Market Overview

The Australia Naval Ammunition market is primarily driven by increasing defense expenditure and modernization of naval capabilities. In 2025, Australia’s defense spending reached USD~ billion, and the demand for advanced naval ammunition, including naval artillery and missile systems, is expected to grow significantly as the Royal Australian Navy continues to expand and modernize. The market size for naval ammunition is projected to grow due to the nation’s strategic defense initiatives, technological advancements, and the need for enhanced defense capabilities.

Australia’s market is largely dominated by key defense contractors and industries based in major defense hubs like Canberra, Sydney, and Melbourne. These cities are home to critical defense infrastructure and facilities, including research centres and manufacturing plants. The Royal Australian Navy, as well as international collaborations, further drive the demand for high-quality, reliable ammunition. The concentration of advanced manufacturing capabilities and strategic defense installations makes these cities pivotal players in the Australian naval ammunition market.

Market Segmentation

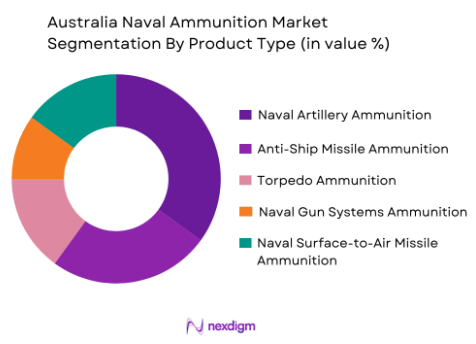

By Product Type

The Australian naval ammunition market is segmented by product type into naval artillery ammunition, anti-ship missile ammunition, torpedo ammunition, naval gun systems ammunition, and naval surface-to-air missile ammunition. Among these, naval artillery ammunition dominates the market due to its integral role in naval defense operations. Australia’s naval forces, including the Royal Australian Navy, rely heavily on artillery for both defense and offensive operations. With the ongoing modernization of naval ships and the replacement of outdated systems, artillery ammunition has seen consistent demand, underpinned by technological advancements in gun systems, which enhance the overall effectiveness of naval vessels in real-world combat situations.

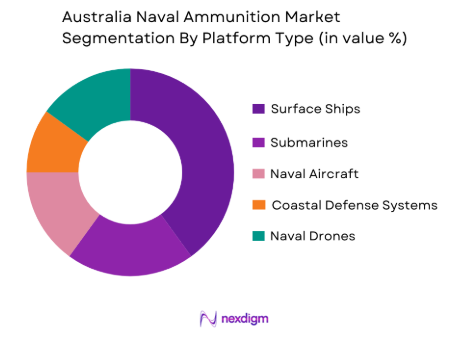

By Platform Type

The market is also segmented by platform type, including surface ships, submarines, naval aircraft, coastal defense systems, and naval drones. Among these, surface ships dominate the market, with the largest demand for ammunition coming from Australia’s naval fleets. The Royal Australian Navy’s continuous expansion of surface combatant ships, such as the Hobart-class destroyers and ANZAC-class frigates, fuels the demand for a variety of naval ammunition, particularly naval artillery and surface-to-air missiles. This platform’s dominance is also attributed to its versatility and the ongoing investment in surface vessel defense systems that require highly sophisticated and reliable ammunition systems.

Competitive Landscape

The Australia naval ammunition market is concentrated with a few major players dominating the space. Companies such as Rheinmetall Defence Australia, BAE Systems Australia, and Lockheed Martin Australia play a crucial role in providing advanced ammunition technologies, supported by their long-standing expertise in the defense sector. These players have strong relationships with government defense contracts, helping them maintain their dominant position in the market. Furthermore, their extensive research and development investments ensure the continuous supply of high-performance ammunition systems to meet the needs of modern naval warfare.

