Market Overview

The Australia Parachute market is valued at approximately USD ~, driven by robust demand in both military and civilian sectors. The growth of the market is influenced by technological innovations in parachute design, increased investment in defense systems, and rising popularity of recreational parachuting activities. Additionally, government and defense initiatives continue to support the development of advanced parachute systems for military and search-and-rescue operations, further boosting the market’s overall size.

Key cities such as Sydney and Melbourne dominate the Australian parachute market due to their established aerospace and defense sectors, high recreational skydiving activity, and strong tourism infrastructure. These cities benefit from a combination of favorable regulations, a growing number of military training operations, and active civilian skydiving communities. Their prominence is further supported by the presence of leading manufacturers and strong logistical networks, positioning them as hubs for both civilian and military parachuting needs.

Market Segmentation

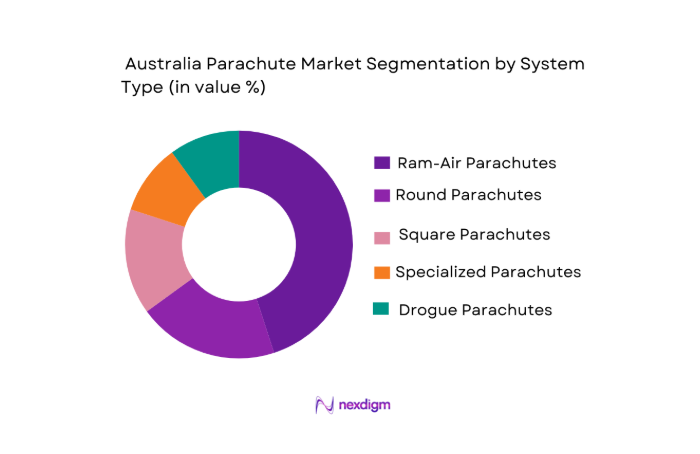

By System Type

The Australian parachute market is segmented by system type into round parachutes, square parachutes, ram-air parachutes, specialized parachutes, and drogue parachutes. Among these, ram-air parachutes have a dominant market share due to their superior performance, reliability, and versatility in various applications. These parachutes, widely used in both military and civilian sectors, offer stable and controlled descent, making them highly favored for skydiving, search-and-rescue, and military operations. The adoption of ram-air parachutes is further fueled by advancements in materials and designs, which enhance safety and maneuverability.

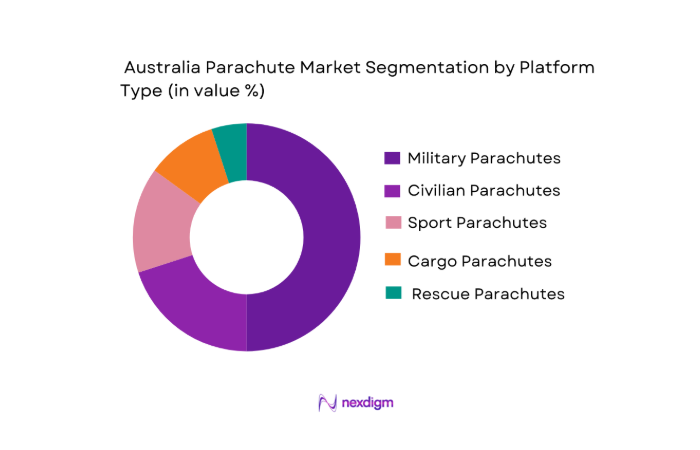

By Platform Type

The market is further segmented by platform type into military parachutes, civilian parachutes, sport parachutes, cargo parachutes, and rescue parachutes. Military parachutes hold the largest share in the market due to the high demand for tactical, specialized, and high-performance systems in defense operations. The growing investments in defense and military training, coupled with increasing security concerns, drive the demand for military-grade parachutes. Additionally, the evolution of advanced parachute systems that meet specific mission requirements, such as high-altitude, high-opening (HAHO) jumps and high-speed deployments, sustains the dominance of this segment.

