Market Overview

The Australia Naval Vessels Maintenance, Repair, and Overhaul (MRO) market is valued at approximately USD ~ billion in 2024. The market is driven by ongoing modernization and maintenance programs for the Australian Navy’s fleet, which includes frigates, destroyers, and submarines. The need to extend the operational life of naval vessels, enhance their readiness, and ensure compliance with international naval standards fuels demand for MRO services. Additionally, defense spending by the Australian government and strategic investments in maintaining and upgrading existing vessels contribute significantly to the growth of the market. The Australian government’s commitment to strengthening its naval defense forces ensures continued demand for high-quality MRO services.

Australia is the dominant player in the Naval Vessels MRO market, largely due to its extensive naval fleet and strategic maritime defense requirements. Major cities such as Sydney and Perth play a crucial role in the market due to their proximity to naval bases and shipyards. Sydney, being home to the Australian Navy’s Fleet Base East, serves as a key hub for naval vessel operations, including MRO services. Perth, with its strategic location near the Indian Ocean, also houses key facilities for naval vessel maintenance. The Australian government’s ongoing investments in naval modernization ensure that these cities remain central to the growth of the MRO market.

Market Segmentation

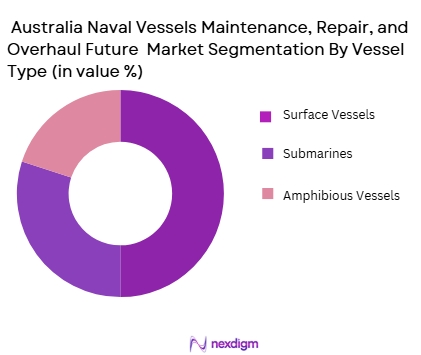

By Vessel Type

The Australia Naval Vessels MRO market is segmented by vessel type into surface vessels, submarines, and amphibious vessels. Among these, surface vessels hold the largest market share in 2024. The Australian Navy operates a large number of surface vessels, including destroyers, frigates, and patrol boats, which require regular maintenance, repair, and overhaul services to ensure their operational readiness. The Australian government’s investment in modernizing its surface fleet with advanced technologies, such as new radar systems and missile defense systems, further fuels the demand for MRO services for these vessels. Surface vessels play a key role in securing Australia’s maritime borders, which increases the focus on maintaining their peak performance.

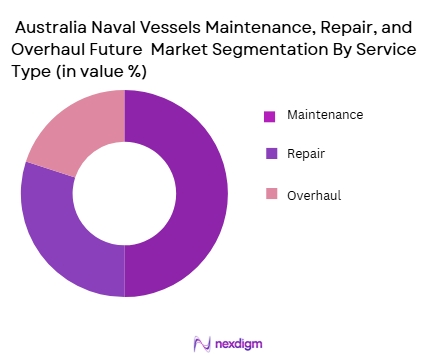

By Service Type

The market is also segmented by service type into maintenance, repair, and overhaul. Maintenance services dominate the market in 2024. The ongoing need to keep naval vessels operational without major breakdowns makes maintenance a continuous requirement. The Australian Navy prioritizes regular servicing and preventive maintenance to extend the lifespan of its vessels, avoid unplanned repairs, and ensure the safety of personnel onboard. Moreover, maintenance services are essential for ensuring that naval vessels are combat-ready and compliant with both national and international regulations. As the Australian Navy modernizes its fleet, the demand for proactive maintenance services continues to rise, maintaining the dominance of this segment.

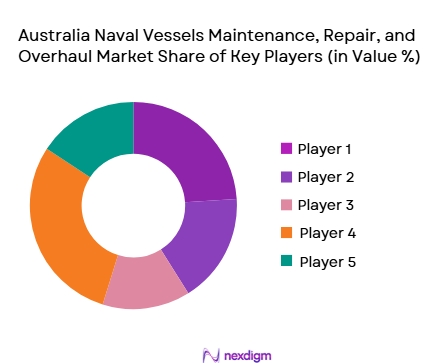

Competitive Landscape

The Australia Naval Vessels MRO market is dominated by several key players, including BAE Systems Australia, Saab Australia, ASC Pty Ltd, Navantia, and Austal. These companies are leading the market due to their extensive experience in naval vessel maintenance and repair, their established relationships with the Australian government, and their ability to provide comprehensive, high-quality MRO services. BAE Systems Australia, for example, is a significant player due to its ongoing contracts with the Australian Department of Defence for fleet support and modernization. The presence of these large defense contractors underscores the competitive nature of the market, where players must maintain high levels of expertise and technological capability to secure contracts.

