Market Overview

The Australia Maritime Patrol Aircraft market is valued at USD ~ billion in 2024, as the country continues to invest in enhancing its maritime security. This market is driven by rising defense budgets and the necessity for advanced surveillance technology to safeguard Australia’s vast coastlines and territorial waters. A combination of increasing regional maritime threats and technological advancements in radar, sensors, and surveillance systems are propelling the demand for more efficient and effective maritime patrol aircraft. Continuous investments in modernization and upgrades by the Australian government support this upward trajectory, highlighting the growing importance of maritime security in the defense sector.

Australia is the dominant player in the maritime patrol aircraft market, with the Australian Defence Force (ADF) spearheading the demand for advanced surveillance and reconnaissance platforms. The ADF’s focus on maintaining a strategic military advantage in the Indo-Pacific region is a key reason for the dominance of Australian defense contractors and collaborations with international manufacturers. Additionally, the defense ecosystems in neighboring countries like New Zealand and regional stakeholders such as Japan also influence the market dynamics, as many of these nations share security interests and engage in joint defense operations, boosting cross-border demand for these specialized aircraft.

Market Segmentation

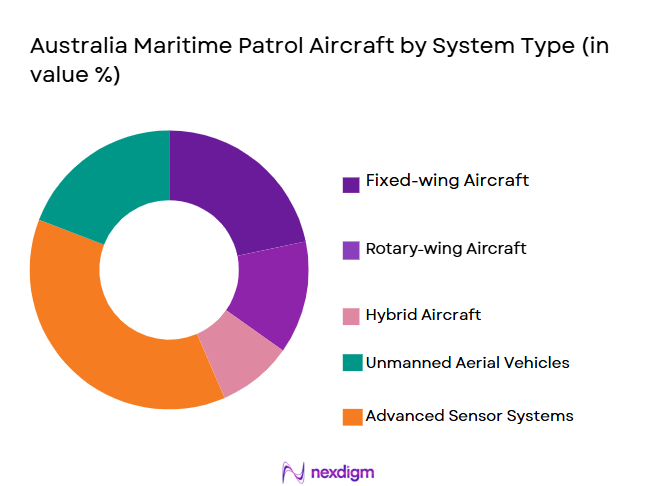

By System Type

Australia Maritime Patrol Aircraft market is segmented by system type into fixed-wing aircraft, rotary-wing aircraft, and unmanned aerial systems (UAS). Among these, fixed-wing aircraft have the largest share in 2024. The dominance of this sub-segment is attributed to their higher operational range, endurance, and ability to carry heavier payloads. Fixed-wing aircraft, such as the Boeing P-8 Poseidon, are widely preferred due to their capability to perform long-duration surveillance missions, making them ideal for Australia’s vast maritime domain. Additionally, advancements in sensor integration and enhanced communication systems further solidify the preference for fixed-wing platforms.

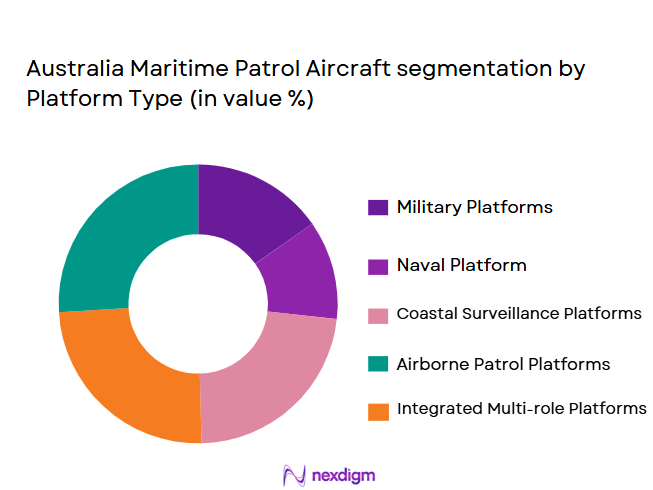

By Platform Type

The market is further segmented by platform type into naval platforms, airborne patrol platforms, and integrated multi-role platforms. Naval platforms dominate the market, holding the largest share in 2024. This is due to the increasing integration of maritime patrol aircraft with naval vessels for enhanced maritime domain awareness. As Australian naval operations focus on enhancing surveillance, reconnaissance, and anti-submarine warfare capabilities, the demand for naval-platform-based aircraft such as the Boeing P-8 Poseidon and other similar systems is expected to remain strong. Their compatibility with naval missions makes these platforms a preferred choice.

Competitive Landscape

The Australia Maritime Patrol Aircraft market is dominated by a few key players, including international giants like Boeing, Lockheed Martin, and Airbus. These companies are major suppliers of advanced systems and technology used in maritime patrol aircraft, such as the Boeing P-8 Poseidon, a prominent aircraft in Australia’s fleet. The market’s competitive landscape reflects the strategic importance of maritime surveillance and the need for continuous innovation, which is why these global players with extensive technological capabilities and strong government relationships dominate the sector.

| Company | Establishment Year | Headquarters | Aircraft Portfolio | R&D Investment | Global Presence | Partnerships with Government Bodies | Product Innovation |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| Saab | 1937 | Linköping, Sweden | ~ | ~ | ~ | ~ | ~ |

Australia maritime patrol aircraft Market Dynamics

Growth Drivers

Increased defense budgets focusing on maritime surveillance

The Australian government has significantly increased defense spending, with a particular focus on maritime surveillance to protect its extensive coastline and strategic interests in the Indo-Pacific region. This spending boosts demand for advanced maritime patrol aircraft, enhancing capabilities to detect, track, and respond to maritime threats.

