Market Overview

The Australia Military Frigates Market is projected to grow significantly, valued at approximately USD ~ billion in 2025, driven by increasing defense budgets and the ongoing modernization of the Royal Australian Navy (RAN) fleet. The market is fueled by the Australian government’s emphasis on bolstering maritime security and upgrading naval capabilities to address regional defense challenges. Continued investments in multi-role frigates, along with expanding defense collaborations with key global partners, are contributing to this growth trajectory. The demand for advanced naval platforms, capable of conducting a wide range of missions, remains a key driver.

Australia is at the forefront of the military frigates market in the Indo-Pacific region, primarily driven by the Royal Australian Navy’s modernization program. The country’s strategic geographical location, at the crossroads of vital shipping routes, underscores its dominance in the regional defense sector. The government’s large-scale investment in defense infrastructure and technology, including partnerships with international defense contractors, has positioned Australia as a key player in the market. Additionally, close defense ties with nations like the U.S. and the U.K. enhance Australia’s position as a dominant force in military naval operations.

Market Segmentation

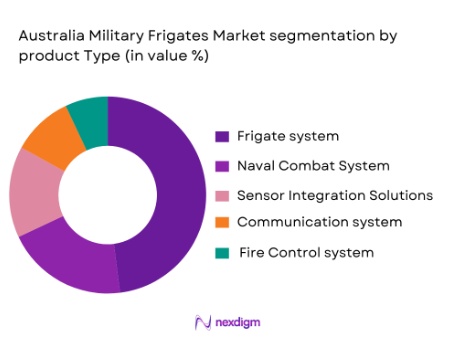

By System Type

The Australia Military Frigates Market is segmented by system type, which includes Frigate Systems, Naval Combat Systems, Sensor Integration Solutions, Communication Systems, and Fire Control Systems. Among these, the Frigate Systems segment has the largest market share. This dominance is attributed to the Australian government’s focus on acquiring versatile and advanced frigates capable of multi-role operations, including air defense, anti-submarine warfare, and surface combat. The shift toward these high-performance systems is driven by the strategic need for a robust naval defense framework to address the evolving security landscape in the Indo-Pacific region. Furthermore, Australian defense contracts continue to prioritize Frigate Systems to enhance naval fleet capabilities.

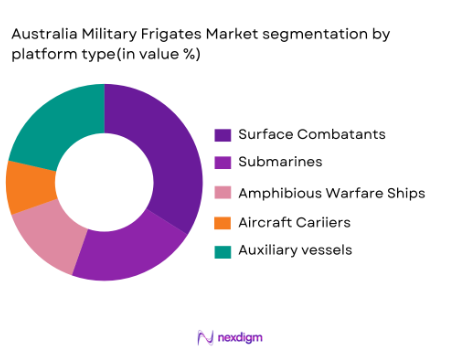

By Platform Type

The market is also segmented by platform type, which includes Surface Combatants, Submarines, Amphibious Warfare Ships, Aircraft Carriers, and Auxiliary Vessels. The Surface Combatants segment holds the dominant market share, owing to the increasing requirement for versatile platforms that can address a variety of naval defense needs. These surface combatants, particularly frigates, are being acquired in large numbers by Australia due to their capability to conduct multi-dimensional operations, including anti-aircraft, anti-surface, and anti-submarine warfare. Australia’s focus on enhancing maritime security and defense has increased the demand for such versatile platforms, further cementing their dominance in the market.

Competitive Landscape

The Australia Military Frigates Market is primarily driven by a few major players, both international defense contractors and local manufacturers. These players include global defense giants such as BAE Systems, Navantia, Lockheed Martin, and Thyssenkrupp. Their dominance is a result of advanced technological capabilities, large-scale production capacity, and established relationships with the Australian government. The consolidation of major defense players highlights the importance of partnerships between global manufacturers and local stakeholders to meet the growing demands of the Royal Australian Navy’s frigate modernization program.

