Market Overview

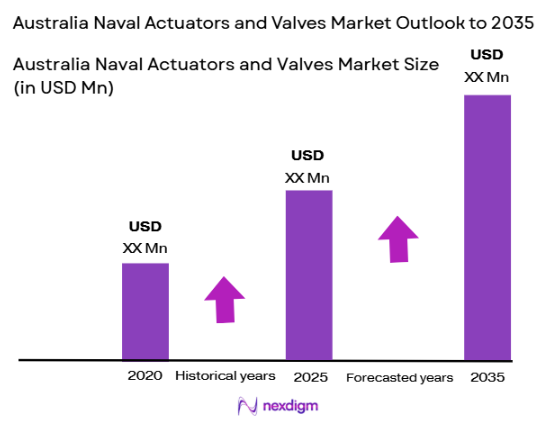

The Australia Naval Actuators and Valves Market has been growing steadily, driven by the increasing need for advanced technology in the country’s naval defense sector. As of recent data, the market reached a valuation of USD ~billion in 2023. Factors such as technological advancements, increasing defense budgets, and the necessity to upgrade naval fleets with modern and efficient actuators and valves are the key drivers of this market’s growth. The demand for actuators and valves is propelled by the need for enhanced operational capabilities in naval operations. This segment is expected to expand further due to the growing emphasis on fleet modernization and defense infrastructure development.Australia, with its robust naval defense spending, remains one of the key players in the global naval actuators and valves market. The country is investing heavily in its maritime defense, which is propelling the demand for advanced actuators and valves. Dominant cities such as Sydney, Melbourne, and Perth play a critical role in shaping the market as they host major naval infrastructure and military facilities. Australia’s position in the Indo-Pacific region also adds to its strategic significance, leading to a higher defense procurement demand, especially from the Australian Navy. This makes the country a dominant force in the regional market.

Market Segmentation

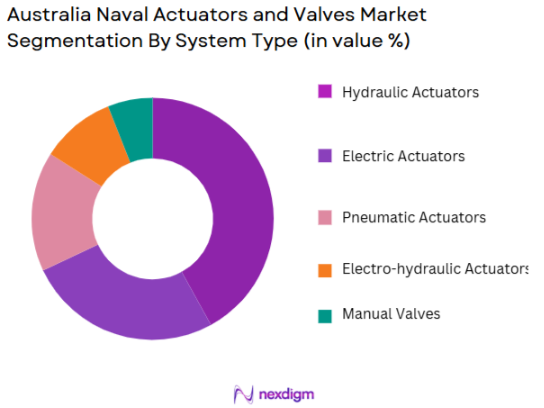

By System Type:

The Australia Naval Actuators and Valves market is primarily segmented by system type, which includes hydraulic actuators, electric actuators, pneumatic actuators, electro-hydraulic actuators, and manual valves. Hydraulic actuators currently dominate the market due to their high reliability and superior performance in heavy-duty applications required in naval vessels. These systems are favored for their ability to operate in extreme conditions, offering efficiency and reliability. The presence of established suppliers and the critical nature of hydraulic actuators in military defense applications give them a significant market share.

By Platform Type:

The market is also segmented by platform type, which includes surface combatants, submarines, auxiliary vessels, landing ship tanks, and support vessels. Surface combatants hold the largest market share due to their constant operational demand and large-scale use in defense fleets. These vessels require a variety of actuators and valves to support their complex mechanical systems, including propulsion and weaponry systems. The strategic importance of surface combatants in naval defense operations further drives the demand for advanced naval actuators and valves, contributing to the dominance of this subsegment in the market.

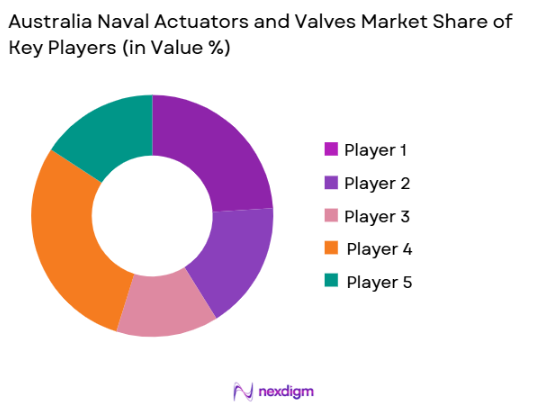

Competitive Landscape

The Australia Naval Actuators and Valves market is characterized by the presence of several key players, both local and international. These players include companies with expertise in naval defense and maritime technologies, as well as those with a history of supplying to the defense sector. The market is competitive, with companies vying for large contracts from defense agencies and governments. The most significant players in the market have established relationships with the Australian Department of Defence, contributing to their dominance in the market.

