Market Overview

The Australia Mil Spec Connectors market is primarily driven by increased demand from the defense and aerospace sectors. The market is valued at USD ~million, with significant growth anticipated as technological advancements and the need for ruggedized, durable connectors continue to rise. The demand for connectors in military and aerospace applications has been strong, with major investments in infrastructure and defense modernization pushing the market forward.The market is dominated by major cities such as Sydney, Melbourne, and Brisbane, which house significant defense infrastructure and aerospace facilities. These cities have become focal points for industries requiring high-performance connectors due to their proximity to key military and defense contractors. Additionally, the presence of major airports and industrial hubs contributes to their dominance in the Mil Spec Connectors market.

Market Segmentation

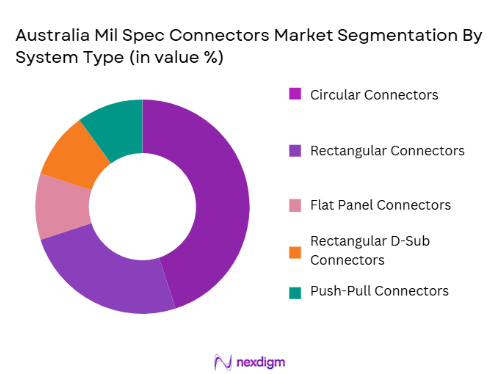

By System Type

The Australia Mil Spec Connectors market is segmented by system type, with the primary subsegments being circular connectors, rectangular connectors, flat-panel connectors, rectangular D-sub connectors, and push-pull connectors. Among these, circular connectors hold the dominant market share. This is primarily due to their versatility, durability, and widespread application in harsh environments, particularly in defense and aerospace sectors. Their design, which ensures reliability in extreme conditions, makes them the preferred choice for military-grade applications.

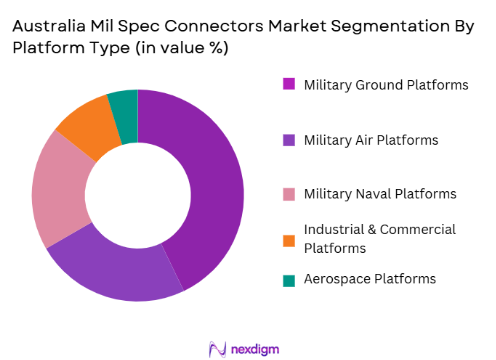

By Platform Type

The Australia Mil Spec Connectors market is also segmented by platform type, which includes military ground platforms, military air platforms, military naval platforms, industrial & commercial platforms, and aerospace platforms. Military ground platforms dominate the market share in this category. The growth in military vehicle procurement and upgrades in Australia’s defense sector, along with the ruggedized nature of connectors for these platforms, drives this dominance. Connectors for military ground vehicles are designed to withstand the harshest conditions, contributing to their preference in the defense industry.

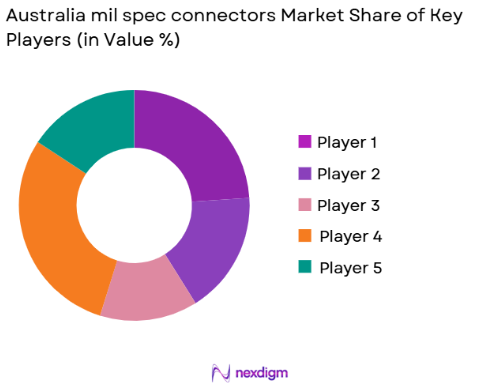

Competitive Landscape

The Australia Mil Spec Connectors market is dominated by a few key players, including global giants like TE Connectivity, Amphenol, and ITT Cannon, as well as specialized companies in the defense and aerospace industries. These companies are leaders due to their established reputations for manufacturing durable, high-performance connectors that meet military and aerospace standards. The consolidation of these major players highlights the intense competition in the market and the high barriers to entry due to the specialized technology and certification requirements.

