Market Overview

The Australia Maritime Patrol Naval Vessels market is valued at USD ~ billion in 2023. This growth is primarily driven by the increasing demand for advanced naval surveillance capabilities to secure maritime borders, particularly due to rising geopolitical tensions in the Indo-Pacific region. The Australian government has significantly invested in modernizing its naval fleet, focusing on cutting-edge maritime patrol vessels to enhance security operations and monitoring. The demand for such vessels is expected to increase as part of Australia’s broader defense strategy to enhance its maritime surveillance and border protection efforts.

Australia is the primary player in the Maritime Patrol Naval Vessels market, with its substantial investments in naval modernization. The Australian government is focusing on upgrading its fleet to enhance regional security and maintain its strategic presence in the Indo-Pacific. Additionally, the country’s proximity to major international shipping lanes increases its need for effective maritime surveillance systems. Other dominant countries include the United States, which plays a significant role in maritime security collaborations with Australia, and key allies in the region. The strategic partnerships and defense alliances among these countries further influence the dominance of Australia and its allies in the market.

Market Segmentation

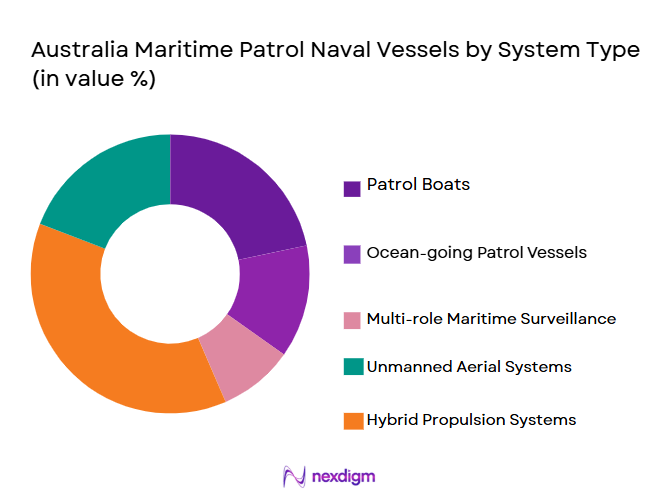

By System Type

The Australia Maritime Patrol Naval Vessels market is segmented by system type into Patrol Boats, Ocean-going Patrol Vessels, Multi-role Maritime Surveillance Platforms, Unmanned Aerial Systems (UAS) for Patrol, and Hybrid Propulsion Systems.

Patrol Boats: Patrol boats dominate the market due to their versatility, efficiency in coastal surveillance, and ability to respond rapidly to threats. These vessels are widely used by the Australian Navy and coast guard for day-to-day operations, border patrol, and anti-smuggling efforts. The Australian government’s focus on bolstering its coastal security through smaller, more agile vessels has led to a significant market share for patrol boats.

Ocean-going Patrol Vessels: These vessels are crucial for securing Australia’s vast oceanic territory. With increasing concerns over maritime threats from regional rivals, the demand for ocean-going patrol vessels has risen. These ships offer long-range patrol capabilities, making them ideal for monitoring international waters, and are a key component of Australia’s defense strategy, especially for operations far from the coastline.

