Market Overview

The Australia on board connectivity market is poised for steady growth, driven by increasing demand for high-speed internet and enhanced communication systems in transportation platforms, particularly aircraft and trains. Based on a recent historical assessment, the market size for 2024 is estimated at USD ~ billion, primarily influenced by advancements in satellite communication and the proliferation of connected devices. As consumer expectations for in-flight and onboard experiences rise, companies in this sector are focusing on providing seamless connectivity solutions.

Australia’s dominance in the market is shaped by its robust aviation and railway sectors, coupled with significant investments in infrastructure development. The country’s strategic geographic location also contributes to its competitive edge, as it serves as a key transit hub in the Asia-Pacific region. Cities like Sydney and Melbourne are pivotal to the market due to their well-developed transportation infrastructure, which includes modern airports and high-speed rail systems. Australia’s regulatory environment also supports the growth of onboard connectivity solutions.

Market Segmentation

By Product Type

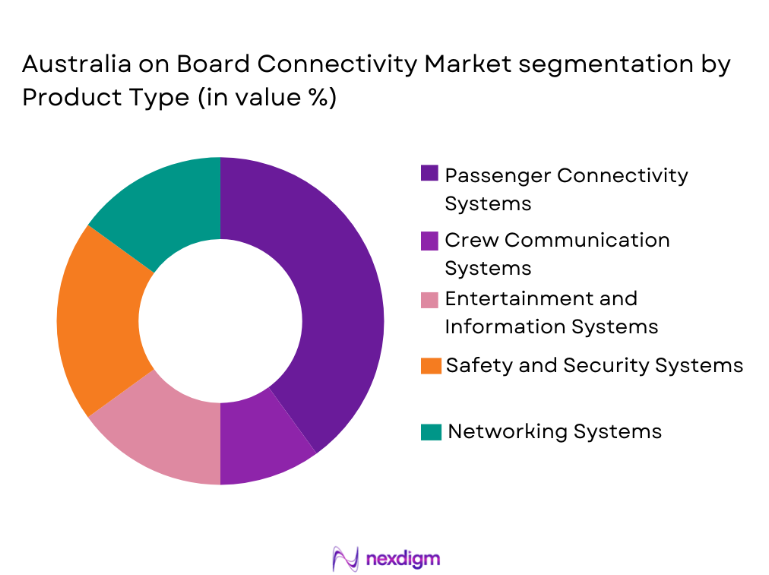

The Australia onboard connectivity market is segmented by product type into passenger connectivity systems, crew communication systems, entertainment and information systems, safety and security systems, and networking systems. Passenger connectivity systems have the dominant market share, driven by increasing demand from both business and leisure travelers for continuous and high-speed internet during their journeys. Airlines and train operators are focusing on providing seamless connectivity to improve the travel experience, enhance customer satisfaction, and remain competitive. The widespread use of mobile devices, laptops, and other connected technologies among passengers has further fueled this demand. These systems enable real-time access to social media, video streaming, emails, and even business operations, ensuring that passengers remain connected at all times. Additionally, airlines and transport operators are investing in technologies such as Wi-Fi systems, satellite communication, and 5G integration to meet the growing expectations of passengers. As passenger experience continues to be a key differentiator, the demand for high-quality connectivity services is expected to remain strong, driving growth in this sub-segment.

