Market Overview

The Australia Naval Missiles and Missile Launch Systems market is valued at USD ~ billion in 2024, driven by increasing regional security concerns, defense modernization efforts, and Australia’s strategic position in the Indo-Pacific region. The Australian Government continues to invest heavily in defense, enhancing its naval capabilities with state-of-the-art missile systems and launch platforms. The need for advanced naval defense systems, along with advancements in missile technology, plays a crucial role in shaping the market. Australia’s increasing defense budget, as part of its military expansion and modernization initiatives, is expected to drive the growth of the naval missile market, especially in the development of hypersonic and anti-ship missile technologies

Australia, with its robust defense industry, remains a dominant player in the market due to its strategic geographical position in the Indo-Pacific region. Additionally, countries like the United States, the United Kingdom, and France significantly influence the global market, with their strong naval forces and technological advancements in missile defense. Australia’s naval base cities like Sydney and Adelaide, which house leading defense contractors such as ASC Shipbuilding and BAE Systems, are central to the market’s development. The collaboration between local and international defense entities helps maintain Australia’s leading position in naval missile technologies, ensuring a steady demand for advanced systems.

Market Segmentation

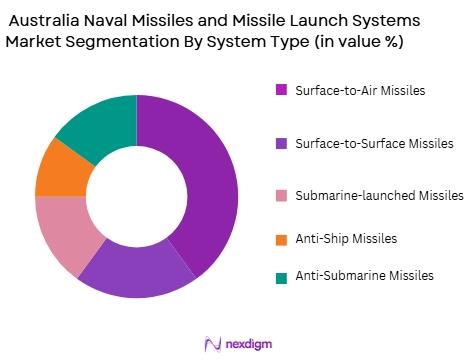

By System Type

The market for naval missiles and missile launch systems is primarily segmented into surface-to-air missiles, surface-to-surface missiles, submarine-launched missiles, anti-ship missiles, and anti-submarine missiles. In 2024, the surface-to-air missile segment dominates the market due to its crucial role in air defense for naval vessels. As air threats become increasingly sophisticated, especially from advanced aircraft and unmanned aerial systems (UAS), the demand for effective surface-to-air missile systems has grown. Australia’s naval defense strategy emphasizes multi-layered defense mechanisms, including integrated air defense systems, which contribute significantly to the dominance of surface-to-air missiles in this segment. This segment is supported by global advancements in missile technology, with countries investing in modern, high-precision systems.

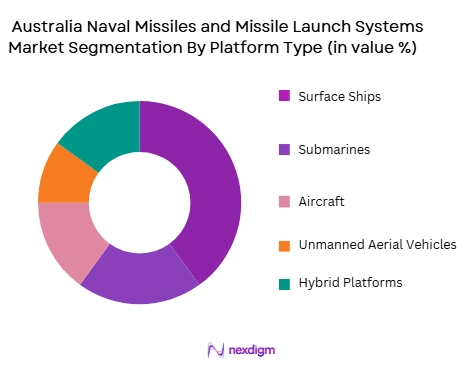

By Platform Type

The Australia Naval Missiles and Missile Launch Systems market is also segmented by platform type, including surface ships, submarines, aircraft, unmanned aerial vehicles (UAVs), and hybrid platforms. The surface ships segment holds the dominant market share due to the robust development of naval platforms that integrate advanced missile launch systems for multi-role capabilities. These platforms, such as the Anzac-class frigates and Hobart-class destroyers, are central to Australia’s naval defense strategy. They provide the necessary operational flexibility for deploying various missile systems, including anti-ship and surface-to-air missiles, thus reinforcing the dominance of surface ships in this segment. The evolution of surface vessels into multi-role platforms further enhances their position in the market.

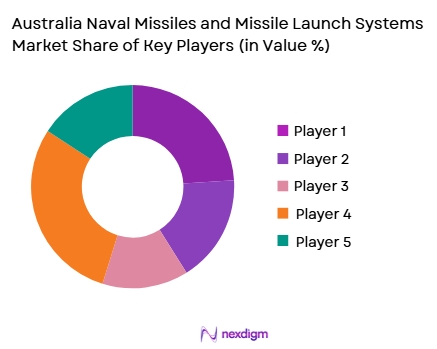

Competitive Landscape

The Australia Naval Missiles and Missile Launch Systems market is highly competitive, with major players including global defense contractors and Australian-based manufacturers. Companies like Lockheed Martin, Raytheon Technologies, BAE Systems, and Thales Group dominate the landscape, offering cutting-edge missile systems and launch platforms. These companies leverage their extensive research and development (R&D) capabilities to provide integrated defense solutions that meet the evolving needs of modern naval forces. In Australia, local defense contractors, such as ASC Shipbuilding and Saab Australia, also play a critical role in the production and integration of missile systems, contributing to the overall competitiveness of the market.

The presence of both international defense giants and local manufacturers highlights the strong collaboration and technology transfer within the industry. This collaboration ensures that Australia’s naval forces have access to the latest missile technologies, maintaining their operational superiority in the Indo-Pacific region. The market is driven by ongoing defense contracts and partnerships with allied nations, strengthening the global competitiveness of Australia’s naval missile capabilities.

