Market Overview

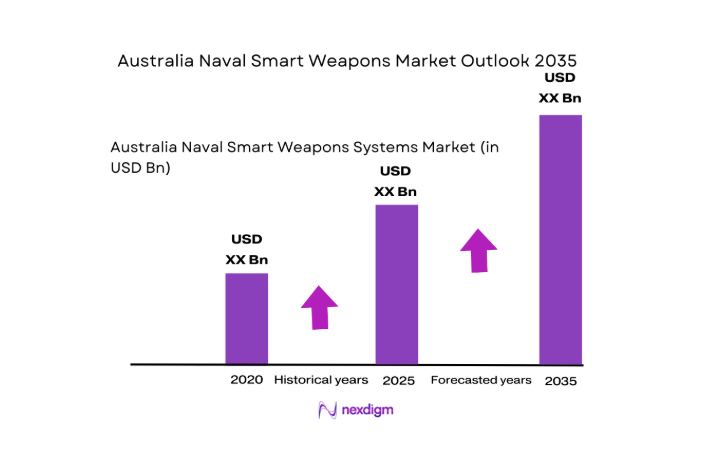

The Australia Naval Smart Weapons market is experiencing substantial growth, driven by advancements in defense technologies and rising military budgets across the Asia-Pacific region. In 2023, the market was valued at USD ~, with projections to reach USD ~ by 2024. The increasing focus on modernizing naval fleets, along with the growing need for advanced, precision-guided weapons, is fueling this expansion. Key drivers include technological innovations, such as autonomous systems and AI-powered weapons, as well as significant investments in naval defense by the Australian government.

Australia is one of the key players in the naval smart weapons market, supported by a robust defense strategy and significant government investment in defense technology. The country benefits from a strategic location in the Indo-Pacific region, increasing its focus on strengthening naval capabilities. Other dominant players in the region include Japan and South Korea, driven by their increasing naval defense budgets and investments in advanced weaponry. These nations are fostering collaborations with global defense firms, enhancing their position in the smart weapons market.

Market Segmentation

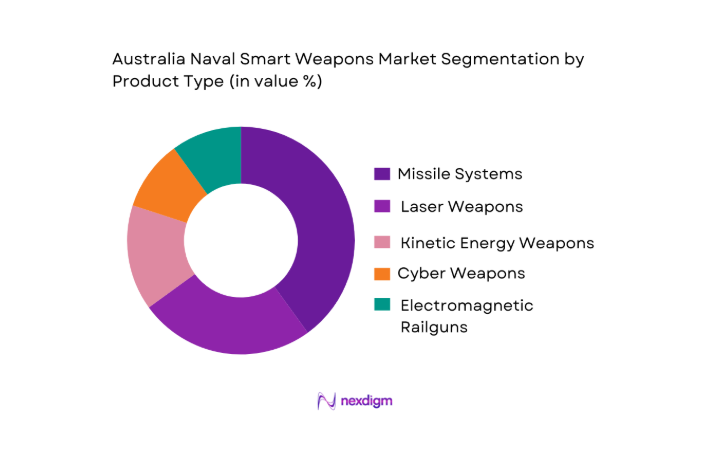

By Product Type

The Australia Naval Smart Weapons market is segmented into missile systems, laser weapons, kinetic energy weapons, cyber weapons, and electromagnetic railguns. The missile systems segment holds the largest market share in 2024, driven by their long-standing integration into naval operations and continued technological advancements. With military forces focusing on precision strikes and operational flexibility, missile systems offer a range of capabilities that make them integral to naval combat. Companies like Lockheed Martin and Raytheon dominate this segment, providing cutting-edge missile solutions that meet modern warfare demands.

By Platform Type

The platform type segmentation of the market includes naval surface vessels, submarines, UAVs, UUVs, and aircraft. In 2024, naval surface vessels dominate this segment due to their critical role in defense and strategic naval operations. Surface vessels, equipped with advanced smart weapons, offer multi-role capabilities, including defense, deterrence, and power projection. Australia’s emphasis on strengthening its naval fleet with modern warships has led to a steady demand for this platform. Companies such as BAE Systems and Saab are key contributors to this segment, providing cutting-edge vessel-integrated weapon systems.

