Market Overview

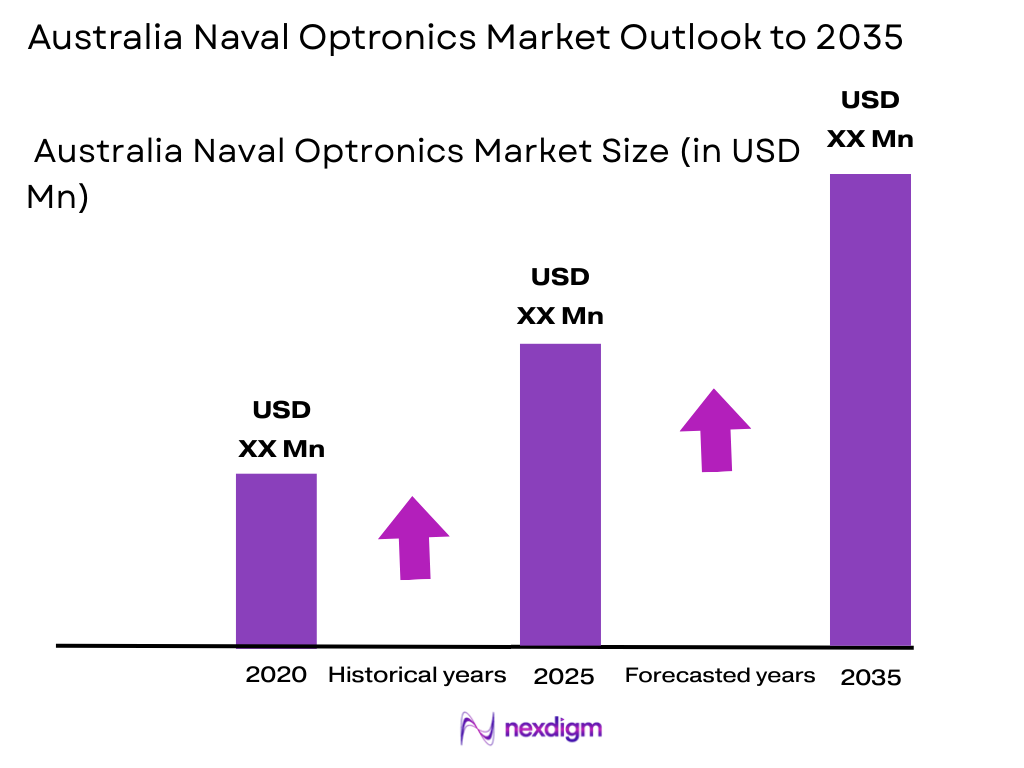

The Australia Naval Optronics market has been experiencing steady growth, with the market size estimated to reach approximately USD ~ billion in 2024. This growth is driven by the increasing defense budgets allocated to naval forces, focusing on enhancing their optical and surveillance capabilities. Additionally, the integration of advanced optical technologies into naval systems, including electro-optical and infrared sensors, plays a key role in the expansion. The growing demand for advanced optronic systems for surveillance, reconnaissance, and targeting is further bolstered by the rise in defense procurement for modern naval platforms.

Key factors contributing to the market’s dominance in Australia include the strategic geographical position and the government’s strong focus on upgrading defense infrastructure. Australia’s advanced naval defense forces are driving the demand for high-performance optronic systems. The government’s strategic defense initiatives and commitment to modernizing the military and defense capabilities have further cemented the country’s leadership in the naval defense sector. The country’s stable economic environment and political support for defense spending have also ensured a robust growth outlook for the naval optronics market.

