Market Overview

The Australia Identification Friend or Foe (IFF) systems market is projected to experience steady growth in the coming years, driven by significant investments in defense infrastructure and the modernization of the Australian Defense Force (ADF). The market is driven primarily by the demand for enhanced security measures and defense communication systems, such as the integration of Mode 5 IFF systems across various defense platforms like military aircraft, naval vessels, and ground forces. In 2025, the market was valued at approximately USD ~ billion, and this growth trajectory is expected to continue, spurred by government defense spending and the expansion of Australia’s defense partnerships in the Indo-Pacific region.

The dominance of key players within the Australia IFF systems market is concentrated in urban centers and regions with a robust defense ecosystem. Cities such as Canberra, the capital, and Sydney play pivotal roles due to their proximity to defense agencies, including the Department of Defence and major defense contractors. These locations benefit from government initiatives focused on strengthening Australia’s defense capabilities, as well as strategic international collaborations with countries like the United States and the United Kingdom. The Australian Defence Force’s requirements for high-tech security systems, including IFF, further positions these areas as the nucleus of market growth and innovation.

Market Segmentation

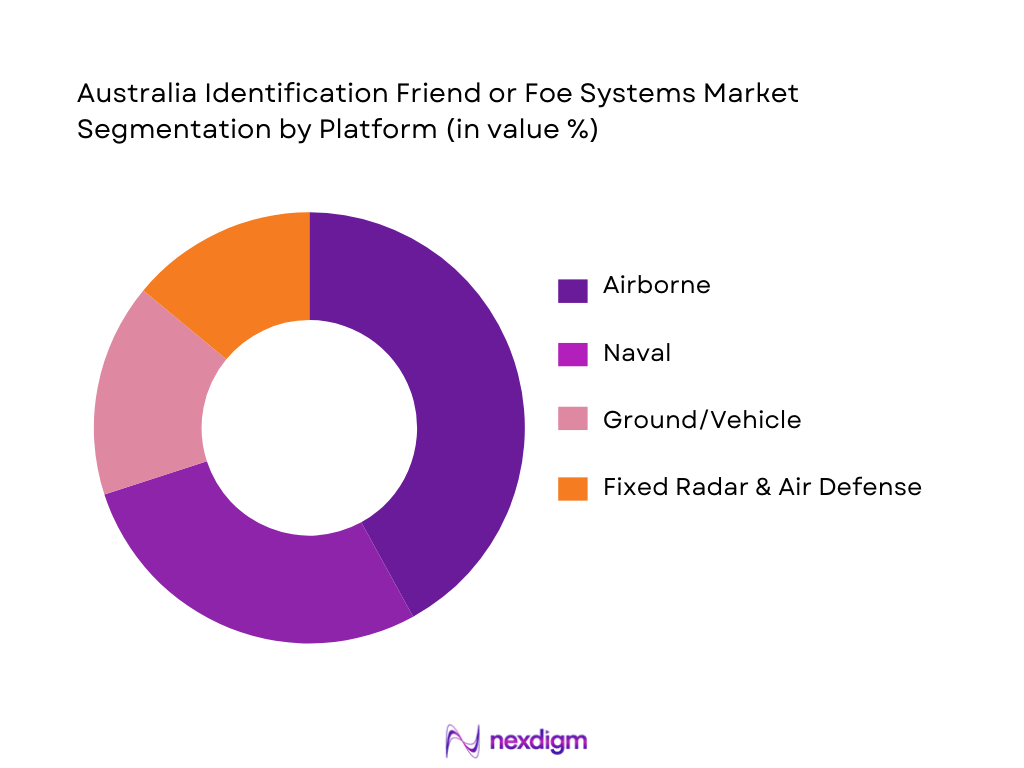

By Platform

The Australia IFF systems market is segmented by platform into airborne, naval, ground/vehicle, and fixed radar & air defense sites. Among these, airborne platforms have the dominant share, accounting for approximately ~ % of the total market. This dominance can be attributed to the continuous need for IFF integration in fighter jets, reconnaissance aircraft, and UAVs. The Australian Air Force’s focus on upgrading its fighter fleet, including platforms like the F-35, which require advanced IFF systems, has led to sustained investments in this segment. Additionally, the emphasis on interoperability with allied nations, particularly in multi-national operations, ensures that IFF systems in airborne platforms remain a top priority for the ADF.

