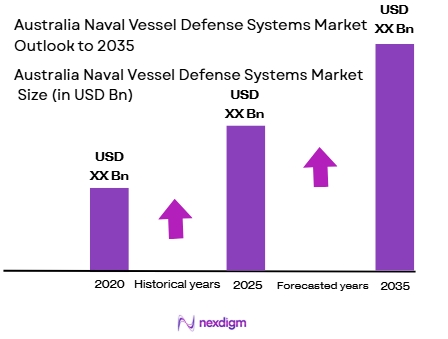

Market Overview

The Australia Naval Vessel Defense Systems market is valued at approximately USD ~billion in 2024, with growth being driven by the ongoing modernization of the Australian Navy and the country’s strategic defense initiatives. The government’s strong commitment to upgrading its naval capabilities to secure maritime borders and enhance defense technology is fueling demand for advanced defense systems in naval vessels. This includes a focus on stealth technology, missile defense systems, and anti-submarine warfare capabilities. Moreover, partnerships with global defense firms and significant defense spending further boost the market. The robust military expenditure is anticipated to drive technological advancements in naval defense systems, contributing to long-term growth in this sector.

Australia remains the dominant country in the naval vessel defense systems market, driven by its strategic location in the Indo-Pacific region and the government’s commitment to defense modernization. The Australian government has embarked on an ambitious plan to enhance its naval fleet through substantial investments in advanced defense technologies. Additionally, other key players such as the United States, Japan, and the United Kingdom contribute to shaping the market, with their defense collaboration and technology transfer agreements influencing the local industry. Major cities like Sydney and Canberra, with their proximity to defense procurement and governmental operations, play a significant role in driving the market forward.

Market Segmentation

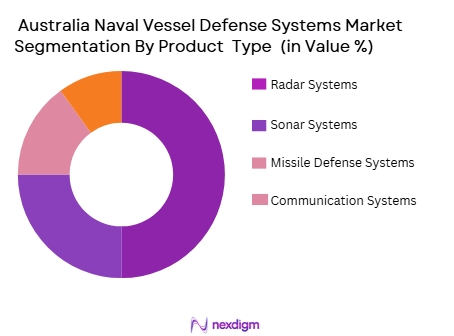

By Product Type

The Australia Naval Vessel Defense Systems market is segmented by product type into radar systems, sonar systems, missile defense systems, and communication systems. Among these, missile defense systems hold the largest share in 2024. The growing need to safeguard Australian naval assets against missile threats, particularly in the Indo-Pacific region where tensions remain high, has led to a surge in demand for these systems. Australia’s defense strategy heavily focuses on modernizing its fleet with advanced missile defense systems to ensure the protection of its territorial waters. As part of this modernization, contracts with global defense giants such as Lockheed Martin and Raytheon have further strengthened the dominance of missile defense systems in the market.

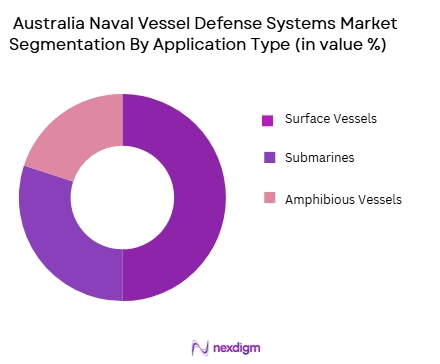

By Application

The market is also segmented by application into surface vessels, submarines, and amphibious vessels. Surface vessels dominate the market in 2024. This is primarily due to Australia’s focus on enhancing the operational capabilities of its surface fleet, which forms the backbone of its naval defense strategy. The Australian Navy has invested in multi-role surface combatants, including frigates and destroyers, to secure its maritime domain. These vessels are equipped with cutting-edge defense systems, such as radar, missile defense systems, and electronic warfare technology, which significantly contribute to the dominance of surface vessels in the naval defense systems market.

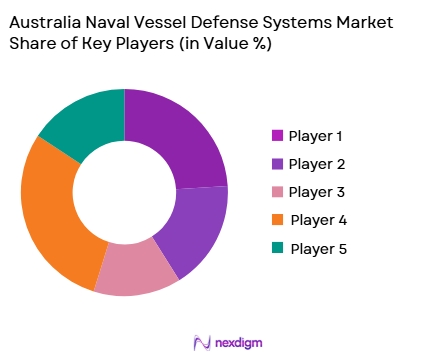

Competitive Landscape

The Australia Naval Vessel Defense Systems market is dominated by a mix of local and international defense companies. This consolidation is driven by the need for advanced technological solutions, and global defense giants play a critical role. The key players in the market include:

| Company Name | Establishment Year | Headquarters | Product Portfolio | Key Partnerships | Innovation Focus | Revenue (USD) | Market Reach | R&D Investments |

| BAE Systems Australia | 1999 | Adelaide, Australia | Shipbuilding, Combat Systems | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | Missile Defense, Sensors | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1989 | Stockholm, Sweden | Submarine Defense Systems | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | Waltham, USA | Air Defense, Missiles | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | Communication Systems, Radar | ~ | ~ | ~ | ~ | ~ |

Australia Naval Vessel Defense Systems Market Analysis

Growth Drivers

Increased Defense Spending and Modernization Programs

Australia’s growing defense budget and modernization initiatives are major growth drivers for the naval vessel defense systems market. The Australian government’s strategic defense plan, under the Defense White Paper and the 2020 Force Structure Plan, focuses on upgrading and expanding the country’s naval fleet with state-of-the-art defense technologies. This includes enhancing existing vessels with advanced weaponry, missile defense systems, and integrated combat management systems, driving demand for advanced naval vessel defense solutions.