| Company | Year of Establishment | Headquarters | Technology | End-User Segment | Key Products | Market Focus |

| Rolls-Royce | 1904 | London, UK | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | East Aurora, USA | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1918 | Cleveland, USA | ~ | ~ | ~ | ~ |

| IMI plc | 1862 | Milton Keynes, UK | ~ | ~ | ~ | ~ |

Australia Naval Actuators and Valves Market Analysis

Growth Drivers

Urbanization

Urbanization plays a crucial role in driving the demand for advanced naval actuators and valves in Australia, especially due to the increased focus on enhancing national defense systems. As more cities grow in population and infrastructure, urban regions like Sydney and Melbourne host critical naval defense facilities, which require state-of-the-art equipment for effective military operations. Urbanized areas are typically hubs for technological development, which naturally boosts demand for sophisticated actuators and valves. Additionally, rapid urbanization often leads to greater government investment in infrastructure, including defense upgrades. This creates an environment conducive to the procurement of high-performance naval systems, which rely heavily on actuators and valves for the functionality of systems like propulsion and weaponry.

Industrialization

The industrialization of defense-related manufacturing in Australia contributes significantly to the growth of the naval actuators and valves market. As Australia continues to build and maintain a strong naval defense capability, the need for specialized industrial systems that support naval vessel operations, including hydraulic and electric actuators, is increasing. Australian industries are increasingly investing in advanced technologies for naval systems manufacturing, improving operational efficiency, and providing greater system reliability in naval vessels. The rapid industrialization of defense-related sectors enhances the local production and innovation of actuators and valves, further driving the market’s growth. As industries scale up their capabilities, the demand for high-tech, reliable components like actuators and valves surges to support the country’s military modernization.

Restraints

High Initial Costs

One of the key challenges hindering the growth of the Australia naval actuators and valves market is the high initial costs associated with these advanced technologies. The cost of high-quality actuators and valves can be prohibitively expensive, particularly for smaller defense contractors or agencies working on limited budgets. These high upfront costs make it difficult for smaller players to enter the market or upgrade existing systems. For large-scale defense projects, securing funding for procurement can also be a challenge, especially during periods of fiscal constraint. Consequently, the high initial costs can slow down the adoption and implementation of new naval systems, affecting overall market growth in the short term. Governments and defense agencies may delay or scale back procurement, which can disrupt growth projections in the sector.

Technical Challenges

Technical challenges present another significant restraint to the market for naval actuators and valves in Australia. As military technology becomes more advanced, the complexity of naval systems increases, requiring actuators and valves to operate under more stringent and demanding conditions. These systems need to be highly reliable, durable, and capable of withstanding extreme environmental conditions such as high pressure, saltwater corrosion, and temperature variations. Meeting these technical requirements often necessitates significant research and development investments. The long design cycles and the need for customized solutions can cause delays in production and deployment. Additionally, the complexity involved in integrating new actuators and valves with existing naval systems can also slow down adoption, making it a challenging area for manufacturers to navigate.

Opportunities

Technological Advancements

Technological advancements represent a significant opportunity for the Australia naval actuators and valves market. Innovations such as the development of electro-hydraulic actuators, advanced materials that can withstand harsh maritime environments, and smart actuators that offer greater precision and control are opening new avenues for growth. The integration of automation, sensors, and IoT in actuators and valves is expected to further enhance their efficiency, reliability, and functionality. As defense systems become more complex, the demand for next-generation actuators that integrate seamlessly with advanced military systems will increase. Companies investing in R&D to develop cutting-edge actuators and valves can position themselves as leaders in the growing Australian defense sector. With Australia’s emphasis on modernizing its military forces, the market for advanced actuators and valves is set to expand substantially in the coming years.

International Collaborations

International collaborations offer another opportunity to enhance the Australia naval actuators and valves market. Australia has established strong defense partnerships with key global players like the United States, the United Kingdom, and other NATO allies. These partnerships present opportunities for technology transfer, joint ventures, and the exchange of defense technologies, which can enhance the local capabilities of Australian defense contractors. By collaborating with international firms specializing in high-tech actuators and valves, Australia can improve its indigenous defense systems while benefiting from global expertise and advanced technologies. Additionally, international collaborations may open up new markets for Australian defense contractors, enabling them to participate in large-scale naval projects outside of Australia, thereby expanding the market size and strengthening the industry.