Competitive Landscape Table

| Company | Establishment Year | Headquarters | Product Portfolio | R&D Investment | Global Presence | Government Collaborations | Defense Contracts |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1989 | Adelaide, Australia | ~ | ~ | ~ | ~ | ~ |

Australia Naval Missiles and Missile Launch Systems Market Analysis

Growth Drivers

Increased Regional Defense Tensions and Strategic Importance

The growing defense tensions in the Indo-Pacific region are one of the major growth drivers for the Australia Naval Missiles and Missile Launch Systems market. Australia’s strategic position in this region places it at the forefront of global security dynamics. As countries in the region, particularly China, continue to increase their naval presence, Australia is compelled to enhance its defense capabilities to maintain regional stability. The need for advanced naval defense systems, including missile technologies, has been accelerated by rising concerns over territorial disputes and maritime security. As a result, Australia’s military modernization programs, including the acquisition and development of advanced missile launch systems, have gained momentum. These defense enhancements are aimed at strengthening Australia’s deterrence capabilities, ensuring protection against evolving threats, and maintaining its influence in the region. This strategic need for robust defense systems is fueling investments in the naval missile sector, driving market growth in the coming years. Consequently, Australia is expected to continue expanding its defense budgets, which directly supports the demand for advanced missile technologies and launch platforms, making regional tensions a critical factor in market expansion.

Advancements in Missile Technology and Modernization Programs

Advancements in missile technologies, particularly in areas such as hypersonic missiles, anti-ship missiles, and multi-role platforms, are driving the growth of the Australia Naval Missiles and Missile Launch Systems market. The modernization of Australia’s defense forces, including its naval fleet, focuses heavily on integrating cutting-edge missile technologies to improve operational effectiveness and threat deterrence. The Australian Government’s investment in missile defense systems is aimed at achieving greater precision, extended range, and enhanced maneuverability. The development of hypersonic missile systems, which travel at speeds greater than Mach 5, has become a key area of focus. These systems promise to revolutionize naval combat capabilities, giving Australia’s naval forces an advanced edge in deterrence and offensive operations. Furthermore, the increasing need for integrated, multi-layered defense systems that combine anti-air, anti-ship, and surface-to-surface missile capabilities has spurred the demand for advanced launch systems. Such advancements in missile technology and the ongoing focus on military modernization ensure sustained growth in the naval missile and missile launch systems market in Australia.

Market Challenges

High Costs of Advanced Missile Systems

A significant challenge in the Australia Naval Missiles and Missile Launch Systems market is the high cost of acquiring and maintaining advanced missile systems. The integration of cutting-edge technologies such as hypersonic missiles, anti-ship systems, and advanced missile launch platforms requires substantial financial investment. These systems are not only expensive to develop but also to sustain over their lifecycle. Maintenance costs, system upgrades, and the integration of newer technologies to counter evolving threats increase the overall expenditure. For Australia, which is continuously modernizing its defense infrastructure, balancing defense spending with the need to remain technologically competitive becomes a critical challenge. Furthermore, the procurement of missile systems often involves long-term contracts and financing arrangements, which can stretch defense budgets and create operational constraints. High capital costs also pose barriers for smaller nations seeking similar capabilities, making the Australian market reliant on strategic defense partnerships to offset the financial burden.

Integration and Interoperability Issues

The integration and interoperability of diverse missile systems with existing naval platforms is another significant challenge faced by the Australian defense sector. Australia’s naval fleet incorporates a range of advanced missile launch systems, and ensuring that these systems can work seamlessly with each other, as well as with allied forces’ technologies, remains a complex task. Different missile types and launch systems often require unique configurations, making system integration both costly and time-consuming. Moreover, the interoperability between older systems and newly developed missile technologies must be carefully managed to avoid operational inefficiencies. As missile systems evolve with new technological advancements, Australia must continuously upgrade and integrate these systems into its naval platforms, while ensuring compatibility with international defense systems in joint operations. The complexity of maintaining this level of interoperability across platforms such as surface ships, submarines, and aircraft increases the risk of system malfunctions and delays in deployment, posing operational challenges that could impact mission success.

Opportunities

Development of Hypersonic Missile Systems

One of the most promising opportunities in the Australia Naval Missiles and Missile Launch Systems market is the development and deployment of hypersonic missile systems. Hypersonic missiles, capable of traveling at speeds exceeding Mach 5, represent the future of naval defense. These systems are designed to defeat traditional missile defense systems due to their high speed, maneuverability, and ability to operate at low altitudes. Australia’s investment in hypersonic missile technology has been accelerating, with research and development programs underway to enhance these capabilities. The Australian government has recognized the potential of hypersonic missiles to provide a strategic advantage in the Indo-Pacific region, where high-speed threats could neutralize enemy defenses before they even have a chance to respond. The development of these advanced systems opens new markets for defense contractors, both domestically and internationally, as Australia aims to maintain its competitive edge in global naval defense. Additionally, the global push for hypersonic capabilities creates collaboration opportunities with international defense partners, further driving innovation and market expansion.

