Market Overview

Based on a recent historical assessment, the Australia laser range finder and laser designator market reached an absolute market size of USD ~ billion, supported by confirmed acquisition programs under the Integrated Investment Program, platform upgrade contracts, and delivery disclosures from the Australian Department of Defence, aligned with SIPRI-referenced procurement data. Market demand is driven by sustained modernization of land, air, and naval targeting capabilities, increasing adoption of precision-guided munitions, and the integration of laser-enabled fire control systems across infantry, armored vehicles, and airborne platforms supporting joint-force operations.

Based on a recent historical assessment, Australia dominates this market through centralized defense procurement and strong alignment with allied capability development. Canberra serves as the primary policy and procurement hub, while Adelaide, Melbourne, and Brisbane host key defense manufacturing, systems integration, and testing facilities. International dominance is reinforced through deep interoperability with the United States and allied forces, enabling rapid adoption of advanced laser targeting technologies and standardized integration across coalition platforms deployed for regional security and expeditionary missions.

Market Segmentation

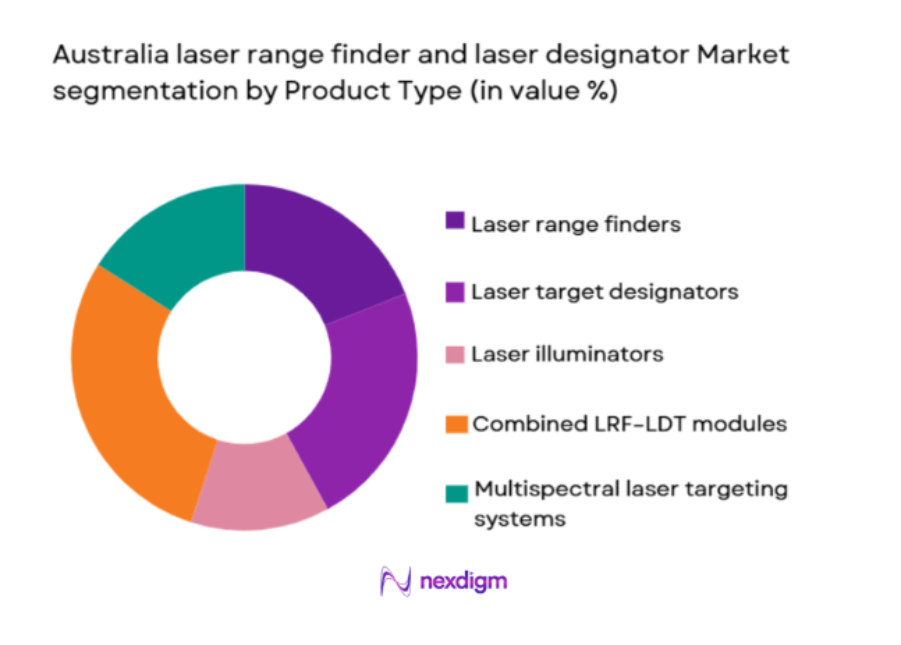

By Product Type

Australia laser range finder and laser designator market is segmented by product type into laser range finders, laser target designators, laser illuminators, combined LRF–LDT systems, and multispectral laser targeting modules. Recently, combined LRF–LDT systems have held a dominant market share due to their ability to integrate ranging, designation, and illumination functions into a single compact solution. This integration reduces system weight, simplifies logistics, and enhances operational efficiency for dismounted soldiers, vehicles, and airborne platforms. Australian Defence Force modernization programs increasingly favor multifunction systems to minimize integration complexity and lifecycle costs. Compatibility with NATO-standard laser-guided munitions further reinforces procurement preference. Strong supplier support, proven interoperability, and reduced training burdens sustain consistent adoption across multiple service branches.