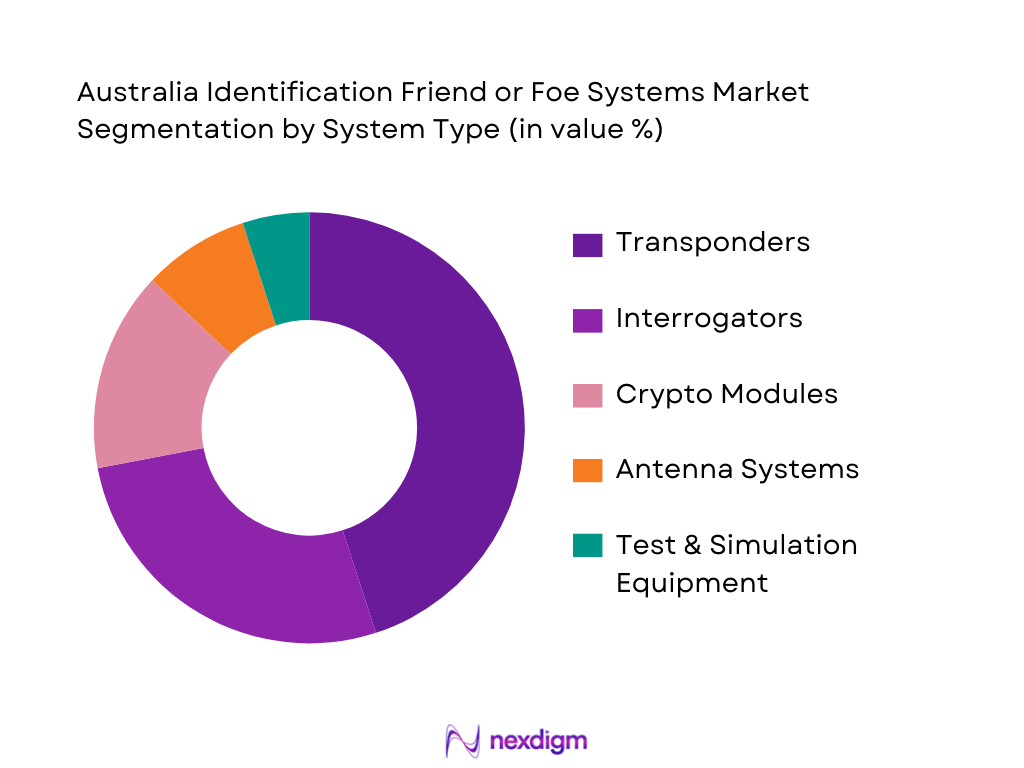

By System Type

In the system type segmentation, transponders account for the largest market share, capturing around ~ % of the IFF systems market. This is primarily due to their critical role in the identification process, particularly in military aircraft and naval vessels. As Australia continues to modernize its defense systems, the demand for Mode 5 transponders, which comply with the latest NATO standards, is on the rise. These systems are essential for secure identification in high-threat environments, ensuring that Australian forces can maintain a high level of operational security while participating in joint military exercises and operations with international allies.

Competitive Landscape

The Australia IFF systems market is characterized by a competitive landscape dominated by a few major global and regional players, such as BAE Systems, Thales Group, and Raytheon Technologies. These companies play a crucial role in supplying the latest IFF technologies, including Mode 5 transponders and encrypted crypto modules. The consolidation of the market by these key players highlights the growing importance of IFF systems within the Australian defense procurement strategy. In addition to these multinational corporations, several local players have established themselves by offering tailored solutions that meet Australia’s specific defense requirements.

| Company Name | Establishment Year | Headquarters | Product Offering | Technology Focus | Key Market Region | Key Partnerships |

| BAE Systems | 1999 | Australia | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Sydney, Australia | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2004 | Waltham, USA | ~ | ~ | ~ | ~ |

| Leonardo S.p.A | 2001 | Rome, Italy | ~ | ~ | ~ | ~ |

| Lockheed Martin | 2002 | Bethesda, USA | ~ | ~ | ~ | ~ |

Australia Identification Friend or Foe (IFF) Systems Market Analysis

Growth Drivers

Defense Modernization Imperatives Fueling IFF Upgrades

Australia’s ongoing defense modernization initiatives are a significant driver for the adoption of advanced IFF systems. The Australian Defence Force (ADF) is heavily investing in next-generation technologies, including Mode 5 IFF systems, to ensure its platforms, such as the F-35 fighter jets, naval vessels, and ground forces, are fully interoperable with allied forces like the US, UK, and NATO. These upgrades are not only to enhance operational efficiency but also to meet the evolving threats in multi-domain operations, where secure identification and communication are critical. The Australian Government’s commitment to defense spending, exemplified by initiatives like the Defence Strategic Update and Capability Acquisition and Sustainment Group (CASG), directly impacts the demand for IFF systems, driving significant growth in the market.

