Market Overview

The Australia Maritime Situational Awareness Systems market is valued at approximately USD ~ billion in 2024. This growth is primarily driven by increasing demand for maritime security solutions, including radar and sonar systems, aimed at enhancing the safety and efficiency of the country’s maritime operations. The Australian government’s focus on improving defense infrastructure, coupled with the need to secure vital trade routes, contributes significantly to the market’s expansion. These systems help in monitoring coastal activities, ensuring safety, and preventing illegal activities in maritime zones.

Australia’s maritime market is predominantly driven by key coastal regions such as Sydney, Melbourne, and Brisbane. These cities serve as hubs for both commercial and defense operations, hosting major ports and naval facilities. Australia’s extensive coastline, combined with its strategic importance in the Indo-Pacific region, positions these cities as vital centers for maritime situational awareness systems. The government’s investment in maritime security technologies further strengthens the presence of these regions in the market.

Market Segmentation

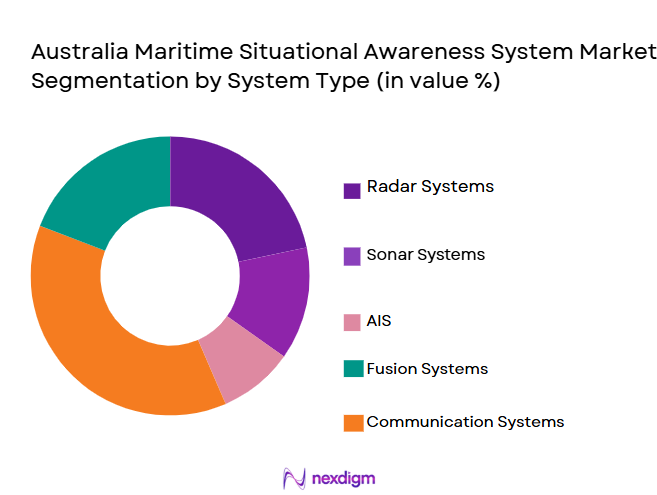

By System Type

The Australia Maritime Situational Awareness Systems market is segmented by system type into radar systems, sonar systems, Automatic Identification Systems (AIS), communication systems, and fusion systems. Among these, radar systems hold the dominant market share in 2024. This is due to their established use in detecting ships and other maritime activities over long distances, making them a critical tool for surveillance and navigation. Radar systems are widely used in both commercial and defense sectors, contributing to their strong presence in the market.

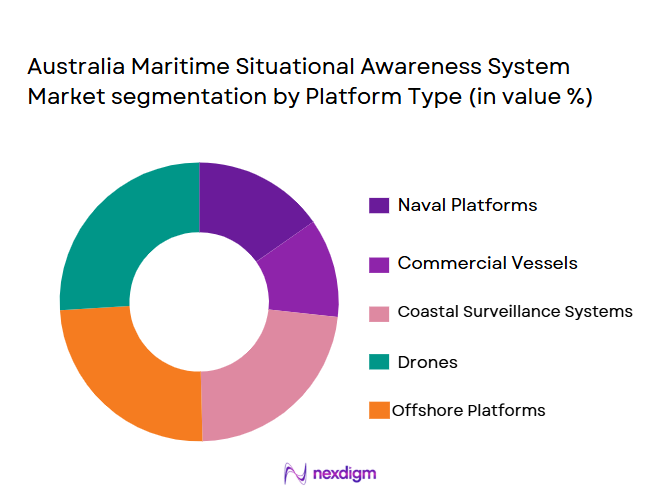

By Platform Type

The market is also segmented by platform type into naval platforms, commercial vessels, coastal surveillance systems, drones, and offshore platforms. The naval platforms segment dominates the market, as it represents the primary consumer of advanced situational awareness systems for defense and national security purposes. The Australian Navy’s ongoing efforts to modernize and enhance its surveillance capabilities drive the demand for these systems.

Competitive Landscape

The Australia Maritime Situational Awareness Systems market is dominated by a few key players who specialize in defense and security technologies. The market is consolidated, with companies like Thales Group, L3 Technologies, and Lockheed Martin playing pivotal roles in the sector. These companies are instrumental in the development and supply of cutting-edge maritime security solutions to both the government and private sectors. The market’s competitive dynamics reflect the significant influence of these industry leaders.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Focus | R&D Investment | Geographic Presence |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ |

| L3 Technologies | 2018 | New York, USA | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Kongsberg Gruppen | 1814 | Kongsberg, Norway | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

Australia Maritime Situational Awareness Systems Market Dynamics

Growth Drivers

Increased demand for enhanced maritime security

The growing need for robust maritime security solutions in Australia has resulted in increased demand for advanced situational awareness systems. These systems, such as radar and sonar technologies, are crucial for monitoring maritime activities, preventing illegal practices, and ensuring the safety of trade routes. Rising concerns about terrorism, piracy, and illegal fishing activities have further intensified the focus on maritime security. As Australia is a key player in the Indo-Pacific region, safeguarding its waters has become essential, driving the adoption of these systems by both governmental and commercial entities.

Government initiatives to improve maritime defense capabilities

The Australian government’s focus on enhancing its defense capabilities has greatly influenced the growth of the maritime situational awareness systems market. Various defense programs, such as the Australian Defence Force’s commitment to upgrading its naval and coastal surveillance systems, have been critical drivers. The government’s investments in modernizing maritime surveillance infrastructure, including the integration of advanced technologies like AI and machine learning, aim to bolster national security. These strategic initiatives ensure that Australia remains competitive in maritime defense and helps safeguard its extensive maritime territory.