| Company Name | Establishment Year | Headquarters | Product/Service Focus | Key Partnerships | Innovation Focus | Revenue (USD) | Market Reach | R&D Investments |

| BAE Systems Australia | 1999 | Adelaide, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1989 | Melbourne, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| ASC Pty Ltd | 1985 | Adelaide, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

| Navantia | 2000 | Madrid, Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Austal | 1988 | Henderson, Australia | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Naval Vessels Maintenance, Repair, and Overhaul Market Analysis

Growth Drivers

Rising Defense Budgets and Modernization of Naval Fleet:

The Australian government has significantly increased defense spending over the past few years, especially in relation to naval capabilities. This growth in the defense budget is aimed at modernizing the country’s naval fleet, which is essential for maintaining a strong maritime defense posture in the Indo-Pacific region. As a result, there is a rising demand for maintenance, repair, and overhaul (MRO) services to ensure that naval vessels remain operational and technologically advanced. Regular upgrades and repairs are crucial for extending the lifespan of aging assets, enabling them to meet current operational demands. This consistent investment in fleet readiness drives demand for MRO services, leading to growth in the Australian Naval Vessels MRO market.

Technological Advancements and Complex Systems Integration:

The increasing complexity of naval vessels, driven by the integration of advanced technologies like AI, drones, and sophisticated navigation systems, has created a growing need for specialized MRO services. Modern naval vessels often operate on intricate systems that require high-level expertise and advanced equipment to maintain. The demand for technical expertise in maintaining these complex systems is propelling growth in the MRO market. As technology evolves, vessels need frequent upgrades and specialized repairs, thus ensuring long-term demand for maintenance services. This shift toward more advanced technologies in naval vessels has made it an essential driver for the growth of the MRO market in Australia.

Market Challenges

Skills Shortage in the Workforce:

One of the significant challenges facing the Australian Naval Vessels MRO market is the shortage of skilled labor. As naval vessels become more technologically advanced, the demand for skilled technicians and engineers capable of servicing these vessels also grows. However, there is a gap in the workforce, with insufficient numbers of skilled personnel available to meet the increasing demand for MRO services. The shortage of qualified labor impacts the efficiency of maintenance programs and results in delays, which can affect the operational readiness of the fleet. Addressing this skills gap through training and recruitment is crucial for the continued growth of the MRO market.

High Maintenance Costs and Budget Constraints:

While Australia has increased its defense budget, maintaining a modern fleet can still be a costly endeavor. The cost of MRO services for naval vessels is often high, due to the specialized equipment, materials, and skilled labor required. Budget constraints within the defense sector can limit the availability of funds for necessary repairs and upgrades, leading to deferred maintenance, which might compromise the operational readiness of the fleet. The high cost of naval vessel MRO services can also limit the ability to keep all ships in peak condition, leading to challenges in fleet management.

Opportunities

Expansion of Strategic Partnerships with Private Sector:

Australia has opportunities to expand its collaboration with the private sector for MRO services. By partnering with established private companies that specialize in naval vessel maintenance, the Australian government can enhance the efficiency of its MRO programs. These partnerships offer opportunities for cost-effective maintenance solutions, leveraging private sector innovation and resources. Additionally, the involvement of private companies can help mitigate the shortage of skilled labor, as these companies can provide specialized expertise and technologies. This collaboration can also result in quicker turnaround times for vessel repairs and enhancements, ensuring the fleet is maintained at optimal readiness levels.

Increased Investment in Research and Development for Sustainable MRO Solutions:

Another key opportunity for growth in the Australian Naval Vessels MRO market is the focus on sustainable and innovative MRO solutions. As the Australian defense industry moves toward greener practices, there is an increasing emphasis on sustainable materials and energy-efficient technologies in naval vessel operations. Investment in research and development (R&D) to develop these new technologies can lead to more cost-effective and environmentally friendly MRO solutions. By adopting advanced materials, digital diagnostics, and predictive maintenance systems, Australia’s naval fleet can reduce maintenance costs and downtime, while also improving the overall efficiency and longevity of its vessels. This focus on R&D could open up significant growth prospects for MRO services in Australia’s naval sector.