By Platform Type

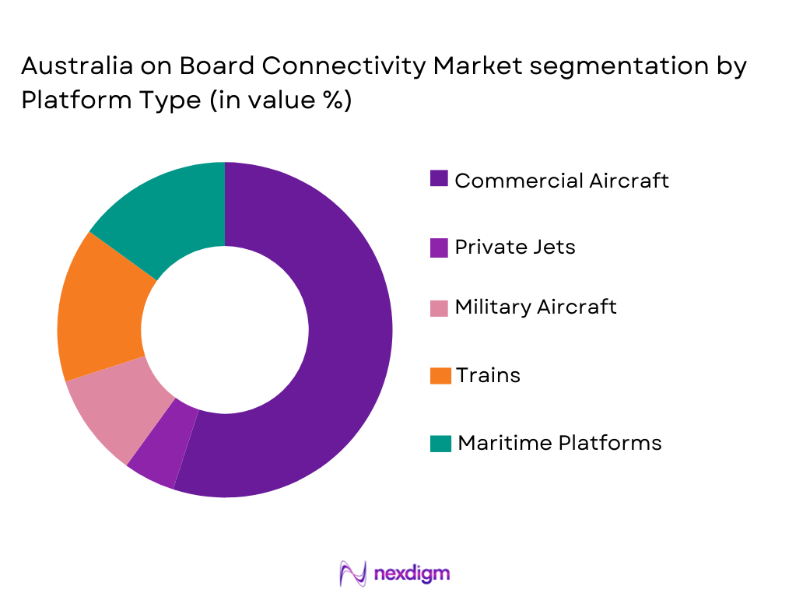

The Australia onboard connectivity market is also segmented by platform type into commercial aircraft, private jets, military aircraft, trains, and maritime platforms. The commercial aircraft segment holds the dominant market share, largely driven by the increasing volume of both domestic and international air travel. As air passenger numbers continue to rise, airlines are under pressure to enhance passenger satisfaction through improved onboard services, particularly connectivity. Travelers expect uninterrupted internet access for work, entertainment, and communication, making high-speed, reliable Wi-Fi a necessary service. The competition among airlines to offer better connectivity options is increasing as passengers demand more robust services. Furthermore, the expansion of low-cost carriers and the increase in regional flights are contributing to the growth of the commercial aircraft segment. The integration of satellite communication and 5G technology into aircraft ensures seamless service, allowing airlines to meet passenger expectations and stay competitive in the market. The other platform types, such as private jets and trains, also benefit from increased demand for reliable connectivity, but the commercial aircraft segment remains the primary contributor to market growth.

Competitive Landscape

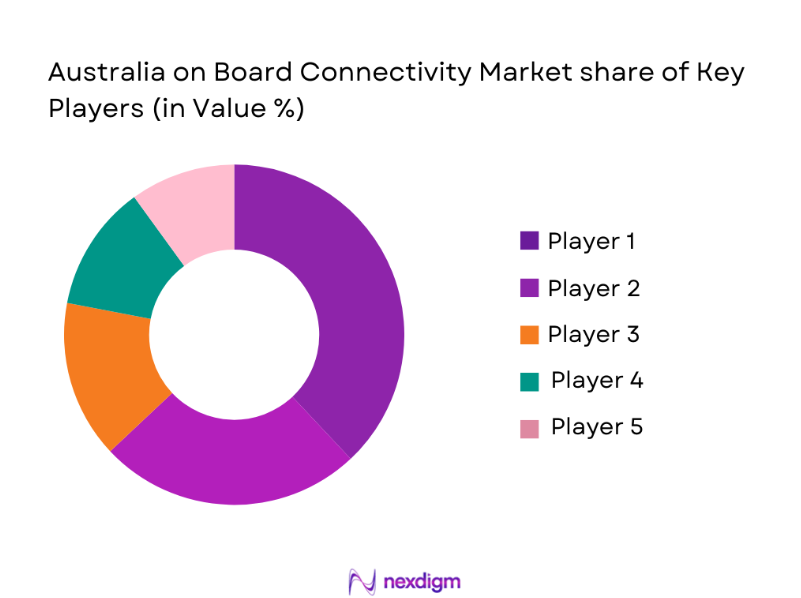

The competitive landscape in the Australia on board connectivity market is characterized by a high level of consolidation with major players providing cutting-edge technology solutions to meet the growing demand. Leading companies are focusing on innovation, partnerships, and expanding their market reach. As demand for connectivity services continues to rise, these key players are leveraging their technological expertise and robust infrastructure to cater to both consumer and business needs.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Market Parameter |

| Viasat Inc. | 1986 | Carlsbad, CA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Inmarsat | 1979 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Charlotte, NC | ~ | ~ | ~ | ~ | ~ |

| Panasonic Avionics | 1979 | Osaka, Japan | ~ | ~ | ~ | ~ | ~ |

Australia On-Board Connectivity Market Analysis

Growth Drivers

Increased Demand for Seamless Passenger Experience

One of the primary growth drivers for the Australia onboard connectivity market is the increasing demand for seamless connectivity solutions from passengers. With the rise of mobile devices, laptops, and other connected technologies, passengers now expect uninterrupted and high-speed internet access while traveling, whether by air or rail. This trend is particularly evident in the aviation sector, where business and leisure travelers alike rely on Wi-Fi for a range of activities such as streaming, browsing, working remotely, or staying connected with family and friends. As technology continues to advance, the gap between in-flight and ground-based connectivity is narrowing, and passengers now expect onboard internet to be as reliable as the one they have at home or in the office. This heightened expectation for continuous connectivity is propelling transport providers to implement or upgrade onboard systems that can accommodate these needs. The demand for high-speed internet and advanced in-flight entertainment systems is now a key factor in differentiating airlines and transportation providers in a competitive market. Furthermore, the increase in remote working has contributed significantly to the growing demand for reliable internet during travel. With employees frequently required to be on the move, whether for business trips or commuting, staying connected to their work is crucial. This factor has led companies and governments to prioritize the improvement of onboard connectivity services in order to meet these demands. Alongside the demand for seamless connectivity, the growth of digital services such as video calls, social media, and cloud computing is contributing to the increasing need for fast, reliable internet services, further reinforcing the demand for high-quality onboard connectivity systems. These factors combined make seamless connectivity a fundamental requirement for airlines, rail operators, and other transportation companies, driving market growth.