Market Challenges

High initial investment costs for advanced systems

The primary challenge facing the Australia Maritime Situational Awareness Systems market is the high upfront costs associated with deploying advanced surveillance systems. Technologies such as radar, sonar, and integrated communication systems require substantial capital investment, which can be prohibitive for smaller entities or regions with limited budgets. Although these systems offer long-term benefits in terms of safety and operational efficiency, the significant initial financial burden may slow down widespread adoption, particularly in the private sector or among smaller maritime operators.

Challenges in system integration across different platforms

Another significant challenge in the market is the difficulty of integrating different maritime situational awareness systems across various platforms. For instance, aligning radar systems, sonar equipment, and communication technologies in both naval and commercial vessels is complex. The lack of standardization and the necessity for custom-built solutions for different maritime platforms can lead to compatibility issues and inefficiencies. Additionally, ongoing maintenance and upgrades of these systems add to the operational costs, further complicating the integration process.

Market Opportunities

Expansion of offshore energy production and exploration

The expansion of offshore energy production, particularly in oil, gas, and renewable energy sectors, presents a major opportunity for the maritime situational awareness systems market. As Australia continues to explore and develop its offshore resources, the need for real-time surveillance and monitoring systems will grow. These systems are essential for ensuring the safety of personnel and vessels in often remote and hazardous offshore environments. The increased focus on offshore exploration and production will drive the demand for advanced monitoring solutions to improve operational efficiency and safety.

Increased investment in smart port technologies

The growth of smart ports, which integrate digital technologies for improved operational efficiency, offers substantial opportunities for maritime situational awareness systems. Smart ports rely heavily on real-time data to manage vessel traffic, cargo handling, and port security. The deployment of advanced situational awareness technologies, such as radar and AIS systems, will be crucial in enhancing port operations. As Australia’s ports modernize to accommodate increasing shipping traffic and emerging technologies like autonomous vessels, there will be a growing need for systems that can ensure both security and operational efficiency.

Future Outlook

Over the next decade, the Australia Maritime Situational Awareness Systems market is expected to see steady growth, driven by the Australian government’s continued emphasis on enhancing defense and security technologies. This will be supported by technological advancements, such as the integration of artificial intelligence in maritime surveillance systems and the increasing need for autonomous shipping and offshore operations. The market is likely to witness a steady adoption of these systems, particularly in the naval defense sector, with a strong forecasted CAGR of ~% from 2026 to 2035.

Major Players in the Market

- Thales Group

- L3 Technologies

- Lockheed Martin

- Kongsberg Gruppen

- Raytheon Technologies

- BAE Systems

- Harris Corporation

- Elbit Systems

- Northrop Grumman

- Leonardo

- General Electric

- Navantia

- Rheinmetall Defence

- Honeywell International

- Saab AB

Key Target Audience

- Defense and Security Agencies (e.g., Australian Department of Defence)

- Government and Regulatory Bodies (e.g., Australian Maritime Safety Authority)

- Naval Operators

- Port Authorities

- Commercial Shipping Companies

- Offshore Oil and Gas Companies

- Manufacturers of Maritime Surveillance Systems

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the core components of maritime situational awareness systems in Australia, such as radar and sonar technologies, and understanding how these systems are integrated into various platforms. Desk research and secondary data sources are used to map out the market drivers and challenges that influence system adoption.

Step 2: Market Analysis and Construction

We gather historical market data to construct a comprehensive overview of the maritime situational awareness systems market in Australia. This includes reviewing past market trends, product developments, and user adoption rates to provide a detailed understanding of the current market state and future forecasts.

Step 3: Hypothesis Validation and Expert Consultation

We validate the market hypotheses with consultations from key stakeholders in the defense and maritime industries. These consultations help refine the understanding of market needs and provide additional insights into future trends, customer preferences, and technological developments.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all research findings and engaging with key players to acquire the latest product information, market strategies, and technological advancements. This phase ensures that the market forecast and analysis are both comprehensive and accurate.

- Executive Summary

- Australia Maritime Situational Awareness Systems Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for enhanced maritime security

Government initiatives to improve maritime defense capabilities

Technological advancements in situational awareness systems - Market Challenges

High initial investment costs for advanced systems

Challenges in system integration across different platforms

Regulatory compliance hurdles in maritime surveillance systems - Market Opportunities

Expansion of offshore energy production and exploration

Increased investment in smart port technologies

Growing demand for autonomous shipping systems - Trends

Advancement of AI and machine learning in maritime situational awareness

Integration of blockchain technology for data security

Increased focus on cybersecurity for maritime systems

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Radar Systems

Sonar Systems

AIS (Automatic Identification Systems)

Fusion Systems

Communication Systems - By Platform Type (In Value%)

Naval Platforms

Commercial Vessels

Coastal Surveillance Systems

Drones

Offshore Platforms - By Fitment Type (In Value%)

New Installations

Retrofit Systems

Upgrade Systems

Integrated Systems

Standalone Systems - By EndUser Segment (In Value%)

Defense & Security Agencies

Shipping & Logistics Companies

Port Authorities

Offshore Exploration Companies

Coastal Surveillance Services - By Procurement Channel (In Value%)

Direct Procurement

Distributor Networks

OEM Partnerships

Online Procurement Platforms

Public Sector Tendering

- Market Share Analysis

- Cross Comparison Parameters

(Market Share, Product Innovation, Regional Presence, Technology Integration, Customer Loyalty) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Cochlear Limited

L3 Technologies

Thales Group

Elbit Systems

Lockheed Martin

Raytheon Technologies

Bae Systems

Kongsberg Gruppen

Harris Corporation

Navantia

Rheinmetall Defence

Northrop Grumman

Leonardo

General Electric

Honeywell International

- Defense and security agencies focusing on border protection

- Shipping and logistics companies adopting advanced tracking systems

- Port authorities upgrading to smart ports for efficient operations

- Offshore exploration companies implementing real-time monitoring

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035