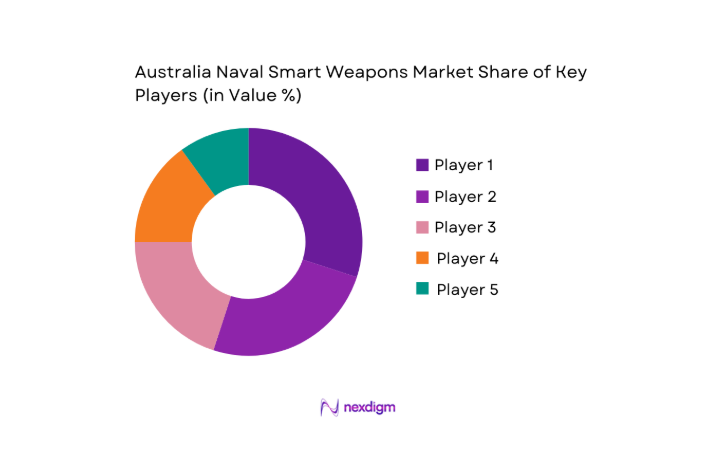

Competitive Landscape

The Australia Naval Smart Weapons market is dominated by several key players, including global defense giants and regional manufacturers. These companies leverage advanced technologies and strategic partnerships to capture significant market share.

The market is competitive, with companies such as Lockheed Martin, BAE Systems, and Raytheon Technologies leading the way. These players benefit from established relationships with governments and defense agencies, providing them with a competitive edge in securing large defense contracts. Additionally, the growing demand for more precise, efficient, and technologically advanced naval weapons is pushing other companies to innovate, contributing to a dynamic and evolving market landscape.

| Company | Establishment Year | Headquarters | Technology | Market Focus | Key Products | Defense Collaborations |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1994 | United States | ~ | ~ | ~ | ~ |

| Saab AB | 1989 | Sweden | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ |

Australia Naval Smart Weapons Market Analysis

Growth Drivers

Rising defense budgets in Australia and the Asia-Pacific region

Australia’s defence spending has risen markedly, underpinning demand for advanced naval systems. In the 2024 fiscal budget, Australia allocated AUD ~to defence, a record high reflecting strategic prioritization of military capability improvements. This allocation supports procurement of smart weapon systems integrated into naval platforms, including long‑range missile defence and autonomous systems. Additionally, the 2025–26 budget increased to AUD ~, with a notable AUD ~ earmarked for the AUKUS submarine program within naval forces, further driving procurement of advanced smart weapons. These funding trends correlate with sustained investment in naval modernization, increasing demand for target acquisition, precision guidance, and integrated weapon systems.

Increased focus on naval modernization and smart weapon technologies

Australia’s strategic environment and military expenditure context in the Asia‑Pacific also drives market growth. Global defence outlays reached US ~ in 2024, indicating heightened defence prioritization worldwide. Within this, China’s military expenditure stood at an estimated US ~ in 2024, the world’s second largest, and reinforcing regional naval modernization imperatives. High regional defence spending motivates Australia and allies to acquire smart weapons to counter advanced capabilities, making naval smart weapons a pivotal component of broader defence budgets. This macro defence expenditure environment substantiates escalating investments in next‑generation weapons subsystems.

Market Challenges

High research and development costs

One of the primary challenges facing the Australia Naval Smart Weapons market is the high research and development burden associated with next‑generation systems. Although macro defence budgets are increasing, development of autonomous targeting, AI‑enhanced guidance, and secure communications requires significant investment before operational deployment. The 2025–26 Australian defence budget increases to AUD ~, yet much of this is committed to broad force structure and platform acquisition, with only discrete allocations for weapons R&D. This leaves smart weapons projects contending for limited R&D portions within broader procurement commitments.

Complexity in integrating new technologies with existing naval systems

Additionally, integrating advanced smart weapons into existing platforms presents substantial technical complexity. Australia’s military spending was ~ of GDP in 2023, signalling fiscal prioritization of defence but also reflecting constraints relative to overall economic output. Ensuring advanced weapons systems, including guided torpedoes and integrated strike packages, function effectively within multi‑domain naval operations requires extensive systems engineering and interoperability testing. These integration demands place further strain on R&D and testing budgets, challenging developers to balance innovation with platform compatibility and long‑term sustainment.

Opportunities

Adoption of autonomous and AI-driven smart weapons

The adoption of autonomous and AI‑driven smart weapons systems offers a significant opportunity for the Australia Naval Smart Weapons market. With global defence expenditure at US ~ in 2024, defence forces are increasingly prioritizing technologies that enhance situational awareness and autonomous engagement capabilities. Autonomous systems reduce risk to personnel and enable persistent operations in complex maritime environments. Current defence budgets, such as Australia’s AUD ~ allocation in 2025–26, include funding for advanced technologies that dovetail with smart weapon deployment, creating a conducive environment for vendors offering AI and autonomy integration solutions.