Advancements in Connectivity Technology

Technological innovation, particularly in satellite communications and the implementation of 5G technology, has significantly influenced the growth of the Australia onboard connectivity market. Over the last few years, advancements in satellite communication technology, particularly low Earth orbit (LEO) satellite constellations, have played a crucial role in improving the quality and speed of onboard connectivity. LEO satellites, with their low altitude and rapid orbiting capabilities, offer near-continuous global coverage, even in remote areas where traditional communication systems fail to provide reliable service. This technological advancement has not only enhanced the connectivity experience for passengers but has also allowed service providers to extend their reach to new regions, particularly over oceans and in sparsely populated areas. Satellite technology has also become more affordable, allowing smaller operators to access these services and extend connectivity to underserved regions. In addition, the ongoing rollout of 5G networks is set to transform onboard connectivity solutions by providing faster internet speeds, lower latency, and increased reliability, further boosting the passenger experience. The high bandwidth and low latency offered by 5G technology will enable a seamless connection for high-definition streaming, cloud computing, gaming, and video conferencing, all of which are increasingly popular among travelers. Moreover, the integration of 5G with Internet of Things (IoT) devices onboard allows for the implementation of new services such as real-time data tracking, predictive maintenance, and personalized entertainment. As 5G and satellite communications continue to advance, they provide a powerful platform for expanding and enhancing the connectivity offerings of airlines, rail operators, and other transport sectors, thus driving growth in the market. These advancements in technology are helping transportation providers offer a differentiated and higher-value service to passengers, resulting in continued market expansion.

Market Challenges

High Infrastructure and Setup Costs

The significant infrastructure and installation costs required to provide and maintain onboard connectivity systems are a major challenge for the Australia onboard connectivity market. Establishing high-speed, reliable internet services in transportation systems such as aircraft and trains necessitates substantial upfront investment in satellite communication systems, onboard network hardware, and the technologies needed to ensure a smooth and continuous connection. The implementation of these systems often requires retrofitting existing transport vehicles with specialized hardware, which incurs significant expenses. Additionally, integrating next-generation communication technologies such as 5G and satellite systems requires both high investment and expertise, further complicating the process for smaller service providers. While larger companies may have the financial resources to absorb these costs, smaller airlines, rail operators, and private transport providers often struggle to compete due to the substantial financial burden posed by these infrastructure demands. The installation of satellite connectivity systems, which require large-scale infrastructure investments, is especially expensive for smaller entities. The need for ongoing maintenance, updates to hardware, and software upgrades to meet changing standards further increases the financial demands on operators. For example, regular upgrades to satellite and communication systems to keep up with technological advancements are a necessity, which adds to the overall cost of providing connectivity services. Furthermore, ensuring that the connectivity system functions properly across a variety of geographic regions, particularly in remote or rural areas, can require additional infrastructure investments. All of these costs, including equipment and installation, lead to increased operational expenses and potentially higher service charges, making it more difficult for operators to offer affordable pricing for passengers. These high costs can also hinder the growth of new entrants in the market, limiting the competitiveness of the industry.

Cybersecurity and Data Privacy Risks

Data security and privacy concerns represent a significant challenge in the Australia onboard connectivity market. As the demand for onboard Wi-Fi and internet services increases, so does the volume of sensitive data being transmitted over these networks. Passengers often provide personal information, such as payment details, travel itineraries, and even health data, while using onboard services. This data is vulnerable to cyber threats such as hacking, phishing, and data breaches, which can compromise user privacy and lead to severe reputational and financial damage for transport providers. Ensuring secure data transmission over onboard connectivity systems is not only crucial for protecting passengers but also for maintaining regulatory compliance. Various data privacy regulations, including the European Union’s General Data Protection Regulation (GDPR) and Australia’s own privacy standards, require transportation providers to implement strict security measures and obtain informed consent for data collection and usage. The dynamic nature of cybersecurity threats means that transport companies must continually update their security protocols to protect against new risks, which adds to operational complexities. This ongoing need for enhanced cybersecurity measures can also increase costs for airlines, rail operators, and other transport providers, as they must invest in more advanced security technologies, encryption methods, and secure communication channels. With the increasing sophistication of cyberattacks, transport providers must prioritize the implementation of robust defense systems, which includes encryption of customer data, secure networks for transmitting sensitive information, and continuous monitoring of connectivity systems for potential threats. As a result, managing cybersecurity and ensuring passenger data privacy remain critical challenges for the onboard connectivity market in Australia, particularly as the sector continues to grow and attract more digital consumers.

