Market Overview

The Australia logistics market is valued at 130.4 billion in 2024 with an approximated compound annual growth rate (CAGR) of 7% from 2025-2030, supported by the rising e-commerce sector, increased consumer demand for timely deliveries, and advancements in logistics technology. Market growth is driven by the expansion of supply chain networks and increasing investments in infrastructure. This sector has seen significant investments leading to enhanced operational efficiency, contributing to its substantial growth momentum from previous years.

Key cities dominating the Australian logistics market include Sydney, Melbourne, and Brisbane due to their strategic locations and developed infrastructure. These cities serve as crucial distribution hubs, connecting various regions across Australia. The concentration of major logistics providers in these metropolitan areas enables efficient handling of goods, thereby accelerating the supply chain and enhancing service levels. Moreover, local government policies promoting urban freight logistics further solidify their market dominance.

Australia’s import regulations significantly impact the logistics sector, with stringent guidelines governing the movement of goods across borders. The Department of Home Affairs reported that import volumes continue to increase, with more than 11 million container imports expected into Australian ports in 2023. These regulations impose strict compliance requirements on logistics providers to adhere to customs duties, tariffs, and safety measures to prevent the entry of prohibited or dangerous goods.

Market Segmentation

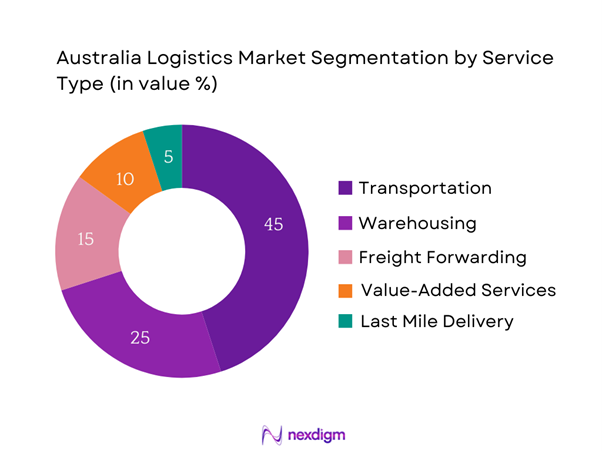

By Service Type

The Australia logistics market is segmented by service type into transportation, warehousing, freight forwarding, value-added services, and last mile delivery. Transportation holds a dominant market share within this segment, largely driven by the substantial demand for freight movement across the vast Australian landscape. Efficient road and rail networks facilitate seamless goods transfer. Furthermore, major transportation companies continue to embrace technology, utilizing optimization tools and AI for better route planning, which enhances efficiency and reduces operational costs.

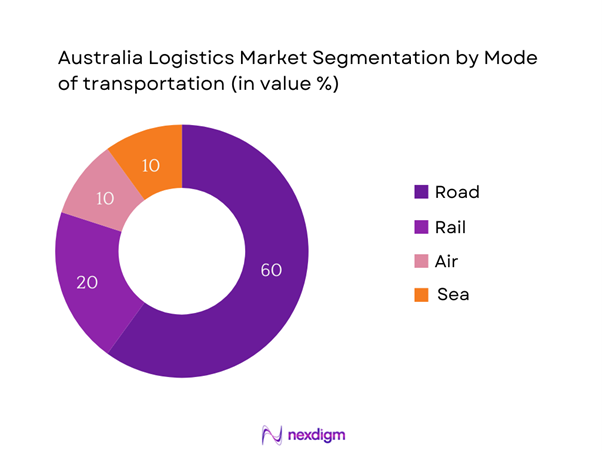

By Mode of Transport

The market is also segmented by mode of transport into road, rail, air, and sea. Road transport dominates the logistics market share due to its flexibility, allowing for door-to-door delivery services that are essential for the e-commerce boom. Road logistics companies benefit from an extensive road network that simplifies distribution channels, and with innovations such as real-time tracking, they enhance customer satisfaction significantly. This adaptability helps businesses meet the increasing consumer expectations for rapid deliveries, solidifying road transport’s leading position in the logistics market.