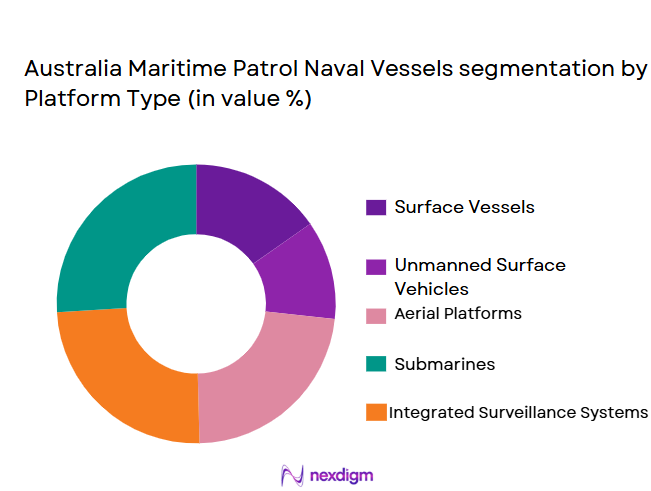

By Platform Type

The market is segmented into Surface Vessels, Unmanned Surface Vehicles (USVs), Aerial Platforms, Submarines, and Integrated Surveillance Systems.Surface vessels have the largest market share in the platform type segment. These vessels are preferred for their operational flexibility, ability to cover large areas, and adaptability to various missions, including patrol, rescue, and defense operations. The Australian Navy, with its large fleet of surface vessels, continues to invest in upgrading these platforms to enhance their capabilities, such as improving stealth features and integrating advanced radar and communication systems.USVs are gaining traction due to their cost-effectiveness and ability to operate in high-risk areas without risking human life. These vehicles are increasingly used in maritime patrols for surveillance, reconnaissance, and even anti-submarine warfare, offering a significant technological edge for naval forces. The Australian government is investing in the integration of these unmanned systems into their maritime patrol strategy, pushing USVs into the spotlight.

Competitive Landscape

The Australia Maritime Patrol Naval Vessels market is dominated by several key players, which include both domestic and international companies. The market’s competitive nature stems from the ongoing advancements in naval technology, with a focus on enhanced surveillance, stealth, and automation. Companies like BAE Systems, Lürssen, and Naval Group Australia are crucial players, driving innovation in the sector.

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Fleet Modernization Initiatives | Global Presence |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ |

| Lürssen | 1893 | Germany | ~ | ~ | ~ | ~ |

| Naval Group Australia | 2017 | Australia | ~ | ~ | ~ | ~ |

| Fincantieri | 1959 | Italy | ~ | ~ | ~ | ~ |

| Huntington Ingalls | 1933 | United States | ~ | ~ | ~ | ~ |

Australia maritime patrol naval vessels Market Dynamics

Growth Drivers

Increasing demand for enhanced coastal and border security

The increasing need for coastal and border security is one of the key growth drivers in the Australia Maritime Patrol Naval Vessels market. As geopolitical tensions rise and maritime security concerns grow, Australia’s government has prioritized the protection of its maritime borders. The vast size of the country’s Exclusive Economic Zone (EEZ) requires advanced surveillance systems, prompting investments in modern naval vessels designed to enhance detection and response capabilities for illegal activities like smuggling, human trafficking, and unauthorized fishing.

Investment in maritime defense and surveillance technologies

The Australian government has made substantial investments in maritime defense and surveillance technologies, leading to a surge in demand for advanced patrol vessels. The integration of cutting-edge radar, sonar systems, and satellite-based communication ensures superior monitoring of vast maritime areas. These technologies provide the Australian Navy with the tools necessary for real-time intelligence gathering, strategic defense planning, and the ability to respond to potential maritime threats, thereby bolstering the need for modernized patrol vessels in the defense sector.

Market Challenges

High initial capital investment for advanced platforms

The high capital expenditure required to acquire advanced maritime patrol vessels is one of the main challenges facing the market. Advanced systems equipped with modern surveillance, sonar, and communication technologies come with a hefty price tag. This creates a financial burden for the Australian government, which must balance investments in these platforms with other national security needs. Additionally, the cost of developing and deploying such advanced vessels can slow the pace at which the fleet is modernized and expanded, posing a challenge for sustained market growth.

Technological integration challenges in multi-platform environments

Integrating new technologies into existing naval platforms remains a significant challenge in the Australia Maritime Patrol Naval Vessels market. Many of the older vessels in Australia’s fleet were not designed to accommodate advanced systems like AI-driven surveillance tools and autonomous control systems. Retrofitting these vessels with new technology is often complex and costly, and integration issues may arise, leading to operational inefficiencies or delays in modernization. Achieving seamless interoperability between new and old systems can slow down the adoption of next-generation platforms.

Market Opportunities

Expanding defense budgets across the Asia-Pacific region

Expanding defense budgets in the Asia-Pacific region present a significant opportunity for the Australia Maritime Patrol Naval Vessels market. As the region faces rising security threats, including territorial disputes in the South China Sea, many countries are increasing their military spending, particularly in naval defense capabilities. Australia’s proximity to this growing demand for advanced naval assets provides an opportunity to enhance its defense infrastructure and further develop its maritime patrol capabilities to meet regional needs.

Adoption of AI and machine learning for enhanced surveillance

The adoption of artificial intelligence (AI) and machine learning (ML) in maritime surveillance systems offers a major opportunity for growth in the Australia Maritime Patrol Naval Vessels market. These technologies can significantly improve threat detection, data analysis, and decision-making processes in naval operations. AI-powered systems can autonomously monitor large areas for potential threats, analyze vast amounts of data faster, and reduce human error, making them invaluable for modernizing Australia’s naval patrol fleet. The increasing integration of AI and ML in surveillance platforms will enhance the effectiveness of Australia’s maritime defense capabilities.

