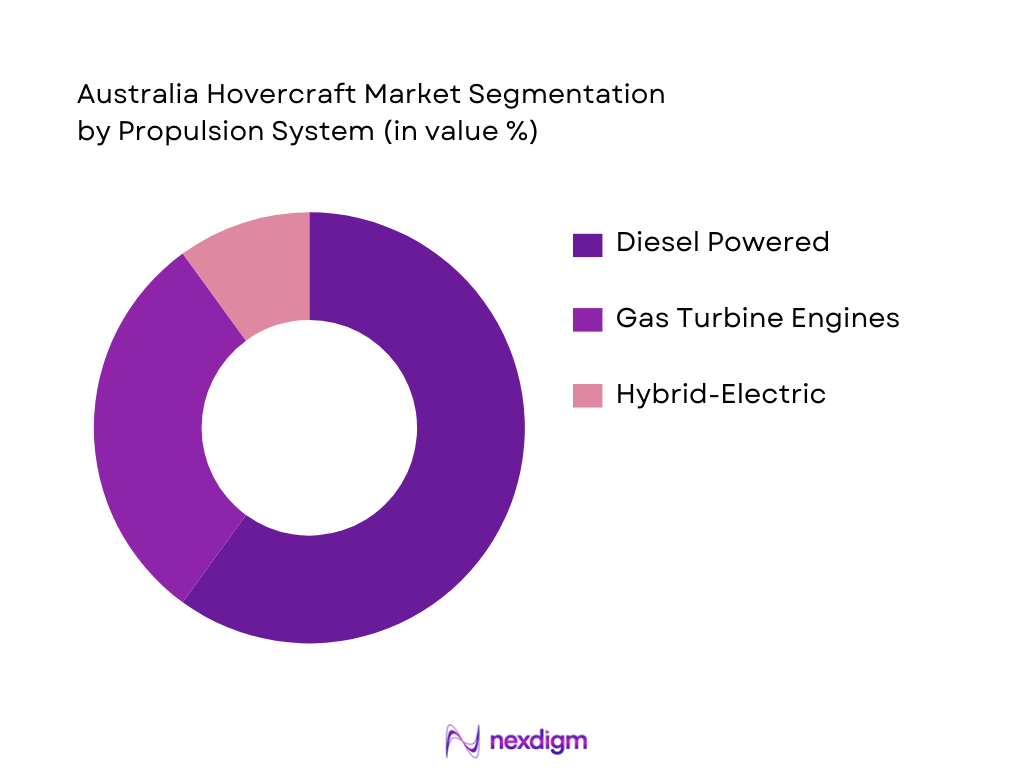

By Propulsion System

The market for hovercraft propulsion systems in Australia is divided into diesel-powered, gas turbine engines, and hybrid-electric systems. Diesel-powered systems dominate the market, primarily due to their cost-efficiency and high power output, which is necessary for large, heavy-duty hovercraft. These systems are commonly used in military hovercraft for amphibious operations and by commercial operators requiring robust and reliable propulsion for offshore transport. Hybrid-electric systems, though growing in popularity, remain a smaller segment as the technology is still evolving, and demand for full electric or hydrogen-powered hovercraft has not yet reached critical mass.

Competitive Landscape

The Australia Hovercraft Market is characterized by the presence of both local manufacturers and international OEMs. Major players in the market include Australian companies such as MARIAH International Hovercraft Australia Pty Ltd, which specialize in bespoke hovercraft solutions for military and commercial applications. Additionally, international brands such as Griffon Hovercraft and Neoteric Hovercraft are key competitors in the market, providing high-quality, versatile hovercraft with advanced propulsion systems. The market is consolidated, with a few large players dominating the supply of hovercrafts to government and defense agencies. Companies like Textron and Griffon Hovercraft lead the market with their robust product offerings in both military and commercial segments.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technology Focus | Service and Maintenance | Market Focus |

| MARIAH International | 1980 | Australia | ~ | ~ | ~ | ~ |

| Griffon Hovercraft | 1968 | United Kingdom | ~ | ~ | ~ | ~ |

| Neoteric Hovercraft | 1962 | USA | ~ | ~ | ~ | ~ |

| Textron Systems | 1954 | USA | ~ | ~ | ~ | ~ |

| Universal Hovercraft | 1980 | USA | ~ | ~ | ~ | ~ |

Australia Hovercraft Market Analysis

Growth Drivers

Defense Modernization & Amphibious Capability Expansion

Defense modernization and the expansion of amphibious capabilities are central to Australia’s evolving defense strategy. Hovercraft play a critical role in enabling rapid, multi-terrain deployment for both military and humanitarian operations. Their ability to navigate coastal, riverine, and flood-prone areas offers tactical advantages, ensuring versatile and effective responses in diverse environments. This demand for versatile, all-terrain vehicles is growing as Australia seeks to enhance its defense capabilities and address emergency response needs.

