Market Overview

The Australia naval vessels market has witnessed a steady increase in investments and modernization efforts, driven by the country’s strategic defense needs and its rising defense budget. The market size for naval vessels in Australia, valued at USD ~billion in 2023, is supported by the government’s focus on maintaining a strong maritime defense presence in the Indo-Pacific region. The modernization and upgrade of aging fleets, alongside the demand for cutting-edge defense systems, contributes significantly to market growth. Increased defense spending over the years has helped in boosting the naval vessel maintenance, repair, and overhaul (MRO) market, further fueling the need for advanced vessels.

Australia remains a dominant player in the naval vessels sector due to its strategic location in the Indo-Pacific region and its substantial defense budget allocation. Sydney, Melbourne, and Perth are key cities driving the market, with Sydney being a major hub for naval procurement and MRO activities. Melbourne plays a crucial role in shipbuilding, while Perth houses the critical naval defense infrastructure. Australia’s advanced technology integration and ongoing investments in fleet modernization have solidified its position as a leader in the naval vessels market within the region.

Market Segmentation

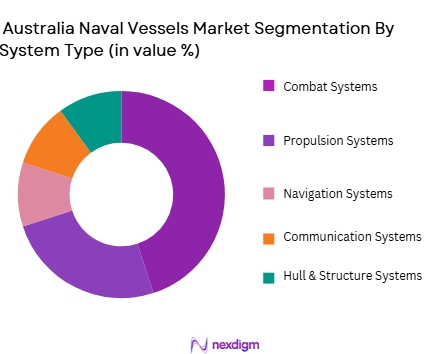

By System Type

The Australia naval vessels market is segmented by system type into combat systems, propulsion systems, navigation systems, communication systems, and hull & structure systems. Among these, combat systems hold a dominant market share due to the rising need for advanced defense systems in naval vessels. With ongoing geopolitical tensions and maritime security concerns in the Indo-Pacific, Australia has significantly invested in strengthening its combat systems to enhance operational readiness and defense capabilities. Modern combat systems, including radar, weaponry, and missile systems, are integral to Australia’s naval fleet and are critical in addressing regional security challenges.

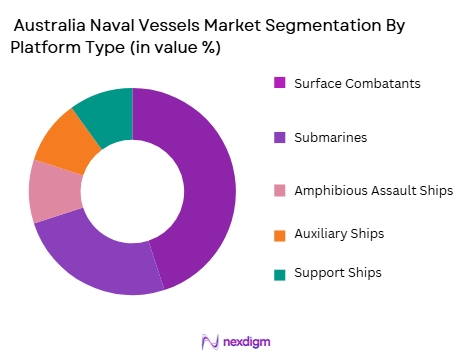

By Platform Type

The naval vessels market in Australia is also segmented by platform type into surface combatants, submarines, amphibious assault ships, auxiliary ships, and support ships. Surface combatants dominate the market as Australia focuses on enhancing its fleet of warships, including destroyers and frigates. These vessels are crucial for maintaining maritime security and are often equipped with advanced combat systems, making them vital to Australia’s defense strategy. Additionally, the country is investing in surface combatant technologies to address threats in the Indo-Pacific region.

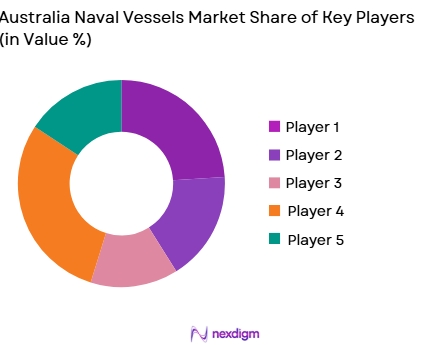

Competitive Landscape

The Australia naval vessels market is primarily dominated by a few major players, including local manufacturers and international defense contractors. Companies such as ASC Pty Ltd, BAE Systems Australia, and Navantia Australia are key contributors to the naval vessel sector. These companies are involved in shipbuilding, maintenance, and the development of advanced naval technologies. The consolidation of key players in the market highlights the strategic importance of naval defense in Australia. The strong presence of international companies such as Lockheed Martin and Raytheon further underscores the competitive landscape.

