Market Overview

Based on a recent historical assessment, the Australia Infantry Fighting Vehicles market was valued at USD ~ billion, supported by officially released defense capability plans, Commonwealth budget papers, and contract announcements issued by the Australian Department of Defence. Market momentum is driven by large-scale mechanized infantry modernization, replacement of legacy armored fleets, integration of advanced survivability systems, and digital battlefield management requirements. Additional demand originates from long-term sustainment programs, local manufacturing mandates, interoperability alignment with allied forces, and increased emphasis on protected mobility for land combat operations.

Based on a recent historical assessment, Australia dominates this market due to centralized defense procurement authority in Canberra and the concentration of armored vehicle manufacturing and integration facilities across Queensland and Victoria. Brisbane serves as a key center for vehicle assembly, testing, and sustainment infrastructure, while Melbourne supports advanced systems engineering, electronics integration, and supply chain coordination. National dominance is reinforced by sovereign defense of industrial policies, stable funding mechanisms, strong alliance-driven capability alignment, and sustained government commitment to domestic land combat system development.

Market Segmentation

By Product Type

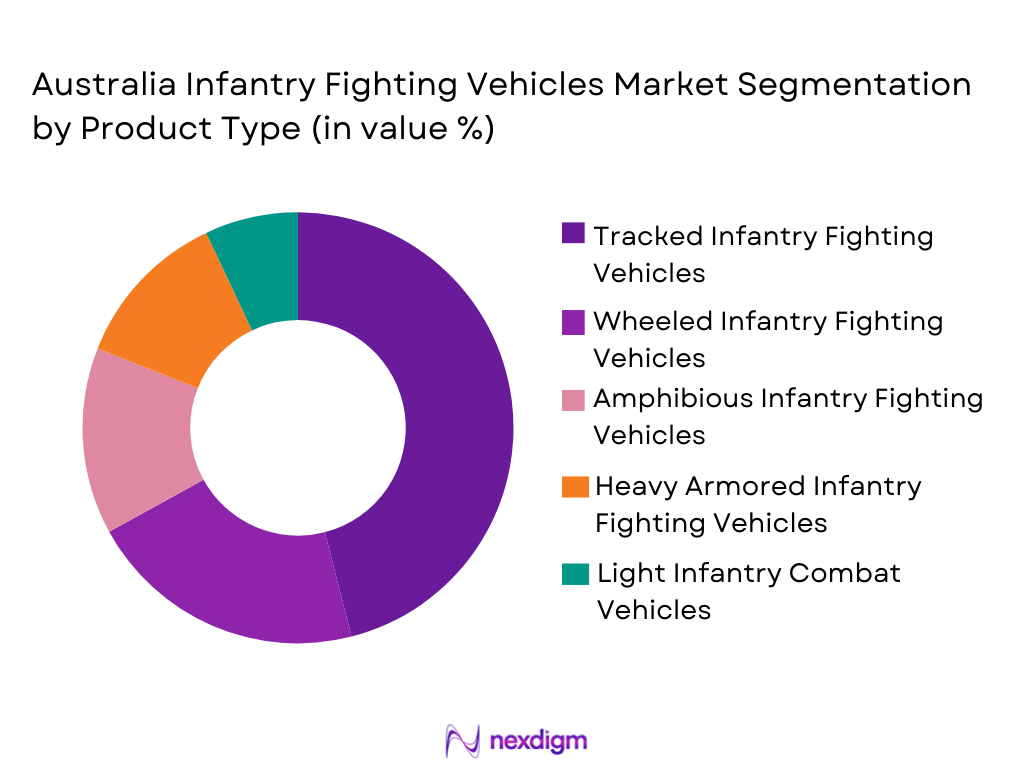

Australia Infantry Fighting Vehicles market is segmented by product type into tracked infantry fighting vehicles, wheeled infantry fighting vehicles, amphibious infantry fighting vehicles, heavy armored infantry fighting vehicles, and light infantry combat vehicles. Recently, tracked infantry fighting vehicles have a dominant market share due to their superior protection levels, higher payload capacity, and suitability for high-intensity mechanized warfare environments emphasized in Australian Army doctrine. Tracked platforms provide enhanced mobility across rugged and arid terrains, support heavier weapon stations, and enable integration of advanced active protection systems. Ongoing replacement of aging tracked fleets, combined with interoperability requirements with allied armored formations and long-term sustainment advantages, continues to reinforce procurement preference toward tracked infantry fighting vehicle configurations across national land forces.