Future Outlook

Over the next five years, the Australia Naval Vessels MRO market is expected to witness significant growth. This growth will be driven by the Australian government’s ongoing commitment to modernizing its naval fleet, which will require extensive MRO services to maintain the operational readiness of vessels. The continued investment in advanced technologies, including autonomous systems and cyber defense capabilities, will further increase the demand for specialized maintenance and overhaul services. Additionally, the expansion of the Australian Navy’s presence in the Indo-Pacific region and the need to secure maritime borders will result in the increased importance of maintaining a high level of fleet readiness, ensuring a sustained demand for MRO services.

Major Players

- BAE Systems Australia

- Saab Australia

- ASC Pty Ltd

- Navantia

- Austal

- Rolls-Royce

- General Dynamics

- Huntington Ingalls Industries

- L3 Technologies

- Northrop Grumman

- Thyssenkrupp Marine Systems

- Damen Shipyards

- Lockheed Martin

- Rheinmetall Defence

- Leonardo S.p.A.

Key Target Audience

- Government and Regulatory Bodies

- Investment and Venture Capitalist Firms

- Naval Procurement and Modernization Units

- Defense Contractors

- Technology Providers

- Maintenance and Repair Contractors

- Defense Technology Manufacturers

- Military Maritime Agencies

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify the key variables driving the Australia Naval Vessels MRO market, focusing on governmental investments, fleet modernization programs, and technological developments. Data is collected from secondary sources like government reports, defense industry publications, and proprietary databases.

Step 2: Market Analysis and Construction

Historical data related to naval vessel MRO services in Australia will be analyzed, including data on procurement, fleet composition, and historical maintenance schedules. This analysis will help assess the growth trajectory of the market and identify key trends influencing the demand for MRO services.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with experts in the naval defense sector, including representatives from the Australian Department of Defence, defense contractors, and MRO service providers. This will help refine market assumptions and validate findings.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and expert insights into a detailed market report. This report will be reviewed by stakeholders in the defense sector to ensure the accuracy and relevance of the findings, ensuring the market analysis reflects the current dynamics of the Australia Naval Vessels MRO market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense spending in Australia

Ongoing fleet modernization programs

Technological advancements in shipbuilding and maintenance - Market Challenges

High maintenance and repair costs

Dependency on foreign suppliers for advanced technologies

Complexity of integrating new systems with existing naval vessels - Market Opportunities

Expansion of shipyard capabilities in Australia

Government initiatives to boost local defense production

Technological advancements in automation and predictive maintenance - Trends

Increase in demand for life-cycle support and extended vessel uptime

Growing focus on sustainability and eco-friendly maintenance practices

Rise in autonomous systems for naval vessel maintenance - Government regulations

Australian defense procurement regulations

Shipbuilding and maintenance standards in the Australian Navy

Environmental regulations for naval vessel operations - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Hull Maintenance Systems

Engine Maintenance Systems

Combat Systems Maintenance

Communication Systems Maintenance

Other Specialized Systems - By Platform Type (In Value%)

Corvettes

Frigates

Destroyers

Submarines

Amphibious Warfare Vessels - By Fitment Type (In Value%)

OEM Systems

Upgraded Systems

Integrated Systems

Retrofit Systems

Hybrid Systems - By EndUser Segment (In Value%)

Royal Australian Navy (RAN)

Other Australian Defense Agencies

International Defense Agencies

Commercial Vessels

Private Defense Contractors - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

OEM Partnerships

Defense Distributors

Third-Party Suppliers

- Cross Comparison Parameters (Service Reliability, Turnaround Time, Maintenance Cost, Technological Expertise, Cost of Spare Parts,Technical Expertise, Turnaround Time, Cost Efficiency, Dry-Dock Facilities, Regulatory Compliance, Quality Assurance Standards, Digital Maintenance Capabilities, Predictive Maintenance Technology)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems Australia

Navantia Australia

Thales Australia

Lockheed Martin Australia

DCNS Australia

Rheem Australia

Saab Australia

Northrop Grumman Australia

Raytheon Australia

L3 Technologies

General Dynamics

BAE Systems Submarines

Huntington Ingalls Industries

Kongsberg Gruppen

Mitsubishi Heavy Industries

- Royal Australian Navy’s strategic shipbuilding and maintenance needs

- Growing collaboration between Australian shipyards and international contractors

- Increase in commercial interest for defense-grade maintenance services

- Private defense contractors investing in long-term ship maintenance contracts

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035