Market Overview

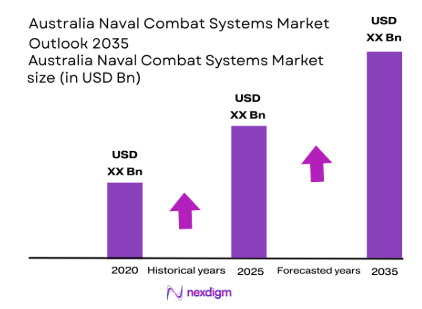

The Australian naval combat systems market is valued at approximately USD ~billion in 2023, with a steady growth trajectory expected through 2025. This market is driven by increasing defense budgets, particularly in response to geopolitical tensions and growing naval modernization efforts by the Australian government. The demand for advanced systems is being propelled by the need for enhanced defense capabilities and the integration of cutting-edge technologies such as artificial intelligence and cyber defense. Additionally, government defense spending has been increasing, further contributing to the growth of the market. The Australian defense sector remains a key driver in naval combat systems investments, prioritizing cutting-edge technology to maintain a competitive naval force.

Australia, with its strategic location in the Asia-Pacific region, dominates the naval combat systems market. Key cities driving this market include Canberra, Sydney, and Melbourne, where defense contractors, governmental bodies, and R&D institutions are concentrated. The Australian government’s focus on modernizing its naval forces and increasing defense spending has made the country a leader in the market. Additionally, Australia’s strategic partnerships with major global players like the United States and the United Kingdom further contribute to its dominance in naval defense technology. These collaborations, combined with domestic policy support for defense modernization, position Australia as a key player in the naval combat systems market.

Market Segmentation

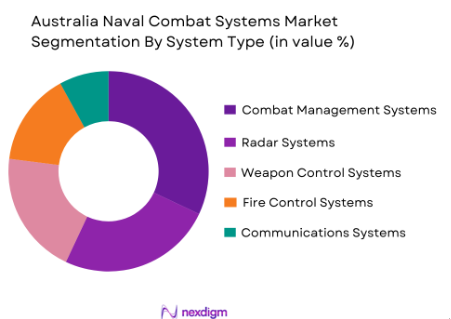

By System Type

Australia’s naval combat systems market is segmented by system type into combat management systems, radar systems, weapon control systems, fire control systems, and communications systems. Among these, the combat management systems segment holds the largest market share in 2025, driven by the increasing need for integrated solutions to enhance the decision-making capabilities of naval forces. These systems are central to modernizing naval fleets and ensuring efficient and coordinated defense operations. The integration of various platforms such as surface combatants, submarines, and aircraft into a unified management system is pushing the demand for combat management systems, making them a dominant sub-segment in the market.

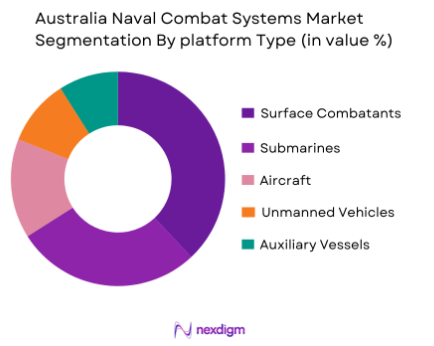

By Platform Type

The market for naval combat systems is further segmented by platform type into surface combatants, submarines, aircraft, unmanned vehicles, and auxiliary vessels. Surface combatants dominate the market share, accounting for a significant portion of the market in 2025. The increasing modernization of Australia’s surface fleet, which includes frigates and destroyers, plays a significant role in the dominance of this segment. Additionally, the Australian Navy’s investment in state-of-the-art surface combatants with integrated combat systems drives the growth of this sub-segment. As a result, surface combatants remain a vital part of the Australian naval combat systems market.

Competitive Landscape

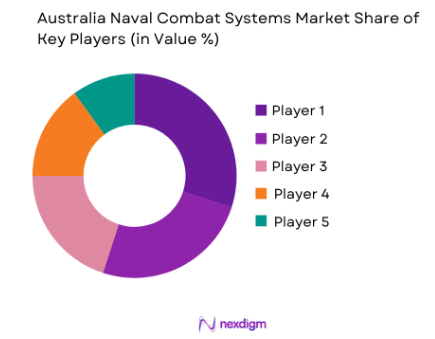

The Australian naval combat systems market is competitive, with a few major players dominating the industry. Global defense companies such as Lockheed Martin, BAE Systems, Thales, and Raytheon Technologies lead the market, alongside Australian defense companies like ASC Pty Ltd and Austal. These players provide a range of advanced solutions, including combat management systems, radar, and weapon control systems. The presence of both international and domestic companies in Australia ensures a diverse and competitive market landscape, with innovations and strategic collaborations playing a key role in shaping the market’s future.