Market Segmentation

By System Type

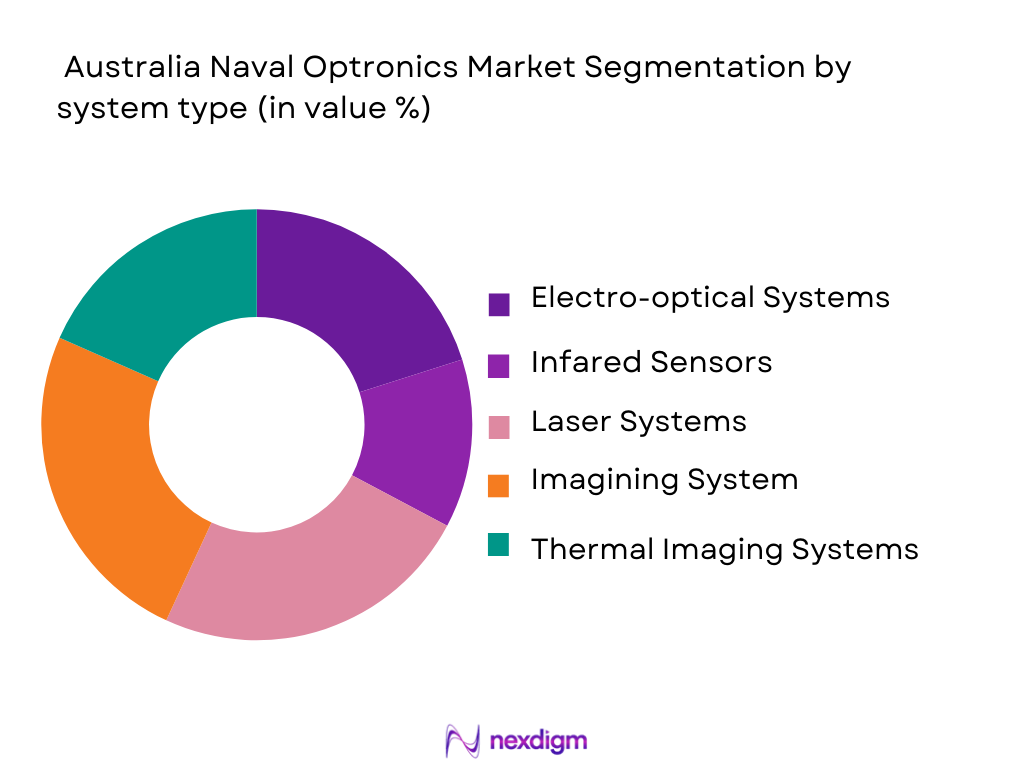

The Australia Naval Optronics market is segmented by system type into electro-optical systems, infrared sensors, laser systems, imaging systems, and thermal imaging systems. Among these, infrared sensors hold the dominant market share due to their critical role in providing superior surveillance and targeting capabilities for naval forces. These sensors are extensively used in both surface ships and submarines for their ability to detect heat signatures, ensuring improved visibility and operational efficiency in low-light conditions. The increasing emphasis on upgrading naval defense systems with advanced infrared technologies to enhance situational awareness is a key driver for this dominance.

By Platform Type

The market is segmented by platform type into surface ships, submarines, aircraft, drones, and land-based platforms. Surface ships dominate the market share due to the high demand for optronic systems that provide advanced targeting, surveillance, and reconnaissance capabilities in naval operations. The emphasis on naval ship modernization and the integration of cutting-edge optronic technologies for situational awareness and mission success is a major driver for surface ships’ dominance. These systems are integral to improving naval fleet capabilities, enhancing defense readiness, and ensuring effective communication across various maritime environments.