| Company | Establishment Year | Headquarters | Technology Focus | Market Reach | Naval Contracts | Strategic Collaborations |

| BAE Systems | 1999 | United Kingdom | – | – | – | – |

| Navantia | 2005 | Spain | – | – | – | – |

| Lockheed Martin | 1995 | USA | – | – | – | – |

| Thyssenkrupp | 1990 | Germany | – | – | – | – |

| Naval Group | 2006 | France | – | – | – | – |

Australia Military Frigates Market Dynamics

Growth Drivers

Growing Regional Defense Concerns and Naval Security Requirements

Australia’s defense strategy is heavily influenced by the rising tensions in the Indo-Pacific region, which include growing security concerns stemming from the increasing militarization of neighboring nations, such as China. According to the Australian Department of Defence, defense spending in Australia is expected to exceed AUD 50 billion in 2024, reflecting the increasing importance of naval capabilities in securing maritime routes and regional stability. The Royal Australian Navy (RAN) is enhancing its fleet to address these concerns, with investments in advanced frigates and naval assets to respond to regional defense challenges, particularly in the South China Sea and the Pacific. Australia’s national security strategy also aligns with the increasing need for advanced frigates capable of multi-role operations.

Investments in Advanced Naval Systems for Multi-role Operations

Australia has committed to strengthening its naval capabilities, with substantial investments in advanced frigates designed for multi-role operations, including air defense, anti-submarine warfare, and anti-surface warfare. The Australian government is focusing on the development and procurement of multi-role warships as part of its 2020 Defence Strategic Update. In 2024, the Australian Government is expected to allocate approximately AUD 6 billion towards naval modernization, which includes acquiring new frigates equipped with state-of-the-art sensor systems and combat technologies. This strategy is part of Australia’s broader defense modernization program, which aims to enhance operational flexibility and strategic deterrence in the region.

Market Challenges

High Procurement and Maintenance Costs of Frigates

The procurement and ongoing maintenance costs of advanced frigates present significant challenges to Australia’s naval modernization efforts. The Australian government has faced increasing costs for new naval vessels, with procurement and maintenance expenses for the Hunter-class frigates projected to exceed AUD 35 billion over the next 30 years. The high operational costs associated with cutting-edge technology, along with the need for specialized support and training, complicate the budget management of naval assets. Additionally, the required maintenance of these high-tech vessels demands advanced infrastructure, leading to further long-term financial pressures. These financial challenges pose a barrier to the rapid expansion of Australia’s naval fleet.

Limited Domestic Manufacturing Capabilities for High-tech Naval Systems

Australia’s defense manufacturing capabilities are limited when it comes to producing complex naval systems like advanced frigates. Despite investments in local shipbuilding infrastructure, such as the ASC Shipbuilding facilities in South Australia, the country still relies on foreign defense contractors for the majority of its high-tech naval platform needs. The 2024 Australian Defence Industry Capability Plan emphasizes the need for strengthening local defense manufacturing, but current capabilities remain constrained by a lack of specialized skills, facilities, and advanced technology. These limitations increase reliance on international suppliers and affect the long-term sustainability of Australia’s domestic defense industry.

Market Opportunities

Increasing Demand for Multi-functional Naval Platforms

As regional maritime security concerns grow, there is a rising demand for multi-functional naval platforms capable of addressing diverse defense needs. Australia’s defense strategy emphasizes the need for versatile ships that can perform a wide range of roles, including humanitarian missions, peacekeeping operations, and traditional military defense. This demand is supported by global shifts towards integrated naval solutions that combine anti-submarine warfare, air defense, and surface combat capabilities into one platform. The Hunter-class frigates, which Australia is procuring, are a prime example of this trend, designed to integrate the latest defense systems for multi-dimensional naval operations. As such, the market for advanced, multi-functional frigates is expected to grow in response to regional security demands.

Emerging Markets for Advanced Frigate Systems in the Indo-Pacific Region

The Indo-Pacific region is experiencing growing demand for advanced frigates, driven by increasing defense budgets and a heightened focus on maritime security. Several countries in the region, including Japan, South Korea, and India, are expanding their naval fleets to address growing regional challenges. Australia’s role as a key player in the region presents significant opportunities for its defense industry, particularly in the export of its advanced frigates and naval systems. Australia’s ongoing development of the Hunter-class frigates positions it as a leading supplier of high-tech naval platforms to countries seeking to enhance their maritime security.