By Platform Type

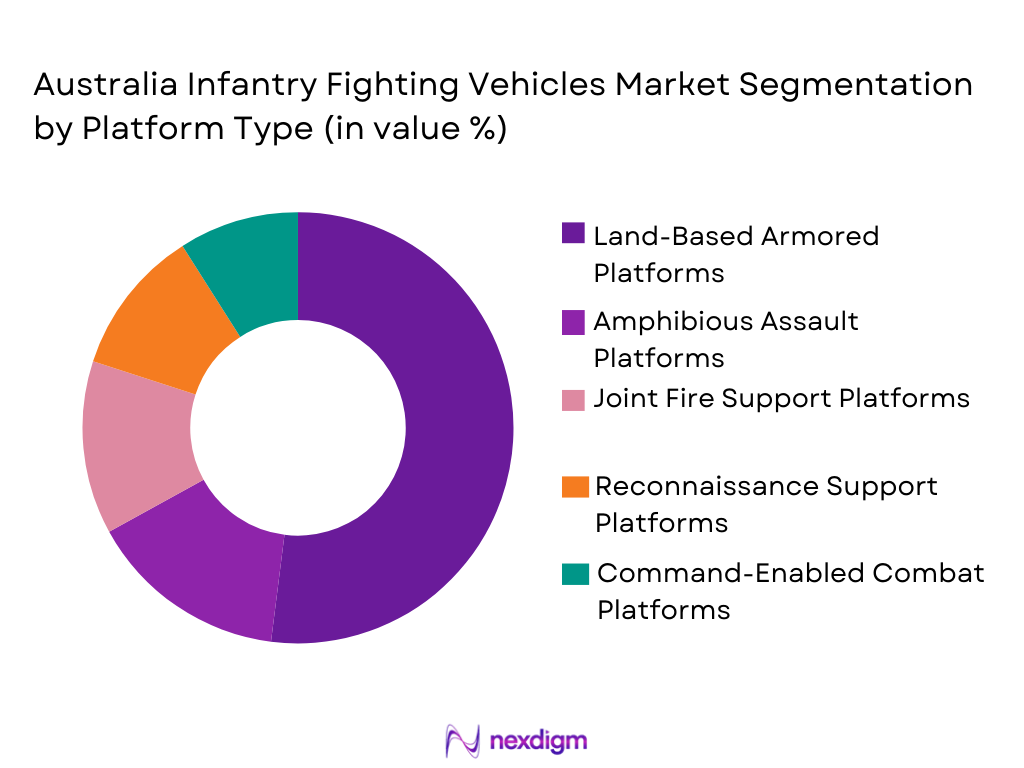

Australia Infantry Fighting Vehicles market is segmented by platform type into land-based armored platforms, amphibious assault platforms, joint fire support platforms, reconnaissance support platforms, and command-enabled combat platforms. Recently, land-based armored platforms have a dominant market share due to their foundational role in brigade-level combined arms operations and mechanized maneuver concepts. These platforms serve as the primary carriers for infantry units, integrating weapons, communications, and protection systems in a single architecture. Established logistics networks, proven operational reliability, compatibility with existing infrastructure, and alignment with Army force structure modernization programs collectively drive sustained investment in land-based armored infantry fighting vehicle platforms.