| Company Name | Establishment Year | Headquarters | Annual Revenue (USD) | Key Product/Service | Fleet Size | Defense Contracts |

| ASC Pty Ltd | 1986 | Adelaide | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1958 | Melbourne | ~ | ~ | ~ | ~ |

| Navantia Australia | 2007 | Sydney | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Raytheon Australia | 1922 | Canberra | ~ | ~ | ~ | ~ |

Australia Naval Vessels Market Analysis

Growth Drivers

Increased Defense Spending and Fleet Modernization

Australia has made significant investments in its defense sector, particularly in modernizing its naval fleet. The government has committed substantial funds to replace aging vessels and develop new, more advanced naval systems, including advanced submarines and surface combatants. These efforts are driven by the need to maintain a strategic maritime presence in the Indo-Pacific region, particularly given increasing regional security concerns. The upgrade and expansion of Australia’s naval fleet have resulted in increased demand for maintenance, repair, and overhaul (MRO) services, which are expected to continue driving the growth of the naval vessel market through 2035. With a continued focus on advanced technology, defense budgets are likely to remain strong, providing sustained growth for the industry.

Geopolitical Tensions and Regional Security Concerns

Rising geopolitical tensions in the Indo-Pacific region, driven by the increasing assertiveness of China and other regional powers, have spurred Australia to strengthen its naval capabilities. As a key member of regional security alliances such as the Quad, Australia is focused on enhancing its maritime defense posture. This geopolitical shift has led to a greater emphasis on bolstering naval defense, creating sustained demand for advanced naval vessels. As tensions continue, Australia will likely invest more in both shipbuilding and fleet maintenance to maintain operational readiness. Consequently, the need for modern naval vessels and their maintenance is expected to grow significantly, contributing to the market’s expansion.

Market Challenges

Skilled Labor Shortage and Workforce Demographics

One of the significant challenges for Australia’s naval vessels market is the shortage of skilled labor. As naval vessels become more technologically advanced, the demand for specialized labor to design, maintain, and repair these systems increases. However, the Australian workforce is facing an aging demographic, and there is a limited influx of new talent with the required technical expertise in advanced maritime technologies. This skills gap may slow down the production and maintenance of vessels, affecting the efficiency of defense projects. To address this challenge, the country will need to invest in training programs and initiatives to attract and retain younger, skilled workers in the naval defense industry.

High Maintenance Costs and Budget Constraints

The cost of maintaining a modern naval fleet is high, and this poses a challenge to the Australian naval vessels market. With the need for regular repairs, upgrades, and specialized services, the ongoing maintenance of naval vessels requires substantial financial resources. Additionally, budget constraints within the defense sector may limit the ability to allocate sufficient funds to sustain the fleet in optimal operational conditions. The financial burden of maintaining advanced naval systems might delay necessary upgrades, potentially reducing the fleet’s effectiveness and readiness. Overcoming this challenge will require strategic financial planning and prioritization of critical defense investments.

Opportunities

Technological Advancements in Naval Systems

Advancements in technology present a significant opportunity for Australia’s naval vessels market. The integration of cutting-edge technologies such as artificial intelligence (AI), robotics, and predictive maintenance systems can significantly improve the operational efficiency of naval vessels. These technologies enhance vessel performance, reduce maintenance costs, and improve fleet longevity. Furthermore, digital transformation and automation in shipbuilding and vessel maintenance can provide a competitive edge in the market. As Australia continues to prioritize technological innovation in defense, opportunities for incorporating advanced systems into its naval fleet and expanding the MRO market will continue to grow.

Strategic Defense Partnerships and Collaborations

Australia’s increasing focus on defense partnerships with nations like the United States, the United Kingdom, and regional allies offers significant growth opportunities for the naval vessels market. Collaborative defense projects, such as joint naval exercises, technology exchanges, and shared MRO initiatives, can lead to the transfer of cutting-edge technologies and best practices. Additionally, these partnerships could result in long-term contracts for the maintenance and upgrading of naval fleets. As Australia strengthens its defense relationships, these partnerships will help enhance the technological capabilities of the fleet and foster economic growth through increased investment in naval vessels.