Competitive Landscape

The Australia logistics market is dominated by several major players, including Toll Holdings, Linfox, and Australia Post. This consolidation indicates the significant influence of key companies leveraging their extensive networks to capture a larger market share. These firms benefit from established relationships with clients and deep expertise in logistics management, making them vital players in shaping market dynamics.

| Company | Establishment Year | Headquarters | Revenue | Services Offered | Market Focus | Technology Utilization |

| Toll Holdings | 1888 | Melbourne | – | – | – | – |

| Linfox | 1956 | Melbourne | – | – | – | – |

| Australia Post | 1809 | Melbourne | – | – | – | – |

| DB Schenker | 1872 | Frankfurt | – | – | – | – |

| Kuehne + Nagel | 1890 | Zurich | – | – | – | – |

Australia Logistics Market Analysis

Growth Drivers

Rise of E-commerce

The rise of e-commerce continues to reshape the logistics landscape in Australia, as the country recorded AUD 63.5 billion in online sales during 2022, reflecting a significant growth trajectory driven by increased consumer adoption of digital shopping platforms. This shift demands sophisticated logistics solutions, including efficient last-mile delivery services. The Australian Bureau of Statistics indicated that the e-commerce sector accounted for approximately 14.4% of total retail turnover in 2022, significantly influencing demand for logistics and distribution services that can meet consumer expectations for swift order fulfillment and flexible delivery options.

Urbanization and Infrastructure Development

Urbanization in Australia has accelerated, with the urban population reaching over 90% of the total population in 2023. This increasing concentration of people in urban centers, particularly in cities like Sydney and Melbourne, has led to heightened demand for efficient logistics and transportation solutions. In 2022, government investments in infrastructure development saw allocations surpassing AUD 16 billion to enhance road, rail, and port facilities, facilitating improved connectivity and logistics efficiency. The ongoing urban expansion is motivating logistics companies to optimize infrastructure strategies to support higher freight volumes in densely populated areas.

Market Challenges

Regulatory Compliance

The logistics market in Australia faces several regulatory compliance challenges, as companies must navigate a complex landscape of federal and state regulations. Compliance with the Heavy Vehicle National Law (HVNL) is vital, given that the road freight sector handles approximately 70% of domestic freight movements. In 2022, the National Heavy Vehicle Regulator reported nearly 1,000 breaches of compliance rules, highlighting the difficulties logistics firms encounter in adhering to evolving regulatory frameworks. Regulations continue to tighten in areas such as safety standards and environmental compliance, placing additional burdens on logistics providers.

Labor Shortages

Labor shortages are a critical challenge for the logistics sector in Australia, with the industry reporting a shortfall of approximately 30,000 skilled workers in 2023. The Australian Workforce and Productivity Agency noted that a significant portion of the logistics workforce is aging, leading to an urgent need for younger talent and adequate training programs. Additionally, the impact of the COVID-19 pandemic on migration policies has exacerbated the labor deficit, slowing the influx of essential foreign workers needed in various logistics roles. Addressing this labor gap is vital for sustaining operational capacity and efficiency in the logistics market.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the Australia logistics market. Investments in automation technologies, including robotics and artificial intelligence, have surged, with companies allocating an estimated AUD 1 billion towards integrating these technologies into their logistics operations throughout 2022. Additionally, advancements in predictive analytics are allowing logistics firms to optimize inventory management and improve operational efficiency. This evolving technological landscape enhances supply chain visibility and customer service capabilities, paving the way for a more responsive logistics ecosystem that anticipates and adapts to market demands.

Sustainability Initiatives

The increasing focus on sustainability is creating opportunities for logistics firms to innovate and enhance their eco-friendliness. Currently, approximately 40% of logistics companies in Australia are undertaking initiatives to reduce carbon emissions and improve energy efficiency within their fleets, driven by both consumer demand and regulatory pressures. The Federal Government’s commitment to achieving net-zero emissions by 2050 aligns with logistics firms’ efforts to adopt greener practices, including investing in electric vehicle fleets and utilizing sustainable packaging materials. These initiatives not only comply with regulations but also respond to a growing consumer base that values sustainability in purchasing decisions.

