Market Overview

The Australia Naval Radar Systems Market is valued at approximately USD ~ billion in 2024, with growth driven by the Australian government’s defense modernization programs. In 2025, Australia’s defense budget reached USD ~ billion, with a significant allocation directed toward enhancing naval capabilities. As the Australian Navy continues to focus on securing its maritime borders and strengthening its defense posture in the Indo-Pacific region, the demand for advanced radar systems such as phased array radars, S-band, and X-band radar systems has surged, further driving the market.

Australia, particularly its coastal cities like Sydney, Darwin, and Perth, dominates the naval radar systems market. Sydney houses the headquarters of key defense contractors, while Darwin and Perth are strategically located near vital maritime trade routes and Australian naval ports, which are central to the Australian Navy’s operational focus. Australia’s dominance stems from its ongoing investment in advanced naval systems to strengthen defense against regional security threats. The increasing military modernization, alongside strategic investments in naval radar technology, underscores the country’s leadership in the sector.

Market Segmentation

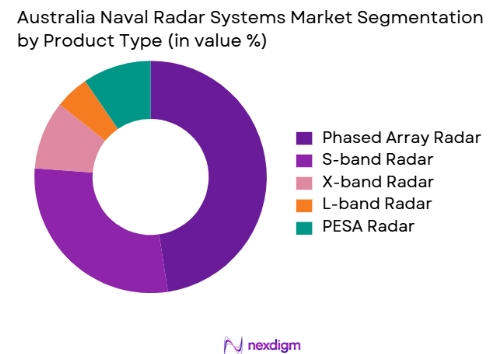

By Product Type

The Australia Naval Radar Systems Market is segmented by product type into S-band radar, X-band radar, L-band radar, phased array radar, and PESA (Passive Electronically Scanned Array) radar. Phased array radar systems have the dominant market share in this segment, driven by their versatility and ability to provide high-resolution, multi-target tracking in harsh maritime environments. The Australian Navy has prioritized phased array radar for its ships and submarines as part of its broader naval modernization efforts, making it the primary technology in use for advanced surveillance and defense capabilities.

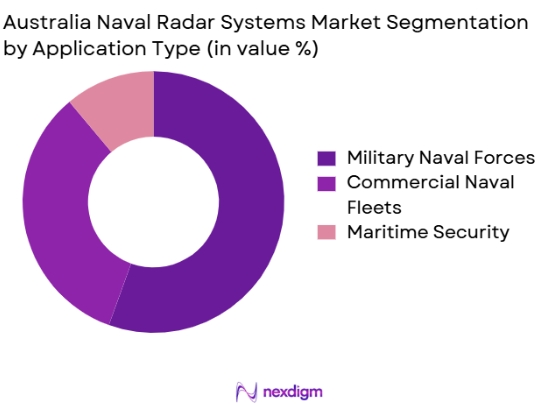

By Application

The Australian Naval Radar Systems Market is segmented by application into military naval forces, commercial naval fleets, and maritime security. The military naval forces segment dominates, accounting for the majority of radar system applications, driven by the Australian government’s continued investment in military infrastructure. The Australian Navy relies heavily on radar systems to enhance its operational capabilities in detecting and tracking potential threats. The growing need to secure Australia’s maritime borders and respond to regional tensions further bolsters the demand for advanced radar systems in military applications.

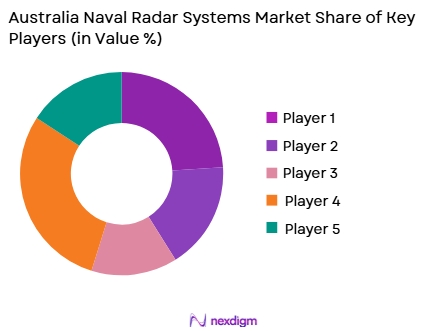

Competitive Landscape

The Australia Naval Radar Systems Market is highly competitive, with several key players leading the market. The market is dominated by global defense giants such as Raytheon Technologies, BAE Systems, Lockheed Martin, and Thales Group, which have significant investments in advanced radar technologies. These companies play a key role in providing both military and commercial naval radar systems, contributing to Australia’s defense modernization programs. Australia’s strategic geographic location also attracts these global players to provide solutions tailored to the Australian Navy’s specific operational needs.

