Market Overview

The Australia Naval Navigation and Communication Systems market is valued at approximately USD ~ billion in 2024, with consistent growth fueled by the country’s increasing defense budget and modernization of its naval fleet. Australia’s strategic focus on improving its naval capabilities, particularly with advanced navigation and communication systems, has been pivotal in driving market expansion. The country’s naval forces continue to invest in integrating sophisticated radar systems, satellite communication technologies, and real-time data analytics to enhance operational efficiency and security. Additionally, Australia’s geographical position in the Indo-Pacific and its role as a regional security leader necessitate robust naval communication and navigation systems. With increasing regional maritime activities and emerging security threats, demand for advanced, secure, and efficient communication solutions for naval platforms continues to rise.

Australia is a dominant player in the naval navigation and communication systems market due to its strong defense infrastructure and strategic maritime position in the Indo-Pacific region. Cities like Canberra, Sydney, and Adelaide are key hubs, housing major defense contractors and government agencies that contribute to the development and integration of naval communication and navigation technologies. Australia’s collaboration with key defense allies, including the United States and the United Kingdom, further strengthens its market position, allowing the country to benefit from advanced technologies and integrated defense solutions. Furthermore, international naval operations and the increasing need for secure maritime communication systems in the region amplify Australia’s role as a leader in naval defense systems.

Market Segmentation

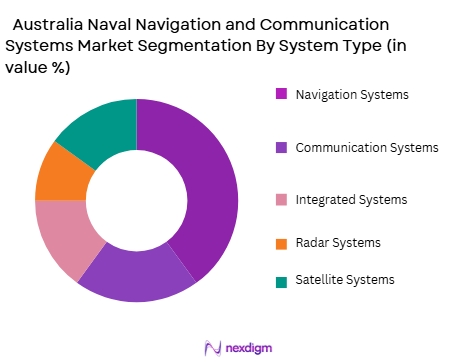

By System Type

The market is segmented by system type into navigation systems, communication systems, integrated systems, radar systems, and satellite systems. Among these, navigation systems dominate the market share. The critical need for precise, real-time navigation systems in naval vessels has made this segment essential. As Australia enhances its naval defense capabilities, investing in advanced GPS and inertial navigation systems is a priority. These systems ensure the accurate positioning of naval vessels during operations, even in remote maritime regions. The demand for cutting-edge, high-precision navigation systems is also driven by the country’s interest in expanding its operational reach in the Indo-Pacific. Moreover, advancements in system integration, which combine navigation with communication and radar systems, contribute to the increasing demand for navigation technologies.

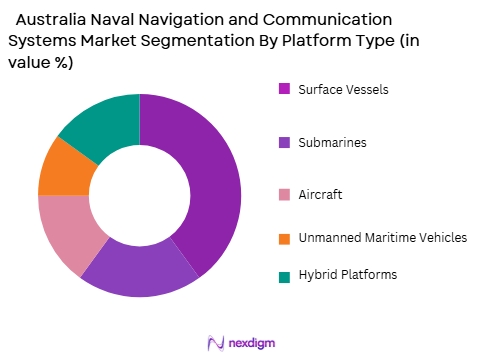

By Platform Type

The market is segmented by platform type, which includes surface vessels, submarines, aircraft, unmanned maritime vehicles (UMVs), and hybrid platforms. The surface vessels segment holds the largest market share, driven by Australia’s emphasis on strengthening its surface naval fleet. Vessels like the Hobart-class destroyers and the Anzac-class frigates are equipped with the latest navigation and communication systems, enabling advanced operations in challenging maritime environments. Surface vessels form the backbone of Australia’s naval strategy and require high-end systems to communicate effectively, maintain situational awareness, and ensure mission success. Additionally, as global threats evolve, these vessels continue to be prioritized for upgrades, driving the dominance of this segment in the market.

Competitive Landscape

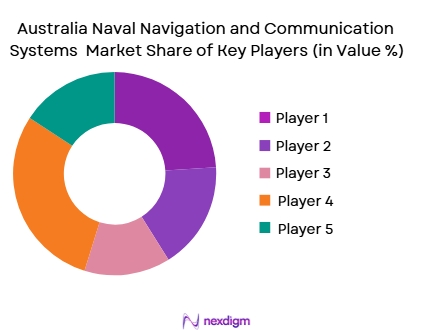

The Australia Naval Navigation and Communication Systems market is characterized by the presence of both local and international defense technology companies. Major players include Thales Group, Lockheed Martin, BAE Systems, and Saab Australia. These companies provide advanced navigation, radar, and communication systems tailored to meet the specific needs of Australia’s naval forces. Thales Group, for instance, is a key supplier of radar and communications systems, while Lockheed Martin leads in integrated communication technologies. The market also benefits from strong collaboration with global defense contractors, ensuring the continuous development of state-of-the-art systems. This competitive landscape highlights the critical role that both established global defense firms and regional technology providers play in shaping the future of Australia’s naval communication and navigation capabilities.