| Company | Establishment Year | Headquarters | Market Focus | Product Range | R&D Capabilities | Market Reach |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ |

| Thales | 2000 | Paris, France | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ |

| ASC Pty Ltd | 1985 | Adelaide, Australia | ~ | ~ | ~ | ~ |

Australia Naval Combat Systems Market Analysis

Growth Drivers

Increased Government Defense Spending

The Australian government’s growing defense budget is a key growth driver for the naval combat systems market. As regional security concerns rise, particularly with the growing influence of China in the Asia-Pacific, Australia has increased its defense expenditure to modernize its military capabilities. The government’s commitment to enhancing its naval fleet, including the procurement of new ships, submarines, and advanced combat systems, has created a significant demand for cutting-edge naval technologies. Furthermore, defense modernization initiatives such as the “Future Submarine Program” and other large-scale defense projects have bolstered market growth, resulting in an increased focus on upgrading and expanding naval combat systems. With ongoing defense procurements, including radar systems, combat management systems, and integrated weapon control platforms, the Australian defense sector is positioned for long-term growth, directly driving the demand for advanced naval combat systems.

Technological Advancements in Combat Systems

The continuous evolution of naval combat technologies plays a critical role in driving the growth of the market. New advancements in artificial intelligence (AI), machine learning, radar technologies, and cybersecurity solutions have significantly transformed naval combat systems, offering enhanced efficiency, precision, and security. Australia’s naval forces are increasingly relying on integrated, multi-role platforms that leverage the latest technologies to enhance operational effectiveness. For instance, AI-powered combat management systems enable faster decision-making, improving the overall responsiveness of naval forces. Additionally, the shift towards autonomous systems, such as unmanned underwater vehicles and autonomous surface vessels, is opening up new opportunities for naval defense. These technological advancements not only improve the combat capabilities of the Australian Navy but also create demand for sophisticated defense systems, thereby driving growth in the naval combat systems market.

Market Challenges

High Cost of Procurement and Installation

One of the primary challenges facing the Australian naval combat systems market is the high cost of procuring and installing advanced systems. Naval combat systems are highly complex and involve significant financial investments in terms of both initial procurement and ongoing maintenance. These systems require state-of-the-art technologies, which often come with a hefty price tag. The long procurement timelines and high installation costs associated with these systems are barriers for both the government and private contractors. Furthermore, the complexity of integrating these advanced systems with existing platforms adds another layer of cost. While the Australian government is committed to defense modernization, budget constraints and competing priorities in the national fiscal policy can sometimes delay or limit the scope of procurement. This financial burden poses a challenge to the long-term scalability and adoption of new combat systems within the Australian Navy.

Integration and Interoperability Issues

The integration of advanced naval combat systems with existing platforms and equipment is a significant challenge in the Australian market. As Australia continues to modernize its naval fleet, integrating new combat management systems, radar technologies, and weapon control platforms with older ships and submarines becomes increasingly complex. Interoperability issues arise when newly acquired systems do not seamlessly connect with legacy systems, resulting in reduced operational efficiency and higher costs. Furthermore, the integration of multi-domain platforms, such as unmanned systems or cyber defense technologies, with traditional naval assets requires extensive coordination and specialized knowledge. Ensuring smooth integration between different components—whether within Australia’s defense framework or through international collaborations—remains a key challenge for stakeholders. These hurdles can lead to project delays, cost overruns, and a slower-than-anticipated rollout of next-generation naval combat systems.

Opportunities

Rise of Autonomous Naval Systems

The increasing interest in autonomous naval systems presents a significant opportunity for the Australian naval combat systems market. Autonomous technologies, such as unmanned surface vessels (USVs) and unmanned underwater vehicles (UUVs), are gaining traction within global defense industries, and Australia is actively investing in these advanced systems. These technologies offer various benefits, including enhanced operational range, reduced risk to personnel, and cost-effectiveness in long-duration missions. As part of its defense modernization strategy, Australia is looking to integrate more autonomous platforms into its naval forces. These systems can operate in high-risk environments, such as deep-water surveillance or mine detection, where human presence is limited or dangerous. Additionally, the development of autonomous systems aligns with Australia’s broader defense strategies, creating a unique opportunity for defense contractors and suppliers to develop and provide advanced technologies, thus contributing to market expansion.

