Market Overview

The Australia Naval Combat Weapons market has been steadily growing due to strategic defense priorities, with the market valued at approximately USD ~ billion in 2023 and expected to reach around USD ~billion in 2024. This growth is driven by Australia’s focus on enhancing its naval defense capabilities to secure its vast maritime borders and maintain regional stability. A key factor in this market expansion is the modernization of Australia’s naval fleet, which includes the acquisition of advanced weapons systems, missile defense systems, and naval guns. The Australian government is heavily investing in these advanced systems as part of its broader defense strategy, with a focus on building a highly capable and technologically advanced naval force to address regional security threats, particularly in the Indo-Pacific region. Additionally, the increasing need for interoperability with international allies like the U.S. and the growing demand for precision strike capabilities contribute to the growth of this market.

Australia is the dominant player in the naval combat weapons market in the Indo-Pacific region, with major activity concentrated in cities such as Canberra (the capital) and major coastal cities like Sydney, Adelaide, and Perth. Canberra is the political hub where key defense decisions are made, driving investments and policy frameworks. Sydney and Adelaide host significant defense industry operations, including the headquarters of major defense contractors and naval shipyards. Perth plays a key role due to its proximity to Australia’s strategic naval bases and its position as a gateway for defense exports. Additionally, Australia’s partnerships with global defense powers such as the U.S. and the U.K., alongside its naval exercises with regional allies, solidify its position in the market. These cities benefit from a combination of government support, high defense expenditure, and strong ties to international defense alliances, which further propels the market dominance.

Market Segmentation

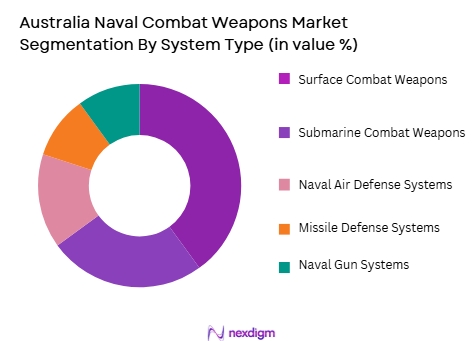

By System Type

The Australia Naval Combat Weapons market is segmented by system type into Surface Combat Weapons, Submarine Combat Weapons, Naval Air Defense Systems, Missile Defense Systems, and Naval Gun Systems. Among these, Surface Combat Weapons dominate the market share due to their critical role in naval operations. The increasing demand for advanced surface warfare capabilities, including advanced missiles, radar systems, and electronic warfare (EW) systems, has driven this segment’s growth. Australia’s naval modernization efforts have been centered on enhancing the capabilities of surface combatants, particularly through the integration of multi-role combat systems capable of executing a range of operations, including anti-ship, anti-air, and land-strike missions. The Australian Navy is also increasing the number of surface combatants in its fleet, which adds to the growing demand for advanced surface combat weapons.

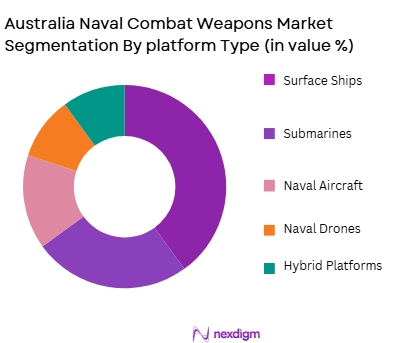

By Platform Type

The Australia Naval Combat Weapons market is segmented by platform type into Surface Ships, Submarines, Naval Aircraft, Naval Drones, and Hybrid Platforms. The dominance of Surface Ships in this segment is driven by the Australian Navy’s strategic emphasis on enhancing the firepower and versatility of its surface fleets. These vessels are equipped with cutting-edge combat systems such as long-range missiles, advanced radar, and EW systems, enabling them to perform a variety of roles, from anti-submarine warfare (ASW) to strike missions. Australia’s ongoing investment in surface combatants, including the construction of new guided missile frigates and destroyers, has further boosted the demand for advanced naval combat weapons on these platforms. Moreover, surface ships are seen as the backbone of naval defense and play a significant role in deterring potential threats in the Indo-Pacific region.