Rising Geopolitical Tensions in the Indo-Pacific Region

The rising geopolitical tensions in the Indo-Pacific, particularly with China’s growing naval presence, are fueling the demand for enhanced naval capabilities. Australia’s defense posture is increasingly focused on strengthening its maritime security and maintaining peace in the region. As a result, the Australian Navy is accelerating the procurement and modernization of naval vessels with advanced defense systems, creating a significant market for naval defense technologies.

Market Challenges

High Costs and Budget Constraints

One of the key challenges facing the Australian naval vessel defense systems market is the high cost of advanced defense technologies. Naval vessels equipped with cutting-edge systems such as anti-missile defense, radar systems, and communication technologies require significant capital investment. Despite a rising defense budget, financial constraints and competing priorities may limit the pace of procurement and fleet upgrades, posing challenges for the broader adoption of advanced naval defense systems.

Integration Complexity of New Systems

Integrating new defense systems into existing naval vessels presents a significant challenge. As the Australian Navy modernizes its fleet, the compatibility of new technologies with older systems remains a complex issue. The high cost and technical difficulties associated with retrofitting and system integration, along with ensuring interoperability among different defense systems, can delay projects and add to the overall expenses of naval vessel upgrades and procurements.

Opportunities

Technological Advancements in Naval Systems

Advancements in naval technologies, particularly in autonomous systems, AI, and cyber defense, present substantial opportunities for growth in the Australian naval defense systems market. The integration of autonomous systems for surveillance, reconnaissance, and even combat functions offers the potential for enhanced operational capabilities with reduced crew requirements. These innovations will drive the adoption of new technologies in Australia’s naval vessels, providing opportunities for defense contractors and technology providers to develop and deliver next-generation systems.

International Collaborations and Export Potential

Australia’s strong relationships with international allies, such as the United States and the United Kingdom, present opportunities for collaboration in developing and sharing naval defense technologies. These partnerships can open doors for joint ventures and export opportunities for Australian-made defense systems. With Australia’s strategic location and expanding defense capabilities, there is potential for local companies to engage in global defense contracts, contributing to market growth and technological advancements.

Future Outlook

Over the next five years, the Australia Naval Vessel Defense Systems market is expected to experience substantial growth, driven by the country’s focus on modernizing its naval fleet and maintaining maritime security in the Indo-Pacific region. With increasing defense budgets and technological advancements, Australia will continue investing in state-of-the-art naval vessel systems. The need for next-generation defense systems, particularly missile defense and surveillance technologies, will remain at the forefront, propelling market expansion. Furthermore, international defense partnerships and the enhancement of cyber defense and AI technologies will further shape the sector’s trajectory.

Major Players

- BAE Systems Australia

- Lockheed Martin

- Saab AB

- Raytheon Technologies

- Thales Group

- Northrop Grumman

- Leonardo S.p.A.

- General Dynamics

- Huntington Ingalls Industries

- L3 Technologies

- Damen Shipyards

- Navantia

- Naval Group

- Rolls-Royce

- Rheinmetall Defence

Key Target Audience

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Naval Force Procurement Units

- Defense Contractors

- Technology Providers

- Defense Technology Manufacturers

- Maritime Defense Agencies

- Global Defense Organizations

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves identifying the critical variables that influence the Australia Naval Vessel Defense Systems market. We will gather secondary data from proprietary databases and open-source reports, focusing on technological advancements, market trends, and defense expenditure.

Step 2: Market Analysis and Construction

In this phase, historical data related to naval vessel defense systems will be compiled and analyzed. Key metrics, including market penetration, government expenditure, and technological innovations, will be evaluated to understand past market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts, including representatives from the defense sector. These consultations will provide valuable insights into emerging technologies, procurement strategies, and the future outlook of the market.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing research findings into a comprehensive report. Direct engagements with naval defense manufacturers and defense forces will help verify product segment data, ensuring that all findings are accurate and up-to-date.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing naval defense investments in Australia

Rising defense and naval security concerns in the Indo-Pacific region

Technological advancements in naval defense systems - Market Challenges

High cost of defense procurement

Integration complexity of new defense systems

Geopolitical uncertainties affecting defense spending - Market Opportunities

Growing naval defense spending under Australian defense strategy

International partnerships for defense systems development

Advancements in artificial intelligence and automation for naval defense systems - Trends

Shift towards modular and scalable naval defense systems

Increasing use of autonomous systems in naval defense

Focus on cyber security and electronic warfare in naval systems - Government regulations

Australian defense procurement regulations

International arms trade regulations

Standards for naval defense systems integration - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Surface Combatant Systems

Submarine Defense Systems

Naval Anti-Missile Defense Systems

Naval Communication Systems

Naval Combat Management Systems - By Platform Type (In Value%)

Corvettes

Frigates

Destroyers

Submarines

Amphibious Warfare Vessels - By Fitment Type (In Value%)

OEM Systems

Upgraded Systems

Integrated Systems

Retrofit Systems

Hybrid Systems - By EndUser Segment (In Value%)

Australian Navy

Other Defense Agencies

International Defense Agencies

Commercial Shipping Companies

Naval Research Institutions - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

OEM Partnerships

Defense Distributors

Online Marketplaces

- Cross Comparison Parameters (System Reliability, Operational Range, Defense Capabilities, System Integration Flexibility, Cost of Operation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems

Thales Australia

Lockheed Martin Australia

Raytheon Australia

Navantia

Northrop Grumman

Leonardo Australia

L3 Technologies

Harris Corporation

SAAB Australia

Elbit Systems

DCNS Group

General Dynamics

Kongsberg Gruppen

Huntington Ingalls Industries

- Australian Navy’s strategic defense initiatives

- Collaborations between Australian Navy and international defense agencies

- Growing role of private defense contractors in naval procurement

- Increasing demand for advanced naval defense systems from international markets

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035