Competitive Landscape Table

| Company | Establishment Year | Headquarters | Product Portfolio | Technology Integration | R&D Investment | Government Collaborations | Defense Contracts |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1989 | Adelaide, Australia | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

Australia Naval Navigation and Communication Systems Market Analysis

Growth Drivers

Advancements in Communication Technologies

The Australian Naval Navigation and Communication Systems market is significantly driven by advancements in communication technologies. As modern naval warfare becomes more complex, the demand for secure, real-time communication systems has surged. Australia’s investment in satellite communication, data transmission, and integrated systems has been a major factor in enhancing its naval capabilities. The adoption of high-frequency communication systems, combined with advanced encryption protocols, has become crucial in ensuring that Australia’s naval vessels maintain secure and uninterrupted communication during both peacetime and combat operations. The increasing focus on enhancing the reliability of communication systems in the face of evolving cyber threats has driven further technological innovations. Additionally, the push for more resilient communication infrastructure has led to the integration of satellite systems and advanced radar solutions into naval platforms. These improvements allow for better coordination, faster decision-making, and enhanced situational awareness, all critical in maintaining maritime security. As Australia strengthens its naval presence in the Indo-Pacific region, these technological advancements in navigation and communication systems play a pivotal role in ensuring operational success and global defense collaboration.

Expanding Defense Budget and Naval Modernization

Australia’s expanding defense budget and commitment to naval modernization are major growth drivers for the naval navigation and communication systems market. The Australian Government has been investing heavily in modernizing its naval fleet, including the procurement of next-generation vessels and upgrading existing systems. With the growing importance of naval power in the Indo-Pacific region and increasing maritime threats, there is a strong push to enhance the operational capabilities of Australia’s navy. This modernization includes the integration of cutting-edge navigation and communication systems that enable more efficient and effective maritime operations. For example, the Australian Navy’s recent investments in multi-role platforms and enhanced communication networks are designed to improve operational readiness and provide real-time data across various platforms. Additionally, the government’s commitment to defense technology innovation further supports the need for advanced communication and navigation systems to ensure Australia’s naval fleet remains at the forefront of global defense. This sustained funding for defense modernization will continue to drive the demand for state-of-the-art naval navigation and communication systems in the coming years.

Market Challenges

High Costs of Advanced Systems

One of the primary challenges facing the Australia Naval Navigation and Communication Systems market is the high cost associated with the development, procurement, and maintenance of advanced systems. While technological advancements have significantly improved the capabilities of these systems, the integration of such sophisticated technologies comes with a substantial price tag. The cost of research and development, coupled with the need for specialized infrastructure, has made these systems expensive to acquire and maintain. For Australia, balancing the need for cutting-edge technology with budget constraints becomes a difficult task. Additionally, the cost of upgrading existing systems and integrating them with newer platforms, while ensuring compatibility across multiple vessels and submarines, further increases the financial burden. Although the Australian government has committed substantial resources to defense modernization, the ongoing investment required to maintain and enhance naval communication and navigation systems is a significant challenge. The high capital expenditure on these systems also limits the scope for diversification of procurement channels and affects the overall profitability of companies in the market.

Integration and Interoperability Issues

The integration of advanced navigation and communication systems with existing naval platforms is a significant challenge for the Australian defense sector. Australia’s naval fleet consists of a wide range of vessels, from surface ships to submarines, each requiring specific systems that must be customized and integrated. The complexity of ensuring that these systems operate cohesively across different platforms presents a major technical hurdle. Furthermore, the rapid pace of technological advancements often results in compatibility issues with legacy systems. As new communication protocols, radar technologies, and navigation systems are developed, integrating them into existing platforms while ensuring smooth interoperability becomes a time-consuming and costly process. Moreover, interoperability with international defense systems is a key requirement for global operations and joint military exercises. For Australia, maintaining this level of system compatibility and integration across various vessels, submarines, and aircraft poses both operational and technical challenges, leading to delays in deployment and higher costs for the procurement and installation of navigation and communication systems.

Opportunities

Development of Autonomous Naval Systems

The growing demand for autonomous naval systems presents significant opportunities for the Australia Naval Navigation and Communication Systems market. With the rise of unmanned maritime vehicles (UMVs) and autonomous surface vessels, there is a corresponding need for advanced navigation and communication systems that can support these platforms. Autonomous systems offer enhanced operational capabilities, such as the ability to conduct missions in high-risk environments without endangering crew members. As Australia explores the potential for unmanned systems in its naval operations, particularly in reconnaissance, surveillance, and defense, there is a need to develop sophisticated communication systems that enable real-time control and data transmission between unmanned vessels and command centers. The integration of advanced satellite communication, secure data exchange, and real-time situational awareness will be essential to the success of autonomous naval systems. As the Australian Navy embraces these technologies, it will drive innovation in the communication and navigation systems market, presenting significant growth opportunities for both local and international defense contractors.

