Market Overview

The Australia passenger emergency oxygen deployment systems market is valued at USD ~ based on recent historical analysis. The market is driven by growing demand for advanced safety measures in the aviation industry, increased air traffic, and stringent safety regulations imposed by aviation authorities. This growth is further fueled by advancements in oxygen delivery systems, including portable and fixed oxygen systems, ensuring effective emergency responses during flight emergencies. The market’s expansion is also supported by rising consumer awareness regarding safety standards and passenger well-being.

Australia dominates the market primarily due to its well-established aviation infrastructure and adherence to international aviation safety standards. Key cities such as Sydney, Melbourne, and Brisbane are central to the market’s growth, driven by their high volume of international and domestic flights, along with significant investments in aviation safety technology. The country’s strict regulatory environment ensures that airlines prioritize passenger safety, further driving the adoption of emergency oxygen systems.

Market Segmentation

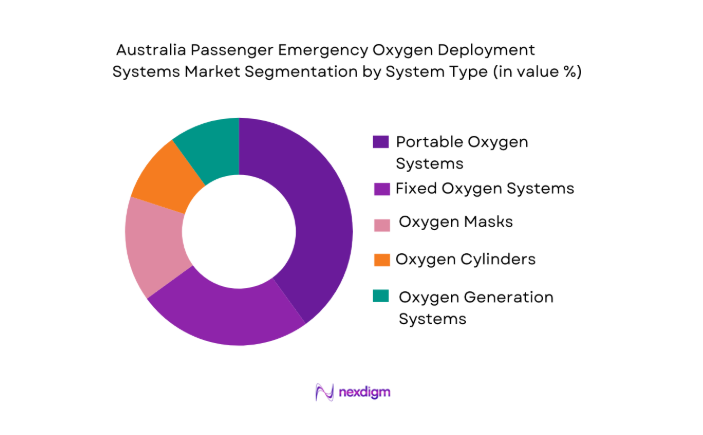

By System Type

The Australia passenger emergency oxygen deployment systems market is segmented by system type into portable oxygen systems, fixed oxygen systems, oxygen masks, oxygen cylinders, and oxygen generation systems. Among these, portable oxygen systems hold a dominant market share, primarily due to their increasing usage in emergency medical situations. Portable systems are favored for their flexibility, ease of use, and ability to deliver oxygen in a controlled and efficient manner during an emergency. Their growing adoption in both commercial and private aircraft highlights the segment’s dominance.

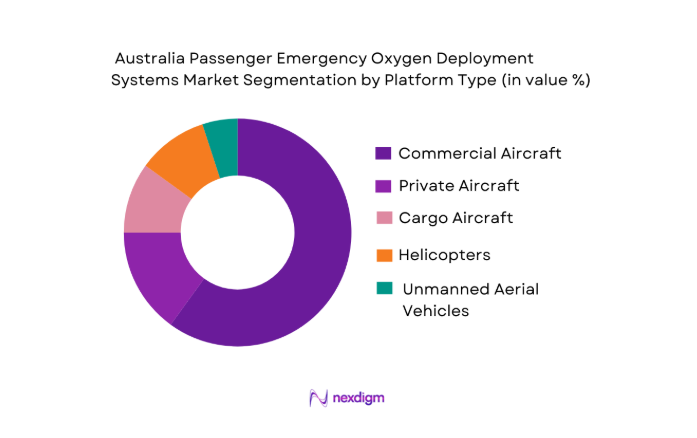

By Platform Type

The market is also segmented by platform type, which includes commercial aircraft, private aircraft, cargo aircraft, helicopters, and unmanned aerial vehicles. Commercial aircraft dominate this segment due to the high number of international and domestic flights operating in Australia. These aircraft require comprehensive oxygen deployment systems to meet stringent aviation safety standards, particularly in emergency situations. The continued expansion of commercial aviation and the increasing focus on passenger safety contribute to the strong performance of this segment.

