Market Overview

The Australia Maritime Security market is valued at USD ~ billion, supported by increased investments in national defense and rising concerns over maritime threats in the region. This market is driven by various factors, such as growing global maritime trade, the rise in piracy incidents, and the increasing need for port security. Government agencies and private stakeholders continue to prioritize investments in advanced maritime security technologies, bolstering market growth. Additionally, the government’s focus on safeguarding vital resources like oil rigs and shipping lanes has further contributed to the market’s expansion.

Australia’s maritime security market is predominantly dominated by key coastal cities, including Sydney, Melbourne, and Brisbane. These cities serve as major ports for the country, thereby driving the demand for maritime security solutions. Sydney, being the largest port city, handles a significant portion of Australia’s international trade, necessitating advanced security systems. Moreover, the Australian Government’s strategic initiatives and proximity to Asia-Pacific shipping lanes further reinforce Australia’s dominance in the market.

Market Segmentation

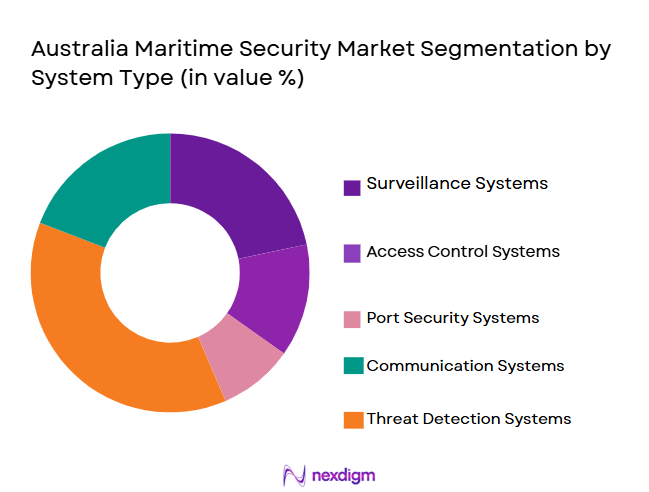

By System Type

The Australia Maritime Security market is segmented into various system types, including surveillance systems, access control systems, port security systems, communication systems, and threat detection systems. Among these, surveillance systems have the dominant market share due to their critical role in monitoring vast maritime zones and ensuring the security of ports and vessels. The continuous development of advanced radar and CCTV systems, coupled with governmental investments in coastal surveillance, further strengthens the dominance of this segment. As technology advances, the integration of AI-based surveillance systems has become more commonplace, allowing for proactive threat identification and monitoring.

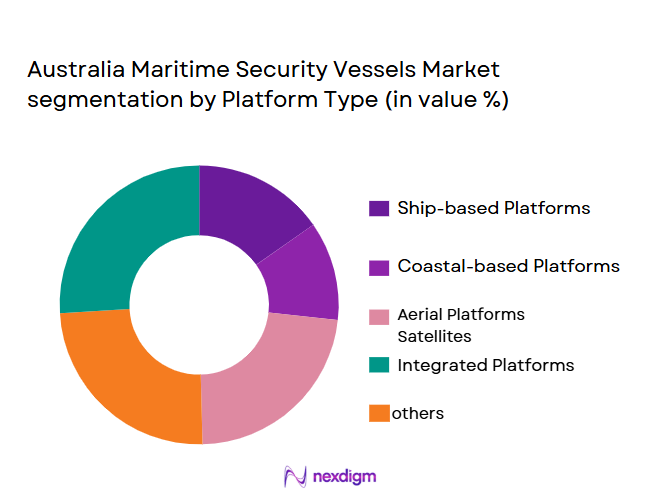

By Platform Type

Australia Maritime Security is segmented by platform type into ship-based platforms, coastal-based platforms, aerial platforms, satellites, and integrated platforms. Ship-based platforms dominate the market share due to their crucial role in securing Australian waters and shipping lanes. The need for vessel tracking, onboard security, and threat detection systems is driving this platform type’s dominance. Moreover, advancements in unmanned maritime vessels and shipboard security technologies contribute to the continuous growth in this segment. With the expansion of international maritime trade and shipping routes, ship-based platforms remain the primary focus for security initiatives.

