Market Overview

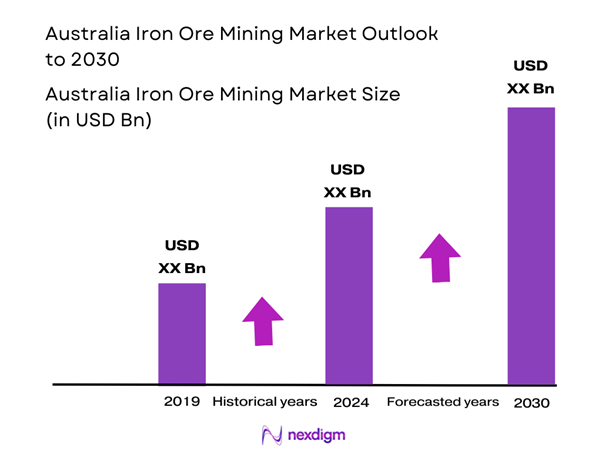

The Australia Iron Ore Mining Market is valued at USD 68 billion in 2024 with an approximated compound annual growth rate (CAGR) of 3.8% from 2024-2030, based on a five-year historical analysis. This market is primarily driven by the robust demand for iron ore from the steel manufacturing sector, which constitutes a significant portion of Australia’s exports. With Asia, particularly countries like China and India, being major consumers of steel, the demand for iron ore continues to experience growth. Recent data reveals that the market value is expected to rise further owing to investments in mining infrastructure and technology, enhancing production efficiency.

Australia’s dominance in the iron ore market can be attributed to its rich mineral deposits and established mining infrastructure. Western Australia is particularly notable, with the Pilbara region being a hub for iron ore production, housing some of the largest mines in the world. The country’s stable political environment, coupled with strong economic ties with key Asian markets, further solidifies its position as a leading player in the global iron ore landscape.

Australia’s iron ore export opportunities are bolstered by its strategic positioning as a key supplier to major markets such as China and Japan. In 2022, Australia’s iron ore exports were valued at AUD 75 billion, solidifying its status as a crucial player in the global iron ore market. The robust growth of infrastructure projects in Asian countries has catalyzed demand, stressing Australia’s favorable trade relationships as essential for reliable supply chains.

Market Segmentation

By Product Type

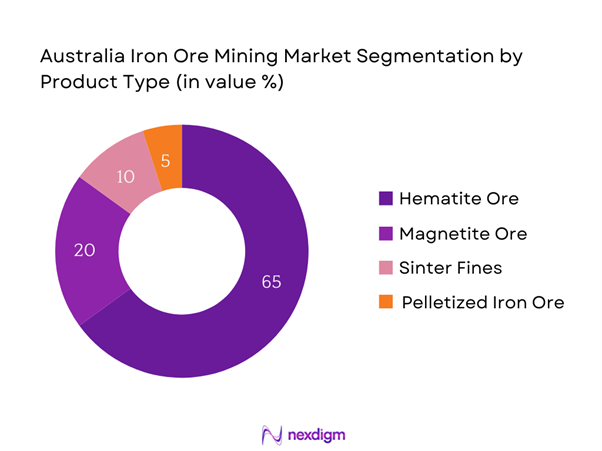

The Australia Iron Ore Mining market is segmented by product type into hematite ore, magnetite ore, sinter fines, and pelletized iron ore. Hematite ore dominates the market share due to its high iron content and extensive use in steel production. Its efficiency and cost-effectiveness make it the preferred choice among steel manufacturers. Furthermore, major players like BHP and Rio Tinto have significantly invested in hematite mining, leading to an increased supply and a well-established distribution network.

By Application

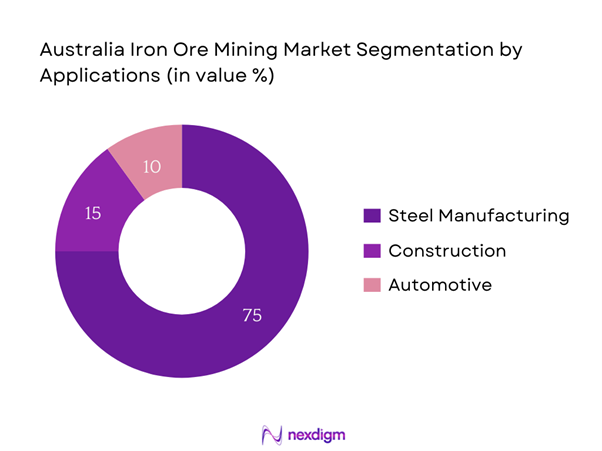

The Australia Iron Ore Mining market is segmented by application into steel manufacturing, construction, and automotive. The steel manufacturing segment holds a dominant market share as iron ore is the primary raw material for steel production. The rapid growth in construction projects, driven by urbanization and infrastructure development, further propels the demand for steel. Major mining companies are strategically aligned with key steel manufacturers, ensuring a consistent demand for iron ore.