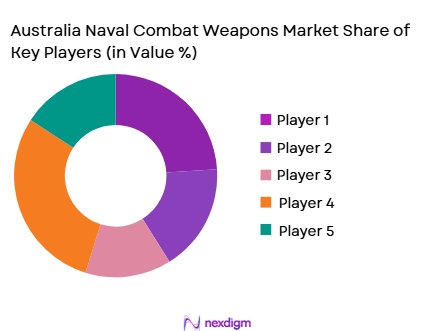

Competitive Landscape

The Australia Naval Combat Weapons market is dominated by both global and domestic players, offering a range of advanced solutions to meet the defense needs of the Australian Navy. This market is highly competitive, with leading defense contractors providing cutting-edge technology, including surface-to-air missiles, advanced radar systems, and integrated naval combat systems. The presence of these major defense contractors highlights the consolidation of key players in the market. BAE Systems Australia and Lockheed Martin Australia, for example, have established themselves as critical suppliers of advanced naval combat systems, including surface combat systems and missile defense systems. Their longstanding partnerships with the Australian government and significant investments in R&D play a pivotal role in their market dominance.

| Company Name | Establishment Year | Headquarters | Key Product Categories | Market Focus | R&D Investment | Government Contracts |

| BAE Systems Australia | 1950 | Sydney, Australia | ~ | ~ | ~ | ~ |

| Lockheed Martin Australia | 1994 | Canberra, Australia | ~ | ~ | ~ | ~ |

| Raytheon Australia | 1999 | Melbourne, Australia | ~ | ~ | ~ | ~ |

| Saab Australia | 1987 | Adelaide, Australia | ~ | ~ | ~ | ~ |

| Thales Australia | 1997 | Sydney, Australia | ~ | ~ | ~ | ~ |

Australia Naval Combat Weapons Market Analysis

Growth Drivers:

Increasing Defense Budget and Strategic Focus on Maritime Security

Australia’s growing defense budget is a key driver for the expansion of the naval combat weapons market. The Australian government has made significant investments in modernizing its naval capabilities as part of its broader defense strategy to ensure maritime security in the Indo-Pacific region. With rising geopolitical tensions and security threats, particularly around the South China Sea, the Australian government is focusing on enhancing its naval power, which includes acquiring advanced combat systems, missiles, and naval gun systems. This strategic shift is expected to continue driving demand for next-generation naval weapons, including those capable of precision strikes, anti-submarine warfare, and anti-air warfare. Increased funding for both research and development, and procurement of cutting-edge technologies, is fueling long-term growth in the market.

Technological Advancements in Naval Combat Systems

Another key growth driver for the Australia Naval Combat Weapons market is the rapid advancement in naval combat technologies. Innovations such as autonomous systems, artificial intelligence (AI), and advanced missile defense systems are transforming naval warfare. These technologies enable more efficient operations, improved targeting capabilities, and enhanced decision-making. Australia’s efforts to modernize its fleet with systems such as advanced radar, AI-driven missile systems, and unmanned aerial and underwater vehicles are playing a crucial role in the growth of the market. These technological advancements are enhancing the Australian Navy’s capabilities to respond quickly to evolving threats, further boosting the demand for sophisticated naval weapons systems.

Market Challenges:

High Integration and Operational Costs

One of the key challenges facing the Australia Naval Combat Weapons market is the high cost of integrating and maintaining modern naval combat systems. Upgrading legacy systems to incorporate advanced technologies often requires significant financial investment. These high costs include not only the acquisition of sophisticated weapon systems but also the costs associated with system integration, training personnel, and ongoing maintenance. Additionally, as naval combat systems become more complex, there is a need for regular updates and high-level technical support, which increases operational costs. With defense budgets often constrained by competing priorities, managing these costs while ensuring the fleet’s operational readiness remains a major challenge for the Australian government.

Dependency on International Suppliers for Advanced Technologies

Despite efforts to strengthen local defense manufacturing, Australia’s naval combat weapons market continues to rely on international suppliers for some of its most advanced technologies. Many of the high-tech components used in naval weapons systems, such as radar systems, missile defense systems, and electronic warfare technologies, are sourced from global defense contractors. This dependence on foreign suppliers presents risks in terms of supply chain disruptions, geopolitical tensions, and the potential for delays in procurement. Additionally, it creates vulnerabilities related to national security and technology transfer, as the country must ensure that these advanced technologies are aligned with its strategic defense needs while minimizing foreign influence.

Opportunities:

Collaboration with Global Defense Contractors for Innovation

One of the key opportunities for Australia’s naval combat weapons market lies in fostering collaboration with global defense contractors. By partnering with international defense giants such as Lockheed Martin, Raytheon, and BAE Systems, Australia can access cutting-edge technologies and innovations in naval combat systems. These collaborations can drive technological advancements in areas such as missile defense, autonomous weapons systems, and AI-powered systems, while also contributing to the development of a more advanced and interoperable naval force. Additionally, such collaborations can help Australia reduce the time and costs associated with developing these technologies domestically, enabling faster deployment and operational readiness of advanced systems.