Future Outlook

Over the next decade, the Australia naval vessels market is expected to experience steady growth driven by continuous government investment in defense capabilities, modernization of the naval fleet, and technological advancements. Australia’s strategic location in the Indo-Pacific region and its increased defense budget will support the development of cutting-edge naval vessels. Additionally, the demand for MRO services will continue to grow as the fleet is modernized and older vessels are upgraded to meet emerging security threats. The integration of advanced technologies such as AI, automation, and predictive maintenance will further bolster the market’s growth potential.

Major Players

- ASC Pty Ltd

- BAE Systems Australia

- Navantia Australia

- Lockheed Martin

- Raytheon Australia

- Austal Limited

- Huntington Ingalls Industries

- L3 Technologies Australia

- Thales Australia

- Rheinmetall Defence Australia

- General Dynamics Bath Iron Works

- Saab Australia

- Fincantieri Australia

- Mitsubishi Heavy Industries

- Northrop Grumman Australia

Key Target Audience

- Government Agencies

- Naval Contractors

- Shipbuilders

- Research Institutions

- Security Agencies

- Investments and Venture Capitalist Firms

- Regulatory Bodies

- Commercial and Private Sector Operators

Research Methodology

Step 1: Identification of Key Variables

The first step involves gathering and defining the primary variables influencing the Australia naval vessels market. This includes an assessment of current naval assets, defense budget allocation, and geopolitical factors, using both secondary research from reputable sources and primary data collection from defense agencies.

Step 2: Market Analysis and Construction

Data from historical trends, defense procurement records, and shipbuilding activities will be analyzed. This step will also include evaluating market penetration rates, ongoing contracts, and expenditure patterns, offering a clear picture of the current market dynamics and its components.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations, including interviews with naval contractors, defense officials, and key industry players, will validate initial hypotheses. These consultations help refine assumptions and provide valuable insights from the industry to ensure data accuracy.

Step 4: Research Synthesis and Final Output

After data validation, the research findings will be synthesized to present a comprehensive report. This includes engagement with major naval industry players and further cross-referencing of statistics to ensure the robustness of the analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising defense budgets and modernization of naval fleet

Increasing geopolitical tensions in the Indo-Pacific region

Adoption of advanced technologies and digital systems - Market Challenges

High maintenance costs and budget constraints

Skilled labor shortage and technical expertise gap

Intense competition from regional and global defense players - Market Opportunities

Expansion of strategic partnerships with private sector

Growth in predictive and condition-based maintenance services

Increasing demand for sustainable naval systems and green technologies - Trends

Integration of AI and automation in naval maintenance

Shift towards modular and flexible maintenance systems

Growing emphasis on cybersecurity in naval vessels - Government regulations

Defense Procurement Act (Australia)

Naval Vessel Sustainability Regulations

Maritime Safety and Pollution Prevention Standards - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Combat Systems

Propulsion Systems

Navigation Systems

Communication Systems

Hull & Structure Systems - By Platform Type (In Value%)

Surface Combatants

Submarines

Amphibious Assault Ships

Auxiliary Ships

Support Ships - By Fitment Type (In Value%)

Newbuild

Retrofit

Upgrade

Refurbishment

Overhaul - By EndUser Segment (In Value%)

Government & Defense

Naval Contractors

Shipbuilders

Research Institutions

Security Agencies - By Procurement Channel (In Value%)

Direct Procurement

Tendering & Bidding

Private Contracts

Government Funding

International Collaboration

- Cross Comparison Parameters (System complexity, Procurement channels, Regional influence, Technological innovation, Contract length)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

ASC Pty Ltd

BAE Systems Australia

Navantia Australia

Thales Australia

Rheinmetall Defence Australia

Raytheon Australia

Huntington Ingalls Industries

Lockheed Martin Australia

Naval Group Australia

Downer EDI

Australian Submarine Corporation

L3 Technologies Australia

Austal Limited

Hewlett Packard Enterprise

General Dynamics Bath Iron Works

- Government & defense agencies focusing on naval fleet readiness

- Naval contractors looking for specialized MRO services

- Shipbuilders investing in long-term vessel life-cycle support

- Research institutions leveraging naval vessels for technological development

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier.2026-2035

- Future Demand by Platform,2026-2035