Market Overview

The Australian Naval Intelligence, Surveillance, and Reconnaissance (ISR) market is valued at approximately USD ~ billion in 2024, driven by the country’s growing defense budget and strategic focus on enhancing its maritime security capabilities. The Australian government’s commitment to modernizing its naval fleet, combined with increasing geopolitical tensions in the Indo-Pacific region, has resulted in a surge in demand for advanced ISR technologies. These systems are crucial for monitoring maritime activities, gathering real-time intelligence, and supporting national security efforts. Moreover, Australia’s collaboration with global defense contractors and its emphasis on developing autonomous and unmanned ISR platforms further fuels market growth. As a result, the market continues to expand as Australia invests in cutting-edge ISR systems to maintain its naval dominance and counter regional threats.

Australia is the dominant player in the naval ISR market within the Indo-Pacific region, with key activities concentrated in cities such as Canberra, Sydney, and Adelaide. Canberra, as the nation’s political capital, is home to defense policy decision-making and procurement processes, which drive the adoption of advanced ISR systems. Sydney and Adelaide house major defense contractors, naval bases, and shipyards, serving as the backbone of Australia’s naval defense infrastructure. These cities benefit from a combination of strategic geographical location, robust defense initiatives, and partnerships with international defense organizations, ensuring their dominance in shaping the naval ISR market. Australia’s position as a leader in maritime defense in the Indo-Pacific is reinforced by its technological capabilities and defense collaborations with global partners.

Market Segmentation

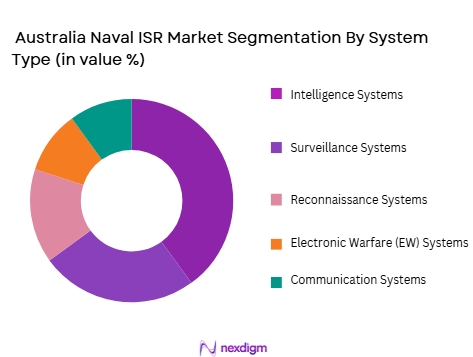

By System Type

The Australia Naval ISR market is segmented by system type into Intelligence Systems, Surveillance Systems, Reconnaissance Systems, Electronic Warfare (EW) Systems, and Communication Systems. Among these, Intelligence Systems are the dominant segment, driven by the growing need for real-time data processing and situational awareness in naval operations. Intelligence systems integrate a wide range of technologies, including radar, sonar, and data analytics, to gather critical information on maritime threats and environmental conditions. The Royal Australian Navy (RAN) has heavily invested in these systems to enhance its operational effectiveness, enabling it to monitor vast oceanic areas and respond to potential threats swiftly. As ISR systems become more sophisticated, the demand for comprehensive intelligence capabilities will continue to drive market growth, as these systems are essential for national security and defense operations.

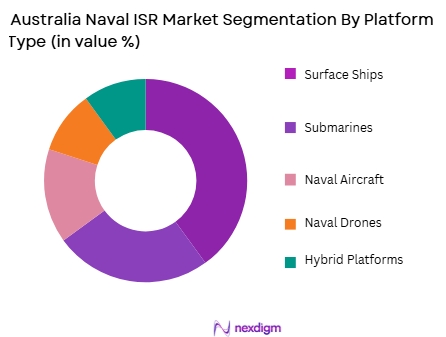

By Platform Type

The Australia Naval ISR market is also segmented by platform type into Surface Ships, Submarines, Naval Aircraft, Naval Drones, and Hybrid Platforms. Surface Ships hold the dominant share due to their versatility and the large number of ISR systems integrated into these platforms. These ships, including frigates, destroyers, and amphibious assault vessels, are equipped with radar, sonar, and surveillance systems that enable real-time information gathering over vast maritime areas. The Royal Australian Navy uses surface ships extensively for ISR operations, particularly in the Indo-Pacific region where the geopolitical landscape demands enhanced maritime surveillance. The ability to deploy these advanced systems across various surface vessels ensures that surface ships remain the key platform for ISR, continuing to dominate the market.

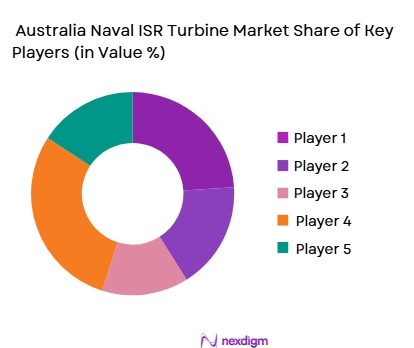

Competitive Landscape

The Australia Naval ISR market is dominated by a few major players, including global defense contractors such as Thales, Lockheed Martin, BAE Systems, and Saab Australia. These companies are at the forefront of providing cutting-edge ISR systems, leveraging their technological capabilities and strong ties with the Australian Department of Defence (DoD). The consolidation of these key players highlights their significant influence on the market, with each company offering comprehensive ISR solutions that span across intelligence gathering, surveillance, reconnaissance, and electronic warfare. Furthermore, the growing focus on unmanned and autonomous ISR platforms presents opportunities for these companies to expand their product offerings and collaborate with the Australian government on future defense projects.