Opportunities

Expansion of Regional Connectivity in Underserved Areas

One of the most significant opportunities in the Australia onboard connectivity market is the expansion of connectivity services to regional and underserved areas. While major cities like Sydney and Melbourne have robust connectivity infrastructure, many rural and remote areas still face challenges in accessing reliable internet services, particularly on transport modes such as airplanes and trains. This gap presents a substantial opportunity for service providers to offer high-quality, high-speed internet to these areas, fulfilling the growing demand for digital services in less-connected regions. The Australian government is increasingly investing in infrastructure to improve connectivity in remote areas, which aligns with the market opportunity for transport providers to tap into these regions. Providing reliable onboard connectivity in these areas could bridge the digital divide, allowing rural residents to access online services, remote work opportunities, and educational resources. Additionally, this expansion could cater to the growing tourism industry, where both domestic and international travelers seek seamless internet access while exploring remote locations. For airlines and rail operators, this expansion into underserved areas can open up new revenue streams and provide a competitive edge over rivals that focus only on metropolitan routes. With more passengers in remote areas seeking connectivity, this untapped market presents a significant opportunity for growth. Furthermore, offering high-quality internet access in these regions would align with Australia’s broader push for digital inclusion, enabling access to critical services like telemedicine, online banking, and distance learning. Given the increasing reliance on the internet across various sectors, airlines and rail operators investing in regional connectivity will benefit from improved customer satisfaction and increased patronage from both business and leisure travelers in rural regions.

Integration of 5G and IoT for Innovative Services

Another major opportunity in the Australia onboard connectivity market lies in the integration of 5G technology and the Internet of Things (IoT) into transport connectivity systems. 5G is poised to revolutionize the onboard experience by offering ultra-fast internet speeds, low latency, and high reliability, enabling passengers to stream high-definition video, play real-time online games, and engage in video conferencing without the buffering or connectivity interruptions typically associated with older technologies. This next-generation connectivity will be particularly beneficial for business travelers who require consistent, high-speed internet for remote work or meetings during their travels. The rollout of 5G will allow service providers to enhance passenger experience through seamless connectivity, transforming how people work and interact while traveling. In addition to improved internet access, the integration of IoT within transportation platforms provides another opportunity to deliver innovative services. IoT allows for the collection and analysis of real-time data, enabling predictive maintenance of aircraft, trains, and other transport vehicles. This data-driven approach helps prevent potential malfunctions and delays, improving operational efficiency and safety, which directly enhances the passenger experience. IoT also offers the ability to provide personalized services to passengers by analyzing their behavior and preferences. For example, IoT can track a passenger’s previous in-flight entertainment choices and suggest similar options, or adjust seating preferences automatically, providing a tailored experience for each traveler. Furthermore, IoT-enabled systems can optimize onboard operations, such as monitoring seat occupancy and ensuring optimal service during peak travel times. As 5G and IoT technologies become more mainstream, the integration of these innovations in the onboard connectivity market will not only improve passenger satisfaction but also boost operational efficiency for transport providers, offering significant growth potential for companies that can successfully implement these technologies. This opportunity positions transport companies to lead the market by offering cutting-edge, personalized, and seamless connectivity experiences.

Future Outlook

The future of the Australia on board connectivity market is optimistic, with continuous growth anticipated in the next five years. Technological advancements, including the rollout of 5G networks and the expansion of satellite communications, are expected to drive substantial improvements in connectivity quality and speed. Increased demand for seamless travel experiences and reliable internet access will fuel the market, with passenger expectations for in-flight and onboard connectivity continuing to rise. As infrastructure improves and regional connectivity expands, the market is poised to grow further, offering significant opportunities for innovation and investment. Regulatory support and consumer adoption will play key roles in shaping the market’s trajectory, as service providers align their offerings with evolving technological standards and consumer demands.

Major Players

- Viasat Inc.