Expansion of Global Defense Exports

The Australia Naval Navigation and Communication Systems market presents significant export opportunities, particularly as Australia’s naval defense capabilities continue to evolve and expand. With advanced technological expertise in navigation, communication, and integrated systems, Australian defense contractors are well-positioned to meet the growing demand for sophisticated defense solutions in global markets. Australia’s strong international alliances with countries like the United States, Japan, and the United Kingdom, as well as its increasing role in regional security, make it an attractive partner for other nations looking to enhance their naval defense systems. The demand for advanced communication and navigation systems in the Middle East, Asia-Pacific, and Europe, driven by growing security concerns and naval modernization efforts, provides Australia with a valuable export opportunity. Australian manufacturers are increasingly engaging in joint ventures, technology sharing, and partnerships with international defense agencies, allowing for the development and distribution of cutting-edge naval systems globally. As countries around the world modernize their defense forces, Australia’s strong capabilities in this area provide a solid foundation for expanding defense exports, further driving market growth.

Future Outlook

Over the next decade, the Australia Naval Navigation and Communication Systems market is expected to experience substantial growth. This growth will be driven by Australia’s continuous investment in defense modernization, technological advancements in communication systems, and the increasing need for secure and efficient naval operations. The integration of cutting-edge technologies like artificial intelligence, satellite communications, and unmanned vehicle systems into naval operations will be pivotal in shaping the future of this market. Australia’s strategic partnerships with global defense leaders and its focus on enhancing its naval capabilities, especially in the Indo-Pacific region, will further accelerate demand for advanced navigation and communication systems. As global security dynamics evolve, the need for superior maritime defense solutions will continue to push the market forward.

Major Players

- Thales Group

- Lockheed Martin

- BAE Systems

- Saab Australia

- Raytheon Technologies

- Israel Aerospace Industries

- Northrop Grumman

- Elbit Systems

- General Dynamics Mission Systems

- Leonardo

- L3 Technologies

- Leonardo

- Israel Shipyards Ltd.

- Naval Group

- Huntington Ingalls Industries

Key Target Audience

- Australian Department of Defence

- Royal Australian Navy

- International Naval Forces

- Defense Contractors

- Investments and Venture Capitalist Firms

- Government Agencies

- Military Technology Providers

- System Integrators for Naval Platforms

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical market drivers and variables influencing the Australia Naval Navigation and Communication Systems market. We will gather insights through extensive desk research, utilizing secondary and proprietary databases to build a comprehensive understanding of the market landscape.

Step 2: Market Analysis and Construction

This phase will involve compiling and analyzing historical data related to market trends, system types, and platform types within the naval navigation and communication domain. The research will focus on technological adoption, spending patterns, and advancements within the defense sector.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses related to system demands, technological trends, and regional defense strategies will be validated through consultations with industry experts, including defense analysts, technology providers, and military officials. Their insights will help refine and confirm the findings.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from primary and secondary sources to provide a complete analysis of the market. The findings will be validated through direct engagement with key stakeholders to ensure accuracy and comprehensiveness in the final report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast

Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in naval communication technologies

Australia’s growing defense budget and naval modernization

Strategic necessity for enhanced maritime defense systems - Market Challenges

High cost of advanced navigation and communication systems

Integration challenges with legacy naval platforms

Cybersecurity threats targeting communication systems - Market Opportunities

Development of next-generation satellite communication systems

Increasing demand for autonomous naval platforms

Export potential of advanced communication systems to allied nations - Trends

Integration of AI and machine learning in naval communication systems

Focus on secure and resilient maritime communication networks

Expansion of autonomous and unmanned naval operations - Government regulations

Regulations regarding the integration of new communication systems in military vessels

International trade regulations on defense technology exports

Australian defense procurement laws - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Navigation Systems

Communication Systems

Integrated Systems

Radar Systems

Satellite Systems - By Platform Type (In Value%)

Surface Vessels

Submarines

Aircraft

Unmanned Maritime Vehicles

Hybrid Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Modular Fitment

Custom Fitment

Upgrade Fitment - By EndUser Segment (In Value%)

Australian Navy

International Naval Forces

Private Contractors

Defense Research Institutions

Government Defense Agencies - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Government Contracts

Private Sector Contracts

Online Platforms

- Cross Comparison Parameters (Technology Adoption, System Integration, After-sales Service, Regulatory Compliance, Cost Efficiency)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Australia Aerospace Industries

Rafael Advanced Defense Systems

Thales Group

Lockheed Martin

BAE Systems

Navantia

General Dynamics Mission Systems

L3 Technologies

Northrop Grumman

Saab AB

Elbit Systems

Raytheon Technologies

Israel Aerospace Industries

Leonardo

Huntington Ingalls Industries

- Australia’s strategic military alliances influencing demand

- Need for advanced navigation systems in regional naval forces

- Private sector participation in providing advanced systems

- Collaboration with international partners for technology transfer

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035