| Company | Year Established | Headquarters | Product Portfolio | Market Focus | Technological Innovation | Client Base |

| TE Connectivity | 2007 | Switzerland | ~ | ~ | ~ | ~ |

| Amphenol | 1932 | USA | ~ | ~ | ~ | ~ |

| ITT Cannon | 1915 | USA | ~ | ~ | ~ | ~ |

| Molex | 1938 | USA | ~ | ~ | ~ | ~ |

| Harwin | 1952 | UK | ~ | ~ | ~ | ~ |

Australia Mil Spec Connectors Market Analysis

Growth Drivers

Urbanization

The increasing trend of urbanization is a critical driver for the Australia Mil Spec Connectors market. As urban centers continue to expand, the demand for infrastructure in defense, aerospace, and commercial sectors rises, creating a need for high-performance connectors in new facilities and machinery. Australia’s urban population in 2024 is estimated at ~% of the total population, according to the World Bank, reflecting a steady growth of urbanization. This rapid urban growth drives demand for advanced infrastructure projects, including military and aerospace developments, which are heavily reliant on robust connector systems. Urbanization is also accelerating the need for military modernization to protect national interests and infrastructure in urban environments.

Industrialization

The industrial sector in Australia continues to expand, with an increased demand for ruggedized and high-performance connectors. Australia’s industrial production is projected to grow at a rate of ~% annually in 2024, with particular demand for advanced connectors in defense, mining, and aerospace industries. Industrialization is fueling the creation of new manufacturing facilities and the upgrading of older equipment, requiring connectors that can withstand harsh conditions. The continued growth of these sectors, especially in defense and aerospace, is a significant growth driver for the Mil Spec Connectors market in Australia

Restraints

High Initial Costs

One of the significant challenges facing the Australia Mil Spec Connectors market is the high initial cost of military-grade connectors. These connectors are specifically designed to meet stringent reliability, environmental, and security standards, which significantly increases their production costs. The cost of manufacturing connectors that meet military specifications can be 30-40% higher than standard commercial connectors. Additionally, the specialized materials and testing processes required further inflate costs. In 2024, with defense and aerospace programs seeing substantial budgets, the high costs are a concern, particularly for small manufacturers and startups looking to enter the market.

Technical Challenges

The Mil Spec Connectors market faces ongoing technical challenges as manufacturers must continuously meet the stringent demands of modern military and aerospace platforms. The complexity of designing connectors that can operate in extreme temperatures, resist corrosion, and handle high electrical loads remains a technical hurdle. Moreover, the development of connectors with increasing miniaturization while maintaining robustness presents challenges. As technological demands evolve, ensuring connectors meet these specifications without compromising performance or reliability is a constant technical challenge. In 2024, defense projects continue to face these technical barriers in component integration.

Opportunities

Technological Advancements

Technological advancements present significant opportunities for the Mil Spec Connectors market, particularly with the rise of miniaturized and more efficient connectors. The continued progress in connector technologies, such as fiber optics and wireless connectors, enhances the capabilities of military and aerospace platforms. As Australia modernizes its defense systems, the demand for innovative connector solutions that are smaller, lighter, and more durable is expected to grow. Advances in materials science and manufacturing processes also provide opportunities for local manufacturers to compete on a global scale in the Mil Spec Connectors market.

International Collaborations

International collaborations offer substantial opportunities for the Mil Spec Connectors market in Australia. Partnerships with global defense and aerospace firms allow Australian manufacturers to access advanced technologies and expertise, improving the performance and reliability of their connectors. Australia’s involvement in multinational defense projects, such as those under the ANZUS Treaty and regional defense alliances, fosters collaboration opportunities for local companies. The defense sector’s reliance on global supply chains and multinational partnerships increases the market’s reach and provides opportunities for growth and innovation.

Future Outlook

Over the next 10 years, the Australia Mil Spec Connectors market is expected to witness steady growth driven by the increasing defense budgets, technological advancements in connector designs, and a rising demand for ruggedized solutions in aerospace and military applications. This growth will be supported by continued investments in defense infrastructure and the shift toward more compact and high-performance systems in military vehicles, aircraft, and communication systems.