Mode 5 Retrofit Deadlines & Regulatory Mandates

The mandatory deadline for upgrading to Mode 5 IFF systems across military platforms is a primary growth driver. Mode 5, the latest standard for secure identification, ensures that the systems meet international standards set by NATO and other defense allies. Australia is committed to adopting this technology by specific deadlines to maintain interoperability during joint missions. The regulatory push for compliance with Mode 5 standards across various platforms—such as air, sea, and land—has created a sense of urgency within the defense sector, thereby accelerating the need for retrofitting older systems to meet these requirements.

Challenges & Barriers

High Implementation and Lifecycle Support Costs

One of the significant barriers to widespread adoption of advanced IFF systems in Australia is the high cost associated with both implementation and ongoing support. Integrating new IFF systems, particularly on older platforms, can be resource-intensive, involving the replacement of legacy components, complex installations, and system certifications. Furthermore, maintenance, training, and lifecycle support are ongoing costs that can strain defense budgets. While these systems provide critical operational capabilities, the substantial financial outlay required for both initial installation and long-term upkeep remains a significant challenge for defense procurement agencies.

Cybersecurity Risks for IFF Encryption Modules

With increasing reliance on advanced encryption and secure communication protocols, cybersecurity risks for IFF systems are a major concern. As defense systems become more interconnected, the potential for cyber-attacks targeting sensitive identification and communication systems grows. IFF systems, particularly those using advanced encryption, are critical to ensuring secure identification in multi-national operations. Any breach of these systems could result in false identification, miscommunication, or even loss of life during joint missions. Therefore, the continuous development of secure encryption protocols and robust cybersecurity measures is essential to safeguarding these systems against evolving threats from cyber adversaries.

Opportunities

AI/ML-Augmented Identification Algorithms

The application of Artificial Intelligence (AI) and Machine Learning (ML) in IFF systems presents a significant opportunity for the market. AI/ML algorithms can improve the accuracy and speed of identification, particularly in complex and high-pressure environments. These technologies enable more efficient data analysis, allowing for real-time identification of friendly and hostile entities based on a range of dynamic inputs, such as radar data, transponder signals, and sensor inputs. As the defense sector increasingly adopts AI/ML technologies, IFF systems that integrate these capabilities are set to become more advanced, reducing human error and enhancing operational efficiency in military operations.

Growth in Civil Aviation IFF Safety Applications

Another key opportunity for the Australia IFF systems market lies in the growing need for IFF applications in civil aviation. With increased air traffic and a growing focus on airspace safety, IFF systems are becoming essential for ensuring safe identification of aircraft in both civilian and military airspace. In Australia, the adoption of IFF for air traffic control and management is expected to rise, driven by regulations around airspace safety and the increasing presence of military aircraft in civilian airspace. This growth in civil aviation applications will further fuel the demand for advanced IFF systems, expanding the market beyond traditional defense applications and opening new revenue streams for IFF manufacturers and service providers.

Future Outlook

Over the next six years, the Australian IFF systems market is expected to witness significant growth, driven by continued defense modernization efforts, the need for secure identification across multi-domain operations, and Australia’s growing defense budgets. Additionally, technological advancements in IFF systems, such as AI-driven identification algorithms and the integration of IFF with unmanned systems, will contribute to the market’s expansion. Government regulations mandating compliance with international IFF standards (e.g., Mode 5) will further fuel demand for upgrading legacy systems, particularly within the Australian Air Force and Navy. The rising threat of cyber-attacks and the focus on cybersecurity will also drive the adoption of encrypted and secure IFF systems. Consequently, the market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of ~ % .

Major Players

- BAE Systems

- Thales Group

- Raytheon Technologies

- Leonardo S.p.A

- Lockheed Martin

- Northrop Grumman Corporation

- L3Harris Technologies

- General Dynamics Corporation

- Indra Sistemas S.A

- HENSOLDT AG

- Elbit Systems Ltd

- Cobham

- General Atomics

- Textron Inc

- ASELSAN A.S

Key Target Audience

- Australian Defence Force (ADF)

- Department of Defence, Australia

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Department of Defence, Australian Security Intelligence Organisation)

- Defense Procurement Agencies (e.g., Capability Acquisition and Sustainment Group)

- OEMs of Defense Systems and Components

- International Defence Alliances (e.g., NATO, Indo-Pacific Nations)

- Public Sector R&D Entities Focused on Defense Technologies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia IFF Systems Market. Secondary and proprietary databases are utilized for gathering comprehensive industry-level information. The focus is to identify and define the critical variables that influence market dynamics, such as platform type, technology requirements, and regulatory standards.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the IFF systems market in Australia is compiled and analyzed. This includes assessing the installed base, growth rates, and the revenue impact of major players in different sectors such as airborne, naval, and ground platforms.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including representatives from major defense contractors, OEMs, and regulatory bodies. These consultations help refine the market data and offer insights into key developments and potential market challenges.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with defense contractors to gather insights into system capabilities, sales performance, and future trends. This data is combined with the findings from the previous steps to produce an accurate and comprehensive market report.

