Market Overview

The Australian Naval Gas Turbine market is valued at approximately USD ~billion in 2024, driven by the country’s efforts to modernize its naval fleet with advanced propulsion systems. The market is propelled by the increasing demand for high-performance, fuel-efficient, and reliable gas turbines that can support various naval vessels such as surface combatants and submarines. The Australian government’s defense spending and strategic initiatives to maintain a strong naval presence in the Indo-Pacific region contribute significantly to this market’s growth. Additionally, technological advancements in turbine efficiency and environmental regulations requiring cleaner energy sources are driving the adoption of more advanced turbines in new naval projects. This growth is also supported by the ongoing collaborations with global defense companies for the development of next-generation naval gas turbines.

Australia dominates the Naval Gas Turbine market within the Indo-Pacific region, with key activities centered around cities like Canberra, Sydney, and Adelaide. Canberra, as the political capital, is at the heart of defense policymaking, with defense procurement decisions influencing the naval projects requiring advanced gas turbines. Sydney and Adelaide are home to major defense contractors, shipyards, and naval bases, where the development, manufacturing, and integration of gas turbines into naval platforms take place. Additionally, these cities are pivotal in fostering collaboration with international defense giants, such as Rolls-Royce and General Electric, which strengthen Australia’s naval propulsion capabilities. The country’s close cooperation with international defense partners and its focus on maintaining advanced naval technology ensure Australia’s dominance in the market.

Market Segmentation

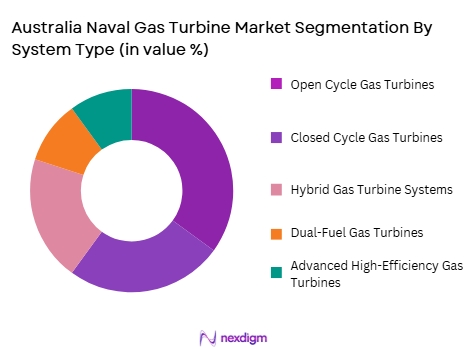

By System Type

The Australia Naval Gas Turbine market is segmented by system type into Open Cycle Gas Turbines, Closed Cycle Gas Turbines, Hybrid Gas Turbine Systems, Dual-Fuel Gas Turbines, and Advanced High-Efficiency Gas Turbines. Among these, Open Cycle Gas Turbines dominate the market. Open cycle systems are widely used in naval applications due to their ability to provide high power output, ease of maintenance, and quicker startup times, making them ideal for military vessels that require fast operational readiness. Additionally, they offer a favorable balance between performance and cost, making them the preferred choice for the Royal Australian Navy’s surface combatants and amphibious ships. While closed-cycle and hybrid systems are growing in demand for more fuel-efficient and environmentally friendly solutions, open cycle turbines continue to lead due to their established presence and operational flexibility in the Australian naval fleet.

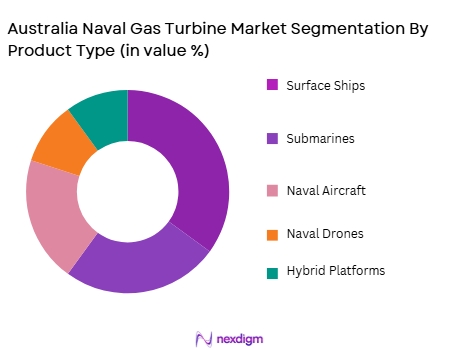

By Platform Type

The Australia Naval Gas Turbine market is also segmented by platform type into Surface Ships, Submarines, Naval Aircraft, Naval Drones, and Hybrid Platforms. Surface Ships lead the market, with gas turbines being the primary propulsion system for the majority of these vessels. The Australian Navy’s emphasis on enhancing the firepower and mobility of surface ships, such as frigates and destroyers, has driven the demand for high-performance gas turbines. These turbines provide the necessary speed, range, and power to support a variety of missions, from combat operations to humanitarian assistance. Furthermore, the need for fuel-efficient turbines that reduce operational costs while maintaining high performance is fostering growth in this segment. The Australian Navy’s future investments in advanced surface combatants ensure that surface ships remain the dominant platform type in the gas turbine market.