| Company | Establishment Year | Headquarters | Product Range | R&D Investment | Market Presence | Key Collaborations |

| Rheinmetall Defence Australia | 2009 | Melbourne | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1953 | Sydney | ~ | ~ | ~ | ~ |

| Lockheed Martin Australia | 1966 | Canberra | ~ | ~ | ~ | ~ |

| Thales Australia | 1999 | Sydney | ~ | ~ | ~ | ~ |

| Raytheon Australia | 2006 | Canberra | ~ | ~ | ~ | ~ |

Australia Naval Ammunition Market Analysis

Growth Drivers

Increase in Defense Spending and Naval Modernization

The Australia Naval Ammunition market is significantly driven by the continuous rise in defense spending, which has seen a steady increase in recent years. The Australian government’s focus on enhancing the country’s naval defense capabilities and maintaining a modernized fleet fuels the demand for advanced naval ammunition. As part of the government’s defense strategy, which includes replacing outdated naval platforms and investing in next-generation capabilities, the need for sophisticated ammunition systems has surged. The Australian government’s strategic priority of strengthening its defense forces in response to rising geopolitical tensions in the Indo-Pacific region further drives this market. The procurement of cutting-edge naval platforms, including new destroyers, submarines, and aircraft carriers, necessitates the development and acquisition of corresponding ammunition, particularly in naval artillery and missile systems, driving overall market growth.

Geopolitical Tensions and Regional Defense Dynamics

The strategic importance of the Indo-Pacific region, where Australia plays a pivotal role in maintaining regional security, has made the Australian Naval Ammunition market highly dynamic. Rising geopolitical tensions in the region, particularly concerns over China’s growing influence, have prompted Australia to bolster its defense capabilities. As part of its efforts to ensure maritime security and support its allies, Australia is making significant investments in naval forces and ammunition. These investments aim to modernize naval fleets with high-performance weaponry that is capable of countering regional threats. Australia’s participation in joint military exercises and defense collaborations with nations such as the United States, Japan, and India further strengthens its naval capabilities and drives demand for more advanced, reliable, and diverse naval ammunition solutions to meet strategic defense needs.

Market Challenges

High Cost of Research and Development

One of the significant challenges faced by the Australia Naval Ammunition market is the high cost of research and development (R&D) required for advancing ammunition technologies. As the demand for more sophisticated and high-performance ammunition grows, defense contractors are under pressure to invest heavily in R&D to develop innovative solutions, such as precision-guided munitions, advanced torpedoes, and air-defense systems. These technologies require substantial capital investment in terms of testing, production, and procurement. The high cost of development can slow down the pace of innovation, particularly when the defense budget is constrained or when production timelines are delayed. The risk of project overrun costs further exacerbates the financial burden, and while the Australian government’s defense spending continues to grow, the expense of cutting-edge technologies poses a persistent challenge to manufacturers and defense contractors in the sector.

Supply Chain and Procurement Delays

The Australia Naval Ammunition market also faces challenges related to supply chain inefficiencies and procurement delays. With growing demand for advanced ammunition, there has been an increased pressure on manufacturers to maintain a consistent and timely supply of components, particularly for specialized ammunition types like anti-ship missiles and naval torpedoes. Global supply chain disruptions, caused by factors such as geopolitical instability, pandemics, and international trade tensions, complicate the timely delivery of raw materials and key technologies essential for ammunition production. Procurement delays within the Australian Department of Defence can also cause gaps in the availability of critical ammunition, hampering operational readiness and limiting the effective use of the naval fleet. These logistical and procurement-related challenges make it difficult to meet the growing demand for ammunition systems and can lead to delays in defense program execution.

Opportunities

Growing Demand for Multi-Purpose Ammunition Systems

The Australian Naval Ammunition market is presented with significant opportunities due to the increasing demand for multi-purpose ammunition systems. As the complexity of naval defense operations continues to evolve, there is a growing need for versatile ammunition that can be adapted for various missions, from anti-ship operations to air defense. Multi-purpose systems offer operational flexibility, reducing the need for various specialized munitions and improving the efficiency of naval operations. As Australia modernizes its naval fleets, integrating multi-role systems into its platforms will allow the country’s naval forces to respond to a broader range of security threats. Defense contractors have the opportunity to innovate in this space, offering solutions that meet the requirements of both offensive and defensive naval operations. The ability to provide ammunition systems that can be adapted to different mission profiles is expected to be a key driver of market growth in the coming years.

Strategic Partnerships and Defense Collaboration

Another major opportunity for the Australia Naval Ammunition market lies in the country’s growing defense collaborations and partnerships within the Indo-Pacific region. As Australia seeks to strengthen its defense relationships with nations like the United States, Japan, India, and others, there is a rising demand for high-performance naval ammunition that can support joint military exercises, peacekeeping operations, and strategic defense objectives. These collaborations often lead to co-production agreements, technology sharing, and joint defense initiatives, allowing Australia to benefit from cutting-edge ammunition technologies developed by partner nations. Moreover, partnerships with global defense manufacturers create opportunities to expand the local production of naval ammunition, reduce reliance on imports, and potentially lower procurement costs. Increased international cooperation and participation in defense coalitions ensure long-term growth prospects for the Australian Naval Ammunition market.