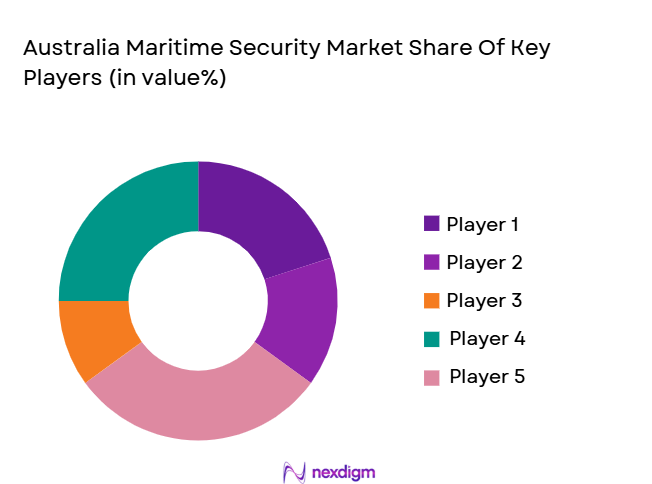

Competitive Landscape

The Australia Maritime Security market is dominated by a few key global and local players, such as Thales Group, Lockheed Martin, and Northrop Grumman. These companies have established themselves as significant players due to their technological advancements, expertise in defense systems, and the ability to meet regulatory requirements. These companies are supported by strong defense and security budgets, government contracts, and their presence in major maritime ports.

| Company | Establishment Year | Headquarters | Revenue | Product Portfolio | R&D Investment | Global Reach | Client Base | Technological Innovation |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo S.p.A. | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ | ~ |

Australia maritime security Market Dynamics

Growth Drivers

Increase in Maritime Trade Activities

The growth in global maritime trade significantly drives the demand for enhanced maritime security systems in Australia. As the country serves as a major hub for trade in the Asia-Pacific region, there has been an increased need for advanced surveillance and monitoring systems to protect ports, vessels, and shipping lanes. The rising volume of goods transported via sea boosts the importance of maintaining a secure maritime environment to prevent disruptions in trade and to safeguard critical infrastructure.

Rising Threats to National and International Maritime Security

The growing frequency of maritime security threats such as piracy, terrorism, and illegal trafficking has intensified the need for robust security systems. With Australia’s strategic position along vital global shipping routes, there is a pressing demand for technologies that can detect and mitigate potential threats. The global nature of maritime security means that Australia’s involvement in international cooperation and secure trade routes also drives innovation and investment in security measures.

Market Challenges

High Installation and Maintenance Costs

The installation and ongoing maintenance costs of maritime security systems are a major challenge in the market. Sophisticated surveillance, access control, and threat detection systems require substantial capital investment and long-term maintenance. For both government and private entities, these high costs can be prohibitive, particularly for smaller ports and shipping companies that may lack the necessary financial resources to implement or upgrade their security infrastructure.

Lack of Standardization in Maritime Security Technologies

One of the challenges faced in the maritime security sector is the lack of standardization across security technologies. With a wide range of security systems, protocols, and technologies available, interoperability issues often arise between different systems, which can undermine the effectiveness of security measures. This lack of uniformity complicates the integration of newer technologies into existing infrastructure, creating barriers to the adoption of advanced security solutions and hindering overall system efficiency.

Market Opportunities

Emerging Maritime Security Technology Developments

Technological advancements in areas such as artificial intelligence, automation, and cybersecurity are offering significant opportunities for growth in the maritime security market. The development of autonomous systems, such as unmanned surface vessels and drones, is transforming the way maritime security threats are monitored and addressed. These innovations allow for more efficient and cost-effective security measures, enhancing the capability to detect and respond to potential threats in real-time.

Public-Private Partnerships for Security Infrastructure

Public-private partnerships (PPPs) offer significant opportunities for improving maritime security infrastructure. Collaborations between government agencies and private security solution providers can help bridge funding gaps and accelerate the deployment of advanced technologies. These partnerships enable better coordination and resource sharing, ensuring that critical infrastructure, such as ports and shipping lanes, is adequately secured. By leveraging the expertise and resources of both sectors, PPPs can help drive innovation and enhance the resilience of maritime security systems.