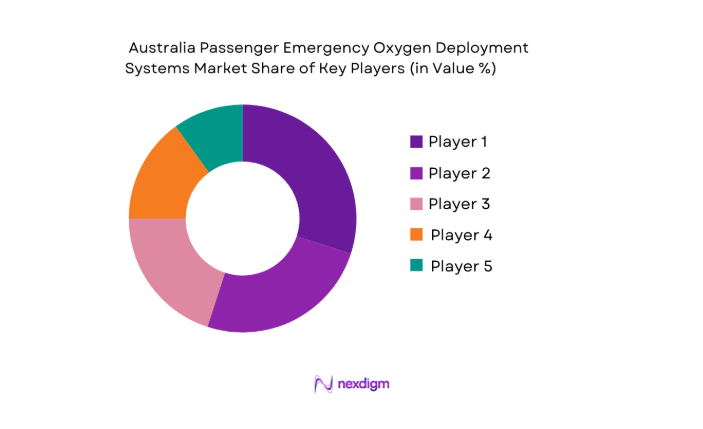

Competitive Landscape

The Australia passenger emergency oxygen deployment systems market is characterized by a competitive landscape dominated by a few major players. These include global and regional companies specializing in aviation safety systems, such as B/E Aerospace, Honeywell Aerospace, and Rockwell Collins. These companies are key contributors to the market due to their ability to develop and deploy state-of-the-art oxygen systems that meet the stringent safety regulations of the aviation industry.

The market is consolidated with major players focusing on innovations in system integration, ease of deployment, and compliance with the latest safety standards. As safety remains a top priority in the aviation industry, these companies lead with robust product portfolios and strategic partnerships with major airlines, driving market consolidation.

| Company Name | Establishment Year | Headquarters | Product Range | Market Focus | Technological Advancements | Regional Presence |

| B/E Aerospace | 1986 | USA | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1961 | USA | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | ~ | ~ | ~ | ~ |

| Safran | 2005 | France | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Europe | ~ | ~ | ~ | ~ |

Australia Passenger Emergency Oxygen Deployment Systems Market Analysis

Growth Drivers

Increase in global air passenger traffic

Global air passenger traffic has seen a steady increase in recent years. According to the International Civil Aviation Organization (ICAO), passenger traffic in 2023 reached approximately ~ passengers, reflecting a robust recovery from previous years affected by the pandemic. The rise in air traffic is closely tied to expanding middle-class populations in emerging economies, which boosts demand for both domestic and international travel. This surge in passengers places significant emphasis on the enhancement of safety systems, including emergency oxygen systems, which are crucial for meeting the demand for higher passenger volumes and safety standards.

Rising safety regulations and compliance standards

The global aviation industry is witnessing increasingly stringent safety regulations. Regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) are enforcing higher standards for emergency oxygen systems in response to a growing focus on passenger safety. For instance, the FAA’s regulations mandate that all aircraft must be equipped with functional oxygen systems for passenger and crew use in emergencies. These enhanced safety standards not only ensure passenger well-being but also drive the adoption of more advanced oxygen deployment systems in the aviation sector.

Market Challenges

High initial investment in oxygen systems

The high initial investment required for emergency oxygen systems poses a significant challenge to the aviation market. Aircraft manufacturers and operators must allocate substantial resources for purchasing and installing these systems, which can be a deterrent, especially for smaller carriers. According to the International Air Transport Association (IATA), airlines globally faced increased operational costs in 2023, which also include investments in safety systems like oxygen systems. The upfront cost of equipping fleets with state-of-the-art oxygen delivery solutions can strain the budgets of smaller operators, limiting the pace of adoption.

Regulatory hurdles and compliance costs

Compliance with global and regional safety regulations often involves significant operational costs for airlines. As regulatory frameworks continue to evolve, airlines must invest in upgrading their oxygen systems to meet new standards. For example, new regulations from the International Civil Aviation Organization (ICAO) stipulate that all commercial aircraft must carry supplemental oxygen systems for emergency situations, adding to the operational burden. The complexity and expense of ensuring these systems meet regulatory criteria can be a barrier to the adoption of newer technologies, particularly for airlines with older fleets.

Opportunities

Growing demand for air ambulance services

The demand for air ambulance services is growing rapidly due to increasing medical emergencies and the need for faster patient transportation. Air ambulance services rely heavily on advanced oxygen deployment systems to ensure patient safety during transport. In Australia, the number of air ambulance flights has increased significantly, with agencies expanding their fleets to accommodate the rising demand. As the population ages and healthcare infrastructure faces pressure, the market for oxygen systems used in air ambulances is expected to see substantial growth.

Technological innovation in lightweight oxygen systems

There is a strong opportunity in the development of lightweight oxygen systems, which are expected to play a key role in the future of aviation safety. The development of compact, portable oxygen systems allows for more flexible use in both commercial and private aircraft, improving their performance without adding significant weight. Airlines and private operators are increasingly looking to invest in these lighter, more efficient systems to improve operational efficiency while maintaining high safety standards. This trend is expected to drive the growth of the market as technology continues to evolve.