Maritime Border Security Spend

The increasing focus on maritime border security is another significant driver for hovercraft adoption. With growing national security concerns, Australia has invested heavily in enhancing its maritime surveillance and interception capabilities. Hovercrafts are crucial to this effort, as they can patrol the country’s extensive coastlines and reach remote islands, providing access to regions that traditional vehicles cannot. Their efficiency in navigating coastal and flood-prone regions makes them indispensable for securing Australia’s maritime borders.

Market Challenges

High Acquisition Cost and Lifecycle Operating Expense

One of the main challenges for the hovercraft market is the high acquisition cost and ongoing lifecycle operating expenses. Hovercrafts are expensive to purchase, and their specialized parts, fuel consumption, and maintenance can be costly. These factors make them less attractive, especially to smaller operators or in cost-sensitive sectors. While hovercraft offer distinct advantages, their high operational costs can limit widespread adoption.

Noise & Power Utilization Constraints

Noise and power utilization constraints also present significant challenges for hovercraft. Due to their propulsion systems, hovercraft generate considerable noise, which can be problematic in areas such as wildlife conservation zones or densely populated regions. Additionally, the power required for hovercraft operations limits their fuel efficiency, further complicating their adoption in sectors where fuel consumption and noise levels are critical factors.

Opportunities

Government Grants for Defence SME Innovation

The Australian government’s grants and incentives for defense SMEs create significant opportunities for innovation within the hovercraft market. These funding programs support the development of advanced technologies, including energy-efficient designs and hybrid propulsion systems. By fostering innovation, the government helps local manufacturers and startups expand their capabilities, driving the evolution of hovercraft technology and contributing to Australia’s defense sector growth.

Integration of Autonomy & Sensor Suites

The integration of autonomy and advanced sensor suites into hovercraft presents another exciting opportunity. Autonomous navigation systems and sophisticated sensor technologies can enhance operational efficiency, reduce the need for human operators, and allow for more precise navigation in hazardous environments. These advancements make hovercraft more attractive for military, emergency response, and environmental monitoring, offering enhanced capabilities and making them a more versatile and cost-effective solution for a range of applications.

Future Outlook

The Australia Hovercraft Market is expected to witness steady growth over the next five years, driven by continuous advancements in propulsion technology, increasing government investments in defense infrastructure, and a growing emphasis on environmental sustainability. As Australian defense forces modernize their fleets, hovercrafts are expected to play an increasingly significant role in amphibious warfare and humanitarian operations. On the commercial front, the tourism sector is likely to adopt more hovercrafts for eco-friendly travel experiences, while offshore industries will benefit from more versatile, high-speed vessels for logistics and transport. Furthermore, research into hybrid and electric hovercraft solutions is anticipated to gain traction, offering more energy-efficient and sustainable options in the long term.

Major Players in the Market

- MARIAH International Hovercraft Australia Pty Ltd

- Griffon Hovercraft

- Neoteric Hovercraft

- Textron Systems

- Universal Hovercraft

- AirLift Hovercraft Pty Ltd

- Christy Hovercraft

- The British Hovercraft Company Ltd

- Almaz Shipbuilding Company

- Hovertechnics LLC

- Bill Baker Vehicles Ltd

- Viper Hovercraft

- AEROHOD Ltd

- AirFlow Hovercraft NZ

- Ivanoff Hovercraft AB

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military and Defense Contractors

- Coastal and Border Security Agencies (Department of Home Affairs)

- Emergency and Disaster Management Organizations (State Emergency Services)

- Offshore Transport Operators

- Maritime Tourism Operators

- Hovercraft Manufacturers and OEMs

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the Australian Hovercraft Market’s critical stakeholders, including government agencies, military contractors, and commercial operators. Desk research, drawing on both secondary and proprietary databases, helps identify the key drivers of market dynamics and market gaps.

Step 2: Market Analysis and Construction

In this phase, historical data and trends are collected to assess market penetration and analyze sector-specific demand. We focus on key parameters such as hovercraft type, propulsion systems, and region-specific drivers, ensuring that all factors influencing market size and growth are comprehensively analyzed.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are refined and validated through consultations with industry experts, including defense contractors and commercial operators. These discussions provide valuable insights into the operational and financial aspects of hovercraft use in Australia, helping validate and refine the data.