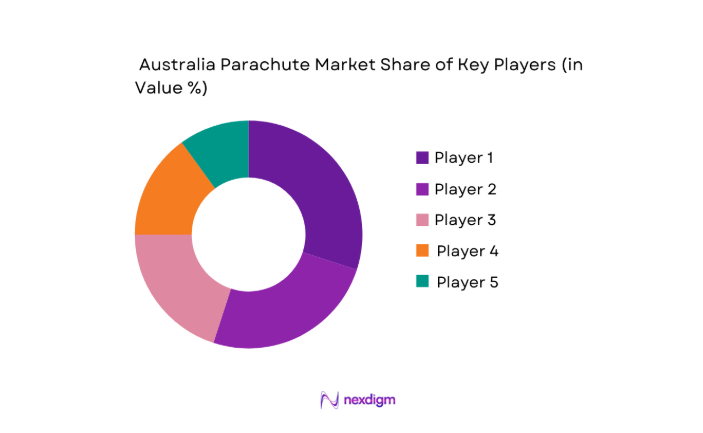

Competitive Landscape

The Australian parachute market is dominated by key players, including both local and international companies. These companies have established strong market positions due to their innovations in design and materials, coupled with their experience in military, recreational, and industrial applications. Notable players in the market include Airborne Systems, Performance Designs, and Skydive Australia. These companies are known for their high-quality products, advanced technology, and wide distribution networks, which cater to both defense and civilian parachuting needs.

| Company Name | Establishment Year | Headquarters | Product Range | Technological Innovation | Market Reach | Distribution Channels | Government Contracts | Customer Service | Industry Partnerships | Price Competitiveness |

| Airborne Systems | 1981 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Performance Designs | 1982 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Skydive Australia | 1990 | Australia | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| United Parachute Tech. | 1980 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| National Parachute Ind. | 1975 | USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Parachute Market Analysis

Growth Drivers

Increase in Military and Defense Investments

Military and defense spending in Australia has seen a steady increase, with the Australian government allocating approximately AUD ~ for defense spending in 2024. This represents about ~ of the country’s GDP, highlighting the government’s focus on strengthening defense capabilities. A large portion of this budget is directed towards modernizing military equipment and training systems, which includes investments in specialized equipment such as parachutes for airborne operations. According to the Australian Department of Defence, this continued growth in defense spending is expected to drive the demand for high-performance parachute systems.

Rising Popularity of Skydiving and Parachute Sports

Skydiving in Australia has witnessed an upward trajectory, with the Australian Parachute Federation reporting more than 300,000 tandem skydiving jumps annually in recent years. This surge in recreational parachuting is driven by factors such as increased disposable income and a growing interest in adventure sports. As a result, the demand for sport parachutes has risen significantly. According to the Australian Bureau of Statistics, consumer expenditure on recreational activities has increased by ~ in 2024, contributing to the expansion of parachuting sports. This trend is expected to sustain and amplify the market for parachutes.

Market Challenges

High Cost of Advanced Parachute Systems

The cost of advanced parachute systems remains a key challenge, especially for military and commercial operators. The Australian Department of Defence reports that the price of specialized military parachutes can exceed AUD ~ per unit due to the complex materials, designs, and manufacturing processes involved. Additionally, the initial investment in advanced parachute technology, including training, maintenance, and operational integration, further adds to the cost burden. With the rising adoption of high-performance parachutes, defense budgets and private sector investments must account for these high upfront costs.

Regulatory Barriers and Compliance Standards

The parachute market is subject to stringent regulations, particularly in the civilian and defense sectors. The Civil Aviation Safety Authority (CASA) enforces regulations that govern parachute design, certification, and usage in Australia. Compliance with these standards, which includes safety measures, technical specifications, and periodic inspection requirements, can significantly slow down market entry for new products. As a result, companies need to invest in extensive research, development, and regulatory approvals, which raises operational costs. These regulatory barriers can hinder the rapid adoption of innovative parachute systems, particularly in the civilian market.

Opportunities

Rising Demand for Parachute Training and Safety Courses

As skydiving and parachute sports grow in popularity, there is a corresponding rise in the demand for professional parachute training and safety courses. The Australian Parachute Federation (APF) has seen a ~ increase in membership and instructor-led training sessions in 2024, indicating strong market growth. With increased public awareness of the importance of safety in high-risk activities, more individuals are seeking certified training programs. Furthermore, the Australian Department of Defence has also increased funding for military parachute training programs, ensuring that both civilian and defense sectors require ongoing educational and safety programs. These trends provide significant opportunities for growth in the parachute training market.

