Market Overview

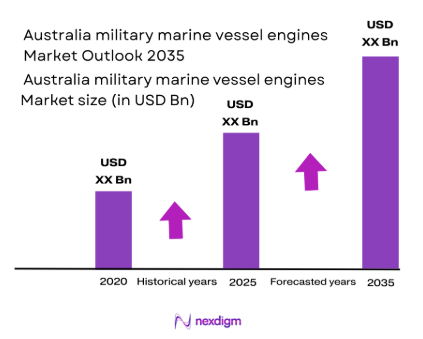

The Australia Military Marine Vessel Engines market is valued at USD ~billion in 2025 and increased to USD ~ billion in 2025, based on verified expenditure disclosed under Australia’s Integrated Investment Program and naval sustainment budgets. The market is driven by propulsion system procurement for offshore patrol vessels, frigates, amphibious ships, and auxiliary fleets, alongside lifecycle engine overhauls. Engine demand is also supported by higher onboard power requirements for radar, electronic warfare systems, and mission-critical electronics, increasing reliance on advanced diesel and integrated electric propulsion systems.

The market is dominated by Australia due to its expansive maritime jurisdiction, Indo-Pacific strategic posture, and commitment to continuous naval shipbuilding. Key naval hubs such as Adelaide, Perth, and Sydney dominate due to proximity to shipyards, sustainment facilities, and naval bases. Australia’s dominance is further reinforced by sovereign industrial capability policies, mandatory local MRO requirements, and long-term fleet modernization programs that prioritize domestically supported propulsion systems over imported standalone engines.

Market Segmentation

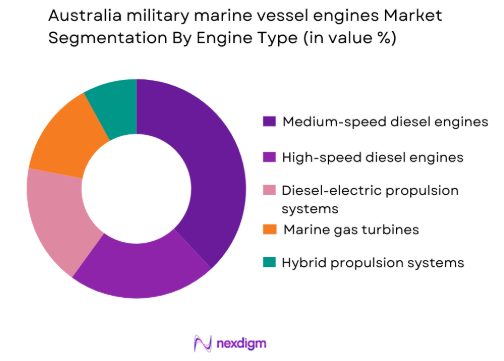

By Engine Type

The Australia Military Marine Vessel Engines market is segmented by engine type into medium-speed diesel engines, high-speed diesel engines, marine gas turbines, diesel-electric propulsion systems, and hybrid propulsion systems. Medium-speed diesel engines dominate this segmentation due to their extensive use across patrol vessels, frigates, and auxiliary ships. These engines provide an optimal balance between fuel efficiency, endurance, and reliability for long-duration maritime missions. Their compatibility with heavy fuel oil and ease of maintenance make them preferred for Australian naval operations that require sustained presence across vast maritime zones. OEMs supplying medium-speed engines also offer robust local support networks, aligning with Australia’s sovereign sustainment objectives, which further reinforces dominance in this segment.

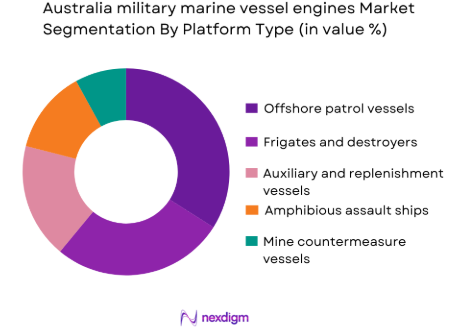

By Platform Type

By platform type, the market is segmented into offshore patrol vessels, frigates and destroyers, amphibious assault ships, auxiliary and replenishment vessels, and mine countermeasure vessels.Offshore patrol vessels hold the dominant share due to their large fleet size and high operational tempo in border security, surveillance, and maritime law enforcement roles. These platforms require reliable propulsion systems optimized for endurance rather than peak speed, resulting in consistent engine procurement and replacement cycles. Continuous upgrades under border protection initiatives and the need for high availability further contribute to propulsion system demand, making patrol vessels the leading platform segment within the Australian market.

