Market Overview

The Australia precision guided munition market is valued at USD ~ billion, based on a five-year historical analysis. This market is primarily driven by the increasing defense budget allocation in Australia and the growing demand for advanced precision weaponry. The continuous investment in research and development, particularly in enhancing the accuracy and reliability of these munitions, has also been a key driver. The rising geopolitical tensions in the Asia-Pacific region further underscore the importance of modernized defense capabilities, accelerating the demand for precision guided systems.Australia stands as a dominant player in the precision guided munition market due to its significant defense expenditure, which reached USD ~ billion in 2023. The country’s strategic location in the Asia-Pacific region necessitates robust military preparedness, contributing to its dominance in the market. Additionally, close ties with key defense allies, such as the United States, enable Australia to access advanced technologies and leverage collaborative defense initiatives. These factors combined with the country’s military modernization programs drive its leadership in the sector.

Market Segmentation

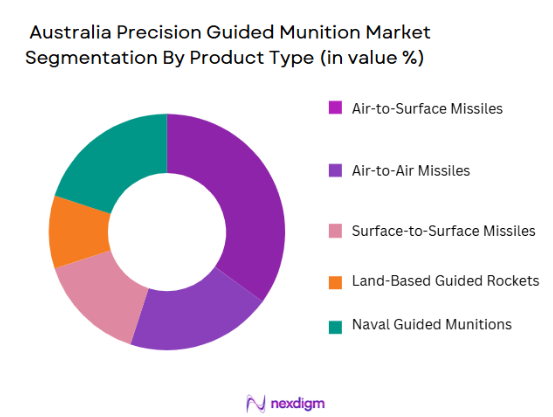

By Product Type

The Australia precision guided munition market is segmented into air-to-surface missiles, air-to-air missiles, surface-to-surface missiles, land-based guided rockets, and naval guided munitions. Among these, air-to-surface missiles dominate the market due to their versatile applications across different platforms, including fighter jets and bombers. Their ability to strike long-range targets with high accuracy makes them a crucial component of Australia’s defense strategy. The strategic importance of air-to-surface missiles in modern warfare has led to their consistent demand, with several defense initiatives focused on enhancing the effectiveness of these systems.

By Platform Type

The precision guided munition market is further segmented by platform type into land platforms, naval platforms, airborne platforms, subsea platforms, and space platforms. Among these, airborne platforms lead the market, primarily due to the extensive use of fighter jets and bombers equipped with precision-guided munitions. The strategic need for air superiority and long-range strike capabilities positions airborne platforms as a dominant factor in the Australian defense strategy, further accelerated by advancements in unmanned aerial vehicles (UAVs) and integration with modern aircraft systems.

Competitive Landscape

The Australia precision guided munition market is characterized by a few dominant players, including both international defense contractors and local manufacturers. The presence of multinational defense giants like Lockheed Martin, Raytheon, and BAE Systems highlights the strong competition. These companies have extensive experience in precision-guided systems and continue to drive innovation. At the same time, Australia’s investment in domestic defense capabilities has led to the emergence of local players such as Thales Australia, which collaborates closely with the government on defense projects.

| Company | Establishment Year | Headquarters | Product Portfolio | Technological Innovation | Defense Contracts | Strategic Alliances | Market Focus |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1999 | Australia | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 1950 | Australia | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Defence | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

Australia Precision Guided Munition Market Analysis

Growth Drivers

Increase in Military Expenditures by Australia

Australia’s defense spending has shown a consistent upward trajectory in recent years. In 2024, Australia’s defense budget reached AUD ~billion, representing a notable increase from previous years. This funding boost reflects the country’s strategic focus on enhancing defense capabilities, including the procurement of precision-guided munitions (PGMs). The Australian government’s commitment to modernizing its defense forces and strengthening its military readiness amidst growing security concerns in the Indo-Pacific region directly drives the demand for advanced munitions. As a result, the increased defense expenditure plays a pivotal role in propelling market growth for PGMs.

Rising Demand for Precision in Warfare

The shift towards more precise, efficient, and cost-effective military solutions has intensified the demand for precision-guided munitions in recent years. In 2024, military operations in the Indo-Pacific region have been marked by increasing reliance on PGMs to achieve high precision with minimal collateral damage. Australia’s commitment to enhancing its military capabilities in response to regional instability has contributed to the growing demand for PGMs. Additionally, the integration of advanced technologies in military operations and the demand for more surgical strikes are driving investments in PGMs, allowing for more accurate targeting and reducing the risk of civilian harm.

Market Challenges

High Cost of Advanced Munitions Systems

The development and procurement of advanced precision-guided munitions systems come with significant costs. As of 2024, the average cost of developing and deploying PGMs in Australia has exceeded AUD 1 billion for large-scale systems. The high costs are primarily attributed to research and development (R&D) expenses, which account for a substantial portion of the budget. Moreover, the integration of advanced technologies such as AI and enhanced targeting systems into PGMs further increases production costs. These financial challenges pose significant barriers to expanding PGMs deployment, particularly in smaller or less affluent regions of the defense industry.

Limited Availability of Indigenous Manufacturing Capacity

Australia’s reliance on international suppliers for the manufacturing of advanced precision-guided munitions poses a key challenge to its defense capabilities. In 2024, less than 30% of PGMs in Australia are produced domestically. Despite efforts to strengthen indigenous defense manufacturing, such as the establishment of local defense production facilities, the country still faces limitations in scaling up production to meet growing demand. These constraints have been exacerbated by a global supply chain shortage for critical components, which limits Australia’s ability to rapidly expand its PGM manufacturing capabilities and achieve self-reliance.

