Market Overview

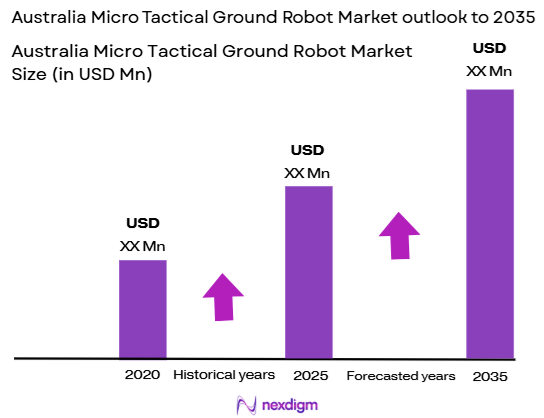

The Australia Micro Tactical Ground Robot market is valued at USD ~million in 2024 .It is expected to grow significantly due to increasing government investments in defense technologies and the expanding adoption of robotics across military operations. The market is driven by the demand for enhanced surveillance, reconnaissance capabilities, and autonomous ground systems that provide tactical advantages in defense applications. Additionally, advancements in AI and robotics technologies are making these systems more effective and affordable. As the Australian government continues to prioritize defense and security technology, the micro tactical ground robot market is set to grow, with projections pointing toward a robust market in the coming years.

The dominant players in the Australia Micro Tactical Ground Robot market are located in regions with robust defense capabilities, particularly major cities like Sydney, Melbourne, and Canberra. These cities are not only home to government defense agencies but also to leading robotics and technology companies focused on developing cutting-edge solutions for military and law enforcement purposes. Additionally, the Australian defense sector is increasingly investing in autonomous systems, making these cities focal points for innovation and development in the tactical robot market. Their strategic importance and ongoing infrastructure development play a key role in maintaining the market’s dominance in the region.

Market Segmentation

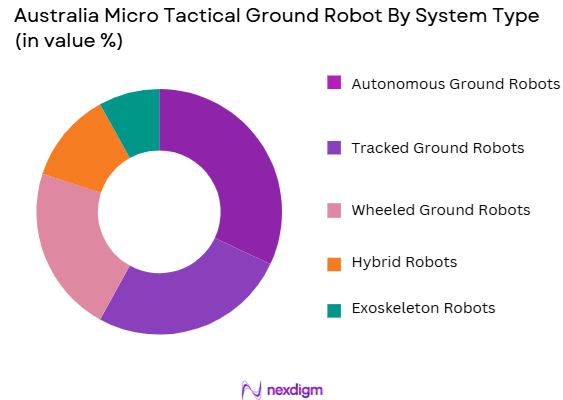

By System Type

The Australia Micro Tactical Ground Robot market is segmented by system type into autonomous ground robots, tracked ground robots, wheeled ground robots, hybrid robots, and exoskeleton robots. Among these, autonomous ground robots currently dominate the market due to their ability to operate independently in high-risk environments without direct human control. These robots are increasingly integrated with advanced sensors and AI algorithms, enabling them to perform complex surveillance and reconnaissance missions autonomously. Their demand is driven by advancements in AI, better operational reliability, and their ability to significantly reduce human risk in hazardous conditions. Autonomous ground robots are highly favored in military applications, where efficiency and quick decision-making are critical.

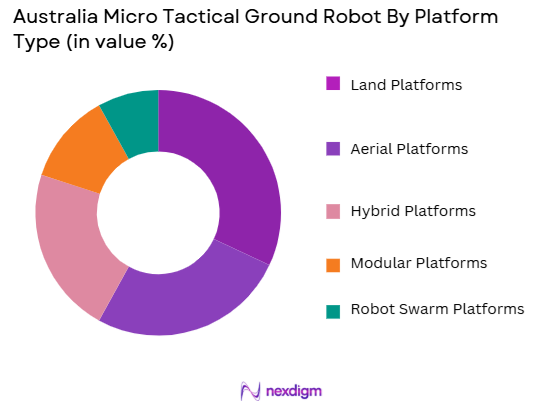

By Platform Type

The market is also segmented by platform type into land platforms, aerial platforms, hybrid platforms, modular platforms, and robot swarm platforms. Land platforms dominate the market due to their versatile deployment in both military and civilian applications, including patrol, surveillance, and rescue operations. These platforms are highly favored for their stability, adaptability to various terrains, and cost-effectiveness. Land-based robots are used extensively by defense forces for ground-based reconnaissance and tactical missions, and they are becoming more advanced with better sensor integration. The robust demand for land platforms, particularly in urban and remote areas, is expected to continue driving their market share in the forecasted period.