Expansion of Defense Exports and International Partnerships

Australia’s strong defense capabilities, particularly in naval missile systems, present significant opportunities for expanding defense exports and establishing international partnerships. As the demand for advanced missile technologies grows globally, Australia can leverage its established reputation in the defense sector to export cutting-edge missile systems and missile launch platforms to allied nations. Countries in the Indo-Pacific, Middle East, and Europe are increasingly investing in advanced naval missile systems for maritime defense, presenting opportunities for Australia to expand its defense technology exports. Furthermore, Australia’s strategic defense relationships with countries such as the United States, the United Kingdom, and Japan open avenues for joint ventures, technology sharing, and co-development of advanced defense systems. These international collaborations can drive technological advancements and create new revenue streams for Australian defense contractors. With its expertise in naval missile technologies and increasing demand for missile systems worldwide, Australia is well-positioned to capitalize on the expanding global market for advanced defense solutions.

Future Outlook

Over the next decade, the Australia Naval Missiles and Missile Launch Systems market is expected to experience steady growth, fueled by the country’s expanding defense budget, technological advancements in missile systems, and the increasing importance of naval power in the Indo-Pacific region. Australia’s ongoing military modernization programs, including the development of hypersonic missile capabilities and advanced multi-role platforms, are expected to drive demand for innovative missile systems. Additionally, rising tensions in the region and the need for a robust deterrence strategy will further propel investment in cutting-edge naval defense technologies. The market is also poised for growth as Australia enhances its collaboration with international partners and allies, reinforcing its defense capabilities and technological expertise.

Major Players

- Lockheed Martin

- Raytheon Technologies

- BAE Systems

- Thales Group

- Saab Australia

- Northrop Grumman

- General Dynamics Mission Systems

- Leonardo

- L3 Technologies

- Rafael Advanced Defense Systems

- Elbit Systems

- Boeing Defense, Space & Security

- Navantia

- Huntington Ingalls Industries

- Israel Aerospace Industries

Key Target Audience

- Australian Department of Defence

- Royal Australian Navy

- International Naval Forces

- Defense Contractors

- Government Agencies

- Military Technology Providers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying key market variables and building an ecosystem map for the Australia Naval Missiles and Missile Launch Systems market. This includes gathering data on market drivers, challenges, and the various missile and launch systems within the naval defense sector.

Step 2: Market Analysis and Construction

This phase focuses on gathering historical market data, including past growth rates, market penetration of missile systems, and relevant defense expenditure data. These findings will form the foundation for estimating future market trends and developments.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, expert interviews will be conducted with industry leaders, defense analysts, and military professionals. These interviews will provide valuable insights into operational dynamics, upcoming technology trends, and defense procurement practices.

Step 4: Research Synthesis and Final Output

The final stage synthesizes data from primary and secondary sources, ensuring comprehensive coverage of market trends, forecasts, and key findings. This step includes consulting with key manufacturers and defense contractors to refine the analysis, ensuring that the final report is comprehensive and accurate.

- Executive Summary

- Research Methodology (Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing regional defense tensions in the Indo-Pacific

Australia’s expanding defense budget and military modernization

Technological advancements in missile defense systems - Market Challenges

High cost of advanced missile systems and launch platforms

Complexity of integration and interoperability with existing naval systems

Vulnerabilities to cyber threats targeting missile defense systems - Market Opportunities

Development of hypersonic missile systems for naval platforms

Growing demand for autonomous missile launch systems

Expansion of missile defense exports to allied countries - Trends

Integration of AI and machine learning in missile guidance systems

Rise in unmanned systems for missile launches

Growing focus on multi-role naval platforms with advanced missile capabilities - Government regulations

Export control laws for missile systems

Naval defense procurement regulations

International treaties on arms control and missile development - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Surface-to-Air Missiles

Surface-to-Surface Missiles

Submarine-launched Missiles

Anti-Ship Missiles

Anti-Submarine Missiles - By Platform Type (In Value%)

Surface Ships

Submarines

Aircraft

Unmanned Aerial Vehicles (UAVs)

Hybrid Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Modular Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Australian Navy

International Naval Forces

Private Defense Contractors

Defense Research Institutions

Government Defense Agencies - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Government Contracts

Private Sector Contracts

Online Platforms

- Cross Comparison Parameters (Price, Technology Adoption, System Integration, After-sales Service, Regulatory Compliance, Technology Integration, Cost Efficiency, System Reliability, Deployment Speed, Customization Options, Maintenance Support, Geopolitical Impact, International Collaboration, Innovation in Defense Systems, System Scalability)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Australia Aerospace Industries

Rafael Advanced Defense Systems

Lockheed Martin

Thales Group

Boeing Defense, Space & Security

Navantia

Northrop Grumman

BAE Systems

Raytheon Technologies

General Dynamics Mission Systems

Saab AB

L3 Technologies

Huntington Ingalls Industries

Elbit Systems

Leonardo

- Australia’s strategic military alliances influencing demand

- Need for advanced missile defense systems in regional naval forces

- Emerging private sector involvement in missile system production

- Increased collaboration with international defense contractors

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035