Future Outlook

Over the next decade, Australia’s maritime security market is expected to experience significant growth. This growth will be fueled by advancements in maritime security technologies, particularly in the areas of surveillance, autonomous systems, and AI-based threat detection. Additionally, the increasing demand for port security and the rising risk of maritime threats, such as piracy and cyber-attacks, will drive government investments and private sector involvement. With Australia’s strategic location in the Asia-Pacific region, the need for robust maritime security solutions will continue to rise.

Major Players in the Market

- Thales Group

- Lockheed Martin

- Northrop Grumman

- Leonardo S.p.A.

- BAE Systems

- Saab AB

- Raytheon Technologies

- Harris Corporation

- L3 Technologies

- Kongsberg Gruppen

- General Dynamics

- Elbit Systems

- Indra Sistemas

- Rockwell Collins

- Oceaneering International

Key Target Audience

- Investments and venture capitalist firms

- Government agencies

- Port authorities and operators

- Shipping companies

- Defense contractors

- Oil & gas exploration firms

- Maritime security technology providers

- Transport & logistics companies

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research involves constructing a comprehensive ecosystem map of the Australian Maritime Security market. This step is carried out through secondary research, reviewing industry reports and databases to understand key market drivers, such as port security and defense investments. Key variables, such as technology adoption and government policies, are identified to assess their impact on market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled, focusing on aspects such as market penetration, revenue trends, and technological adoption. Analysis will be done to evaluate the evolution of maritime security systems, including surveillance, access control, and threat detection systems. The aim is to produce accurate market sizing data for current and future periods.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the growth potential and challenges in the maritime security market are validated through in-depth consultations with industry experts. These consultations help refine assumptions, verify the accuracy of market models, and ensure that the forecasts are robust. Experts provide valuable insights from both the government and private sector perspectives.

Step 4: Research Synthesis and Final Output

In this phase, final validation is done by engaging with key stakeholders, including maritime security firms, government entities, and technology providers. The aim is to verify market trends, emerging technologies, and customer preferences. A combination of primary research and expert consultations will finalize the insights, providing a comprehensive and accurate market forecast.

- Executive Summary

- Australia Maritime Security Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Maritime Trade Activities

Rising Threats to National and International Maritime Security

Government Investment in Maritime Security Infrastructure - Market Challenges

High Installation and Maintenance Costs

Lack of Standardization in Maritime Security Technologies

Regulatory Compliance Issues - Market Opportunities

Emerging Maritime Security Technology Developments

Public-Private Partnerships for Security Infrastructure

Growing Demand for Integrated Security Solutions - Trends

Shift Towards Autonomous and Remote Security Systems

Increased Use of Artificial Intelligence and Big Data in Maritime Security

Collaboration Among Global and Local Security Agencies

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surveillance Systems

Access Control Systems

Port Security Systems

Communication Systems

Threat Detection Systems - By Platform Type (In Value%)

Ship-based Platforms

Coastal-based Platforms

Aerial Platforms

Satellites

Integrated Platforms - By Fitment Type (In Value%)

Retrofit

OEM

Hybrid - By EndUser Segment (In Value%)

Government & Defense

Commercial Ports

Shipping Companies

Oil & Gas Industry

Transport & Logistics - By Procurement Channel (In Value%)

Direct Procurement

Government Procurement

Third-party Vendors

System Integrators

Online Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Revenue Growth, Product Innovation, Regional Presence, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility Customer Base) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Thales Group

Northrop Grumman

Raytheon Technologies

Bae Systems

Lockheed Martin

Saab AB

Leonardo S.p.A.

General Dynamics

L3 Technologies

Kongsberg Gruppen

Indra Sistemas

Elbit Systems

Harris Corporation

Rockwell Collins

Oceaneering International

- Government agencies increasing investment in port security systems

- Shipping companies adopting advanced surveillance solutions

- Growing adoption of automated security systems in logistics operations

- Rising demand for integrated systems by defense forces

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035