Emerging markets for smart weapons in the Indo-Pacific region

Emerging demand for networked weapons systems represents another opportunity. Regional defence budgets, such as Japan’s approval of a US ~ defence budget for 2026, demonstrate a regional trend toward sophisticated weapons procurement. Naval forces are seeking weapons systems that can share targeting data across platforms, enhancing engagement precision. Smart weapons with embedded sensor fusion and network‑enabled capabilities align directly with these requirements, positioning vendors with robust software and communication solutions for increased demand. The growing focus on interconnectivity across naval fleets underscores the future relevance of smart weapons development within established defence frameworks.

Future Outlook

Over the next decade, the Australia Naval Smart Weapons market is set to experience substantial growth, supported by increasing defense spending, the need for more sophisticated naval capabilities, and technological innovations in weapons systems. The Australian government’s focus on modernizing its naval forces, alongside advancements in AI, autonomous weapons, and advanced missile systems, will be key growth drivers. Moreover, the strategic importance of Australia in the Indo-Pacific region will result in a sustained demand for next-generation naval defense systems, positioning Australia as a key player in the global naval smart weapons market.

Major Players

- Lockheed Martin

- BAE Systems

- Raytheon Technologies

- Saab AB

- Northrop Grumman

- Thales Group

- General Dynamics

- L3 Technologies

- Leonardo S.p.A.

- MBDA Missile Systems

- Rheinmetall AG

- Kongsberg Gruppen

- Elbit Systems

- Honeywell International

- Navantia

Key Target Audience

- Defense Ministries

- Naval Forces

- Defense Contractors

- Military Equipment Manufacturers

- Technology Providers

- Military Equipment Procurement Agencies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key variables that influence the Australia Naval Smart Weapons market. This includes understanding the technological developments, market drivers, and government defense policies through secondary research and industry reports.

Step 2: Market Analysis and Construction

Historical data related to the Australia Naval Smart Weapons market will be compiled, focusing on the growth patterns, technological adoption, and military expenditure in the region. This step includes evaluating the impact of past defense contracts and procurement strategies.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations will validate the market hypotheses, providing operational insights from key industry players. Telephone interviews with executives from defense companies will further refine the market analysis, ensuring accuracy and reliability.

Step 4: Research Synthesis and Final Output

The final stage consolidates the findings from primary and secondary research to generate a comprehensive, accurate report on the Australia Naval Smart Weapons market. This phase involves synthesizing data from defense contractors, technology providers, and government bodies to present a clear view of the market’s potential.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Rising defense budgets in Australia and the Asia-Pacific region

Increased focus on naval modernization and smart weapon technologies

Strategic partnerships for defense innovation and technology sharing - Market Challenges

High research and development costs

Complexity in integrating new technologies with existing naval systems

Challenges in adapting to rapidly evolving cyber threats - Opportunities

Adoption of autonomous and AI-driven smart weapons

Emerging markets for smart weapons in the Indo-Pacific region

Technological advancements in energy-efficient weapons - Trends

Growth of naval defense collaboration in the Asia-Pacific

Shift towards hybrid and energy-efficient naval propulsion systems - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Missile Systems

Laser Weapons

Kinetic Energy Weapons

Cyber Weapons

Electromagnetic Railguns - By Platform Type (In Value%)

Naval Surface Vessels

Submarines

Aircraft

Unmanned Aerial Vehicles (UAVs)

Unmanned Underwater Vehicles (UUVs) - By Fitment Type (In Value%)

Retrofit

OEM

Upgrades

Integrated Systems

Standalone Systems - By EndUser Segment (In Value%)

Military

Defense Contractors

Naval Forces

Government Agencies

Research Institutions - By Procurement Channel (In Value%)

Direct Procurement

Defense Procurement Agencies

System Integrators

- Market Share Analysis

- Cross Comparison Parameters (Technology Integration, Research and Development Capabilities, Government Collaboration, Supply Chain Efficiency, Competitive Pricing)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- key players

BAE Systems

Lockheed Martin

Northrop Grumman

Raytheon Technologies

Thales Group

Saab AB

General Dynamics

L3 Technologies

Leonardo S.p.A.

MBDA Missile Systems

Rheinmetall AG

Kongsberg Gruppen

Elbit Systems

Honeywell International

Navantia

- Military’s increasing reliance on advanced smart weapons

- Growth in naval defense contractor collaborations

- Rising demand for next-gen warfare systems by government agencies

- Increasing defense expenditures in the Asia-Pacific region

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035