Future Outlook

Over the next 5-10 years, the Australia Naval Ammunition market is expected to witness substantial growth, driven by continuous defense modernization and technological advancements. Increased investments in enhancing naval defense capabilities, particularly in missile systems and artillery ammunition, will spur demand. Moreover, strategic geopolitical factors, such as rising security concerns in the Indo-Pacific region, will further contribute to the growth of the naval defense sector. Australia’s focus on strengthening its defense alliances and partnerships will continue to push the development and procurement of advanced naval ammunition systems.

Major Players

- Rheinmetall Defence Australia

- BAE Systems Australia

- Lockheed Martin Australia

- Thales Australia

- Raytheon Australia

- Northrop Grumman Australia

- Leonardo Australia

- Navantia Australia

- L3 Technologies Australia

- Boeing Defence Australia

- Saab Australia

- General Dynamics Mission Systems Australia

- Harris Corporation Australia

- Australian Defence Industries

- Elbit Systems Australia

Key Target Audience

- Government Defense Agencies

- Defense Contractors

- Investments and Venture Capitalist Firms

- International Naval Forces

- Naval Equipment Suppliers

- Military Procurement Officers

- Government and Regulatory Bodies

- Australian Defence Forces

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying and categorizing the key variables affecting the Australia Naval Ammunition market. This includes assessing technological advancements, defense budgets, and procurement strategies, drawing on extensive secondary research and industry reports to understand the ecosystem dynamics.

Step 2: Market Analysis and Construction

This phase encompasses the aggregation and evaluation of historical market data, focusing on market value, system installations, and pricing trends within the Australian defense sector. A key objective is to assess the correlation between defense spending and market growth.

Step 3: Hypothesis Validation and Expert Consultation

A critical part of the methodology includes validating hypotheses through expert consultations. Industry experts, government representatives, and leading defense contractors will provide insights into real-time market developments, challenges, and forecasts.

Step 4: Research Synthesis and Final Output

In the final phase, data will be synthesized through expert consultations and industry feedback to ensure a comprehensive market analysis. Engagement with naval ammunition manufacturers will provide insights into product innovation, production trends, and emerging market needs.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in naval defense budgets

Technological advancements in naval weaponry

Rising geopolitical tensions and naval modernization programs - Challenges

High R&D costs for advanced ammunition

Challenges in supply chain management

Regulatory and environmental constraints - Opportunities

Growing defense collaboration in the Indo-Pacific region

Demand for advanced naval ammunition technology

Increasing investments in defense infrastructure - Trends

Shift towards multi-purpose naval ammunition systems

Integration of AI and automation in ammunition systems

Rise in joint multinational naval exercises

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Naval Artillery Ammunition

Anti-Ship Missile Ammunition

Torpedo Ammunition

Naval Gun Systems Ammunition

Naval Surface-to-Air Missile Ammunition - By Platform Type (In Value%)

Surface Ships

Submarines

Naval Aircraft

Coastal Defense Systems

Naval Drones - By Fitment Type (In Value%)

OEM Ammunition

Aftermarket Ammunition

Refurbished Ammunition

Custom-Fit Ammunition

Standard-Fit Ammunition - By End User Segment (In Value%)

Royal Australian Navy

Defence Contractors

Naval Defence Research Agencies

Private Defence Contractors

International Naval Forces - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Contractors

Third-Party Distributors

Military Auctions

International Trade

- Market Share Analysis

- Cross Comparison Parameters(Product Type, Platform Compatibility, Technological Advancements, Cost-Effectiveness, Geopolitical Partnerships)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Rheinmetall Defence Australia

BAE Systems Australia

Thales Australia

Lockheed Martin Australia

Navantia Australia

Northrop Grumman Australia

Raytheon Australia

L3 Technologies Australia

DST Group

Leonardo Australia

Kongsberg Defence & Aerospace

General Dynamics Mission Systems Australia

Harris Corporation Australia

Australian Defence Industries

Boeing Defence Australia

- Strategic importance of naval defense for Australia’s national security

- Increased demand for high-performance ammunition systems

- Focus on indigenous ammunition production

- Partnerships with international defense forces

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035