Competitive Landscape

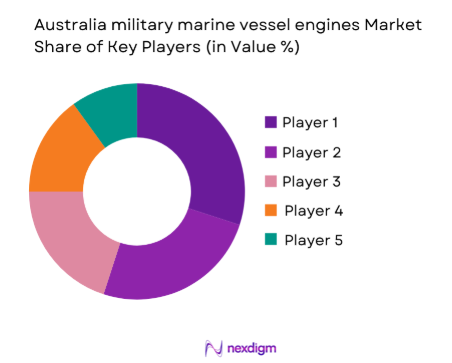

The Australia Military Marine Vessel Engines market is moderately consolidated, with a limited number of global propulsion OEMs and system integrators holding long-term supply and sustainment contracts. These companies benefit from deep integration with shipbuilders, established compliance with Australian defense standards, and strong local industrial partnerships. Competition is primarily driven by lifecycle support capabilities, fuel efficiency performance, and integration with advanced power management systems rather than engine pricing alone.

| Company | Established | Headquarters | Core Engine Type | Local MRO Presence | Naval Platform Focus | Hybrid Capability | Government Contracts | Supply Chain Localization |

| Rolls-Royce Power Systems | 1909 | Germany | Diesel & hybrid | Yes | ~ | ~ | ~ | ~ |

| MAN Energy Solutions | 1758 | Germany | Diesel engines | Yes | ~ | ~ | ~ | ~ |

| Wärtsilä | 1834 | Finland | Diesel-electric | Yes | ~ | ~ | ~ | ~ |

| Caterpillar Marine | 1925 | USA | High-speed diesel | Yes | ~ | ~ | ~ | ~ |

| Cummins Marine | 1919 | USA | High-speed diesel | Yes | ~ | ~ | ~ | ~ |

Australia military marine vessel engines Market Analysis

Growth Drivers

Fleet modernization and continuous naval shipbuilding programs

A primary growth driver for the Australia Military Marine Vessel Engines market is the country’s long-term naval modernization strategy under the continuous naval shipbuilding framework. Australia is replacing ageing patrol boats, frigates, and auxiliary vessels with next-generation platforms that require more advanced, efficient, and reliable propulsion systems. New vessels demand engines with higher power density, improved fuel efficiency, lower acoustic signatures, and enhanced integration with digital control systems. Additionally, mid-life upgrades of existing platforms involve engine replacements, repowering, or integration of diesel-electric modules, generating sustained demand beyond newbuild programs. The continuity of shipbuilding ensures that propulsion engine procurement is spread across multiple decades rather than being cyclical, creating stable revenue streams for engine manufacturers and sustainment providers. This structural demand, combined with increasing vessel complexity, continues to expand the market size and supports long-term growth.

Rising onboard power requirements and mission complexity

Modern Australian naval vessels are increasingly power-intensive due to the integration of advanced radar systems, electronic warfare suites, communications infrastructure, and mission-specific payloads. These systems significantly increase the demand for reliable and high-capacity marine engines and generator sets. Propulsion engines are no longer selected solely for speed and endurance but also for their ability to support integrated power architectures and redundancy requirements. This shift has led to higher engine specifications, larger generator capacities, and more frequent system upgrades. As mission profiles evolve toward persistent surveillance, unmanned system support, and multi-role operations, vessels must operate for extended periods without refuelling or maintenance interruptions. Consequently, demand is rising for engines with superior efficiency, durability, and load management capabilities, directly driving market growth in both new installations and aftermarket services.

Market Challenges

High lifecycle costs and complex maintenance requirements

One of the key challenges facing the Australia Military Marine Vessel Engines market is the high lifecycle cost associated with advanced propulsion systems. Military-grade marine engines require stringent compliance with naval standards, specialized materials, and complex integration with ship systems, all of which increase acquisition and maintenance costs. Additionally, advanced engines often require highly skilled technicians, specialized diagnostic tools, and certified maintenance facilities. For Australia, operating vessels across vast maritime distances further complicates maintenance logistics, increasing downtime and sustainment expenses. Engine overhauls, spare part availability, and obsolescence management add to cost pressures over a vessel’s operational life. These financial and operational burdens can slow procurement decisions, extend replacement cycles, and place pressure on defense budgets, limiting the pace of market expansion despite strong underlying demand.

