Market Overview

The Australia Naval Ship Propeller market is valued at approximately USD ~ in 2024. This market is primarily driven by rising investments in naval defense and the modernization of the Australian naval fleet, aimed at maintaining maritime security and operational efficiency. Demand for technologically advanced, energy-efficient, and durable propellers is increasing. The Australian government has significantly increased defense budgets, with the Australian Department of Defence allocating over USD 36 billion in 2024 to naval modernization programs. This surge in investment directly impacts the propulsion system market.

Australia remains a dominant force in the Asia-Pacific region’s naval defense sector. Major cities like Sydney and Perth are central to the country’s naval and shipbuilding industries due to their proximity to key naval bases. Australia’s commitment to strengthening its maritime defense capabilities, bolstered by government funding, makes it a leader in naval propeller demand. The naval modernization efforts, coupled with active participation in international maritime security, cement Australia’s position as a key player in this market.

Market Segmentation

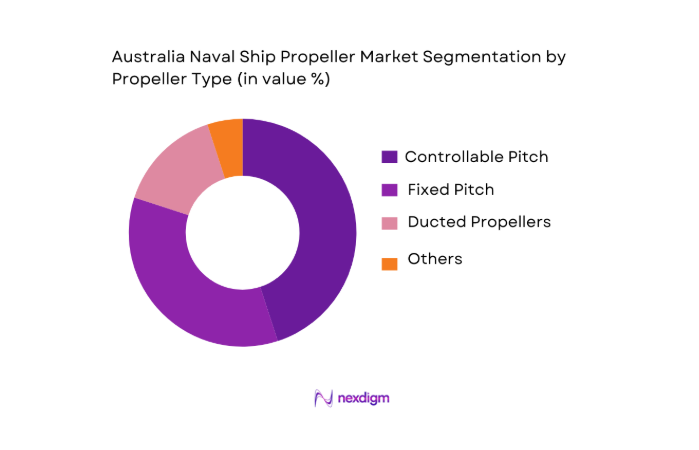

By Propeller Type

The Australia Naval Ship Propeller market is segmented into various propeller types, such as fixed-pitch propellers, controllable-pitch propellers, and ducted propellers. Among these, the controllable-pitch propellers hold a dominant market share due to their superior efficiency and adaptability in various operating conditions. These propellers provide optimal power output and fuel efficiency, which is essential for the naval fleets operating in diverse and dynamic environments. Controllable-pitch propellers are becoming increasingly popular in military and commercial ships because they allow for smoother operation and fuel savings, which are crucial for long-range naval operations.

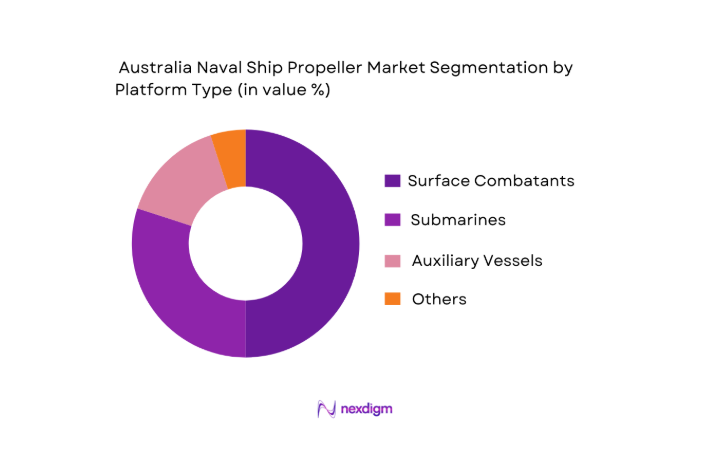

By Platform Type

The market is also segmented by platform type, including surface combatants, submarines, and auxiliary vessels. Surface combatants dominate the market share due to their frequent use and the increasing demand for enhanced naval defense capabilities. The rise in naval defense budgets and the growing need for advanced surface warfare platforms have led to an increase in the production of surface combatants, thereby boosting the demand for naval ship propellers. These ships require high-performance propellers to ensure speed, maneuverability, and operational readiness in various maritime conditions.