- Executive Summary

- Research Methodology (Market Definitions and IFF Terminology (e.g., Mode 0/1/2/3/A, Mode 5, ADS‑B integration), Assumptions on Defense Budget Allocations & Future Procurement Cycles, Data Sources (Defence Whitepapers, Government Tenders, RAAF/Australian Defence Force Programs), Primary Research Framework (Interviews with Defence Acquisitions, OEMs, System Integrators), Market Sizing & Validation Techniques (Shipments, Installed Base, Contract Backlogs), Limitations & Future Research Scope)

- Definition and Scope of IFF Systems and Sub‑systems

- Role of IFF in Australian Defence Architecture (Air, Sea, Land C4ISR)

- Evolution of IFF Standards

- IFF Interoperability with Coalition Partners (US, UK, NATO)

- Supply Chain Overview — Key Nodes (Transponders, Interrogators, Crypto Modules, Antennas)

- Growth Drivers

Defense Modernization Imperatives Fueling IFF Upgrades

Mode 5 Retrofit Deadlines & Regulatory Mandates

Multi‑domain Operations Requirement (Air / Sea / Land)

UAV Proliferation and Mixed Airspace Management

Integration with AESA Radars & Networked C2 Systems - Challenges & Barriers

High Implementation and Lifecycle Support Costs

Cybersecurity Risks for IFF Encryption Modules

STANAG Interoperability Complexity

Supply Chain Constraints for High‑reliability Components - Opportunities

AI/ML‑augmented Identification Algorithms

Growth in Civil Aviation IFF Safety Applications

Export Potential to Indo‑Pacific Allies

Aftermarket Support & Long‑Term Sustainment Contracts - Trends

Shift to Software‑Defined IFF and Open Architecture Platforms

Embedded IFF within Multi‑Sensor Networks

Lifecycle Contracting & Performance‑Based Logistics - Government Regulation & Standards

Australia Defence Procurement Framework (Capability Life Cycle)

National IFF Policies & Security Clearances

STANAG 4193, Mode 5 AIMS, ADS‑B Certification

Export Control Regimes (ITAR/ECR/Local Offsets)

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-202

- By Platform (In Value %)

Airborne

Naval

Ground/Vehicle Platforms

Fixed Radar & Air Defence Sites

Integrated C2 Networks - By System Type (In Value %)

Transponders

Interrogators

Cryptographic Security Modules

Antenna Systems

IFF Test & Simulation Equipment - By Technology Layer (In Value %)

Radio‑Frequency IFF

Software‑Defined IFF & Cryptographic Enhancements

ADS‑B Augmented IFF

AI‑enabled Identification Algorithms - By Frequency & Compliance Standards (In Value %)

Low Frequency (<30 MHz)

High Frequency (30–300 MHz)

Ultra High Frequency (>300 MHz)

Mode Compliance (Gen2, Mode 4, Mode 5, AIMS Certified) - By End Users (In Value %)

Australian Defence Force (RAAF, RAN, Army)

Civil Aviation Authorities (Air Traffic Management)

Coalition Forces / Export Channels

- Market Share Analysis — Value & Systems Installed

- Cross Comparison Parameters (Company Profile & Value Proposition, Technology & Standard Compliance (Mode 5, AIMS), Installed Base by Platform Type, Contract Backlog & Bid Pipeline, R&D Investment Intensity, Aftermarket & Support Services Strength, Supply Chain Footprint & Localization Strategy, Pricing Structure & Margin Benchmarks, Cybersecurity Capabilities, Interoperability Certifications, Integration Partnerships (Platform OEMs))

- Key Competitor Profile

BAE Systems plc (IFF solutions, cryptographic modules)

RTX Corporation (Primary IFF interrogators/transponders)

Thales Group (Mode 5 & ADS‑B compliant IFF systems)

Leonardo S.p.A (Integrated IFF for air defence)

HENSOLDT AG (Secondary surveillance & IFF hardware)

Northrop Grumman Corporation (C2 / IFF integration)

Raytheon Australia (Defence systems integrator)

General Dynamics Corporation (Military platform integration)

L3Harris Technologies (IFF communications modules)

Indra Sistemas S.A (IFF system integrators)

Elbit Systems Ltd (IFF subsystems & avionics)

Textron Inc (IFF transponders)

General Atomics (UAV / IFF packages)

Cobham (IFF antennas & test equipment)

ASELSAN A.S (IFF radios & defense electronics)

Lockheed Martin (Integrated IFF on defense platforms)

- Australian Defence Force

- Civil Aviation Authorities

- Export Customers (Indo‑Pacific)

- Procurement Cycles & Budget Allocations

- Decision Making Drivers & Pain Points

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025