Future Outlook

Over the next decade, the Australia passenger emergency oxygen deployment systems market is expected to witness substantial growth. This growth is driven by continuous advancements in aviation safety systems, rising passenger traffic, and a growing focus on enhancing emergency preparedness in the aviation industry. Furthermore, technological innovations such as lightweight and efficient oxygen systems will play a significant role in shaping the future of the market. Regulatory mandates will also support the continued demand for highly reliable and safe emergency oxygen deployment systems in commercial and private aviation.

Key Players

- B/E Aerospace

- Honeywell Aerospace

- Rockwell Collins

- Safran

- Airbus

- Thales Group

- Collins Aerospace

- Zodiac Aerospace

- Parker Hannifin Corporation

- United Technologies Corporation

- Elbit Systems

- GKN Aerospace

- Panasonic Avionics Corporation

- Curtiss-Wright Corporation

- Eaton Corporation

Key Target Audience

- Investments and Venture Capitalist Firms

- Australian Department of Infrastructure, Transport, Regional Development and Communications

- Civil Aviation Safety Authority

- Australian Airlines

- Aircraft Manufacturers

- Military Aviation Agencies

- Private Aircraft Operators

- Airlines and Air Charter Service Providers

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying the critical variables that influence the market dynamics of the Australia passenger emergency oxygen deployment systems market. This includes recognizing key stakeholders such as airlines, regulatory bodies, and manufacturers of oxygen systems. Extensive secondary research is conducted, leveraging industry reports, governmental sources, and trade publications to develop a comprehensive understanding of these variables.

Step 2: Market Analysis and Construction

In this phase, historical market data from trusted sources such as government bodies and aerospace industry associations is gathered. The analysis includes market penetration of oxygen systems, trends in air traffic, and changes in regulatory policies. The data is used to build a robust market model for forecasting future trends and demand.

Step 3: Hypothesis Validation and Expert Consultation

This phase includes validating the market hypotheses by conducting interviews with key industry experts and stakeholders. These consultations provide insights into operational and financial aspects, ensuring that the market data reflects the current and future state of the market accurately.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all research findings into a comprehensive market report. Insights gained from expert consultations and data analysis are used to refine the market model. This phase ensures that the report is both accurate and actionable, providing reliable recommendations to stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Increase in global air passenger traffic

Rising safety regulations and compliance standards

Technological advancements in oxygen delivery systems - Market Challenges

High initial investment in oxygen systems

Regulatory hurdles and compliance costs

Dependence on aerospace suppliers for key components - Opportunities

Growing demand for air ambulance services

Technological innovation in lightweight oxygen systems

Emerging markets and rising disposable income - Trends

Integration of smart and automated oxygen delivery systems

Adoption of eco-friendly and sustainable materials in system design - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Portable Oxygen Systems

Fixed Oxygen Systems

Oxygen Masks

Oxygen Cylinders

Oxygen Generation Systems - By Platform Type (In Value%)

Commercial Aircraft

Private Aircraft

Cargo Aircraft

Helicopters

Unmanned Aerial Vehicles (UAVs) - By Fitment Type (In Value%)

New Installations

Retrofit Systems

OEM Systems

Aftermarket Systems

Modular Systems - By EndUser Segment (In Value%)

Commercial Airlines

Private Aircraft Operators

Cargo Airlines

Government & Military Agencies

Air Ambulance Services - By Procurement Channel (In Value%)

Direct Procurement from Manufacturers

Third-Party Distributors

OEM Procurement

- Market Share Analysis

- Cross Comparison Parameters (Product Quality, Price, Delivery Time, Customer Service, Brand Reputation)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Aerospace Technologies Pty Ltd

AeroHealthcare

Airbus

Honeywell Aerospace

L3 Technologies

Rockwell Collins

B/E Aerospace

Safran

Thales Group

Cobham Aerospace

Air India Engineering Services

Air New Zealand Engineering

Emirates Engineering

Qantas Engineering

Rolls-Royce

- Commercial airlines increasingly adopting advanced oxygen systems

- Private operators opting for cost-effective oxygen deployment options

- Cargo airlines improving oxygen supply systems for emergency readiness

- Government agencies focusing on regulatory compliance for emergency oxygen supply

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035