Major Players

- TE Connectivity

- Amphenol

- ITT Cannon

- Molex

- Harwin

- Smiths Group

- Ametek

- L-com

- Souriau

- Rosenberger

- Aerospace & Defense Products

- Pasternack Enterprises

- Eaton

- Digi-Key Electronics

- Sagemcom

Key Target Audience

- Defense contractors and manufacturers

- Aerospace system manufacturers

- Military and government agencies

- OEMs in defense and aerospace sectors

- System integrators in military and commercial sectors

- Investments and venture capitalist firms

- Government and regulatory bodies

- Procurement managers and supply chain professionals

Research Methodology

Step 1: Identification of Key Variables

The first step is to construct a comprehensive ecosystem map that includes all major stakeholders in the Australia Mil Spec Connectors market. This involves gathering data from secondary sources, such as industry reports, government publications, and company websites, to identify and define the critical variables that influence the market’s growth.

Step 2: Market Analysis and Construction

In this phase, historical data on market trends, growth rates, and consumer demand will be gathered. This data will be analyzed to identify patterns in system types, platform usage, and end-user requirements in the Mil Spec Connectors market. The focus will be on the performance of major players and their product offerings.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses formed in Step 1 will be validated by engaging in consultations with industry experts. Computer-assisted telephone interviews (CATIs) will be conducted with key players in the market, such as connector manufacturers, suppliers, and distributors. Their insights will help validate assumptions and provide a clearer understanding of the market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered data and refining the analysis. The data from experts, primary interviews, and secondary research will be used to generate a detailed, comprehensive market report, ensuring that the insights are robust and reliable.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for ruggedized, durable connectors

Rising defense spending and military modernization efforts

Technological advancements in aerospace and defense industries - Market Challenges

High manufacturing costs of military-grade connectors

Stringent regulatory and certification requirements

Supply chain disruptions in defense and aerospace sectors - Trends

Miniaturization and lightweight connectors

Advances in environmental sealing technologies

Integration of smart features into connectors

- Market Opportunities

Integration of connectors with emerging technologies (5G, IoT)

Expanding aerospace and defense sectors in Asia-Pacific

Rising demand for military-grade connectors in unmanned vehicles

- Government regulations

Military standardization and certification regulations

Export control laws related to defense components

Environmental regulations governing materials used in military connectors - SWOT analysis

Strength in demand from defense and aerospace sectors

Weakness in high production costs and manufacturing complexities

Opportunities in defense modernization programs

Threats from geopolitical instability affecting defense contracts - Porters 5 forces

Bargaining power of suppliers in the connector market

Competitive rivalry between leading manufacturers

Threat of new entrants in the military connector market

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Circular Connectors

Rectangular Connectors

Flat Panel Connectors

Rectangular D-Sub Connectors

Push-Pull Connectors - By Platform Type (In Value%)

Military Ground Platforms

Military Air Platforms

Military Naval Platforms

Industrial & Commercial Platforms

Aerospace Platforms - By Fitment Type (In Value%)

Panel Mount Connectors

Cable Mount Connectors

Rack & Panel Mount Connectors

Board-to-Board Connectors

Circular Connectors

- By EndUser Segment (In Value%)

Military & Defense

Aerospace

Industrial & Commercial

Telecommunications

Transport - By Procurement Channel (In Value%)

OEMs

Distributors

Direct Sales

E-commerce Platforms

Contract Manufacturing

- Market Share Analysis

- CrossComparison Parameters(Price Sensitivity, Product Innovation, Market Reach, Technological Advancements, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

TE Connectivity

Amphenol Corporation

Smiths Group

Molex

Rosenberger

Aerospace & Defense Products

L-com

ITT Cannon

Ametek

Pasternack Enterprises

Seacon Connectors

Harwin

Souriau

Eaton

Digi-Key Electronics

Sagemcom

- Strong demand from the defense sector for high-performance connectors

- Aerospace industry driving the need for specialized connectors

- Emerging markets in industrial sectors for ruggedized connectors

- Telecommunications sector seeking connectors for critical infrastructure

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035