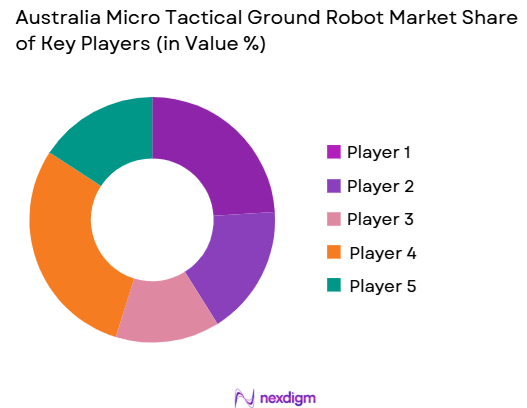

Competitive Landscape

The Australia Micro Tactical Ground Robot market is dominated by a few key players that lead through technological advancements, strong product portfolios, and established defense sector relationships. Companies such as Boston Dynamics, iRobot, and QinetiQ have positioned themselves as key players due to their expertise in robotics and defense systems. These companies not only innovate in autonomous robotics but also maintain strong partnerships with government and defense contractors, ensuring they stay at the forefront of the market. The consolidation of these companies underscores their significant influence in shaping the future trajectory of the market.

| Company | Establishment Year | Headquarters | Technology Focus | Primary Market | Partnerships & Collaborations | Production Capacity | Geographical Reach |

| Boston Dynamics | 1992 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| iRobot | 1990 | Bedford, USA | ~ | ~ | ~ | ~ | ~ |

| QinetiQ | 2001 | London, UK | ~ | ~ | ~ | ~ | ~ |

| FLIR Systems | 1978 | Wilsonville, USA | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

Australia Micro Tactical Ground Robot Market Analysis

Growth Drivers

Urbanization

Urbanization plays a significant role in the growth of the Australia Micro Tactical Ground Robot market. As Australia’s urban population continues to rise, the need for efficient public safety and surveillance systems increases, leading to greater demand for autonomous ground robots. By 2024, Australia’s urban population is projected to exceed ~%, which drives infrastructure investments in smart city solutions and security technologies. Furthermore, urban centers face complex security challenges, making robotics essential in law enforcement, emergency response, and military operations. This urban growth is supported by investments in autonomous systems as part of smart city initiatives.

Industrialization

The ongoing industrialization in Australia contributes to the increasing need for advanced robotic systems for security, manufacturing, and logistical purposes. Australia’s industrial sector is expanding, particularly in the areas of defense and mining, both of which demand sophisticated technologies like micro tactical ground robots. The Australian manufacturing sector grew by ~% in 2024, reflecting increased investments in automation and robotics. This industrial push is expected to create substantial opportunities for robotic systems that enhance productivity, operational efficiency, and worker safety, driving further market growth for tactical robots.

Restraints

High Initial Costs

High initial costs of micro tactical ground robots remain a significant restraint on market growth. While advancements in robotics are accelerating, the high costs associated with research, development, and production of these systems make them difficult for smaller organizations or governments with limited defense budgets to adopt. In 2024, the cost of a high-end micro tactical robot is expected to range from AUD ~ to AUD ~ limiting access for non-governmental entities. Despite technological advancements, the price point of these robots still poses a challenge to widespread adoption in less resource-rich sectors.

Technical Challenges

Technical challenges in the development of autonomous micro tactical ground robots are another barrier to market expansion. Issues such as robot autonomy, adaptability in complex environments, and reliable communication systems are still prevalent. While advancements in AI and machine learning are pushing the boundaries of robot capabilities, integration with existing infrastructure, particularly in defense settings, continues to face obstacles. The lack of standardized protocols for communication between various robotic systems complicates large-scale deployments, hindering growth.

Opportunities

Technological Advancements

Technological advancements in AI, sensor technologies, and robotics present significant growth opportunities for the Australia Micro Tactical Ground Robot market. By 2024, advancements in AI-driven autonomous navigation and sensor integration are expected to improve the efficiency and cost-effectiveness of micro tactical robots. New developments in battery technology and materials science also promise to enhance the performance and sustainability of these systems, making them more attractive to defense and law enforcement agencies. These innovations create new avenues for both defense contractors and robotics developers to tap into growing demand.

International Collaborations

International collaborations in defense and technology are expected to open new opportunities for the Australia Micro Tactical Ground Robot market. Australia is part of several international defense agreements and collaborative research projects with countries like the United States and the United Kingdom. These partnerships facilitate the exchange of technological innovations and the development of next-generation robotic systems. By 2024, Australia’s involvement in collaborative defense projects will likely drive further market adoption and development of tactical robots across various sectors.