| Company Name | Establishment Year | Headquarters | Key Product Categories | Market Focus | R&D Investment | Government Contracts |

| Thales Australia | 2000 | Sydney, Australia | ~ | ~ | ~ | ~ |

| Lockheed Martin Australia | 1994 | Sydney, Australia | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1951 | Adelaide, Australia | ~ | ~ | ~ | ~ |

| Saab Australia | 1987 | Adelaide, Australia | ~ | ~ | ~ | ~ |

| L3 Technologies Australia | 2002 | Melbourne, Australia | ~ | ~ | ~ | ~ |

Australia Naval ISR Market Analysis

Growth Drivers:

Increasing Geopolitical Tensions and Maritime Security Needs

One of the key drivers for the Australia Naval ISR market is the increasing geopolitical tensions in the Indo-Pacific region. With the growing assertiveness of neighboring countries, particularly in the South China Sea, Australia’s maritime security concerns have intensified. The Australian government has prioritized strengthening its defense capabilities, particularly naval forces, to safeguard its maritime borders and ensure the security of vital trade routes. As a result, the demand for advanced Intelligence, Surveillance, and Reconnaissance (ISR) systems has surged. These systems are vital for enhancing situational awareness, detecting threats in real-time, and ensuring that Australia’s naval assets can operate effectively and efficiently in increasingly contested waters. The Australian Navy’s focus on modernizing its fleet with advanced ISR capabilities is expected to continue driving the market for ISR solutions.

Technological Advancements in ISR Systems

Technological innovation is a significant growth driver in the Australia Naval ISR market. The continuous advancement in ISR technologies, particularly the integration of Artificial Intelligence (AI) and machine learning (ML), has dramatically enhanced the capabilities of these systems. AI-powered ISR systems can now process and analyze vast amounts of data in real-time, providing actionable intelligence and faster decision-making capabilities. Furthermore, the growing reliance on unmanned aerial systems (UAS) and autonomous sensors is also revolutionizing how ISR operations are conducted. These advancements allow the Australian Navy to operate with greater efficiency and precision, giving Australia a technological edge in maintaining national security. With technological progress driving down the cost of these systems and increasing their reliability, demand for these advanced solutions continues to rise.

Market Challenges:

High Cost of ISR Systems and Integration

A significant challenge facing the Australia Naval ISR market is the high cost associated with procuring and integrating advanced ISR systems. These systems require significant investments in hardware, software, and specialized infrastructure, making them costly to deploy. The integration of ISR technologies into existing naval platforms often involves complex engineering and requires substantial time and resources. Furthermore, the ongoing maintenance, upgrades, and training required for personnel to effectively use these systems add to the overall cost burden. As a result, the cost of adoption becomes a major consideration for the Australian government, particularly when balancing other defense priorities. Managing these costs without compromising operational effectiveness poses a challenge for defense planners, especially in a climate of tightening defense budgets.

Interoperability Issues with Legacy Systems

Another key challenge in the Australian Naval ISR market is ensuring the interoperability of new ISR systems with legacy platforms. Many of the existing naval assets, including surface ships and submarines, were not initially designed to accommodate the advanced ISR systems available today. As Australia modernizes its fleet and integrates new ISR technologies, it faces challenges in ensuring these systems can work seamlessly with older platforms. Achieving this interoperability is essential for maintaining operational efficiency, as the Australian Navy requires its vessels and aircraft to function as a cohesive unit across all domains. Without full integration, there is the risk of system failures, which could undermine mission success and delay operational readiness.

Opportunities:

Export Opportunities for Advanced ISR Systems

Australia has significant potential to become a key exporter of naval ISR technologies. As many countries in the Indo-Pacific and other regions look to modernize their naval forces, there is a growing demand for advanced ISR systems. Australia’s expertise in developing cutting-edge ISR technologies, combined with its strong defense industry, positions it well to capitalize on this opportunity. By exporting ISR systems to allied nations, Australia can not only strengthen its economic standing but also enhance its strategic alliances. Countries seeking to upgrade their maritime defense capabilities, especially those in the Indo-Pacific region, will find Australia’s advanced ISR solutions attractive, further boosting the growth of this market.