Competitive Landscape

The Australia Infantry Fighting Vehicles market exhibits a moderately consolidated competitive structure characterized by a limited number of global prime contractors supported by domestic industrial partners. Competition is shaped by long procurement cycles, stringent qualification requirements, and strong government emphasis on sovereign industrial participation. Major players leverage long-term sustainment contracts, technology transfer agreements, and local manufacturing investments to strengthen market positioning. Strategic partnerships between international original equipment manufacturers and Australian defense firms play a critical role in meeting capability, compliance, and supply chain resilience objectives.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Local Manufacturing Presence |

| Rheinmetall Defence Australia | 2015 | Brisbane, Australia | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1954 | Melbourne, Australia | ~

|

~

|

~

|

~

|

~

|

| Hanwha Defense Australia | 2019 | Geelong, Australia | ~

|

~

|

~

|

~

|

~

|

| General Dynamics Land Systems | 1952 | Virginia, US | ~

|

~

|

~

|

~

|

~

|

| Thales Australia | 1998 | Sydney, Australia | ~

|

~

|

~

|

~

|

~

|

Australia Infantry Fighting Vehicles Market Analysis

Growth Drivers

Mechanized Infantry Capability Modernization Programs

Mechanized infantry capability modernization programs are a core growth driver for the Australia Infantry Fighting Vehicles market because they represent long-term, government-backed commitments to replace and upgrade legacy armored fleets across frontline combat brigades. These programs are designed to address survivability gaps identified through operational assessments, exercises, and allied interoperability benchmarks, leading to strong preference for next-generation infantry fighting vehicles with advanced armor, active protection systems, and integrated digital command architectures. Modernization initiatives prioritize tracked platforms capable of supporting heavier turrets, improved mobility across diverse Australian terrain, and seamless integration with artillery, unmanned systems, and intelligence networks. The scale of these programs extends beyond vehicle acquisition to include training systems, spares, simulators, infrastructure upgrades, and multi-decade sustainment contracts, significantly increasing total market value. Domestic manufacturing and final assembly requirements embedded within modernization programs further amplify spending by expanding local industrial participation and workforce development. Government emphasis on through-life support ensures continuous demand for upgrades, software refreshes, and subsystem replacements. Capability-driven procurement reduces sensitivity to short-term budget fluctuations, providing predictable demand visibility for suppliers. Alignment with official defense capability plans reinforces long procurement timelines, benefiting incumbent manufacturers. Collectively, these modernization programs create a stable, multi-year demand foundation that structurally supports market expansion.

Alliance Interoperability and Force Readiness Mandates:

Alliance interoperability and force readiness mandates drive sustained growth by requiring Australia to field infantry fighting vehicles that are fully compatible with allied operational doctrines, digital networks, and logistics systems. Participation in joint exercises and coalition operations highlights the need for standardized communications, data-sharing protocols, and combat system interfaces, pushing procurement toward advanced platforms with open architectures. Infantry fighting vehicles are increasingly required to operate as network-enabled nodes within joint and combined arms formations, elevating the importance of sensors, battle management systems, and secure communications. Force readiness objectives demand high availability rates, rapid deployment capability, and reliability under extended operational conditions, increasing the value placed on modern platforms over aging fleets. Interoperability requirements also influence ammunition standards, weapon integration, and protection system compatibility, raising technical specifications and overall unit costs. Readiness-driven procurement emphasizes redundancy, maintainability, and sustainment resilience, expanding aftermarket and lifecycle service demand. Suppliers with proven interoperability credentials gain competitive advantage, reinforcing market consolidation. These mandates reduce procurement risk by anchoring decisions to alliance commitments rather than discretionary spending. As regional security dynamics intensify, readiness and interoperability requirements will continue to structurally underpin demand.

Market Challenges

High Acquisition Cost and Long-Term Sustainment Burden:

High acquisition cost and long-term sustainment burden represent a major challenge for the Australia Infantry Fighting Vehicles market because modern platforms incorporate complex and expensive subsystems that significantly increase total ownership costs. Advanced armor materials, active protection systems, digital electronics, and weapon integration drive up unit prices compared to legacy vehicles. Beyond initial procurement, sustainment costs associated with spares, software updates, mid-life upgrades, and specialist maintenance personnel place long-term pressure on defense budgets. Domestic manufacturing and local content requirements, while strategically important, can further elevate costs relative to offshore production due to smaller production runs and higher labor expenses. Budgetary trade-offs often arise between fleet size and capability level, potentially constraining procurement volumes. Cost escalation risks are heightened by customization demands and evolving requirements during program execution. Exchange rate volatility affects imported subsystems and long-term sustainment contracts. Extended approval and contracting cycles delay cost recovery for suppliers. These financial pressures complicate program planning and can slow decision-making, posing a structural challenge to market growth.