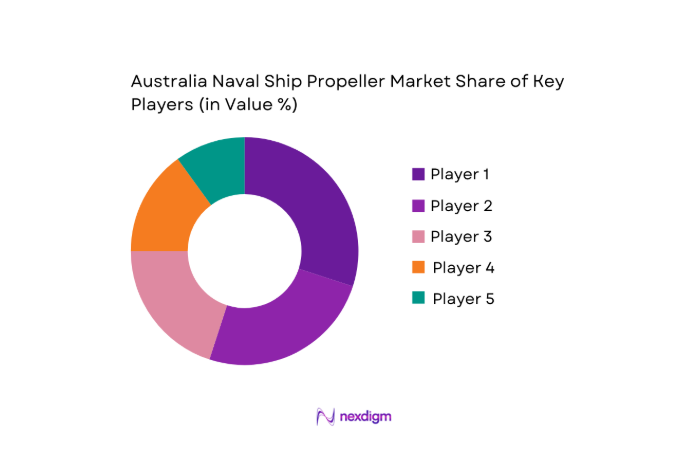

Competitive Landscape

The Australia Naval Ship Propeller market is highly competitive, with major players investing heavily in advanced technologies to strengthen their position. The key players in the market include global leaders such as Rolls-Royce, Wärtsilä, and Caterpillar Marine. These companies dominate due to their extensive experience in marine propulsion systems, strong R&D capabilities, and robust distribution networks.

| Company Name | Establishment Year | Headquarters | Market Specific Parameter 1 | Market Specific Parameter 2 | Market Specific Parameter 3 | Market Specific Parameter 4 | Market Specific Parameter 5 | Market Specific Parameter 6 |

| Rolls-Royce | 1904 | London, UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Wärtsilä | 1834 | Helsinki, Finland | ~ | ~ | ~ | ~ | ~ | ~ |

| Caterpillar Marine | 1925 | Peoria, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| MAN Energy Solutions | 1758 | Augsburg, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| SCHOTTEL | 1901 | Spay, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Naval Ship Propeller Market Analysis

Growth Drivers

Increase in naval defense spending

Australia’s defense budget reached an unprecedented USD ~ for the 2024‑25 fiscal year, reflecting the government’s prioritization of military capability investments, including significant allocations to naval assets such as submarines, frigates, and patrol vessels. The Royal Australian Navy received USD ~ from this budget, underpinning heightened procurement and sustainment activities. These investments directly stimulate demand for advanced naval components such as propellers, as larger and more capable vessels require robust propulsion systems to meet operational specifications. The sustained fiscal commitment signals long‑term defense industrial engagement in naval shipbuilding supply chains.

Rising demand for energy‑efficient propulsion systems

Global shipping energy use reached approximately ~ barrels of oil equivalent per day in 2023, underscoring the sector’s massive fuel consumption and the corporate imperative to reduce operating costs and emissions through more efficient propulsion technologies. International Maritime Organization (IMO) strategies and related regulatory frameworks increasingly emphasize energy efficiency measures, pushing ship operators and naval architects to adopt advanced propulsion designs that lower fuel consumption and emissions in line with maritime GHG reduction objectives. Hybrid and alternative propulsion approaches are gaining traction as avenues to address this broad industry challenge.

Market Challenges

High maintenance costs

Naval ship propulsion systems, particularly those employing advanced materials and precision engineering, incur substantial maintenance expenditures due to complexity and the necessity for specialized servicing infrastructure. For example, continuous support and overhaul of propulsion assemblies for naval fleets contribute to defense sustainment outlays embedded within the larger USD ~ defense budget. Such high lifecycle costs constrain procurement flexibility and can divert funds from new acquisitions to upkeep of existing assets, placing pressure on both industry suppliers and defense planners to optimize maintenance cycles and component reliability.

Complex installation processes

Propulsion systems for naval vessels demand integration with ship designs that often feature bespoke engineering specifications. Complex installation workflows require precise alignment, advanced tooling, and highly trained technicians to ensure operational integrity, particularly given the exacting tolerances required on high‑performance warships and submarines. The intricate nature of such installations extends dockyard time and labor requirements, compounding project timelines and resource allocation challenges within existing shipbuilding programs, as evidenced by extensive naval acquisition and sustainment planning documents outlining workforce needs. This complexity directly affects schedule adherence and operational readiness.