| Company Name | Year Established | Headquarters | Core Products | Technology Strengths | Key Markets of Influence |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ |

~ |

~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ |

| Saab AB | 1989 | Gothenburg, Sweden | ~ | ~ | ~ |

Australia Naval Radar Systems Market Analysis

Growth Drivers

Increasing Naval Defense Budgets

Australia’s defense budget continues to expand, underpinned by federal appropriations that allocated USD~ billion for the defence portfolio in the 202425 budget, illustrating a sustained commitment to military modernization and capability enhancement. A significant portion of this funding supports naval defense platforms, including frigates and surface combatants that require advanced radar systems for surveillance, target tracking, and fire control. Moreover, longterm fiscal planning anticipates defense spending rising to around USD ~billion (AU~ billion) over the next decade via strategic planning documents, reinforcing a robust financial environment for naval radar procurement and upgrades.

Growing Demand for Advanced Surveillance and Navigation Systems

Advanced surveillance and navigation are core to Australia’s maritime strategy, particularly given its vast coastline and regional security responsibilities. The Australian Defence Force has incorporated modern phased array and multifunction radar systems into new surface combatants such as the Hunterclass frigates, which deploy CEAFARtype Sband and Lband radar suites for enhanced maritime domain awareness.Additionally, overthehorizon networks like the Jindalee Operational Radar Network (JORN) reflect national priorities for comprehensive maritime surveillance, with infrastructure investments exceeding AU~billion across multiple phases. These initiatives drive demand for advanced naval radar technology capable of broadarea monitoring and precision navigation support.

Market Challenges

High Cost of Radar System Development and Maintenance

The development and lifecycle support of naval radar systems represent significant financial obligations for defense procurement. Complex radar platforms, including active electronically scanned array (AESA) systems and multifunction phased array radars, require extensive engineering, production, and sustainment investments often running into hundreds of millions of dollars per system. Integrating these systems into surface combatants like the Hunterclass frigate, which incorporates multiple radar bands and sensors, further increases integration costs.This financial pressure is highlighted against the backdrop of defense budgets where equipment acquisition is a substantial line item, making cost management a continual challenge for procurement planners.

Complex Regulatory and Compliance Requirements

The defense sector in Australia is governed by stringent regulatory frameworks and compliance protocols that affect radar system procurement and deployment. Naval radar equipment, as part of military hardware, must meet rigorous technical standards and align with classified security policies administered by the Department of Defence and associated agencies.Furthermore, export and import controls, coupled with international defense cooperation arrangements such as interoperability requirements with allies (notably under AUKUS and other partnerships), introduce additional compliance layers. These regulatory complexities can lengthen acquisition cycles, complicate technology transfer agreements, and require detailed certification processes for radar system components and integration.

Opportunities

Growing Demand for Autonomous and Multifunction Naval Systems

Australia’s investment in autonomous maritime systems and multifunctional naval platforms presents a compelling opportunity for naval radar system adoption. With programs such as the Ghost Shark autonomous underwater drone initiative backed by USD ~ billion in funding, defense planners are integrating situational awareness technologies that depend on advanced radar and sensor fusion for realtime navigation and threat detection.Multifunction radars capable of supporting surface, air, and littoral domain surveillance are increasingly essential for combining autonomous operations with traditional fleet assets. These technologies expand the radar system market beyond conventional shipboard installations to include distributed networked sensors across manned and unmanned platforms.

Rising Investments in Naval Modernization Programs

Australia’s naval modernization initiatives underpin a sustained opportunity for radar system demand. Federal planning documents, including the National Defence Strategy and Integrated Investment Program, outline significant reinvestment in surface combatants, submarines, and associated sensor suites valued at tens of billions of dollars. For example, the Hunterclass frigate program alone involves radar and combat system packages integral to vessel capability, representing a key driver for radar procurement and longterm support contracts.As Australia balances strategic objectives with capability enhancement, radar systems remain a centerpiece of maritime domain awareness, situational monitoring, and fleet interoperability.