Collaboration with Global Defense Contractors for Technological Advancements

Another significant opportunity in the Australia Naval ISR market is the potential for increased collaboration with global defense contractors. Partnerships with leading international companies such as Lockheed Martin, Thales, and Saab offer Australia the opportunity to access the latest technologies in ISR systems, including advancements in AI, machine learning, and unmanned platforms. These collaborations can lead to the co-development of next-generation ISR systems tailored specifically to Australian naval requirements. By working closely with global partners, Australia can accelerate the adoption of innovative ISR solutions, enhancing the capabilities of its naval fleet while also contributing to the development of the global defense technology landscape.

Future Outlook

Over the next decade, the Australian Naval ISR market is expected to experience significant growth driven by ongoing defense investments, advancements in ISR technology, and increasing security concerns in the Indo-Pacific region. The Australian government’s focus on modernizing its defense infrastructure and the growing demand for autonomous and unmanned systems will further fuel the market’s expansion. Technological advancements such as the integration of Artificial Intelligence (AI) and machine learning in ISR systems will enhance real-time data processing and decision-making, positioning Australia as a key player in the global naval ISR market. As the Royal Australian Navy continues to upgrade its fleet and incorporate next-generation ISR capabilities, the market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% from 2026 to 2035.

Major Players

- Thales Australia

- Lockheed Martin Australia

- BAE Systems Australia

- Saab Australia

- L3 Technologies Australia

- Raytheon Australia

- General Dynamics

- Northrop Grumman Australia

- Boeing Australia

- Kongsberg Gruppen

- Israel Aerospace Industries

- Elbit Systems

- Leonardo S.p.A

- Harris Corporation Australia

- Mitsubishi Heavy Industries

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Defense Contractors

- Naval Technology Manufacturers

- International Defense Forces

- Private Sector Defense Technology Companies

- Maritime Security Agencies

- Defense Procurement Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key factors affecting the Australia Naval ISR market, such as technological advancements, defense spending trends, and geopolitical factors in the Indo-Pacific region. Extensive desk research is conducted using secondary data from industry reports, government publications, and expert opinions.

Step 2: Market Analysis and Construction

This phase compiles historical data on the market, including the deployment of ISR systems, procurement patterns, and the adoption of new technologies. Market segmentation is analyzed based on system types and platforms to understand the factors driving demand.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested and refined through consultations with industry experts, including representatives from defense contractors, government officials, and technology providers. These consultations provide valuable insights into current trends and future market developments.

Step 4: Research Synthesis and Final Output

The final phase synthesizes findings from secondary and primary research to produce a comprehensive market analysis. Expert feedback is incorporated to validate the data, ensuring a robust and accurate assessment of the Australia Naval ISR market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for enhanced surveillance capabilities in the Indo-Pacific

Technological advancements in ISR systems and integration with AI

Growing defense budget and modernization of the Royal Australian Navy (RAN) - Market Challenges

High costs of advanced ISR systems and integration into existing platforms

Complexity in ensuring interoperability between new and legacy systems

Limited domestic production capabilities for advanced ISR technology - Market Opportunities

Export potential for Australian-developed ISR systems to allied nations

Collaboration with global defense contractors to enhance ISR capabilities

Rising demand for autonomous and unmanned systems in naval operations - Trends

Integration of Artificial Intelligence (AI) into ISR systems for automated data analysis

Advancement of hybrid systems that combine manned and unmanned platforms

Increased focus on cybersecurity for ISR platforms - Government regulations

Australian Defence Export Control Regime

National Defence Strategy and Procurement Guidelines

Royal Australian Navy Security and Certification Standards - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Intelligence, Surveillance, and Reconnaissance (ISR) Systems

Electronic Warfare (EW) Systems

Radar and Sonar Systems

Communication Systems

Data Processing and Analysis Systems - By Platform Type (In Value%)

Surface Ships

Submarines

Naval Aircraft

Naval Drones

Hybrid Platforms - By Fitment Type (In Value%)

New Installations

Upgrades

Retrofits

Modular Systems

Custom Integrations - By EndUser Segment (In Value%)

Royal Australian Navy (RAN)

Defense Contractors

Government Agencies

Private Sector / Civilian Applications

International Defense Forces - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Resellers

Online Platforms

Government Tenders

OEMs

- Cross Comparison Parameters (Technology integration, interoperability with legacy systems, cost of implementation, supplier capabilities, defense alliances)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Thales Australia

BAE Systems Australia

Lockheed Martin Australia

Raytheon Australia

General Dynamics

Rheinmetall Defence Australia

Saab Australia

Northrop Grumman Australia

L3 Technologies Australia

Navantia Australia

Kongsberg Gruppen

Leonardo Australia

Harris Corporation Australia

Israel Aerospace Industries

Leonardo S.p.A

- The Royal Australian Navy’s increasing focus on maritime security and defense technology

- Defense contractors’ investment in research and development of naval ISR solutions

- Government agencies’ role in setting procurement policies for ISR technologies

- International collaborations with defense forces to enhance ISR capabilities

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035