Competitive Landscape

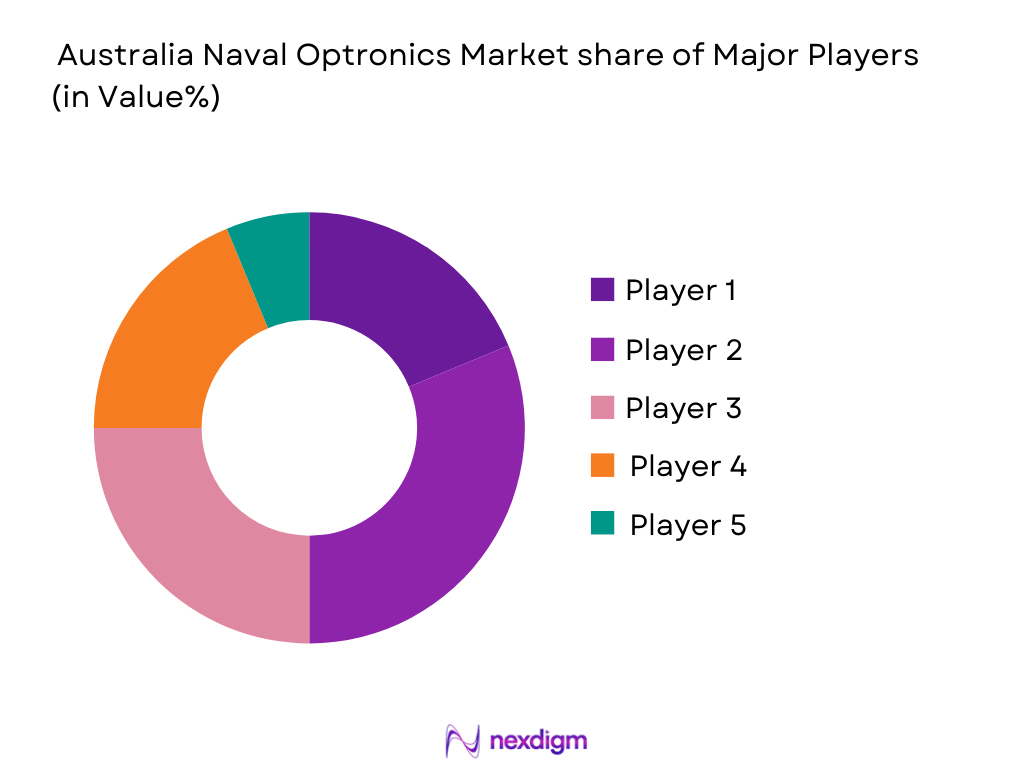

The competitive landscape of the Australia Naval Optronics market is characterized by the presence of both established defense companies and specialized technology providers. Major players in the market, including BAE Systems and Thales Group, continue to lead with innovative optical and infrared solutions that cater to the increasing demand for enhanced naval defense systems. These companies are focusing on technological advancements and long-term strategic partnerships to maintain a competitive edge. The market is witnessing consolidation, with players collaborating for technology transfer, joint ventures, and research and development to expand their product portfolios and capture a larger share of the growing market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

Australia Naval Optronics Market Analysis

Growth Drivers

Advancements in Optical and Infrared Technologies

The continuous evolution of optical and infrared technologies is a major growth driver for the Australia Naval Optronics market. These technologies have significantly improved the operational capabilities of naval forces by providing enhanced surveillance, reconnaissance, and targeting capabilities. As naval defense systems become more reliant on precision and real-time data, the demand for advanced optronic systems has increased. The integration of infrared and electro-optical systems into naval platforms, such as surface ships and submarines, is facilitating greater accuracy in threat detection, tracking, and mission success. The advancements in infrared technology, particularly in detecting and tracking heat signatures, have been crucial in modernizing naval defense systems. This growth is also being fueled by the increased budgets allocated by the Australian government for upgrading defense technology to stay competitive and counter emerging threats. Furthermore, the rising focus on autonomous and unmanned systems, which heavily rely on optronics for navigation and targeting, has opened new avenues for market growth. The ongoing technological innovations in this space promise further improvements in performance, which is expected to sustain growth over the coming years.

Growing Defense Budgets and Geopolitical Tensions

Another significant growth driver is the increasing defense budgets allocated by the Australian government in response to rising geopolitical tensions in the Indo-Pacific region. These heightened tensions have spurred investments in advanced defense technologies to enhance national security and strengthen military capabilities. The demand for optronic systems, which are crucial for effective defense operations, is growing as a result of the expansion of naval fleets and the need for advanced surveillance systems. Australia’s defense strategy emphasizes the enhancement of naval capabilities to safeguard its vast maritime borders and maintain security in international waters. The naval forces’ need for cutting-edge optronic systems that provide high-resolution imaging, precise targeting, and real-time data transmission has led to increased procurement of these systems. With Australia’s strong defense alliances, particularly with the United States and other NATO members, the market is expected to benefit from collaborative defense programs and access to the latest advancements in naval optronics technology. Additionally, the government’s efforts to promote defense sovereignty by encouraging local production and procurement further contribute to the growth of the naval optronics market.

Market Challenges

High Capital Investment in Defense Projects

One of the key challenges facing the Australia Naval Optronics market is the high capital investment required for defense projects. Developing and manufacturing advanced optronic systems involves significant costs, including research and development, testing, and integration into naval platforms. The long procurement cycles and extensive testing required for military-grade technology further increase the financial burden on defense contractors. While the Australian government has allocated substantial funding for defense modernization, the high upfront costs can hinder the rapid deployment of advanced optronics systems. Smaller defense contractors or startups may struggle to compete in this capital-intensive market, leading to a concentration of market power among a few large players. Additionally, defense procurement delays and budget constraints can impact the timely acquisition of necessary technologies, further delaying market expansion. The challenge of balancing high capital investments with the need for cost-efficient and effective solutions continues to pose significant hurdles for the sector, particularly as defense budgets remain under scrutiny.

Regulatory Barriers and Compliance Issues

Regulatory barriers and compliance issues also present challenges for companies operating in the Australia Naval Optronics market. The defense sector is highly regulated, with strict standards governing the development, testing, and deployment of optronic systems. These regulations, often related to defense export controls, cybersecurity standards, and military procurement guidelines, can slow the approval process for new products and technologies. Manufacturers must comply with both national and international regulations, which can complicate supply chain management and increase the time-to-market for new optronic systems. Furthermore, the integration of commercial technologies into military platforms is subject to regulatory scrutiny to ensure that these systems meet military-grade specifications and security standards. This complex regulatory environment requires companies to invest heavily in compliance measures, which adds to the overall costs and operational complexity of their offerings.