Future Outlook

Over the next decade, the Australia Micro Tactical Ground Robot market is expected to witness substantial growth driven by advancements in robotic technology, the increasing need for autonomous systems in military and defense operations, and substantial government spending on defense infrastructure. The evolving landscape of defense technology will continue to enhance the capabilities of micro tactical ground robots, improving their operational efficiency, reliability, and cost-effectiveness. As demand for these systems grows, innovation in AI and robotics is expected to reduce operational costs and expand their application beyond military use into areas like law enforcement and search and rescue missions. The market will also benefit from a more favorable regulatory environment, as government agencies seek to expand their robotic capabilities in security and defense sectors.

Major Players

- Boston Dynamics

- iRobot

- QinetiQ

- FLIR Systems

- Lockheed Martin

- Northrop Grumman

- General Dynamics

- Roboteam

- Thales Group

- Kongsberg Gruppen

- Milrem Robotics

- BAE Systems

- Rheinmetall

- Elbit Systems

- Saab Group

Key Target Audience

- Military and Defense Agencies

- Government Regulatory Bodies

- Investments and Venture Capitalist Firms

- Robotics and Technology Developers

- Homeland Security Agencies

- Public Safety and Emergency Response Authorities

- Law Enforcement Agencies

- Private Security Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia Micro Tactical Ground Robot market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including technology trends, regulatory influences, and adoption rates.

Step 2: Market Analysis and Construction

This phase focuses on gathering and analyzing historical data pertaining to the market. The analysis includes market penetration, the ratio of robotic units deployed in military and defense operations, and the resultant impact on growth. Service quality statistics and financial data from industry reports are evaluated to construct a comprehensive market model.

Step 3: Hypothesis Validation and Expert Consultation

To refine the market model, hypotheses are developed based on initial findings and tested through expert consultations. Computer-assisted telephone interviews (CATIs) with professionals in the defense, robotics, and AI sectors provide valuable insights, helping to validate and adjust the market analysis.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing insights derived from the previous steps and direct engagement with key manufacturers and end-users. Interviews with key stakeholders validate the market data and ensure the research findings are robust and accurate. This final synthesis integrates all data points to generate a comprehensive, forward-looking market report.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for autonomous systems in defense applications

Rising security concerns and the need for tactical surveillance

Technological advancements in robotics and artificial intelligence

- Market Challenges

High initial cost and maintenance of robotic systems

Integration challenges with existing defense infrastructure

Regulatory hurdles and limited standardization - Trends

Increasing deployment of robots for border surveillance and search missions

Shift toward lighter and more energy-efficient robots

Growing demand for robots equipped with AI and machine learning capabilities

- Market Opportunities

Expansion of military spending in Asia-Pacific

Growth in the adoption of autonomous robots in law enforcement

Rising investments in research & development for new robotic technologies - Government regulations

Robotics regulations in defense sectors

Compliance with safety and operational standards for autonomous robots

Regulations surrounding data security and encryption in robotic systems

- SWOT analysis

Strength: Advancements in AI enhance tactical robot capabilities

Weakness: High cost of development limits adoption

Opportunity: Increased government investment in robotic technologies - Porters 5 forces

High bargaining power of suppliers in robotic components

Moderate threat of new entrants due to high barriers to entry

Low threat of substitutes as tactical ground robots are highly specialized

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Autonomous Ground Robots

Tracked Ground Robots

Wheeled Ground Robots

Hybrid Robots

Exoskeleton Robots - By Platform Type (In Value%)

Land Platforms

Aerial Platforms

Hybrid Platforms

Modular Platforms

Robot Swarm Platforms - By Fitment Type (In Value%)

Military Fitment

Civilian Fitment

Special Forces Fitment

Emergency Response Fitment

Research & Development Fitment - By EndUser Segment (In Value%)

Military & Defense

Public Safety & Emergency Response

Research Institutions

Industrial & Commercial Use

Law Enforcement - By Procurement Channel (In Value%)

Direct Procurement

Third-party Procurement

Government Contracts

Online Marketplaces

Reseller Procurement

- Market Share Analysis

- CrossComparison Parameters(Technological capabilities, Market penetration, Product cost, After-sales support, Customer satisfaction)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

IRobot

Boston Dynamics

Northrop Grumman

QinetiQ

FLIR Systems

Kongsberg Gruppen

General Dynamics

Elbit Systems

Thales Group

BAE Systems

Roboteam

Lockheed Martin

Digi International

Milrem Robotics

Rheinmetall

- Increased adoption of micro tactical ground robots in military and defense sectors

- Law enforcement agencies are increasingly using robots for surveillance

- Research institutions are investing in robotic technology for experimentation

- Civilian sectors such as agriculture and logistics exploring tactical robots for efficiency

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035