Competitive Landscape

The Australia Naval Gas Turbine market is competitive, with several major players dominating the industry. These include global turbine manufacturers like Rolls-Royce, General Electric, and MTU Friedrichshafen, along with local defense contractors that contribute to the development and integration of advanced turbines into the Australian Navy’s fleet. The dominance of these companies in the market is a result of their technological expertise, long-standing relationships with the Australian government, and continuous innovations in turbine efficiency and fuel management systems.

| Company Name | Establishment Year | Headquarters | Key Product Categories | Market Focus | R&D Investment | Government Contracts |

| Rolls-Royce Australia | 1904 | Sydney, Australia | ~ | ~ | ~ | ~ |

| General Electric Australia | 1892 | Sydney, Australia | ~ | ~ | ~ | ~ |

| MTU Friedrichshafen GmbH | 1909 | Friedrichshafen, Germany | ~ | ~ | ~ | ~ |

| Wärtsilä Australia | 1834 | Sydney, Australia | ~ | ~ | ~ | ~ |

| Siemens Australia | 1847 | Melbourne, Australia | ~ | ~ | ~ | ~ |

Australia Naval Gas Turbine Market Analysis

Growth Drivers:

Increasing Defense Budget and Naval Modernization

Australia’s growing defense budget has become a key growth driver for the naval gas turbine market. The Australian government has placed a strong emphasis on modernizing its naval fleet, particularly with the rising importance of maritime security in the Indo-Pacific region. The need for high-performance propulsion systems for new surface combatants, submarines, and auxiliary vessels has led to significant investments in advanced naval gas turbines. These turbines are essential for ensuring the operational efficiency, speed, and range of naval vessels, which are critical in maintaining a strategic advantage. The Australian Navy’s focus on fleet modernization and enhancing its defense capabilities is expected to drive the demand for cutting-edge propulsion systems over the coming years.

Technological Advancements in Gas Turbine Efficiency

Technological innovations in gas turbine technology are propelling the growth of the Australian naval gas turbine market. Advanced turbine designs that offer higher fuel efficiency, lower emissions, and improved reliability are becoming increasingly sought after. With the rise of energy-efficient systems and environmental concerns, there is growing demand for turbines that reduce operational costs while maintaining high power output. These advancements also enable naval vessels to operate at greater ranges and with increased reliability in adverse conditions, making them crucial for defense missions in remote and hostile environments. As Australia continues to focus on reducing operational costs while maximizing naval power, these advanced turbines will play an essential role in the country’s naval defense strategy.

Market Challenges:

High Integration and Maintenance Costs

One of the main challenges faced by the Australia Naval Gas Turbine market is the high cost of integrating and maintaining advanced turbine systems. The integration of gas turbines into existing naval platforms requires substantial investment in both the initial installation and subsequent upgrades to ensure compatibility with new technologies. Additionally, ongoing maintenance of these high-performance turbines is expensive, especially as turbines become more complex and require specialized service for optimal performance. These costs can place a significant burden on the defense budget, which is already stretched to accommodate a range of other defense priorities. As a result, managing these costs while ensuring the continued operational readiness of the fleet remains a significant challenge for the Australian government.

Dependency on International Suppliers for Advanced Turbine Technologies

Despite significant advancements in local defense technology, Australia still relies heavily on international suppliers for the procurement of advanced gas turbines. This dependence on foreign manufacturers such as Rolls-Royce and General Electric exposes Australia to risks related to supply chain disruptions, geopolitical tensions, and potential delays in production or delivery. Additionally, reliance on foreign technologies may lead to concerns about technology transfer and security risks, particularly when sensitive defense technologies are involved. While efforts are underway to build local capabilities, the ongoing reliance on international suppliers poses a challenge to achieving full self-sufficiency in the naval gas turbine market.

Opportunities:

Export Opportunities for Advanced Gas Turbines

Australia has significant opportunities to expand its presence in the global naval gas turbine market by exporting advanced propulsion systems to allied countries. With the growing demand for state-of-the-art naval propulsion systems in the Indo-Pacific region and other global markets, Australian defense manufacturers have the potential to leverage their technological expertise to secure export contracts. This opportunity is especially relevant as neighboring countries in the Indo-Pacific, including Japan, South Korea, and India, continue to modernize their naval fleets. By capitalizing on these opportunities, Australia can not only boost its defense sector but also enhance its strategic alliances with key global partners, fostering regional stability and security.

Collaboration with Global Defense Contractors for Technological Innovation

Another significant opportunity lies in forming strategic collaborations with global defense contractors for the development of next-generation gas turbines. Partnerships with companies like Rolls-Royce, Siemens, and MTU Friedrichshafen can provide Australia with access to cutting-edge technologies, advanced materials, and the latest developments in turbine efficiency. Such collaborations would enable Australian defense manufacturers to integrate advanced features such as hybrid propulsion, fuel efficiency optimization, and autonomous turbine systems into their naval vessels. These innovations would not only strengthen Australia’s naval capabilities but also position the country as a leader in developing sustainable and high-performance naval propulsion systems, enhancing its global defense standing.