Market Opportunities

Integration of AI and IoT in PGMs

The integration of artificial intelligence (AI) and the Internet of Things (IoT) into precision-guided munitions presents a significant growth opportunity for the market. In 2024, Australia has begun incorporating AI into its defense systems, with a particular focus on enhancing targeting accuracy, autonomous decision-making, and real-time data analysis. The use of IoT in PGMs allows for better communication between systems, improving operational efficiency and responsiveness during missions. The ongoing R&D in AI and IoT technologies is expected to boost the effectiveness of PGMs, driving their adoption within Australia’s defense sector and opening up new market opportunities.

Collaborations with International Defense Contractors

Australia’s defense sector is increasingly collaborating with international defense contractors, facilitating the exchange of advanced technologies and expertise in the development of precision-guided munitions. In 2024, Australia entered several key defense partnerships, particularly with countries like the United States and the United Kingdom, to jointly develop and deploy next-generation PGMs. These collaborations allow Australia to benefit from technological advancements and more cost-effective production, which not only enhances its military capabilities but also offers significant market opportunities for companies involved in defense manufacturing.

Future Outlook

Over the next decade, the Australia precision guided munition market is expected to experience sustained growth, driven by technological advancements and the increasing need for precision in defense operations. The market will be influenced by the evolving geopolitical dynamics in the Asia-Pacific region, where Australia’s strategic interests continue to expand. The Australian government’s ongoing modernization of its defense capabilities, coupled with defense partnerships with major allies, will further bolster market growth. Increased defense budgets and the need for more accurate, reliable, and cost-effective munitions will be key factors in shaping the future of the market.

Major Players

- Lockheed Martin

- Raytheon Technologies

- BAE Systems Australia

- Thales Australia

- Rheinmetall Defence

- Northrop Grumman

- General Dynamics Mission Systems

- Leonardo

- L3 Technologies

- Kongsberg Gruppen

- Saab Group

- MBDA

- Elbit Systems

- Naval Group

- Boeing Australia

Key Target Audience

- Australian Defense Forces

- Ministry of Defence, Australia

- Military Procurement Agencies

- Aerospace and Defense Technology Firms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Australian Aerospace Manufacturers

- International Defense Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the key variables affecting the Australia precision guided munition market, such as defense budgets, technological advancements, and geopolitical factors. Secondary research from credible sources, including government reports and industry publications, will form the foundation for this analysis.

Step 2: Market Analysis and Construction

This phase will focus on evaluating historical data, including market penetration and product adoption rates. The analysis will incorporate defense budgets, R&D expenditures, and market dynamics, ensuring an accurate representation of the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through consultations with defense experts, government officials, and industry stakeholders. This step will offer insights into product preferences, technological developments, and consumer behavior within the market.

Step 4: Research Synthesis and Final Output

The final phase will synthesize the data collected from expert interviews and secondary research. Direct interactions with key manufacturers and stakeholders will help verify and refine the conclusions drawn during earlier stages, ensuring the report’s accuracy and relevance.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Military Expenditures by Australia

Rising Demand for Precision in Warfare

Advancements in PGMs’ Technological Capabilities - Market Challenges

High Cost of Advanced Munitions Systems

Limited Availability of Indigenous Manufacturing Capacity

Strict Government Regulations on Weapon Sales

- Trends

Increased Miniaturization of Guided Munitions

Focus on Multi-Platform PGMs

Emergence of Autonomous PGMs

- Market Opportunities

Integration of AI and IoT in PGMs

Collaborations with International Defense Contractors

Rising Demand for PGMs in Allied Nations - Government regulations

International Trade in Arms Regulations (ITAR)

National Security & Export Control Laws

Defense Procurement Regulations - SWOT analysis

Strengths: High Technological Capabilities in PGMs

Weaknesses: Dependence on Foreign Suppliers

Opportunities: Expansion into Asia-Pacific Defense Markets - Porters 5 forces

Bargaining Power of Suppliers

Threat of Substitutes

Competitive Rivalry

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Air-to-Surface Missiles

Air-to-Air Missiles

Surface-to-Surface Missiles

Land-Based Guided Rockets

Naval Guided Munitions - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Subsea Platforms

Space Platforms - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Retrofit Fitment

Upgrades & Enhancements

Customization Fitment - By EndUser Segment (In Value%)

Defense Forces

Government Agencies

Private Contractors

Security Agencies

International Defense Alliances - By Procurement Channel (In Value%)

Direct Procurement

Indirect Procurement

Public Tenders

Private Tenders

Government-to-Government Contracts

- Market Share Analysis

- Cross Comparison Parameters(Price, Technology, Market Reach, Production Capacity, After-Sales Support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems Australia

Lockheed Martin Australia

Raytheon Australia

Thales Australia

Rheinmetall Defence Australia

Northrop Grumman Australia

L3 Technologies

General Dynamics Mission Systems

Leonardo Australia

Kongsberg Defence & Aerospace

Saab Australia

Navantia Australia

Boeing Australia

BMT Defence Services

Elbit Systems Australia

- Increasing Demand from Australian Defense Forces

- Growth in International Defense Contracts

- Rising Need for Advanced Weapons in Peacekeeping Operations

- Evolving Threats and Warfare Strategies in the Indo-Pacific Region

- Forecast Market Value ,2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035