Future Outlook

Over the next several years, the Australia logistics market is expected to demonstrate significant growth fueled by continued advancements in technology, sustainability initiatives, and the rising demand for efficient supply chain solutions. Increased investments in infrastructure and government policies promoting supply chain resilience will enhance market dynamics, enabling companies to adapt swiftly to evolving consumer preferences and market challenges.

Major Players

- Toll Holdings

- Linfox

- Australia Post

- DB Schenker

- Kuehne + Nagel

- Cegelec

- Qube Holdings

- Mainfreight

- SCT Logistics

- Agility Logistics

- Linehaul Transport

- Hays Logistics

- DHL Supply Chain

- Emirates SkyCargo

- H. Robinson

Key Target Audience

- Government and Regulatory Bodies (Australian Competition and Consumer Commission)

- Transportation and Logistics Companies

- Retail and E-commerce Businesses

- Warehousing Entities

- Manufacturing Firms

- Investments and Venture Capitalist Firms

- Infrastructure Development Companies

- Supply Chain Management Consultants

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia Logistics Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Australia Logistics Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Additionally, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates. This thorough examination of past trends will aid in mapping future trajectories.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data. This step ensures that the research remains grounded in real-world operational experience, enhancing its credibility.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple logistics firms to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Australia Logistics Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Key Trends and Developments

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise of E-commerce

Urbanization and Infrastructure Development - Market Challenges

Regulatory Compliance

Labor Shortages - Opportunities

Technological Advancements

Sustainability Initiatives - Trends

Automation and AI Adoption

Real-Time Tracking Solutions - Government Regulations

Import Regulations

Safety Standards - SWOT Analysis

- Stakeholders Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Service Type (In Value %)

Transportation

– Long Haul

– Short Haul

– Express Delivery

Warehousing

– Cold Storage

– General Storage

– Bonded Warehousing

Freight Forwarding

– International Freight

– Domestic Freight

– Customs Brokerage

Value-Added Services

– Packaging

– Labeling

– Reverse Logistics

Last Mile Delivery

– Urban Delivery

– Suburban Delivery

– Rural Delivery - By Mode of Transport (In Value %)

Road

– Truckload

– Less-than-Truckload (LTL)

Rail

– Intermodal

– Dedicated Freight Rail

Air

– Domestic Cargo

– International Cargo

Sea

– Containerized Cargo

– Bulk Cargo - By Industry Vertical (In Value %)

Retail

– FMCG

– Apparel & Lifestyle

Manufacturing

– Heavy Industries

– Electronics & Electricals

E-commerce

– Direct-to-Consumer

– Marketplace Fulfillment

Healthcare

– Pharmaceuticals

– Medical Equipment

Automotive

– Spare Parts Logistics

– Vehicle Transport - By Region (In Value %)

Eastern Australia

Western Australia

Northern Territory

Southern Australia

Australian Capital Territory - By Customer Type (In Value %)

B2C

– Individual Deliveries

– E-commerce Fulfillment

B2B

– Contract Logistics

– Distribution to Retailers & Wholesalers

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Organizational Structure, Revenues, Revenues by Service Type, Distribution Channels, Number of Touchpoints, Geographic Reach and Coverage, Technological Integration, Sustainability Initiatives, Customer Base and Key Accounts, Delivery Accuracy and Service Reliability Metrics, Margins, Fleet Size and Type, Inventory Management Capabilities, Strategic Partnerships, Value-Added Services, Unique Value Offering, and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Toll Holdings

Linfox

Australia Post

DB Schenker

DHL Supply Chain

Kuehne + Nagel

Cegelec

Mirvac

Mainfreight

Hays Logistics

Qube Holdings

Linehaul Transport

SCT Logistics

APL Logistics

Agility Logistics

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030