Future Outlook

Over the next decade, the Australia Naval Actuators and Valves market is expected to experience significant growth, driven by the continuous modernization of naval fleets, technological innovations, and increasing investments in defense infrastructure. The Australian government’s strategic focus on enhancing its naval defense capabilities will contribute to the sustained demand for advanced actuators and valves. Technological developments, particularly in automation and electro-hydraulic systems, will further augment market expansion. Additionally, with the increasing demand for fleet upgrades and replacements, the need for high-performance actuators and valves will continue to rise in the defense sector.

Major Players in the Market

- Rolls-Royce

- Honeywell International

- Moog Inc.

- Parker Hannifin

- IMI plc

- Schlumberger

- Curtiss-Wright Corporation

- Rotork

- Babcock International Group

- General Electric

- Dresser-Rand

- Camozzi Group

- Zollern GmbH

- JENOPTIK AG

- Eaton Corporation

Key Target Audience

- Defense Contractors

- Naval Forces

- OEMs

- Government Agencies

- Investments and Venture Capitalist Firms

- Repair and Maintenance Service Providers

- Strategic Partners and Technology Providers

- Regulatory Bodies

- Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia Naval Actuators and Valves market. This is done through extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The aim is to identify the critical variables that influence market dynamics, such as technological advancements, policy changes, and market trends.

Step 2: Market Analysis and Construction

In this phase, historical data relevant to the Australia Naval Actuators and Valves market will be compiled and analyzed. Key factors, such as market penetration, unit installations, and the ratio of suppliers to service providers, will be evaluated. Additionally, an assessment of product segment sales and demand forecasts will be conducted to understand the market’s growth trajectory.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed based on initial research and secondary data. These hypotheses will be validated through computer-assisted telephone interviews (CATIs) with industry experts. These experts will provide insights into operational, financial, and technological trends in the market, which will help refine and support the market data.

Step 4: Research Synthesis and Final Output

The final phase will involve in-depth discussions with major naval defense manufacturers, OEMs, and defense agencies. This will help to acquire detailed insights into product development, consumer preferences, procurement strategies, and future projections. This information will complement and verify the data collected from secondary sources, providing a comprehensive market analysis.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budgets

Rising Demand for Naval Modernization

Technological Advancements in Naval Systems - Market Challenges

High Initial Costs of Naval Actuators and Valves

Supply Chain Constraints

Regulatory Compliance Challenges - Market Opportunities

Expanding Naval Fleet in Emerging Markets

Focus on Sustainability and Eco-friendly Technologies

Growth of Naval Defense Collaborations - Trends

Automation and Smart Technologies

Integration of Digital Solutions

Development of Autonomous Naval Systems

- Market Opportunities

Expanding Naval Fleet in Emerging Markets

Focus on Sustainability and Eco-friendly Technologies

Growth of Naval Defense Collaborations - Government regulations

Naval Systems Certification Requirements

Environmental Compliance for Naval Equipment

Safety Standards for Military Platforms - SWOT analysis

Strength: Growing Naval Investments in Australia

Weakness: Dependence on International Suppliers

Opportunity: Expansion into Regional Defense Markets - Porters 5 forces

Bargaining Power of Suppliers: Moderate

Bargaining Power of Buyers: Low

Threat of New Entrants: Low

Threat of Substitutes: Moderate

Industry Rivalry: High

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hydraulic Actuators

Electric Actuators

Pneumatic Actuators

Electro-hydraulic Actuators

Manual Valves - By Platform Type (In Value%)

Surface Combatants

Submarines

Auxiliary Vessels

Landing Ship Tanks

Support Vessels - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Fitment

Repair and Maintenance Fitment

Upgrades - By EndUser Segment (In Value%)

Naval Forces

Defense Contractors

OEMs (Original Equipment Manufacturers)

Repair and Maintenance Service Providers

Government and Defense Organizations - By Procurement Channel (In Value%)

Direct Procurement

Distributor Channels

Online Procurement

Government Tenders

Strategic Partnerships

- Market Share Analysis

- CrossComparison Parameters(System Complexity, Platform Type, Procurement Channel, End-User, Geographical Distribution)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rolls-Royce

Honeywell International Inc.

Schlumberger

Curtiss-Wright Corporation

Parker Hannifin

Moog Inc.

IMI plc

Rotork

Huntington Ingalls Industries

Babcock International Group

General Electric

Dresser-Rand

Camozzi Group

Zollern GmbH

JENOPTIK AG

Eaton Corporation

- Increasing Focus on Technologically Advanced Actuators

- Demand for Energy-efficient Valves

- Preference for Customization and Flexibility

- Rising Maintenance and Retrofit Demands

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035