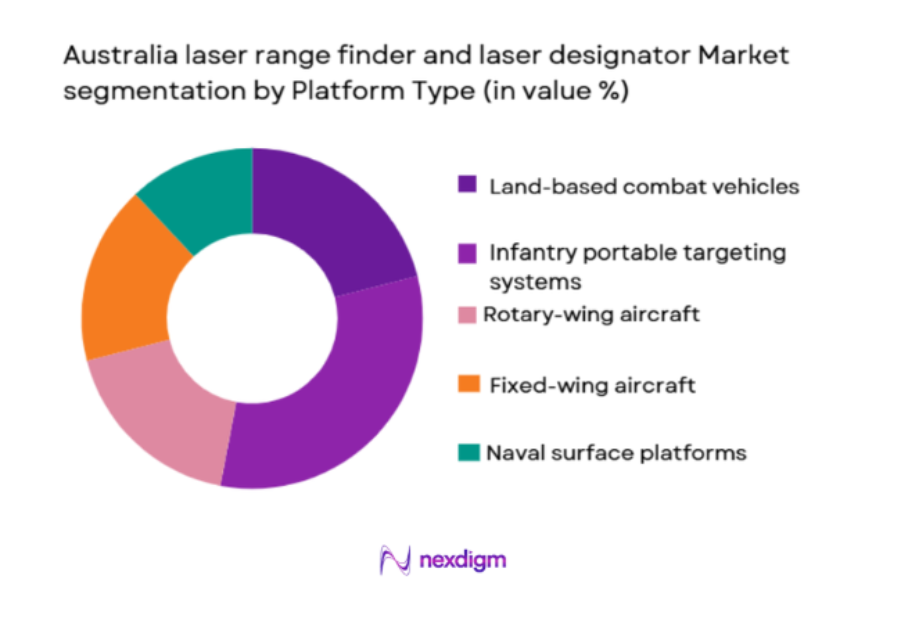

By Platform Type

Australia laser range finder and laser designator market is segmented by platform type into land-based combat vehicles, infantry portable targeting systems, rotary-wing aircraft, fixed-wing aircraft, and naval surface vessels. Recently, infantry portable targeting systems have accounted for the dominant market share due to sustained investment in soldier modernization programs and the emphasis on precision engagement at the tactical level. These systems are critical for joint fires coordination and close air support, driving high procurement volumes. Lightweight, ruggedized designs suited for harsh operating environments are prioritized. Interoperability with allied forces and compatibility with digital battlefield management systems further reinforce adoption, sustaining dominance within this platform segment.

Competitive Landscape

The Australia laser range finder and laser designator market is moderately consolidated, with a small number of global defense primes and specialized domestic firms dominating supply through long-term framework agreements and platform-specific integration contracts. Competitive advantage is shaped by interoperability, ruggedization, lifecycle support capability, and alignment with allied technology standards.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End-Use Platform |

| Thales Australia | 2006 | Sydney | ~ | ~ | ~ | ~ | ~ |

| Raytheon Australia | 1999 | Canberra | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin Australia | 1997 | Canberra | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1994 | Adelaide | ~ | ~ | ~ | ~ | ~ |

| EOS Defence Systems | 1983 | Canberra | ~ | ~ | ~ | ~ | ~ |

Australia Laser Range Finder and Laser Designator Market Analysis

Growth Drivers

Joint Force Modernization and Precision Fires Integration:

Joint Force Modernization and Precision Fires Integration is a core growth driver for the Australia laser range finder and laser designator market because Australian defense strategy increasingly emphasizes networked, precision-enabled operations across land, air, and maritime domains. Laser range finders and designators are essential enablers of joint fires, allowing forward units to coordinate air and artillery strikes accurately. Modernization programs prioritize interoperable targeting systems compatible with allied platforms. The integration of digital battlefield management systems further increases reliance on laser-based targeting. High operational readiness standards drive continuous equipment upgrades. Coalition interoperability requirements reinforce standardization. Precision engagement doctrines reduce collateral risk while increasing effectiveness. These factors collectively sustain consistent demand growth.

Soldier and Platform Lethality Enhancement Programs:

Soldier and Platform Lethality Enhancement Programs drive market expansion by prioritizing advanced targeting capabilities at the tactical level. Infantry and vehicle crews require precise range finding and designation for modern combat scenarios. Laser systems improve first-round hit probability. Lightweight and rugged designs enhance mobility. Training standardization increases adoption. Replacement of legacy optical systems accelerates procurement cycles. Platform upgrades integrate laser systems as core components. Export-aligned specifications further reinforce supplier selection. This sustained focus strengthens long-term market growth.

Market Challenges

High Acquisition and Sustainment Cost Constraints: High

Acquisition and Sustainment Cost Constraints pose a significant challenge to the Australia laser range finder and laser designator market due to the advanced optics, stabilization, and electronics required. Procurement budgets must balance competing modernization priorities. Sustainment costs include calibration, spares, and software updates. Harsh operating environments increase maintenance demands. Long certification cycles elevate upfront costs. Cost pressures may delay replacement programs. Smaller units face prioritization challenges. These factors constrain procurement pace and scalability.

Dependence on Foreign Technology and Supply Chains:

Dependence on Foreign Technology and Supply Chains limits market flexibility as many high-performance laser components are sourced internationally. Supply chain disruptions can delay deliveries. Export control regimes affect availability. Customization timelines extend integration schedules. Currency fluctuations influence costs. Domestic manufacturing scale remains limited. Strategic autonomy objectives increase complexity. These challenges impact planning certainty and long-term resilience.