Rising maritime security concerns in the Indo-Pacific region

Tensions in the Indo-Pacific, particularly related to territorial disputes and rising naval activities, have intensified the need for robust maritime security. Australia’s strategic initiatives, including enhanced patrol aircraft, help address these concerns by ensuring a stronger and more agile defense presence in the region.

Market Challenges

High cost of advanced maritime patrol aircraft systems

The high cost associated with acquiring and maintaining advanced maritime patrol aircraft, including the integration of state-of-the-art technology, poses a challenge. These costs limit procurement by smaller nations or force governments to allocate limited defense budgets towards other priorities, slowing market growth.

Complex regulatory and certification processes

The regulatory and certification processes for defense-related aviation systems, particularly for military and maritime aircraft, are lengthy and complex. Navigating international aviation regulations, export controls, and local defense requirements can delay the production, deployment, and upgrade of maritime patrol aircraft.

Market Opportunities

Emerging demand for unmanned aerial systems (UAS) for surveillance

Unmanned Aerial Systems (UAS) are gaining popularity for maritime surveillance due to their cost-effectiveness and ability to cover large areas without risking human lives. Their growing demand offers a significant market opportunity, as defense agencies look to enhance surveillance capabilities at a lower cost.

Partnerships between defense agencies and technology developers

Increasing collaborations between defense agencies and technology developers present a key opportunity. These partnerships facilitate the development of advanced maritime patrol aircraft equipped with cutting-edge technology, ensuring enhanced operational efficiency and addressing evolving security challenges in the maritime domain.

Future Outlook

Over the next decade, the Australia Maritime Patrol Aircraft market is expected to experience significant growth, driven by ongoing technological advancements, increasing defense budgets, and the growing demand for enhanced maritime security in the Indo-Pacific region. This market will witness an increasing shift towards more advanced systems incorporating artificial intelligence and automation for better surveillance and operational efficiency. Additionally, the integration of unmanned aerial systems (UAS) in maritime patrol operations will open new avenues for cost-effective solutions.

Major Players in the Market

- Boeing

- Lockheed Martin

- Airbus

- Northrop Grumman

- Saab

- Leonardo

- Raytheon Technologies

- BAE Systems

- Thales Group

- General Dynamics

- L3 Technologies

- Textron

- Elbit Systems

- Rockwell Collins

- Leonardo DRS

Key Target Audience

- Australian Defense Forces (ADF)

- Australian Navy

- Australian Air Force

- Investments and Venture Capitalist Firms

- Australian Government (Department of Defence)

- Foreign Government Defense Agencies (e.g., US Department of Defense, UK Ministry of Defence)

- International Maritime Surveillance Agencies

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying all key variables that affect the Australia Maritime Patrol Aircraft market. This is done through a thorough review of secondary and proprietary sources, such as government defense reports, industry publications, and market analysis data. The goal is to construct a comprehensive ecosystem of stakeholders and market dynamics, establishing the variables that will drive further analysis.

Step 2: Market Analysis and Construction

In this phase, we compile and assess historical market data, including the growth rates of key players and market segments. This phase also evaluates historical spending by Australian defense agencies, focusing on maritime patrol aircraft. By analyzing key market factors such as defense budgets and procurement strategies, we develop accurate and relevant market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, we will consult industry experts through interviews and surveys, ensuring that our assumptions are accurate. These consultations will provide valuable insights into both the demand for maritime patrol aircraft and the operational requirements of different end users.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all gathered information into a cohesive and reliable report. This includes validating data through expert opinions, financial analysis, and direct engagement with key players in the market. The output will include verified and comprehensive market insights, detailing trends, forecasts, and actionable recommendations for stakeholders.

- Executive Summary

- Australia Maritime Patrol Aircraft Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense budgets focusing on maritime surveillance

Rising maritime security concerns in the Indo-Pacific region

Technological advancements in radar and sensor systems - Market Challenges

High cost of advanced maritime patrol aircraft systems

Complex regulatory and certification processes

Challenges related to interoperability with existing defense platforms - Market Opportunities

Emerging demand for unmanned aerial systems (UAS) for surveillance

Partnerships between defense agencies and technology developers

Expanding roles of maritime patrol aircraft in environmental monitoring and disaster response - Trends

Development of next-gen surveillance technologies

Integration of artificial intelligence in patrol aircraft systems

Rise in defense spending by Australia and neighboring countries

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Fixed-wing Aircraft

Rotary-wing Aircraft

Hybrid Aircraft

Unmanned Aerial Vehicles (UAVs)

Advanced Sensor Systems - By Platform Type (In Value%)

Military Platforms

Naval Platforms

Coastal Surveillance Platforms

Airborne Patrol Platforms

Integrated Multi-role Platforms - By Fitment Type (In Value%)

Original Equipment Manufacturer (OEM)

Aftermarket Solutions

Retrofit and Upgrades

Platform-based Fitment

Custom-fit Systems - By EndUser Segment (In Value%)

Naval Forces

Air Force & Defense Agencies

Coastal Surveillance Agencies

Private Sector (Contracted Security)

Search & Rescue Units - By Procurement Channel (In Value%)

Direct Purchases from Manufacturers

Government Contracts

Defense Auctions

Indirect Procurement through Third Parties

International Trade & Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Share by System Type, Competitive Intensity, Key Technology Differentiators, Product Price Sensitivity, Geographic Coverage) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Boeing

Lockheed Martin

Airbus

Northrop Grumman

Saab

Leonardo

Thales Group

General Dynamics

L3 Technologies

Elbit Systems

Raytheon Technologies

BAE Systems

Rockwell Collins

Textron

Leonardo DRS

- Growing adoption by defense forces to ensure national security

- Increased interest in maritime patrol aircraft for environmental monitoring

- Demand from private sector for specialized surveillance solutions

- Growing use in coastal and border security applications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035