Competitive Landscape

The Australia Iron Ore Mining market is dominated by a few major players, including BHP, Rio Tinto, and Fortescue Metals Group. This consolidation highlights the significant influence of these key companies, which benefit from economies of scale and extensive operational capabilities. Their substantial investments in technology and sustainable mining practices also position them favorably within the competitive landscape.

| Company | Establishment Year | Headquarters | Market Focus | Product Offerings | Annual Revenue (2024) | Capacity (Million Tonnes) |

| BHP | 1885 | Melbourne, Australia | – | – | – | – |

| Rio Tinto | 1873 | Perth, Australia | – | – | – | – |

| Fortescue Metals Group | 2003 | Perth, Australia | – | – | – | – |

| Mineral Resources | 1993 | Perth, Australia | – | – | – | – |

| Pilbara Minerals | 2013 | Perth, Australia | – | – | – | – |

Australia Iron Ore Mining Market Analysis

Growth Drivers

Demand from Developing Economies

The demand for iron ore is significantly driven by developing economies, particularly in Asia, where China alone consumed approximately 1.2 billion tons of iron ore in 2022, accounting for nearly 57% of global demand. This trend is supported by investments in infrastructure and industrialization projects across emerging markets, including India, where iron ore consumption growth is projected as substantial urban development takes precedence. The World Bank anticipates that emerging markets will contribute to a compound increase in global steel consumption, further solidifying the demand for iron ore from Australia, which is a leading exporter.

Technological Advancements in Mining

Advancements in mining technologies have improved the efficiency and accuracy of iron ore extraction. For instance, Australia’s mining sector has embraced automation, with the implementation of autonomous haul trucks and drilling systems reducing operational costs and increasing productivity by up to 30%. The Australian government reported capital expenditure in mining has increased to AUD 28.4 billion, showcasing the sector’s commitment to technological innovation, leading to enhanced output and more sustainable mining practices. These technological developments are pivotal in sustaining Australia’s competitive edge in global iron ore supply.

Market Challenges

Environmental Regulations

The Australian iron ore mining sector faces stringent environmental regulations, particularly concerning land use and emissions. The Australian government has tightened environmental policies following increasing scrutiny over carbon emissions that reached 523 million tons in Australia for the year 2022. Compliance with these regulations increases operational costs for mining companies. More specifically, adherence to the Environmental Protection and Biodiversity Conservation Act mandates comprehensive environmental assessments, which can extend project timelines and increase expenses, thereby potentially hindering growth in the sector.

Price Volatility of Iron Ore

The iron ore market is characterized by price volatility, influenced by global economic conditions and market sentiment. In 2022, iron ore prices fluctuated significantly, with spot prices peaking at approximately USD 130 per ton before declining to around USD 75 per ton by the end of the year. This volatility can adversely affect profit margins for mining companies, making financial forecasting a challenge. The International Monetary Fund notes that market fluctuations can disrupt capital investment decisions and impact the accrual of revenues necessary for ongoing operational costs.

Opportunities

Investment in Sustainable Mining Techniques

The current shift towards sustainable mining practices presents significant growth opportunities for the Australian iron ore market. With the global focus on reducing carbon footprints, investments in eco-friendly technologies and practices are at the forefront of the mining industry’s evolution. Australia has committed to reducing its greenhouse gas emissions to 26% below 2005 levels by 2030, fostering innovation in sustainable extraction methods. As companies initiate projects involving renewable energy sources, such as solar and wind for operations, these adaptations can enhance competitiveness and attract environmentally conscious investors.

Expanding Asian Markets

Expanding Asian markets present a promising opportunity for the iron ore sector in Australia. Furthermore, forecasts suggest that the Indian government’s initiatives to enhance its infrastructure, valued at USD 1.4 trillion for the next five years, will substantially increase iron ore demand, positioning Australia as a critical supplier for Asian markets.