Export Opportunities for Naval Combat Systems

Australia’s naval defense industry has significant potential for growth through the export of advanced naval combat systems. The country’s strong track record of producing reliable and advanced naval technologies positions it as a potential exporter of sophisticated weapons systems, including naval guns, missile defense systems, and unmanned vehicles, to other nations in the Indo-Pacific region. As countries in the region, such as India, Japan, and South Korea, continue to modernize their naval forces, there is growing demand for high-quality, cost-effective naval systems. Australia can capitalize on this opportunity by expanding its defense exports, leveraging its technological expertise, and fostering strategic partnerships to meet the needs of these emerging markets.

Future Outlook

Over the next decade, the Australia Naval Combat Weapons market is expected to experience significant growth, fueled by continued investment in naval modernization and an increasing emphasis on maritime security. Australia’s expanding defense budget and the need to maintain a strong naval presence in the Indo-Pacific region will drive demand for cutting-edge naval combat systems. Key trends, such as the adoption of AI-powered weapons systems, autonomous vehicles, and advanced missile defense technologies, will play a major role in shaping the future of this market. As Australia’s geopolitical focus shifts to regional security, the demand for advanced and versatile naval combat weapons will remain robust throughout the forecast period.

Major Players

- BAE Systems Australia

- Lockheed Martin Australia

- Raytheon Australia

- Saab Australia

- Thales Australia

- Naval Group Australia

- Rheinmetall Defence

- Leonardo Australia

- General Dynamics

- Northrop Grumman Australia

- L3 Technologies Australia

- Boeing Australia

- Mitsubishi Heavy Industries

- Navantia Australia

- Embraer Australia

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Australian Navy

- Defense Contractors

- Naval Technology Manufacturers

- Private Sector Security Companies

- International Defense Forces

- Government Defense Procurement Agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key factors that influence the Australia Naval Combat Weapons market. This includes analyzing the defense budget, technological advancements, and naval defense strategies. This phase relies heavily on secondary research, including industry reports, governmental publications, and defense databases.

Step 2: Market Analysis and Construction

In this phase, historical market data is analyzed to construct a detailed view of the market’s performance, focusing on market penetration, technological adoption, and revenue generation. This also includes evaluating the strategic initiatives by key players and government procurement activities.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth drivers, challenges, and trends are tested through consultations with industry experts and naval defense contractors. These interviews help refine market assumptions and validate the predictions.

Step 4: Research Synthesis and Final Output

The final phase integrates primary and secondary research findings, providing a comprehensive view of the market’s dynamics. Interviews with industry practitioners and manufacturers will verify product segment performance, sales metrics, and consumer preferences, ensuring accuracy and reliability in the market analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing investments in defense modernization

Geopolitical tensions in the Indo-Pacific region

Advancements in missile defense systems and naval technology - Market Challenges

High integration and operational costs

Complexity in aligning legacy systems with modern combat weapons

Dependency on international suppliers for advanced technologies - Market Opportunities

Collaboration with global defense contractors for innovation

Rising demand for autonomous naval combat systems

Export opportunities for advanced Australian naval combat systems - Trends

Increasing adoption of AI and autonomous systems in naval combat

Growing focus on integrated missile defense systems

Development of next-generation naval gun systems - Government regulations

Australian Defence Export Control Regime

National Security Strategy and Naval Procurement Guidelines

Defence Industry Security Program (DISP) - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Surface Combat Weapons

Submarine Combat Weapons

Naval Air Defense Systems

Missile Defense Systems

Naval Gun Systems - By Platform Type (In Value%)

Surface Ships

Submarines

Naval Aircraft

Naval Drones

Hybrid Platforms - By Fitment Type (In Value%)

New Installations

Upgrades

Retrofits

Modular Systems

Custom Integrations - By EndUser Segment (In Value%)

Australian Navy

Defense Contractors

Government Agencies

Private Sector / Civilian Applications

International Defense Forces - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Resellers

Online Platforms

Government Tenders

OEMs

- Cross Comparison Parameters (Technological innovation, Integration with legacy systems, Cost of procurement, Geopolitical security risks, International defense partnerships)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Boeing Australia

BAE Systems Australia

Rheinmetall Defence

Lockheed Martin Australia

Navantia Australia

Thales Australia

Raytheon Australia

General Dynamics

Saab Australia

L3 Technologies Australia

Northrop Grumman Australia

Naval Group Australia

Tata Advanced Systems

Leonardo Australia

Embraer Australia

- Australian Navy’s increasing reliance on advanced combat systems

- Government agencies’ focus on national defense security

- Private sector’s role in defense technology innovation

- International collaborations and defense export initiatives

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035