Market Overview

The Australia Maritime Surveillance Market is valued at USD ~ billion in 2024, primarily driven by the increasing demand for enhanced maritime security and surveillance across Australia’s coastal regions. This growth is underpinned by government investments in defense technologies, particularly maritime security platforms, alongside the growing need for real-time surveillance to monitor illegal activities like fishing, piracy, and trafficking. The market’s expansion is also fueled by advancements in surveillance technologies, including drones, radar systems, and satellite-based platforms, which provide more accurate and efficient monitoring.

The market is dominated by key players located in major Australian cities such as Sydney, Melbourne, and Brisbane. These cities play a crucial role due to their proximity to strategic maritime routes, and their presence serves as the hub for government agencies and defense contractors driving the demand for surveillance solutions. The dominance of these regions can also be attributed to the proximity to Australia’s naval operations, where innovations in surveillance and security are continually integrated into operational defense strategies.

Market Segmentation

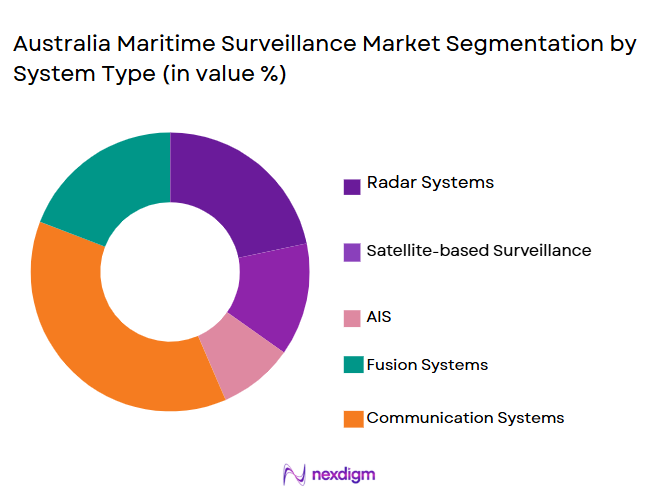

By System Type

The Australia Maritime Surveillance market is segmented into radar systems, satellite-based surveillance, Automatic Identification Systems (AIS), sonar systems, and UAV-based surveillance systems. Radar systems dominate the market in 2024, accounting for the largest market share. This is largely because radar systems have been in use for a long time and are integral to both military and commercial maritime operations. Their ability to detect vessels and monitor large areas makes them indispensable for monitoring Australia’s extensive coastal waters. Moreover, with advancements in radar technology, such as increased resolution and greater range, radar systems remain the preferred solution for maritime surveillance, contributing to their continued dominance in the market.

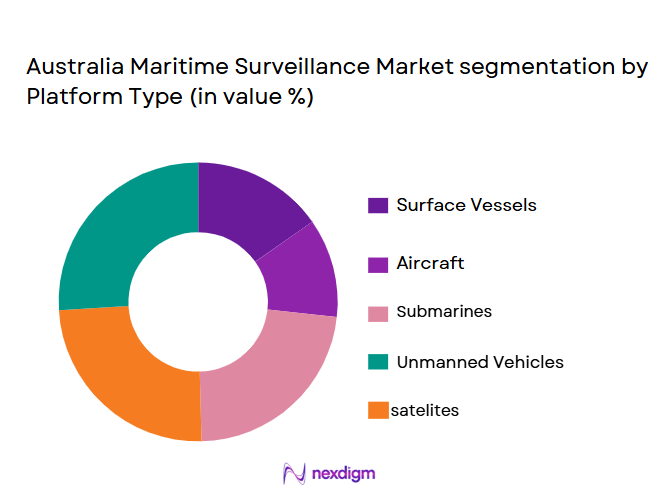

By Platform Type

The Australia Maritime Surveillance market is also segmented by platform type, including surface vessels, aircraft (both fixed-wing and rotary-wing), submarines, unmanned vehicles, and satellites. Surface vessels hold the largest market share, driven by their ability to patrol large expanses of the maritime domain. Their versatility and endurance make them vital assets in both defense and law enforcement operations. Additionally, surface vessels are integral to anti-piracy and anti-smuggling efforts, making them crucial for maintaining Australia’s maritime security. The high demand for surveillance vessels equipped with advanced monitoring systems is expected to continue driving this segment’s dominance.