Future Outlook

Over the next five years, the Australia Iron Ore Mining market is expected to show significant growth driven by continuous government support, advancements in mining technology, and the increasing demand for steel in urbanization projects globally. Moreover, the shift towards sustainable mining practices will enhance production efficiency while minimizing environmental impact. These factors combined will lead to a stronger foundational growth for the segment, enhancing Australia’s position in the global iron ore landscape.

Major Players

- BHP

- Rio Tinto

- Fortescue Metals Group

- Mineral Resources

- Pilbara Minerals

- Champion Iron Limited

- Macarthur Minerals

- GWR Group

- Strike Resources

- Atlas Iron

- Iron Road

- Mount Gibson Iron

- Grange Resources

- Hastings Technology Metals

- Australian Pacific Coal

Key Target Audience

- Mining Companies

- Steel Manufacturers

- Raw Material Exporters

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Mines, Industry Regulation and Safety)

- Construction Firms

- End-Users in Heavy Industries

- Environmental Agencies (Environmental Protection Authority)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map that encompasses all major stakeholders within the Australia Iron Ore Mining Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather relevant industry-level information. The objective here is to identify and define the critical variables that shape market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Australia Iron Ore Mining Market is compiled and analyzed. This includes evaluating market penetration, assessing the operational ratios of suppliers to producers, and the resultant revenue generation. The study will also consider service quality statistics to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry veterans, which are crucial for refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves directly engaging with multiple iron ore mining companies to acquire detailed insights regarding product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Australia Iron Ore Mining market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Structure and Dynamics

- Historical Context and Overview of Major Players

- Supply Chain Analysis

- Value Chain Analysis

- Business Cycle Analysis

- Growth Drivers

Demand from Developing Economies

Technological Advancements in Mining

Export Opportunities - Market Challenges

Environmental Regulations

Price Volatility of Iron Ore - Opportunities

Investment in Sustainable Mining Techniques

Expanding Asian Markets - Trends

Increasing Automation and AI in Mining

Development of Green Steel Initiatives - Government Regulation

Mining Licenses and Compliance

Environmental Impact Assessment Requirements - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Revenue, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Hematite Ore

– Direct Shipping Ore (DSO)

– Blended Hematite Fines

– High-Grade (>60% Fe) Hematite

Magnetite Ore

– Concentrated Magnetite

– Pellet Feed Grade Magnetite

– Low-Impurity Magnetite

Sinter Fines

– 58% Fe Grade Fines

– 62% Fe Benchmark Fines

– Low-Alumina Fines

Pelletized Iron Ore

– Blast Furnace Pellets

– Direct Reduction (DR) Pellets

– Acid Pellets - By Application (In Value %)

Steel Manufacturing

– Basic Oxygen Furnace (BOF)

– Electric Arc Furnace (EAF)

– Direct Reduced Iron (DRI) Feed

Construction

– Infrastructure Projects

– Prefabricated Structures

– Building Frames and Rebars

Automotive

– Chassis and Body Structures

– Engine Parts and Transmissions

– Sheet Metal Applications - By Region (In Value %)

Western Australia

South Australia

Queensland

New South Wales - By Operational Type (In Value %)

Open-Pit Mining

– Large-Scale Surface Mines

– Strip Mining

– Truck and Shovel Operations

Underground Mining

– Sublevel Caving

– Room and Pillar Mining

– Decline Access Methods - By Distribution Channel (In Value %)

Direct Sales

– Long-Term Offtake Agreements

– Export Contracts (China, Japan, South Korea)

– Domestic Steel Plants

Online Sales

– Spot Market Transactions (e.g., via SGX)

– Commodity Trading Platforms

– E-auctions for Mid/Small Producers

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenue by Product/Region, Operational Capacity, Marketing Strategy, Innovation and R&D Investments)

- SWOT Analysis of Major Companies

- Pricing Analysis by Type of Iron Ore

- Detailed Profiles of Major Companies

BHP Group

Rio Tinto

Fortescue Metals Group

Anglo American

Mineral Resources Limited

Mount Gibson Iron

Champion Iron Limited

Grange Resources

Macarthur Minerals

GWR Group

Atlas Iron

Strike Resources

Oz Minerals

Aquila Resources

Element 25

- Market Demand and Utilization Trends

- Purchasing Power and Investment Patterns

- Regulatory Impacts and Compliance Requirements

- Analysis of Needs, Desires, and Pain Points

- Decision-Making Process in Procurement

- By Revenue, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030