Program Complexity and Integration Execution Risk:

Program complexity and integration execution risk challenge market momentum due to the technical difficulty of combining multiple advanced systems into a single, reliable combat platform. Infantry fighting vehicles must integrate propulsion, protection, weapons, sensors, communications, and software architectures without compromising performance or safety. Delays in the maturity of any subsystem can cascade across development schedules and testing milestones. Certification, safety validation, and environmental testing requirements extend timelines and increase costs. Supply chain dependencies across international and domestic suppliers introduce vulnerability to disruptions and delays. Workforce skill shortages in specialized integration disciplines can constrain execution capacity. Changing operational requirements during development may necessitate redesigns, adding further risk. Coordination among government agencies, prime contractors, and subcontractors is complex and resource intensive. These factors increase schedule uncertainty and can affect confidence in large-scale procurement programs, making execution risk a persistent challenge.

Opportunities

Expansion of Sovereign Defense Industrial Capability:

Expansion of sovereign defense industrial capability presents a significant opportunity for the Australia Infantry Fighting Vehicles market as government policy increasingly prioritizes domestic production, integration, and sustainment. Establishment of local manufacturing facilities enhances supply chain resilience and reduces dependence on foreign sources for critical systems. Technology transfer agreements embedded in procurement contracts accelerate the development of domestic engineering and manufacturing expertise. Workforce training initiatives linked to armored vehicle programs support long-term industrial sustainability and regional economic development. Local sustainment capabilities reduce vehicle downtime and lifecycle costs, improving operational availability. Government incentives and co-investment frameworks encourage private sector participation and capital investment. Enhanced domestic capability also positions Australia as a regional support and export hub for allied forces operating similar platforms. This industrial expansion creates recurring revenue streams beyond initial vehicle delivery. As sovereign capability requirements strengthen, opportunities for long-term market participation increase.

Modular Upgrade and Lifecycle Enhancement Pathways:

Modular upgrade and lifecycle enhancement pathways offer strong opportunities by enabling capability growth without full platform replacement. Open architecture designs allow incremental insertion of new sensors, protection systems, and digital capabilities as threats evolve. This approach aligns with budget optimization strategies by spreading investment over time while maintaining combat relevance. Modular upgrades reduce integration risk compared to complete redesigns and allow rapid adaptation to emerging operational requirements. Defense planners increasingly favor platforms with clear upgrade roadmaps, benefiting suppliers offering flexible architectures. Lifecycle enhancement programs generate sustained aftermarket demand through periodic modernization packages. Standardized interfaces simplify certification and testing for new subsystems. These pathways support continuous improvement while maximizing return on initial investment. As modernization cycles accelerate, modular upgrade opportunities will become an increasingly important market growth lever.

Future Outlook

The Australia Infantry Fighting Vehicles market is expected to remain on a structurally stable growth path over the next five years, supported by committed land force modernization programs and long-term defense budget visibility. Continued investment in tracked armored platforms, advanced protection systems, and digitally integrated combat architectures will define platform evolution. Government emphasis on sovereign manufacturing, technology transfer, and domestic sustainment will further strengthen local industrial participation. Demand will also be reinforced by alliance interoperability requirements, regional security considerations, and the need to maintain high readiness levels across mechanized infantry formations.

