Market Overview

The Australia Network Centric Warfare market is valued at USD ~ billion in 2023, with continued investments from the Australian government driving growth across defense systems. This market’s growth is primarily influenced by the increasing need for modernized, highly efficient communication, surveillance, and warfare technologies. Military forces seek more integrated systems to enhance operational effectiveness in defense and security, creating a demand for advanced network-centric warfare solutions. Additionally, ongoing military modernization programs and the expanding defense budget bolster the market’s expansion, contributing to the market’s expected steady growth.

Australia stands at the forefront of the network-centric warfare market, with major cities like Canberra, Sydney, and Melbourne playing key roles in its development. These cities house defense contractors, research centers, and governmental agencies driving innovation. Australia’s geographical position and growing defense strategy in the Indo-Pacific region make it a dominant player in the network-centric warfare sector. The collaboration between the government and defense contractors, coupled with increasing regional security concerns, positions Australia as a key player in the market.

Market Segmentation

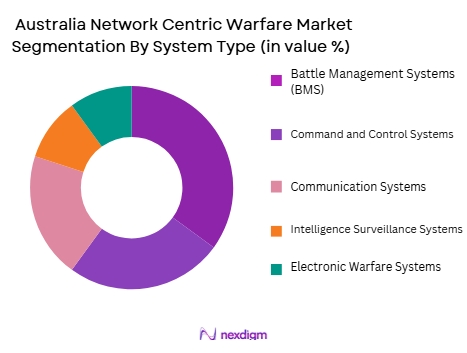

By System Type

The Australia Network Centric Warfare market is segmented into various system types such as battle management systems, communication systems, electronic warfare systems, intelligence surveillance and reconnaissance systems, and command and control systems.

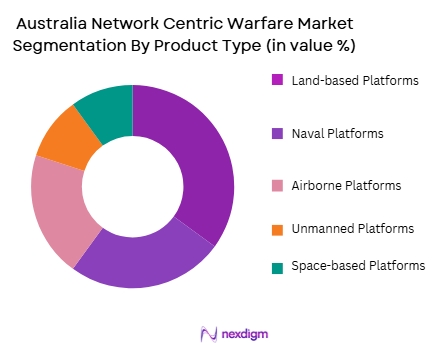

By Platform Type

dominate this segment, driven by the extensive usage of military ground vehicles that support network-centric operations in remote locations. The Australian Army places significant emphasis on enhancing land-based platforms due to their versatility and mobility, especially in complex operational environments.

Competitive Landscape

The Australia Network Centric Warfare market is dominated by several major players that shape the competitive landscape. The market sees both local companies and international giants contributing to the growth. Companies like BAE Systems Australia, Thales Australia, and Lockheed Martin Australia are at the forefront, offering a range of network-centric warfare solutions that cater to the specific needs of the Australian military. These companies have significant influence due to their established presence, technological capabilities, and long-term government partnerships.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technology Offering | Government Contracts | R&D Investments | Market Reach |

| BAE Systems Australia | 1952 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 1999 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin Australia | 2003 | Melbourne, Australia | ~ | ~ | ~ | ~ | ~ |

| Raytheon Australia | 1999 | Melbourne, Australia | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman Australia | 2003 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

Australia Network Centric Warfare Market Analysis

Growth Drivers:

Technological Advancements in Military Communications

The evolution of military communication technologies, such as secure satellite communications, artificial intelligence, and machine learning, is a key driver of the network-centric warfare market in Australia. These technologies enable real-time data sharing and collaboration across various military units and command centers. Enhanced connectivity allows the Australian Defense Force (ADF) to operate in a more efficient, flexible, and responsive manner, significantly improving situational awareness and decision-making. As the Australian military continues to modernize its operations, the demand for advanced communication and surveillance systems in network-centric warfare will continue to grow, providing opportunities for further innovation and investment in this market.

Increased Defense Budget and Strategic Shifts

Australia’s growing defense budget, coupled with its strategic shifts towards ensuring greater defense autonomy and security in the Indo-Pacific region, will boost demand for network-centric warfare systems. The country’s emphasis on modernization and the need for interoperability between various defense partners is driving investment in advanced technologies like drones, cybersecurity, and sensors. The Australian government’s long-term investment plans for defense will be crucial in sustaining market growth, as it prioritizes integrating cutting-edge systems to maintain a competitive edge in regional security.

Market Challenges:

Cybersecurity and Data Protection Risks

One of the main challenges for Australia’s network-centric warfare market is ensuring robust cybersecurity in a highly interconnected defense environment. The increasing reliance on digital networks and cloud systems for military operations exposes the ADF to cyberattacks, data breaches, and other vulnerabilities. As warfare becomes more network-based, securing communication channels and protecting sensitive information against cyber threats will be crucial. The evolving nature of cyber threats demands continuous investment in resilient cybersecurity frameworks, creating challenges in maintaining the integrity of defense operations.

High Costs of Integration and Maintenance

Integrating network-centric warfare systems into existing military infrastructure and maintaining them over time represents a significant financial burden. The high costs associated with acquiring, upgrading, and integrating diverse communication, surveillance, and information-sharing technologies can strain the defense budget. Additionally, ongoing maintenance and the need for constant software updates and system repairs add to the costs, making it challenging for the Australian government to sustain and enhance its network-centric warfare capabilities in the long run.