Future Outlook

Over the next decade, the Australia Maritime Patrol Naval Vessels market is expected to experience significant growth. This is driven by continuous advancements in naval technologies, particularly in unmanned systems and hybrid propulsion. Increased government defense spending, alongside growing concerns over maritime security in the Indo-Pacific region, will likely bolster market demand. Additionally, the Australian Navy’s commitment to fleet modernization, alongside strategic defense collaborations with allies, will sustain long-term market expansion. This growth will also be fueled by a shift towards autonomous systems and eco-friendly propulsion technologies.

Major Players

- BAE Systems

- Lürssen

- Naval Group Australia

- Fincantieri

- Huntington Ingalls Industries

- Lockheed Martin

- Thales Australia

- Kongsberg Gruppen

- Northrop Grumman Australia

- Raytheon Australia

- Leonardo Australia

- ASC Shipbuilding

- General Dynamics

- Navantia

- Rolls-Royce

Key Target Audience

- Defense Contractors

- Government and Regulatory Bodies (Australian Department of Defence)

- Investments and Venture Capitalist Firms

- Maritime Security Agencies (Australian Border Force)

- Naval Fleet Managers

- Military Procurement Agencies (Australian Defence Force)

- Naval Research Institutions

- Private Sector Maritime Security Companies

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out key variables that influence the Australia Maritime Patrol Naval Vessels market, including system types, platform types, procurement channels, and end-user segments. This step involves conducting extensive secondary research through government defense publications and industry reports.

Step 2: Market Analysis and Construction

Data from multiple sources, including historical market data and government defense budgets, are used to analyze trends and growth patterns. This phase focuses on assessing the financial implications of investments in maritime security infrastructure.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including senior naval officers and defense strategists, are consulted to validate the identified market drivers and challenges. These consultations help refine initial hypotheses regarding technological advancements and market expansion.

Step 4: Research Synthesis and Final Output

The final analysis combines both qualitative and quantitative data from industry experts and existing market research, providing a comprehensive, validated market report. This stage involves finalizing the market forecast and segmenting it into different categories such as system types and end-user applications.

- Executive Summary

- Australia Maritime Patrol Naval Vessels Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for enhanced coastal and border security

Investment in maritime defense and surveillance technologies

Growing interest in unmanned and autonomous naval systems - Market Challenges

High initial capital investment for advanced platforms

Technological integration challenges in multi-platform environments

Complexities in maintaining aging vessels and retrofitting systems - Market Opportunities

Expanding defense budgets across the Asia-Pacific region

Adoption of AI and machine learning for enhanced surveillance

Potential for collaboration with allied nations on joint defense projects - Trends

Shift towards unmanned and autonomous maritime patrol systems

Integration of advanced data analytics in surveillance operations

Growing focus on hybrid and sustainable propulsion technologies

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Patrol Boats

Ocean-going Patrol Vessels

Multi-role Maritime Surveillance Platforms

Unmanned Aerial Systems (UAS) for Patrol

Hybrid Propulsion Systems - By Platform Type (In Value%)

Surface Vessels

Unmanned Surface Vehicles (USVs)

Aerial Platforms

Submarines

Integrated Surveillance Systems - By Fitment Type (In Value%)

Fleet-Wide Fitment

Retrofit and Upgrades

New-Generation Platforms

Integrated Coastal Defense Systems

Autonomous Systems - By End-user Segment (In Value%)

Royal Australian Navy

Coast Guard and Border Protection Agencies

Commercial Maritime Operations

Private Security Companies

Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Government Tenders and Contracts

Private Sector Distributors

Military Sales through Defense Alliances

Second-hand and Refurbished Platforms

- Market Share Analysis

- Cross Comparison Parameters

(Technological Innovation, Market Penetration, Product Versatility, Cost Competitiveness, Service Support) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Navantia

BAE Systems Australia

Naval Group Australia

Lürssen

Fincantieri

ASC Shipbuilding

Huntington Ingalls Industries

Lockheed Martin

Thales Australia

Kongsberg Gruppen

Northrop Grumman Australia

General Dynamics

Raytheon Australia

Leonardo Australia

DSTG

- Strong government support for defense procurement

- Increasing use of advanced surveillance systems in non-military sectors

- Rising demand for customizable platforms for diverse end-users

- Private sector exploring maritime security solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035