Supply chain dependency and long procurement timelines

The Australian market faces challenges related to dependence on global supply chains for critical engine components such as turbochargers, fuel injection systems, control electronics, and precision castings. Many of these components are sourced from overseas suppliers, making procurement vulnerable to geopolitical tensions, export restrictions, and manufacturing disruptions. Long lead times for specialized components can delay vessel commissioning, engine replacements, and sustainment activities. Additionally, defense procurement processes involve extensive testing, certification, and compliance checks, further extending timelines. These delays can create mismatches between fleet availability requirements and engine delivery schedules. The complexity of contracting, combined with supply chain risks, poses a significant challenge for both OEMs and the Australian defense ecosystem, impacting operational readiness and cost efficiency.

Opportunities

Adoption of hybrid and integrated electric propulsion systems

A major opportunity in the Australia Military Marine Vessel Engines market lies in the growing adoption of hybrid and integrated electric propulsion systems. These systems combine conventional diesel engines with electric motors and advanced power management, offering improved fuel efficiency, reduced acoustic signatures, and greater operational flexibility. Hybrid propulsion is particularly attractive for patrol vessels, mine countermeasure ships, and auxiliary platforms that operate at variable speeds and require silent or low-noise operation. Australia’s emphasis on reducing fuel consumption, maintenance costs, and environmental impact aligns strongly with hybrid propulsion solutions. Retrofitting existing vessels with hybrid modules also presents a significant opportunity, as it extends vessel life while enhancing performance. Engine manufacturers and system integrators that offer modular, scalable hybrid solutions stand to gain long-term contracts across both newbuild and upgrade programs.

Expansion of local sustainment and sovereign industrial capability

Australia’s defense policy increasingly emphasizes sovereign industrial capability, creating strong opportunities for localized engine assembly, maintenance, repair, and overhaul (MRO) operations. The government’s preference for domestic sustainment reduces reliance on overseas support and improves fleet availability. This policy environment encourages global engine OEMs to establish or expand local facilities, partnerships, and workforce training programs. Localized sustainment not only shortens repair timelines but also generates recurring revenue through long-term service agreements. Additionally, Australia’s role as a regional maritime security provider opens opportunities for export-oriented MRO services to allied navies operating similar platforms. Companies that invest in Australian-based support infrastructure, digital maintenance solutions, and workforce development are well positioned to capture sustained growth in both domestic and regional markets.

Future Outlook

Over the coming decade, the Australia Military Marine Vessel Engines market is expected to witness sustained expansion driven by naval fleet renewal, hybrid propulsion retrofits, and increased emphasis on lifecycle cost optimization. Long-term shipbuilding programs will continue to generate stable demand for propulsion systems and replacement engines. Advancements in digital engine monitoring, acoustic signature reduction, and fuel efficiency will further shape procurement decisions, positioning the market for steady, technology-led growth.

Major Players

- Rolls-Royce Power Systems

- MAN Energy Solutions

- Wärtsilä

- Caterpillar Marine

- Cummins Marine

- GE Aerospace Marine

- Kawasaki Heavy Industries

- ABB Marine & Ports

- Siemens Energy Marine

- BAE Systems

- Thales Australia

- Saab Australia

- ASC Pty Ltd

- Austal

- Honeywell Marine Systems

Key Target Audience

- Naval shipbuilders and defense primes

- Marine propulsion system OEMs

- Fleet sustainment and MRO providers

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense logistics and supply chain operators

- Maritime platform integrators

- Energy efficiency and hybrid propulsion technology providers

Research Methodology

Step 1: Identification of Key Variables

The study begins with mapping the ecosystem of stakeholders involved in the Australia Military Marine Vessel Engines market. Extensive secondary research is conducted using defense budget documents, naval acquisition reports, and OEM disclosures to identify critical variables influencing propulsion demand and procurement cycles.