Future Outlook

Over the next decade, the Australia Naval Gas Turbine market is expected to show strong growth, driven by continued advancements in turbine efficiency, the increasing need for power-efficient propulsion systems, and the Australian Navy’s modernization efforts. The market will benefit from rising defense budgets aimed at upgrading the fleet, alongside a focus on sustainable and environmentally friendly propulsion technologies. The growing adoption of hybrid and fuel-efficient gas turbines will play a significant role in shaping the future of naval propulsion in Australia, making it one of the key segments for innovation in the coming years.

Major Players

- Rolls-Royce Australia

- General Electric Australia

- MTU Friedrichshafen GmbH

- Wärtsilä Australia

- Siemens Australia

- Mitsubishi Heavy Industries

- Pratt & Whitney Australia

- MAN Energy Solutions

- Northrop Grumman Australia

- Thales Australia

- Babcock International Group

- L3 Technologies Australia

- Boeing Australia

- Naval Group Australia

- Lockheed Martin Australia

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Royal Australian Navy

- Naval Defense Contractors

- Marine Propulsion Technology Manufacturers

- Private Sector Defense Technology Companies

- International Defense Forces

- Defense Procurement Agencies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the primary factors that influence the Australia Naval Gas Turbine market. These include naval procurement trends, technological developments in turbines, and regional defense strategies. Secondary research sources like defense industry reports, government publications, and expert consultations are used to gather relevant data.

Step 2: Market Analysis and Construction

In this phase, historical data on naval turbine installations, procurement patterns, and industry investments are analyzed. Market segments, such as system types and platform types, are evaluated to determine their contribution to the overall market. This phase helps identify emerging trends and potential growth areas.

Step 3: Hypothesis Validation and Expert Consultation

The developed hypotheses regarding the growth, challenges, and trends are validated through consultations with industry experts, manufacturers, and government officials. These interviews provide insights into market conditions and help refine projections and forecasts.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from secondary and primary research to provide a comprehensive market analysis. Expert feedback is used to ensure the accuracy and reliability of the final report, which is presented with detailed market insights, forecasts, and recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- By System Type (In Value%)

Open Cycle Gas Turbines

Closed Cycle Gas Turbines

Hybrid Gas Turbine Systems

Dual-Fuel Gas Turbines

Advanced High-Efficiency Gas Turbines - By Platform Type (In Value%)

Surface Ships

Submarines

Naval Aircraft

Naval Drones

Hybrid Platforms - By Fitment Type (In Value%)

New Installations

Upgrades

Retrofits

Modular Systems

Custom Integrations - By EndUser Segment (In Value%)

Royal Australian Navy

Defense Contractors

Government Agencies

Private Sector / Civilian Applications

International Defense Forces - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Resellers

Online Platforms

Government Tenders

OEMs

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Open Cycle Gas Turbines

Closed Cycle Gas Turbines

Hybrid Gas Turbine Systems

Dual-Fuel Gas Turbines

Advanced High-Efficiency Gas Turbines - By Platform Type (In Value%)

Surface Ships

Submarines

Naval Aircraft

Naval Drones

Hybrid Platforms - By Fitment Type (In Value%)

New Installations

Upgrades

Retrofits

Modular Systems

Custom Integrations - By EndUser Segment (In Value%)

Royal Australian Navy

Defense Contractors

Government Agencies

Private Sector / Civilian Applications

International Defense Forces - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Resellers

Online Platforms

Government Tenders

OEMs

- Cross Comparison Parameters (Technology innovation, Market penetration rate, Cost of maintenance, Supplier diversification, Operational efficiency)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Rolls-Royce Australia

General Electric Australia

MTU Friedrichshafen GmbH

Wärtsilä Australia

Siemens Australia

Pratt & Whitney Australia

SAAB Australia

Babcock International Group

Kongsberg Gruppen

Navantia Australia

Lockheed Martin Australia

Thales Australia

L3 Technologies Australia

Boeing Australia

Rheinmetall Defence Australia

- Royal Australian Navy’s focus on modernizing naval fleet propulsion

- Government agencies’ emphasis on cost-effective defense technology

- Private sector investment in energy-efficient and high-performance turbines

- International collaborations with allied defense forces for turbine integration

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035