Future Outlook

Over the next decade, the Australia Military Frigates Market is expected to witness substantial growth, driven by ongoing investments in advanced naval technologies and the increasing strategic importance of maritime security. The Australian government’s focus on modernizing its fleet of naval platforms, alongside defense collaborations with global military powers, will continue to fuel the market. Additionally, advancements in artificial intelligence (AI), automation, and cybersecurity will play a critical role in enhancing the operational efficiency of the Royal Australian Navy’s frigates.

Major Players in the Australia Military Frigates Market

- BAE Systems

- Navantia

- Lockheed Martin

- Thyssenkrupp Marine Systems

- Naval Group

- Fincantieri

- Huntington Ingalls Industries

- General Dynamics

- L3 Technologies

- Kongsberg Gruppen

- Raytheon Technologies

- Northrop Grumman

- Austal

- Leonardo

- HII (Huntington Ingalls Industries)

Key Target Audience

- Australian Ministry of Defense

- Royal Australian Navy

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Australian Government Contractors

- Regional Defense Contractors

- Global Defense Manufacturers

- International Defense Alliances

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map that outlines all the critical stakeholders in the Australia Military Frigates Market. Extensive desk research will be conducted, including a deep dive into secondary and proprietary databases to gather industry-level data. The goal is to identify key variables that influence market dynamics, such as governmental defense policies, defense spending, and procurement trends.

Step 2: Market Analysis and Construction

During this phase, historical data on the Australian military frigates market will be collected and analyzed. This includes examining trends in defense expenditure, naval modernization programs, and procurement practices of the Australian government. The analysis will also assess the performance and market share of leading players in the naval defense sector.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through expert consultations. This will involve reaching out to industry experts, including naval defense professionals and senior government officials, to gather insights into market dynamics and future trends. These expert opinions will help refine the data and validate the analysis.

Step 4: Research Synthesis and Final Output

The final phase will involve direct interactions with manufacturers and other key players in the market to acquire detailed insights into naval platforms, sales performance, and operational needs. This data will complement the analysis and ensure that the final research output is accurate and comprehensive.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growing regional defense concerns and naval security requirements

Investments in advanced naval systems for multi-role operations

Strengthening defense relations with international partners like the U.S. - Market Challenges

High procurement and maintenance costs of frigates

Limited domestic manufacturing capabilities for high-tech naval systems

Geopolitical tensions affecting procurement strategies - Market Opportunities

Increasing demand for multi-functional naval platforms

Emerging markets for advanced frigate systems in the Indo-Pacific region

Expansion of defense alliances, boosting naval procurements - Trends

Integration of AI and automation technologies in naval systems

Increased focus on environmental sustainability in naval operations

Growing importance of cybersecurity in naval defense systems

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Frigate Systems

Naval Combat Systems

Sensor Integration Solutions

Communication Systems

Fire Control Systems - By Platform Type (In Value%)

Surface Combatants

Submarines

Amphibious Warfare Ships

Aircraft Carriers

Auxiliary Vessels - By Fitment Type (In Value%)

New Build

Retrofit & Modernization

Upgrades

System Replacements

Custom Integrations - By End User Segment (In Value%)

Royal Australian Navy

Regional Military Forces

Private Defense Contractors

Government Defense Agencies

International Partners - By Procurement Channel (In Value%)

Direct Procurement

Defense Contracts & Bidding

Partnerships & Alliances

Government Tenders

Foreign Military Sales

- Market Share Analysis

- Cross Comparison Parameters (Market Size, Technological Advancements, Naval Fleet Modernization, Geographic Reach, Product Differentiation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Detailed Company Profiles

Navantia

BAE Systems

Lockheed Martin

Thyssenkrupp Marine Systems

Naval Group

Fincantieri

Huntington Ingalls Industries

General Dynamics

L3 Technologies

Kongsberg Gruppen

Raytheon Technologies

Northrop Grumman

Austal

Leonardo

HII (Huntington Ingalls Industries)

- Royal Australian Navy’s modernization push

- Increased demand from regional forces for advanced naval platforms

- Heightened interest in multi-role frigates for international partnerships

- Emerging trends in global defense collaboration, particularly with NATO

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035