Opportunities

Growing demand for hybrid propulsion systems

The global marine hybrid propulsion market was valued at approximately USD ~ in 2024, reflecting a rising interest in integrated propulsion solutions that combine traditional and electric power sources to enhance fuel efficiency and reduce emissions. The Asia‑Pacific region, encompassing major shipbuilding hubs, accounted for a leading share of this segment, indicating strong regional adoption tendencies. For naval applications, hybrid systems present an opportunity to meet stringent operational performance requirements while aligning with evolving environmental and energy efficiency standards within defense logistics and lifecycle considerations. This demand trajectory can stimulate innovation among propulsion manufacturers and defense integrators.

Increase in naval shipbuilding activities

Australia’s 2024 Naval Shipbuilding and Sustainment Plan outlines a program of activities requiring significant maritime capability delivery over the coming decades, including conventional and nuclear submarine projects and surface combatants. This plan’s extensive scope creates sustained production opportunities for propulsion components, including propellers, as a byproduct of expanded domestic shipbuilding throughput. National strategic emphasis on naval industrial base strengthening draws increased investment and workforce engagement, laying a foundation for robust downstream demand for propulsion technologies within larger shipbuilding initiatives.

Future Outlook

Over the next 5 years, the Australia Naval Ship Propeller market is expected to show moderate growth driven by ongoing naval fleet modernization efforts, increasing defense spending, and advancements in propulsion technology. The demand for energy-efficient, high-performance, and environmentally friendly propellers will be further bolstered by global initiatives for sustainable marine technologies.

Major Players

- Rolls-Royce

- Wärtsilä

- Caterpillar Marine

- MAN Energy Solutions

- SCHOTTEL

- GE Marine

- Voith Turbo

- Roodhart

- MTU Friedrichshafen

- Hamon Deltak

- Nabtesco

- Kongsberg Gruppen

- Propeller Solutions Ltd

- Siemens Marine

- Navantia

Key Target Audience

- Investment and venture capitalist firms

- Government and regulatory bodies

- Naval and commercial shipbuilders

- Maritime equipment suppliers

- Defense contractors

- Propulsion system manufacturers

- Commercial shipping companies

- Research and development institutions in the marine defense sector

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Australia Naval Ship Propeller Market. This step is underpinned by secondary research to gather industry-level data, defining critical variables that impact market dynamics. Key variables include technological trends, market demand drivers, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, historical data for the Australia Naval Ship Propeller Market will be analyzed, focusing on past market trends, product types, and platform growth. This involves assessing historical growth patterns, key regional developments, and the factors affecting propeller sales.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with industry experts representing shipbuilders, propulsion system suppliers, and naval defense agencies. These consultations help refine market data and provide insights into emerging trends and technological developments in naval propulsion.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data to deliver a comprehensive analysis. Insights from consultations with shipbuilders and suppliers will be combined with quantitative analysis to validate growth projections and market share estimations, ensuring the final output is reliable and actionable.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Increase in naval defense spending

Rising demand for energy-efficient propulsion systems

Technological advancements in propeller materials - Market Challenges

High maintenance costs

Complex installation processes

Limited availability of skilled labor - Opportunities

Growing demand for hybrid propulsion systems

Increase in naval shipbuilding activities

Partnerships with advanced marine technology providers - Trends

Shift towards eco-friendly propulsion systems

Integration of smart sensors and automation in propeller systems - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Fixed Pitch Propellers

Controllable Pitch Propellers

Feathering Propellers

Contra-rotating Propellers

Ducted Propellers - By Platform Type (In Value%)

Surface Combatants

Submarines

Auxiliary Ships

Support Vessels

Research & Survey Vessels - By Fitment Type (In Value%)

OEM

Aftermarket - By EndUser Segment (In Value%)

Military/Naval Defense

Commercial Shipping

Research Institutions - By Procurement Channel (In Value%)

Direct Purchase

Distributors

Online Platforms

- Market Share Analysis

- Cross Comparison Parameters (Propeller Efficiency, Material Innovation, Cost of Production, Integration with Propulsion Systems, Market Penetration)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Caterpillar Marine

Wartsila

MAN Energy Solutions

Rolls-Royce

SCHOTTEL

GE Marine

Hamon Deltak

Nabtesco

Voith Turbo

MTU Friedrichshafen

Roodhart

Propeller Solutions Ltd

Kongsberg Gruppen

SMM

Nautican Propulsion Systems

- Growing investment in naval modernization programs

- Increased focus on reducing operational costs in the naval sector

- Surge in demand for advanced military-grade propulsion systems

- Rise in maritime trade and shipping activities

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035