Expansion of Military Applications in Emerging Economies

As defense forces in emerging economies enhance their airborne capabilities, the demand for parachute systems is expected to increase. Australia’s defense industry is actively involved in exporting parachuting technologies and training systems to nations with emerging military needs. The Australian Department of Defence is supporting the expansion of military applications through collaborations with countries in Southeast Asia and the Pacific, where military budgets are increasing. This international market expansion is expected to create growth opportunities for Australian parachute manufacturers and service providers, further driving the market forward.

Future Outlook

Over the next 5 years, the Australian parachute market is poised for significant growth, driven by increased military investments, advancements in parachute technology, and rising consumer interest in recreational parachuting. The ongoing evolution of parachute materials, along with innovations in automation and smart technologies, will likely enhance the efficiency and safety of parachute systems. Additionally, as the demand for military and search-and-rescue applications continues to rise, Australia’s defense sector is expected to remain a key contributor to market expansion.

Major Players

- Airborne Systems

- Performance Designs

- Skydive Australia

- United Parachute Technologies

- National Parachute Industries

- Atair Aerospace

- Para-Flite

- Sun Path Products

- DSE Parachute Systems

- Skydive Dubai

- Aerodyne Research

- Cimarron Parachute Company

- Flyin’ High

- Vargas Parachute Company

- Chamberlain Aerospace

Key Target Audience

- Defense and Military Agencies

- Commercial Parachute Operators

- Adventure Tourism Companies

- Emergency Rescue and Search Agencies

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace Manufacturers

- Parachute Equipment Retailers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves gathering data from multiple reliable sources, including primary and secondary research, to identify the key drivers and restraints influencing the Australian parachute market. These include technological advancements, defense spending, and market demands.

Step 2: Market Analysis and Construction

Historical data on market performance, sales figures, and consumption trends will be compiled and analyzed to construct an accurate market size estimation. The analysis will cover both military and civilian parachute applications, focusing on segment-specific data.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with industry experts, including parachute manufacturers, distributors, and military personnel. Expert interviews will help refine assumptions and ensure accurate forecasting.

Step 4: Research Synthesis and Final Output

In this phase, a detailed report will be compiled, synthesizing all data and expert inputs. The final report will provide actionable insights into market trends, growth projections, and key challenges.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Increase in Military and Defense Investments

Rising Popularity of Skydiving and Parachute Sports

Technological Advancements in Parachute Design - Market Challenges

High Cost of Advanced Parachute Systems

Regulatory Barriers and Compliance Standards

Weather Dependency and Operational Limitations - Opportunities

Rising Demand for Parachute Training and Safety Courses

Expansion of Military Applications in Emerging Economies

Development of Smart Parachutes with IoT Integration - Trends

Increased Adoption of Automated Parachute Systems

Growing Popularity of Eco-friendly and Sustainable Materials - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Round Parachutes

Square Parachutes

Ram-air Parachutes

Specialized Parachutes

Drogue Parachutes - By Platform Type (In Value%)

Military Parachutes

Civilian Parachutes

Sport Parachutes

Cargo Parachutes

Rescue Parachutes - By Fitment Type (In Value%)

Backpacks

Chest-mounted Parachutes

Side-mounted Parachutes

Tandem Parachutes

Personal Parachutes - By EndUser Segment (In Value%)

Military Forces

Commercial Parachute Operators

Sport and Recreation Enthusiasts

Search and Rescue Teams

Aerospace and Aviation - By Procurement Channel (In Value%)

Direct Sales

Distributors and Dealers

Online Sales

- Market Share Analysis

- Cross Comparison Parameters (Market Share, Product Range, Pricing Strategies, Geographic Presence, Technological Innovation)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Para-Flite

DSE Parachute Systems

Airborne Systems

National Parachute Industries

Atair Aerospace

Skydive Australia

Performance Designs

Cimarron Parachute Company

Vargas Parachute Company

United Parachute Technologies

Flyin’ High

ChutingStar

Sun Path Products

Skydive Dubai

Chamberlain Aerospace

Aerodyne Research

- Demand for Military Parachutes in Defense Operations

- Growth of Civilian Parachuting as a Recreational Activity

- Increasing Use of Parachutes in Emergency Rescue Operations

- Technological Advancements in Parachute Design and Functionality

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035