Step 4: Research Synthesis and Final Output

Engagement with hovercraft manufacturers and distributors across Australia and beyond ensures the accuracy and reliability of the data. This step focuses on refining product segment data, sales performance, and consumer preferences, ensuring a comprehensive final market report that reflects the true state of the market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Australian Market Sizing Approach, Primary & Secondary Data Sources, In‑Depth Industry Interview Framework, CAC/ICP Assumptions, Limitations and Future Research Considerations)

- Definition and Scope

- Industry Genesis & Evolution of Hovercraft in Australia

- Global vs Australia Demand Nexus

- Hovercraft Use Cases: Defense, Maritime Safety, Commercial Transport &

- Emergency Response

- Value Chain & Supply Chain Overview

- Growth Drivers

Defense Modernization & Amphibious Capability Expansion

Maritime Border Security Spend

Commercial Offshore Service Demand

Disaster Response Preparedness & Environmental Monitoring - Market Challenges

High Acquisition Cost and Lifecycle Operating Expense

Noise & Power Utilization Constraints

Competitive Modal Alternatives (Hydrofoil, E‑VTOL & Ground Effect Vehicles) - Opportunities

Government Grants for Defence SME Innovation

Integration of Autonomy & Sensor Suites

Emission Reduction & Green Propulsion Incentives - Market Trends

Shift Toward Electrified Hovercraft Platforms

Smart Navigation & Telematics Integration

Domestic OEM R&D Localization - Regulatory & Policy Landscape

Defense Procurement Policies

Maritime Safety & Environmental Regulations

Export Controls & IP Compliance

Strategic Industry Frameworks - PESTEL & Macro‑Economic Impact Assessment

- Porter’s Five Forces — Australia Hovercraft Demand

- SWOT Analysis — National Market Position

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Product Type (In Value %)

Skirted Hovercraft (Lift & Cushion Configuration)

Sidewall Hovercraft (High‑Speed Coastal Models)

Air‑Cushion Vehicles (ACV) Variants

Peripheral Jet & Plenum Chamber Designs

Modular Mission‑Configured Hovercraft - By Propulsion System (In Value %)

Diesel Powered Systems

Gas Turbine Engines

Hybrid‑Electric Systems (Battery Energy Density & Range Metrics)

Alternative Fuel & Hydrogen‑Ready Systems - By Payload Capacity (In Value %)

Lightweight (< 5 Tons Payload)

Medium (5–15 Tons Payload)

Heavy (> 15 Tons Payload)

Modular Payload Mission Kits - By End‑User Sector (In Value %)

Military Forces (Army, Navy & Amphibious Units)

Coast Guard & Border Protection

Emergency Response & Disaster Relief Agencies

Commercial Operators (Maritime Survey, Offshore Support)

Leisure & Tourism Services - By Deployment Environment (In Value %)

Coastal – Littoral & Near‑Shore

Riverine & Inland Waterways

Remote & Flood‑Prone Regions

Inter‑Island/Archipelago Routes

- Market Share Analysis

Share by Revenue & Units in Australia Market

Segment Market Share — Military vs Commercial - Regional Adoption Across States/Territories

- Cross‑Comparison Parameters (Product Portfolio Breadth & Mission Configurations, Technological Differentiators (Propulsion Efficiency, Autonomy), Production Footprint, Australian Supply Base Integration, R&D Investment Levels, After‑Sales Support & Training Capability, Government & Defense Contract Wins, Unit Price Band & Value Engineering Metrics, Commercial Channel Reach & Dealer Networks)

- Competitive Profiles

AEROHOD Ltd (Hovercraft OEM)

Airlift Hovercraft Pty Ltd (Australian Hovercraft Designer & Manufacturer)

GRIFFON HOVERWORK Ltd (UK‑based OEM)

Textron Systems (US Defense Systems)

Neoteric Hovercraft Inc (US OEM)

The British Hovercraft Company Ltd

Christy Hovercraft (Russia‑linked OEM)

Hovertechnics, LLC

Ivanoff Hovercraft AB

Bill Baker Vehicles Ltd

Universal Hovercraft

MARIAH International Hovercraft Australia Pty Ltd (Australia)

AirFlow Hovercraft NZ

Viper Hovercraft

Almaz Shipbuilding Company

- Australian Defence Buyer Behavior

- Procurement Budget Allocations & Funding Cycles

- Specification Requirements (Payload, Range, Redundancy Metrics)

- Total Cost of Ownership (TCO) & Lifecycle ROI

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035