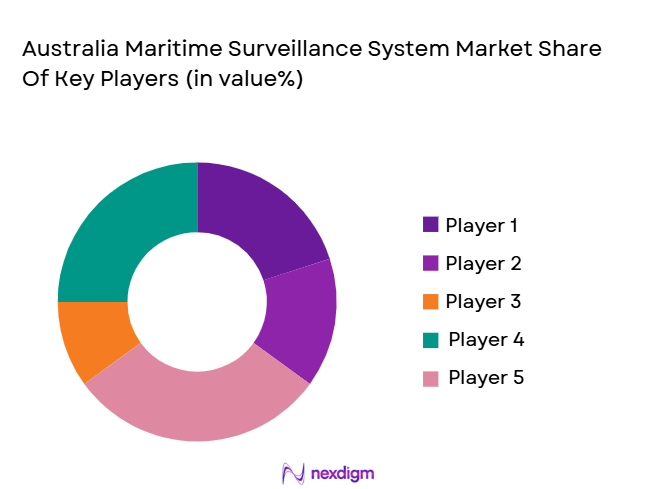

Competitive Landscape

The Australia Maritime Surveillance market is dominated by a few major players who offer a diverse range of solutions to cater to the varying needs of defense, law enforcement, and commercial maritime sectors. Leading companies such as Thales Group, Lockheed Martin, and Boeing play a crucial role in shaping the market with their cutting-edge surveillance technologies. Their dominance in the market is facilitated by their long-standing presence in Australia, strong relationships with government agencies, and a proven track record in providing high-quality surveillance systems. As Australia continues to enhance its maritime surveillance capabilities, these companies are expected to remain at the forefront of innovation and market leadership.

| Company | Establishment Year | Headquarters | Technological Advancements | Market Reach | Product Portfolio | Partnerships |

| Thales Group | 1893 | Sydney, Australia | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| L3 Technologies | 1997 | New York, USA | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ |

Australia maritime surveillance Market Dynamics

Growth Drivers

Increased maritime security concerns

Australia’s vast coastline and significant maritime trade routes have heightened concerns regarding national security, illegal fishing, smuggling, and piracy. The need to safeguard Australia’s borders and territorial waters has led to a greater focus on strengthening maritime security. This concern drives demand for more advanced surveillance systems to monitor these vast expanses efficiently. With increasing threats and challenges posed by both traditional and non-traditional security risks, the push for cutting-edge surveillance technologies has intensified, ensuring better detection, tracking, and monitoring capabilities to protect national interests.

Rising demand for autonomous surveillance platforms

The growing demand for autonomous surveillance platforms in the maritime sector is driven by their ability to operate continuously, reduce human error, and enhance operational efficiency. Drones, UAVs, and autonomous underwater vehicles (AUVs) are gaining popularity due to their ability to perform high-risk surveillance tasks while minimizing human intervention. These platforms offer extended operational hours and increased accuracy, which are vital for covering large maritime areas. As technological advancements make autonomous systems more reliable and cost-effective, their adoption in both defense and commercial sectors is poised for significant growth.

Market Challenges

High cost of deployment and maintenance

The high initial cost of advanced maritime surveillance systems, including radar systems, satellites, and autonomous platforms, poses a significant barrier to market growth. Additionally, these systems require ongoing maintenance, software upgrades, and specialized personnel, further increasing operational costs. For many organizations, especially smaller entities or those with limited budgets, the financial burden can be prohibitive. This challenge is particularly prominent in regions where funding is restricted or defense budgets are stretched, hindering the widespread deployment of advanced maritime surveillance solutions.

Integration complexity with existing systems

Integrating new surveillance technologies with existing infrastructure can be a complex and time-consuming process. Many organizations use legacy systems that were not designed to communicate with modern, advanced surveillance platforms. Compatibility issues, system upgrades, and the need for training personnel to operate these systems efficiently add to the complexity. Additionally, the seamless integration of different data sources, such as radar, satellite, and UAV systems, remains a challenge, requiring substantial coordination and customization to ensure optimal system performance and effective monitoring across various platforms.

Market Opportunities

Growth in regional maritime trade and shipping

Australia’s position as a key player in global trade, particularly in the Asia-Pacific region, has led to an increase in maritime trade and shipping activities. As international shipping grows, there is an increasing need for robust surveillance systems to monitor commercial vessels, detect anomalies, and ensure safety. The expansion of maritime trade brings opportunities for the adoption of advanced monitoring solutions to protect cargo, prevent piracy, and ensure the smooth flow of trade. Consequently, companies and government agencies are investing heavily in maritime surveillance to secure critical shipping routes and enhance operational efficiency.