- Thales Group

- Inmarsat

- Honeywell International

- Panasonic Avionics

- Gogo Inc.

- Iridium Communications

- Global Eagle

- Rockwell Collins

- SITAONAIR

- L3 Technologies

- Zodiac Aerospace

- Mitsubishi Electric

- Aptiv PLC

- Garmin Ltd.

Key Target Audience

- Airlines and aviation companies

- Train operators

- Marine operators

- Government and regulatory bodies

- Private transport operators

- Satellite communication service providers

- Connectivity system providers

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying and defining key variables that influence the onboard connectivity market in Australia. This includes market drivers, technological trends, consumer preferences, regulatory factors, and geographical influences. By understanding these variables, a clearer picture of market dynamics can be established. This also involves reviewing historical data, conducting industry analysis, and pinpointing emerging trends that could impact the market.

Step 2: Market Analysis and Construction

In this step, a comprehensive market analysis is performed, utilizing both primary and secondary research sources. The goal is to segment the market by product type, platform type, end-users, and procurement channels. The construction of a detailed market model follows, incorporating insights gained from industry reports, surveys, and expert consultations. This provides a foundational framework for understanding current market conditions and future growth trends.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed during the market analysis phase are validated through consultations with industry experts, stakeholders, and market leaders. This includes discussions with key players, regulatory bodies, and technology providers. Expert feedback ensures the accuracy of assumptions and helps refine the market model. The validation process involves cross-referencing primary data with expert opinions to confirm the viability of the findings and ensure consistency across different market perspectives.

Step 4: Research Synthesis and Final Output

The final step synthesizes all collected data, integrating insights from market analysis, expert consultations, and secondary research into a cohesive report. This step involves translating the research findings into actionable market insights and strategic recommendations. The synthesis process also includes forecasting future market trends, highlighting key growth opportunities, and addressing challenges. The final output is a comprehensive market report that serves as a valuable resource for stakeholders.

- Executive Summary

- Australia on Board Connectivity Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for high-speed internet on transportation platforms

Rising passenger expectations for seamless connectivity

Growth of e-commerce and online services driving demand for logistics connectivity

Technological advancements in satellite and Wi-Fi infrastructure

Government support for smart city and connected transportation projects - Market Challenges

High infrastructure costs for integrating connectivity solutions

Regulatory complexities and approval delays in the aerospace sector

Lack of standardization across different platforms and regions

Security concerns with data transmission and privacy breaches

Challenges in maintaining connectivity in remote or rural areas - Market Opportunities

Expansion of 5G and next-gen connectivity technologies

Strategic partnerships between connectivity providers and vehicle manufacturers

Integration of on-board entertainment with connectivity services - Trends

Growing adoption of IoT-enabled connectivity solutions

Shift towards hybrid satellite and terrestrial communication networks

Demand for enhanced cybersecurity for connected platforms

Integration of AI and machine learning in connectivity management

Rise of autonomous and connected vehicles demanding higher connectivity - Government Regulations & Defense Policy

Regulations for satellite communication in aerospace

Government-backed initiatives for public transport modernization

Defense-related applications driving on-board communication needs - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Passenger Connectivity Systems

Crew Communication Systems

Entertainment and Information Systems

Safety and Security Systems

Networking Systems - By Platform Type (In Value%)

Commercial Aircraft

Private Jets

Military Aircraft

Trains

Maritime Platforms - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Aftermarket Solutions

Upgraded Systems

Integrated Solutions - By EndUser Segment (In Value%)

Commercial Airlines

Public Transport Services

Passenger Vehicles

Private Aviation

Cargo and Freight Services - By Procurement Channel (In Value%)

Direct Procurement

Distribution Channels

OEM Partnerships

Online Platforms

Third-Party Distributors - By Material / Technology (in Value%)

Advanced Antenna Systems

Communication Satellites

IoT Integration

Cloud-Based Solutions

Hybrid Communication Systems

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Market Value, Installed Units, System Complexity, Platform Type, Fitment Type, Procurement Channel, Regional Expansion, End-User Focus)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Thales Group

Viasat

Panasonic Avionics

Gogo

Harris Corporation

Intelsat

Inmarsat

Eutelsat

Honeywell Aerospace

Global Eagle Entertainment

Zodiac Aerospace

Aptiv

Skycast Solutions

Airbus

SES Networks

- Demand for connectivity solutions from the aviation sector

- Public transport sector investing in enhanced user experiences

- Private vehicles integrating in-car connectivity for better customer experience

- Adoption of real-time tracking and communication in logistics

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035