Opportunities

Expansion of Infantry and Vehicle Targeting Upgrades:

Expansion of Infantry and Vehicle Targeting Upgrades presents a major opportunity as legacy systems are replaced with digital, networked laser solutions. Soldier modernization initiatives create sustained demand. Vehicle upgrade programs integrate advanced fire control. Interoperability with allied forces drives standardization. Modular designs enable phased upgrades. Training efficiencies improve adoption. Exportable configurations enhance volume potential. This opportunity supports steady market expansion.

Naval and Amphibious Force Targeting Modernization:

Naval and Amphibious Force Targeting Modernization offers growth potential as surface vessels and amphibious units adopt advanced laser-enabled fire control. Precision targeting improves naval gun effectiveness. Joint operations require standardized designation. Coastal security missions increase relevance. Integration with combat management systems adds value. Long platform lifecycles ensure recurring upgrades. This opportunity broadens the market beyond land-centric demand.

Future Outlook

Over the next five years, the Australia laser range finder and laser designator market is expected to grow steadily, driven by joint-force modernization, infantry lethality programs, and allied interoperability requirements. Technological advancement will focus on miniaturization, multispectral capability, and digital integration. Regulatory support for defense investment will remain stable. Demand will be reinforced by platform upgrades and sustained regional security commitments.

Major Players

- Thales Australia

- Raytheon Australia

- Lockheed Martin Australia

- BAE Systems Australia

- EOS Defence Systems

- Northrop Grumman Australia

- L3Harris Technologies Australia

- Leonardo Australia

- Saab Australia

- Rheinmetall Defence Australia

- Kongsberg Defence Australia

- Ultra Electronics Australia

- CEA Technologies

- Elbit Systems of Australia

- Honeywell Aerospace Australia

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Infantry modernization programs

- Armored vehicle manufacturers

- Naval combat system integrators

- Defense electronics OEMs

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including system categories, platform integration volumes, pricing benchmarks, and delivery schedules were identified from official defense procurement disclosures and allied capability documents.

Step 2: Market Analysis and Construction

Market sizing was performed using bottom-up aggregation across platforms and system types, aligned with validated acquisition and delivery data.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense procurement specialists, targeting system engineers, and retired military operators.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured market model ensuring analytical rigor, accuracy, and decision-making relevance.

- Executive Summary

- Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Modernization of Australian land and air combat platforms

Increasing adoption of precision guided munitions

Expansion of joint and allied military operations

Rising demand for advanced infantry targeting systems

Integration of laser systems into network centric warfare - Market Challenges

High acquisition and sustainment costs

Dependence on foreign technology suppliers

Stringent regulatory and export control requirements

Complex integration with legacy platforms

Limited domestic manufacturing scale - Market Opportunities

Upgrades to infantry and armored vehicle targeting systems

Naval fire control and targeting modernization

Partnerships with allied defense technology providers - Trends

Miniaturization of laser targeting equipment

Growing use of multifunction laser modules

Emphasis on eye safe and low power lasers

Integration with digital battlefield management systems

Increased focus on interoperability with allied forces - Government Regulations & Defense Policy

Defense modernization under integrated investment programs

Compliance with international laser safety standards

Support for allied defense technology collaboration

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Laser range finders

Laser target designators

Laser illuminators

Combined LRF LDT systems

Multispectral laser targeting modules - By Platform Type (In Value%)

Land based combat vehicles

Infantry portable targeting systems

Rotary wing aircraft

Fixed wing aircraft

Naval surface vessels - By Fitment Type (In Value%)

New platform installation

Mid life upgrade retrofitting

Modular add on systems

Indigenous integration programs

Imported system integration - By EndUser Segment (In Value%)

Australian Army

Royal Australian Air Force

Royal Australian Navy

Special operations forces

Allied and partner military users - By Procurement Channel (In Value%)

Direct Department of Defence procurement

Government to government agreements

Prime contractor system integration

Foreign military sales

Defense industry collaboration programs - By Material / Technology (in Value %)

Solid state laser sources

Eye safe wavelength laser technology

Advanced beam stabilization optics

Electro optical sensor fusion

Digital fire control and targeting software

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (range accuracy, designation distance, wavelength type, platform compatibility, stabilization capability, system weight, power consumption, lifecycle support, interoperability) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Thales Australia

Raytheon Australia

Lockheed Martin Australia

BAE Systems Australia

Northrop Grumman Australia

Elbit Systems of Australia

L3Harris Technologies Australia

Leonardo Australia

Saab Australia

EOS Defence Systems

CEA Technologies

Kongsberg Defence Australia

Ultra Electronics Australia

Rheinmetall Defence Australia

Honeywell Aerospace Australia

- Army units emphasize portable and rugged targeting systems

- Air force prioritizes airborne precision designation

- Naval forces focus on fire control integration

- Special forces demand lightweight and high accuracy solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035