Opportunities:

Public-Private Partnerships (PPPs) for Technological Innovation

There is a growing opportunity for public-private partnerships (PPPs) to advance network-centric warfare systems in Australia. By collaborating with leading technology companies, the Australian government can access cutting-edge innovations in communication, AI, and cybersecurity, as well as benefit from reduced development costs. These partnerships also allow for faster implementation of new technologies into the defense sector, enhancing the effectiveness and efficiency of network-centric warfare strategies. Furthermore, such collaborations may foster long-term growth in the defense industry, creating employment and economic opportunities within Australia.

Expanding Role of Autonomous Systems

Autonomous systems such as unmanned aerial vehicles (UAVs), underwater drones, and AI-based decision support systems present significant opportunities for Australia’s network-centric warfare market. These technologies can enhance surveillance, reconnaissance, and precision strikes while reducing the risks to human personnel. As autonomous systems become more advanced and integrated into the Australian defense strategy, their deployment in complex operations will drive the demand for network-centric warfare systems. This creates a promising avenue for market growth, particularly in the development of AI-powered solutions for battlefield operations and intelligence gathering.

Future Outlook

Over the next decade, the Australia Network Centric Warfare market is poised for substantial growth. This growth will be fueled by continued defense modernization, technological advancements in AI, and Australia’s increasing focus on securing its defense capabilities in the face of emerging geopolitical challenges. Additionally, the government’s commitment to expanding the defense budget and fostering innovation within the defense sector ensures a robust demand for network-centric warfare technologies. The market will see steady advancements in communications, command control, and surveillance systems, which will enhance operational efficiency and interoperability within defense forces.

Major Players

- BAE Systems Australia

- Thales Australia

- Lockheed Martin Australia

- Raytheon Australia

- Northrop Grumman Australia

- L3 Technologies

- General Dynamics Australia

- Harris Corporation

- Leonardo DRS

- Kongsberg Defence & Aerospace

- Elbit Systems Australia

- Saab Australia

- Boeing Australia

- Rheinmetall Defence Australia

- Leidos Australia

Key Target Audience

- Ministry of Defence

- Australian Defence Force

- Department of Homeland Security

- Military Contractors and Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Prime Contractors in the Defense Industry

- Aerospace and Defence Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying critical market variables, such as the primary defense systems in use, technological advancements, and key government stakeholders. This is achieved through secondary research, including a review of government publications, defense contracts, and market reports, to develop a clear picture of the current state and trends within the network-centric warfare market.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled to assess past market performance, focusing on the types of systems, platforms, and procurement channels prevalent in the Australian market. This includes an analysis of revenue generation, key defense projects, and the extent of technological adoption, all of which are essential for building reliable market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted with military officers, industry professionals, and key players in the Australian defense sector to validate the hypotheses drawn from initial data. These discussions ensure that the market projections align with current and future industry expectations, providing deeper insights into product demand and technological advancements.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from multiple sources, including industry reports, expert interviews, and market analysis. The research methodology will be refined further through collaboration with technology providers, manufacturers, and end-users to validate findings and ensure that the market report is comprehensive and accurate.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budget Allocations

Technological Advancements in Communication Systems

Growing Demand for Cybersecurity in Warfare - Market Challenges

High Initial Investment Costs

Complex Integration Requirements

Security Concerns in Network Communication - Market Opportunities

Rise in Cyber Warfare Threats

Increased Collaboration between Public and Private Sectors

Development of Autonomous Warfare Systems - Trends

Growth of Artificial Intelligence in Warfare Systems

Development of Integrated Multi-Platform Networks

Focus on Green and Energy-Efficient Systems - Government regulations

Defense Procurement Guidelines

Cybersecurity Legislation for Military Systems

Export Control Regulations for Military Technologies - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Battle Management Systems

Command and Control Systems

Communication Systems

Intelligence Surveillance and Reconnaissance Systems

Electronic Warfare Systems - By Platform Type (In Value%)

Land-based Platforms

Naval Platforms

Airborne Platforms

Space-based Platforms

Unmanned Platforms - By Fitment Type (In Value%)

Onboard Systems

Ground Stations

Mobile Systems

Fixed Infrastructure

Portable Units - By EndUser Segment (In Value%)

Defense Forces

Government & Intelligence Agencies

Private Sector Security

Research Institutions

Telecommunication Providers - By Procurement Channel (In Value%)

Direct Purchases

Government Tenders

Public-Private Partnerships

OEM Sales

Third-Party Vendors

- Cross Comparison Parameters (System Complexity, Procurement Channels, Platform Types, Fitment Types, System Types, Current Capabilities vs. Global Trends, Future Technologies Adoption)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems Australia

Thales Australia

Lockheed Martin Australia

Northrop Grumman Australia

Raytheon Australia

L3 Technologies

General Dynamics Australia

Harris Corporation

Hewlett Packard Enterprise

Leonardo DRS

Kongsberg Defence & Aerospace

Elbit Systems Australia

Saab Australia

Boeing Australia

Rheinmetall Defence Australia

- Increasing demand for advanced network systems from military agencies

- Growing need for integrated defense technologies

- Adoption of commercial off-the-shelf solutions by private companies

- Rising interest from academia in military technology research

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035