Opportunities

Expansion in Autonomous Naval Systems

The rise of autonomous and unmanned naval systems presents a significant opportunity for growth in the Australia Naval Optronics market. These systems heavily rely on optronic technologies for navigation, surveillance, and targeting, creating a growing demand for advanced optical and infrared solutions. The Australian government’s defense strategy focuses on increasing the capabilities of autonomous naval vessels to improve operational efficiency and reduce human risk in high-threat environments. As autonomous ships and drones become more prevalent, the demand for sophisticated optronic systems capable of providing real-time data, high-resolution imaging, and target acquisition will increase. Additionally, these systems require optronics for continuous monitoring, even in challenging environments such as undersea operations or in low-visibility conditions. The potential for the integration of artificial intelligence and machine learning algorithms into autonomous systems further enhances the growth potential of the market, making it an attractive area for investment and innovation.

Collaboration with Technology Firms for Enhanced Systems

Another opportunity lies in the growing trend of collaborations between defense contractors and technology firms to develop next-generation optronic systems. As the complexity of naval operations increases, there is a rising need for optronics that combine advanced sensors, AI capabilities, and secure data transmission. By partnering with leading technology firms, defense contractors can leverage cutting-edge innovations in optics, artificial intelligence, and data processing to enhance the performance of their systems. These partnerships are expected to result in the development of more cost-effective and efficient solutions, which can be integrated into various naval platforms. Moreover, the collaboration between defense contractors and technology firms can lead to the creation of modular and scalable optronic systems that can be customized to meet the specific needs of different naval platforms, further driving market growth.

Future Outlook

The future outlook for the Australia Naval Optronics market is promising, with significant growth anticipated over the next five years. Key trends, including advancements in artificial intelligence, machine learning, and autonomous systems, are expected to drive the demand for sophisticated optronic solutions. The Australian government’s continued focus on defense modernization and its commitment to enhancing naval capabilities will ensure strong market growth. Technological innovations, regulatory support, and the growing need for advanced surveillance and reconnaissance capabilities will further propel the market forward, positioning it for success in the evolving defense landscape.

Major Players

- BAE Systems

- Thales Group

- Lockheed Martin

- Leonardo

- Northrop Grumman

- Rheinmetall AG

- Elbit Systems

- Harris Corporation

- L3 Technologies

- Saab Group

- General Dynamics

- Raytheon Technologies

- Textron Systems

- Boeing

- Honeywell International

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Defense ministries

- Military forces

- Technology and defense integrators

- Equipment manufacturers

- System integrators

Research Methodology

Step 1: Identification of Key Variables

Identifying key variables such as market size, technology trends, and regulatory frameworks to understand the factors driving the market.

Step 2: Market Analysis and Construction

Conducting a comprehensive analysis of market dynamics, segmentation, and competitive landscape based on primary and secondary research.

Step 3: Hypothesis Validation and Expert Consultation

Validating hypotheses through consultations with industry experts, government agencies, and defense contractors to ensure accurate insights.

Step 4: Research Synthesis and Final Output

Synthesizing research findings into a structured report that provides actionable insights and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in Optical and Sensor Technologies

Increased Defense Budgets

Rising Geopolitical Tensions

Demand for Enhanced Surveillance Capabilities

Integration of Commercial Technologies in Naval Systems - Market Challenges

High Capital Investment in R&D

Regulatory Barriers and Compliance Issues

Technological Integration and Interoperability Issues - Market Opportunities

Growth in Autonomous and Unmanned Naval Systems

Partnerships with Tech Firms for Enhanced Optical Systems

Emerging Demand for Multi-Spectral Imaging Solutions - Trends

Increased Use of AI and Machine Learning in Naval Systems

Integration of Autonomous Systems in Naval Operations

Surge in Cybersecurity Investments for Naval Optronics - Government Regulations

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Electro-optical Systems

Infrared Sensors

Laser Systems

Imaging Systems

Thermal Imaging Systems - By Platform Type (In Value%)

Surface Ships

Submarines

Aircraft

Drones

Land-Based Platforms - By Fitment Type (In Value%)

Onboard Systems

Remote Systems

Integrated Solutions

Modular Systems

Standalone Systems - By EndUser Segment (In Value%)

Naval Forces

Defense Contractors

Government Agencies

Security Services

Research & Development Institutions - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Thales Group

BAE Systems

Raytheon Technologies

Northrop Grumman

Leonardo

Saab Group

General Dynamics

L3 Technologies

Rheinmetall AG

Elbit Systems

Harris Corporation

Textron Systems

Hewlett Packard Enterprise

Boeing

- Naval Forces’ Increasing Demand for Optronic Systems

- Government Agencies’ Role in Regulating and Procuring Optronic Systems

- Defense Contractors’ Push for Innovation and System Integration

- Private Sector’s Growing Interest in Optical Technologies for Defense

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035