Step 2: Market Analysis and Construction

Historical procurement data, fleet composition statistics, and sustainment expenditure are analyzed to construct market size. Platform-wise engine deployment and replacement ratios are evaluated to ensure accurate revenue attribution across engine categories.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through structured interviews with naval engineers, propulsion system suppliers, and shipyard executives. These interactions provide operational insights into engine selection criteria, maintenance cycles, and future propulsion preferences.

Step 4: Research Synthesis and Final Output

Primary insights are combined with validated secondary data to finalize market sizing and forecasts. Cross-verification ensures consistency between bottom-up procurement analysis and top-down defense spending allocations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Fleet recapitalization and continuous shipbuilding programs driving new engine fitments for major surface and patrol platforms

Rising mission power needs for sensors, EW, and communications increasing demand for higher-output gensets and integrated power systems

Operational tempo and availability targets increasing spend on engine sustainment, spares, and reliability upgrades - Market Challenges

Export controls, ITAR constraints, and security clearances elongating procurement timelines and limiting supplier optionality

Maintenance complexity and parts obsolescence for legacy propulsion architectures raising lifecycle cost and downtime risks

Supply chain vulnerability for precision castings, turbochargers, and control electronics causing lead-time volatility - Market Opportunities

Hybridization and integrated electric propulsion retrofits to reduce fuel burn, acoustic signature, and maintenance burden on patrol and auxiliary fleets

Local content expansion through Australian assembly, test facilities, and certified MRO capability for propulsion and genset packages

Digital engine health monitoring and predictive maintenance solutions to improve readiness and reduce unscheduled removals - Trends

Shift toward integrated platform management systems linking engine control, power management, and condition-based maintenance analytics

Noise and vibration reduction enhancements for ASW-relevant platforms through resilient mounting, optimized gearing, and low-signature operating profiles

Standardization of modular spares and common genset families across classes to simplify sustainment and inventory

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Medium-speed marine diesel engines

High-speed marine diesel engines

Marine gas turbines

Integrated diesel-electric propulsion generator sets

Hybrid propulsion powerpacks - By Platform Type (In Value%)

Offshore patrol vessels and border protection cutters

Frigates and destroyers

Amphibious assault and landing ships

Auxiliary and replenishment vessels

Mine countermeasure vessels and unmanned surface support craft - By Fitment Type (In Value%)

Newbuild propulsion engine fitment

Mid-life upgrade and repower programs

Replacement engines for in-service sustainment

Generator set fitment for onboard power and mission loads

Overhaul and life-extension engine kits and modules - By End User Segment (In Value%)

Royal Australian Navy surface combatants

Royal Australian Navy patrol and littoral forces

Australian Border Force maritime fleet

Defence shipbuilders and prime contractors

Naval sustainment depots and regional MRO operators - By Procurement Channel (In Value%)

Direct government-to-OEM acquisition

Prime contractor integrated platform procurement

Through-life support and sustainment contracts

Authorized distributor and local agent supply

Spare parts and modules via framework agreements

- Market Share Analysis

- Cross Comparison Parameters (Delivered power range (kW/MW), Specific fuel consumption, Acoustic signature performance, Time-between-overhaul (TBO), Local MRO/industrial support depth, Lead time for spares and modules)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rolls-Royce Power Systems

MAN Energy Solutions

Wartsila

Caterpillar Marine

Cummins Marine

GE Aerospace Marine

Honeywell

Kawasaki Heavy Industries

ABB Marine & Ports

Siemens Energy Marine Solutions

BAE Systems

Thales Australia

Saab Australia

ASC Pty Ltd

Austal

- Preference for through-life support packages bundling spares, field service, and depot-level overhaul to meet availability KPIs

- Growing requirement for local certified maintenance and rapid-response field teams to reduce operational downtime across dispersed bases

- Increasing emphasis on fuel efficiency and endurance in procurement specifications for patrol and auxiliary mission profiles

- Higher scrutiny on cyber-secure engine controls and integration with combat system and platform networks

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035