Collaborations with Global Defense Contractors

Strategic partnerships between Australia and leading global defense contractors offer significant opportunities for the growth of the naval combat systems market. Australia’s close collaborations with the United States, the United Kingdom, and other NATO countries provide access to advanced technologies and innovation in naval defense systems. Such alliances enable the Australian Navy to procure cutting-edge systems while benefiting from the expertise and research capabilities of global defense giants. Through these partnerships, Australian defense contractors can access the latest technologies in radar, weapon control systems, and combat management platforms, ensuring that the country’s naval forces remain competitive. Additionally, collaborative efforts in joint defense programs and research initiatives allow for cost-sharing in the development of next-generation technologies. This collaboration with global defense leaders positions Australia to continuously enhance its naval capabilities, while boosting the growth of the domestic market for naval combat systems.

Future Outlook

Over the next decade, the Australian naval combat systems market is expected to experience continued growth, driven by advancements in naval technology, increasing defense budgets, and growing regional security concerns. The Australian government’s defense modernization strategy, including investments in cutting-edge combat systems, will fuel demand. Additionally, partnerships with leading global defense firms and the ongoing development of autonomous naval systems will further accelerate market expansion. The market will also witness a greater focus on cyber defense capabilities as naval combat systems continue to evolve in the digital age.

Major Players

- Lockheed Martin

- BAE Systems

- Thales

- Raytheon Technologies

- ASC Pty Ltd

- Austal

- Saab Group

- Leonardo

- Northrop Grumman

- Kongsberg Gruppen

- General Dynamics

- Harris Corporation

- Naval Group

- Rolls-Royce

- Huntington Ingalls Industries

Key Target Audience

- Defense contractors

- Naval defense agencies

- Government bodies

- Military technology companies

- Security agencies

- Investment and venture capital firms

- Government and regulatory bodies

- Equipment manufacturers and suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key variables influencing the Australian naval combat systems market. Through comprehensive secondary research, we will define critical elements, including defense budget allocations, technological advancements, and regulatory frameworks. This step is critical in constructing an accurate ecosystem for the analysis of future trends and forecasts.

Step 2: Market Analysis and Construction

Historical data on Australia’s naval defense spending and system procurement trends will be analyzed to determine market penetration. This includes reviewing government defense policies, past acquisitions, and planned defense investments. Data will also be gathered regarding defense procurement contracts and regional security initiatives to construct a robust market model.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, expert consultations will be conducted with key stakeholders, including defense contractors, naval officers, and industry analysts. Telephone interviews and discussions will ensure the accuracy and feasibility of the market trends and forecasts. This phase aims to gain a deeper understanding of emerging technologies and market dynamics.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing the findings and insights obtained from previous steps. This includes engaging with manufacturers and suppliers in the naval sector to refine and validate data. Interaction with key industry players will ensure the final output accurately represents the market’s current landscape and future direction.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense spending by Australia

Technological advancements in naval combat systems

Expansion of maritime security and defense collaborations - Market Challenges

High cost of procurement and installation

Complexity in system integration

Limited availability of skilled personnel - Market Opportunities

Rise in demand for autonomous naval systems

Growing interest in multi-role combat systems

Strategic partnerships in defense research and technology - Trends

Adoption of artificial intelligence and machine learning in naval systems

Growing focus on cybersecurity for naval combat systems

Shift towards integrated, multi-domain combat platforms

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Combat Management Systems

Radar Systems

Weapon Control Systems

Fire Control Systems

Communications Systems - By Platform Type (In Value%)

Surface Combatants

Submarines

Aircraft

Unmanned Vehicles

Auxiliary Vessels - By Fitment Type (In Value%)

New Builds

Upgrades

Retrofits

Shipyard Installations

Onboard Maintenance - By End User Segment (In Value%)

Australian Navy

International Naval Forces

Defense Contractors

Research Institutions

Private Defense Companies - By Procurement Channel (In Value%)

Government Contracts

Direct Procurement

Defense Manufacturers

Third-party Distributors

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (Market Share, System Complexity, Procurement Models, Technological Advancements, Regional Presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Boeing

Lockheed Martin

Thales

BAE Systems

Raytheon Technologies

Navantia

Northrop Grumman

General Dynamics

Leonardo

Harris Corporation

L3 Technologies

Naval Group

Huntington Ingalls Industries

Kongsberg Gruppen

Rolls-Royce

- Increasing reliance on combat systems for national defense

- Collaboration with international allies for advanced systems

- Rising interest from private sector for defense technology

- Strong focus on modernization and system upgrades

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035