Major Players

- Rheinmetall Defence Australia

- BAE Systems Australia

- Hanwha Defense Australia

- General Dynamics Land Systems

- Thales Australia

- Leonardo Defence Systems

- Elbit Systems Land

- Patria Group

- FNSS Defence Systems

- Otokar

- ST Engineering Land Systems

- Krauss-Maffei Wegmann

- Nexter Systems

- IVECO Defence Vehicles

- Saab Defence

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense ministries

- Armed forces procurement agencies

- Armored vehicle manufacturers

- Tier-one defense suppliers

- System integrators

- Defenselogisticsorganizations

Research Methodology

Step 1: Identification of Key Variables

This step involved identifying demand-side, supply-side, and regulatory variables influencing the Australia Infantry Fighting Vehicles market. Data points included procurement programs, industrial participation policies, and platform specifications. Public defense documents and contract disclosures were reviewed. Variables were validated through cross-referencing multiple sources.

Step 2: Market Analysis and Construction

Market structure was constructed using procurement timelines, platform segmentation, and value chain mapping. Program-level data formed the basis of market sizing. Industrial participation levels were incorporated. Assumptions were aligned with official policy statements.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultation with defense industry experts and open-source analyst commentary. Assumptions were stress-tested against recent program developments. Feedback refined segmentation logic. Consistency checks ensured analytical robustness.

Step 4: Research Synthesis and Final Output

All validated inputs were synthesized into a cohesive market narrative. Quantitative and qualitative insights were integrated. Internal consistency checks were conducted. The final output reflects a structured and evidence-based assessment.

- Executive Summary

- Australia Infantry Fighting Vehicles Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Modernization of mechanized infantry capabilities

Increased focus on regional force readiness

Integration of network-centric warfare systems

Lifecycle extension of legacy armored fleets

Rising emphasis on crew survivability and protection - Market Challenges

High acquisition and lifecycle costs

Complex integration of advanced subsystems

Lengthy defense procurement timelines

Dependence on foreign technology suppliers

Sustainment and maintenance constraints - Market Opportunities

Domestic industrial participation expansion

Upgrades through modular modernization programs

Export-oriented co-development initiatives - Trends

Shift toward digitally integrated combat vehicles

Adoption of active protection systems

Emphasis on modular and scalable designs

Increased use of simulation and digital twins

Focus on interoperability with allied forces - Government Regulations & Defense Policy

Defense capability acquisition reforms

Local industry participation requirements

Export control and technology transfer policies - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Tracked infantry fighting vehicles

Wheeled infantry fighting vehicles

Amphibious infantry fighting vehicles

Heavy armored infantry fighting vehicles

Light expeditionary infantry fighting vehicles - By Platform Type (In Value%)

Land-based armored platforms

Amphibious assault platforms

Joint fire support platforms

Integrated command vehicle platforms

Reconnaissance support platforms - By Fitment Type (In Value%)

New vehicle integration

Mid-life upgrade fitment

Retrofit modernization packages

Mission-specific modular fitment

Technology insertion programs - By EndUser Segment (In Value%)

Army mechanized infantry units

Rapid deployment forces

Border protection units

Joint expeditionary task forces

Training and evaluation commands - By Procurement Channel (In Value%)

Direct government procurement

Defense acquisition programs

Intergovernmental agreements

Domestic manufacturing contracts

Licensed production partnerships - By Material / Technology (in Value %)

Advanced composite armor

Modular add-on armor systems

Active protection systems integration

Digital battlefield management systems

Hybrid propulsion and power systems

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (vehicle protection level, mobility performance, weapon system integration, digital architecture maturity, lifecycle cost efficiency, upgrade modularity, local industrial participation, sustainment support depth, interoperability compliance) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Rheinmetall Defence Australia

BAE Systems Australia

Hanwha Defense Australia

General Dynamics Land Systems

Elbit Systems Land

Leonardo Defence Systems

Thales Australia

Patria Land Systems

FNSS Defence Systems

Otokar Land Systems

ST Engineering Land Systems

Krauss-Maffei Wegmann

Nexter Systems

IVECO Defence Vehicles

Saab Defence

- Operational requirements for high-mobility infantry units

- Demand for enhanced protection in diverse terrains

- Need for interoperability across joint operations

- Training and sustainment support expectations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035