Future Outlook

Over the next decade, the Australia Naval Radar Systems Market is expected to witness substantial growth driven by the Australian government’s continued investment in its defense sector. This growth will be fueled by advancements in radar technologies, including the increasing adoption of phased array radar systems and enhanced multi-function capabilities. Additionally, Australia’s strategic position in the Indo-Pacific and the need for robust defense infrastructure will continue to shape the demand for next-generation radar systems. As Australia upgrades its fleet and defense technologies, the market will experience rising opportunities for radar systems integration and innovation.

Major Players

- Raytheon Technologies

- BAE Systems

- Lockheed Martin

- Thales Group

- Saab AB

- Elbit Systems

- Northrop Grumman

- Leonardo S.p.A

- L3 Technologies

- General Dynamics

- Mitsubishi Electric

- Kongsberg Gruppen

- Rheinmetall AG

- General Electric

- Honeywell International

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Defense Contractors

- Naval Research Institutions

- Aerospace and Defense Manufacturers

- Naval Defense Agencies

- Shipbuilding Companies

- Maritime Security Agencies

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables that impact the Australian Naval Radar Systems Market, such as government defense budgets, technological advancements, and regional security needs. Extensive desk research and interviews with industry experts will help define these variables.

Step 2: Market Analysis and Construction

We will compile and analyze historical data on defense expenditures, radar adoption rates, and market trends. This phase will include analyzing defense strategies, technological adoption, and market demands for naval radar systems in Australia.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with defense experts, manufacturers, and key stakeholders in Australia’s naval defense sector. This will help refine assumptions and validate findings from secondary research.

Step 4: Research Synthesis and Final Output

The final phase will involve synthesizing data from interviews, surveys, and secondary research to create a comprehensive market report. This will include detailed analysis of market trends, growth drivers, challenges, and competitive strategies in the Australia Naval Radar Systems Market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Naval Defense Investments

Technological Advancements in Radar Systems

Increased Focus on Coastal Surveillance - Market Challenges

High Initial Investment Costs

Integration Complexities with Existing Infrastructure

Regulatory Compliance in International Waters - Market Opportunities

Expansion of Commercial Maritime Radar Solutions

Increased Demand for Autonomous Radar Systems

Development of Integrated Multi-Sensor Radar Systems - Trends

Shift Towards Digital and Software-Defined Radars

Growing Demand for Low Probability of Intercept (LPI) Radars

Development of Modular and Scalable Radar Platforms - Government Regulations

International Maritime Organization (IMO) Regulations

National Defense Standards and Certifications

Environmental Impact Regulations for Radar Deployment

- By Market Value 2019-2025

- By Installed Units 2019-2025

- By Average System Price 2019-2025

- By System Complexity Tier 2019-2025

- By System Type (In Value%)

Coastal Surveillance Systems

Air Surveillance Radar Systems

Surface Surveillance Radar Systems

Weather Radar Systems

Integrated Radar Systems - By Platform Type (In Value%)

Shipborne Radar Systems

Submarine Radar Systems

Land-Based Radar Systems

Airborne Radar Systems

Mobile Radar Systems - By Fitment Type (In Value%)

Fixed Mount Systems

Rotary Mount Systems

Modular Mount Systems

Portable Systems

All-in-One Systems - By EndUser Segment (In Value%)

Naval Defense

Coast Guard

Research & Rescue Operations

Commercial Maritime

Environmental Monitoring Agencies - By Procurement Channel (In Value%)

Government Contracts

Private Sector Purchases

Defense Collaborations

Research & Development Grants

Direct Supplier Agreements

- Cross Comparison Parameters (Technology Integration, Network Connectivity, Regulatory Compliance, Cost Competitiveness, After-Sales Support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Thales Group

Lockheed Martin

Northrop Grumman

Raytheon Technologies

BAE Systems

Saab Group

Leonardo S.p.A

Honeywell Aerospace

Elbit Systems

Harris Corporation

Rheinmetall

Kongsberg Gruppen

L3 Technologies

General Dynamics

Indra Sistemas

- Increased Naval Defense Spending in Australia

- Demand for Coastal Surveillance Systems in Maritime Security

- Growth in Commercial Maritime Industry

- Government Focus on Research and Rescue Capabilities

- Forecast Market Value 2026-2030

- Forecast Installed Units 2026-2030

- Price Forecast by System Tier 2026-2030

- Future Demand by Platform 2026-2030