Advancements in AI-powered surveillance technologies

Artificial intelligence (AI) is playing a transformative role in the development of maritime surveillance systems. AI-powered technologies can process vast amounts of data from multiple sensors and surveillance platforms, enabling real-time decision-making and automated threat detection. Machine learning algorithms can also predict patterns of behavior, such as identifying abnormal vessel movements or potential security threats, improving situational awareness. As AI technology continues to evolve, its integration into maritime surveillance systems offers substantial opportunities to enhance system accuracy, reduce operational costs, and improve overall security, making it a key growth driver in the market.

Future Outlook

Over the next decade, the Australia Maritime Surveillance market is expected to show significant growth, driven by continuous government investments in naval defense and the increasing adoption of advanced surveillance technologies. With the rise of new platforms, including unmanned vehicles and AI-powered surveillance systems, the market will benefit from improved monitoring capabilities and increased operational efficiency. Furthermore, expanding maritime trade and rising concerns over illegal activities in Australian waters will continue to drive the demand for robust surveillance solutions.

Major Players

- Thales Group

- Lockheed Martin

- Boeing

- L3 Technologies

- Northrop Grumman

- Leonardo

- Saab

- General Dynamics

- Raytheon

- Elbit Systems

- Harris Corporation

- Kongsberg Gruppen

- Indra Sistemas

- Leonardo DRS

- Cubic Corporation

Key Target Audience

- Australian Defense Forces (ADF)

- Australian Border Force (ABF)

- Australian Maritime Safety Authority (AMSA)

- National Security Agencies (Australia)

- Investment and Venture Capital Firms

- Commercial Shipping Companies

- Government and Regulatory Bodies (Department of Home Affairs)

- Port Authorities and Operators

Research Methodology

Step 1: Identification of Key Variables

The first step involves defining the key variables impacting the Australia Maritime Surveillance market. Desk research is employed to gather data from secondary sources such as industry reports, government publications, and financial databases. This step focuses on identifying factors such as government spending, technological advancements, and market trends that drive the market’s growth.

Step 2: Market Analysis and Construction

In this phase, historical data on market trends, technological deployments, and system use within the Australian defense and maritime sectors are analyzed. This analysis includes assessing the adoption rates of different surveillance technologies and understanding their impact on maritime security.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth drivers and challenges are tested through consultations with industry experts, including engineers, defense contractors, and government officials. These consultations help validate assumptions and provide further insights into operational strategies, technological needs, and future projections.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from various sources to provide a comprehensive market report. This includes integrating insights gained from expert consultations with secondary data to ensure the accuracy and relevance of the final output. Additionally, primary data collection helps refine market estimates, ensuring that the report reflects current trends and future developments accurately.

- Executive Summary

- Australia Maritime Surveillance Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased maritime security concerns

Rising demand for autonomous surveillance platforms

Technological advancements in AI and data analytics - Market Challenges

High cost of deployment and maintenance

Integration complexity with existing systems

Regulatory and compliance barriers - Market Opportunities

Growth in regional maritime trade and shipping

Advancements in AI-powered surveillance technologies

Government investments in defense and security initiatives - Trends

Shift toward AI and machine learning in surveillance systems

Rising use of drones for cost-effective maritime surveillance

Integration of satellite and drone data for improved tracking

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Radar Systems

Satellite-based Surveillance

AIS (Automatic Identification System)

Sonar Systems

Drones and UAVs - By Platform Type (In Value%)

Surface Vessels

Aircraft (Fixed-wing and Rotary-wing)

Submarines

Unmanned Vehicles

Satellites - By Fitment Type (In Value%)

OEM Fitments

Retrofit

Upgrades

Mobile Platforms

Standalone Systems - By EndUser Segment (In Value%)

Defense Forces

Government Agencies

Commercial Shipping Companies

Port Authorities

Search and Rescue Operators - By Procurement Channel (In Value%)

Direct Sales

Distributor Networks

Online Platforms

Government Tenders

Third-Party Vendors

- Market Share Analysis

- Cross Comparison Parameters

(Revenue, Product Portfolio, Market Reach, Technological Innovation, Integration Compatibility with Legacy Platforms, R&D & Technical Innovation Index, Customization & Configuration Flexibility Pricing Strategy) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Thales Group

Leonardo

Northrop Grumman

L3 Technologies

Boeing

Raytheon

Saab AB

General Dynamics

Harris Corporation

Elbit Systems

Indra Sistemas

Cubic Corporation

Leonardo DRS

Kongsberg Gruppen

- Increasing demand for surveillance from defense agencies

- Commercial shipping companies’ need for enhanced safety measures

- Government agencies adopting new surveillance technologies

- Search and rescue operators seeking real-time data for operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035