Market Overview

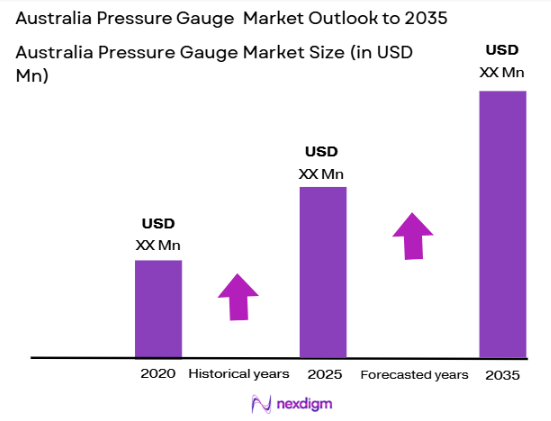

The Australian pressure gauge market is valued at USD ~million in 2024, based on a five-year historical analysis. The market is driven by the increasing demand for accurate measurement systems across industries like oil and gas, manufacturing, and healthcare. Technological advancements in pressure measurement systems, including the integration of IoT and wireless technologies, have propelled the market’s growth. The increased focus on automation and process optimization in industrial applications further supports the demand for pressure gauges in the region.Australia dominates the market, with key drivers being its established industrial base and regulatory frameworks. Cities like Sydney, Melbourne, and Perth, which host major industrial facilities, are the primary drivers of demand for pressure gauges. These cities benefit from robust manufacturing sectors, energy industries, and research and development in automation technologies. The mining and oil industries also significantly contribute to the demand for pressure gauges, given the need for precise measurement and control in such high-risk environments.

Market Segmentation

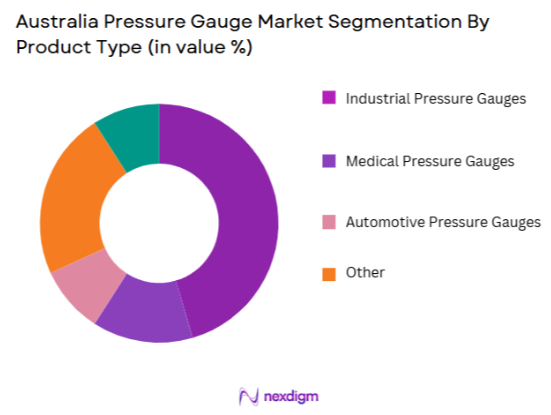

By Product Type

The Australian pressure gauge market is segmented by product type into industrial pressure gauges, medical pressure gauges, automotive pressure gauges, and others. The industrial pressure gauges segment holds a dominant market share in 2024 due to their widespread use in industries like manufacturing, mining, and oil and gas. Industrial applications demand high precision, and pressure gauges are critical for safety, performance, and quality control. Additionally, the growth of automation in these industries further boosts the adoption of industrial pressure gauges, as they are essential for maintaining optimal performance and efficiency.

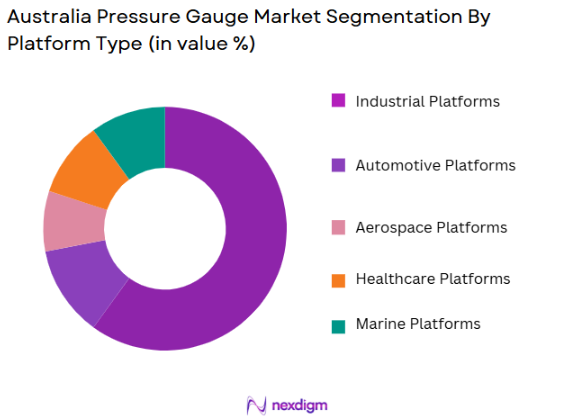

By Platform Type

The market is segmented into industrial, automotive, aerospace, healthcare, and marine platforms. Among these, industrial platforms dominate the market due to the increasing demand for pressure gauges in various industrial processes such as chemical processing, power generation, and oil & gas exploration. Pressure gauges are essential for ensuring equipment safety, reducing downtime, and optimizing processes in these industries. Their critical role in industrial automation and safety standards solidifies their dominance in the market share.

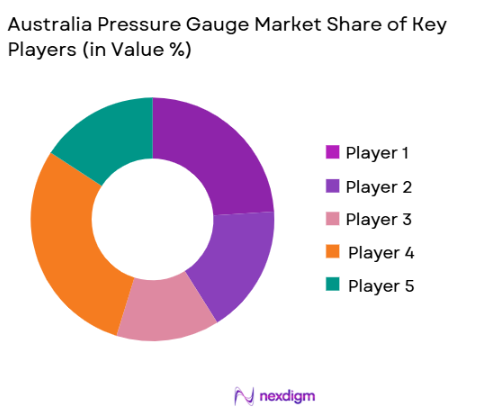

Competitive Landscape

The Australian pressure gauge market is competitive, with both global and local manufacturers vying for market share. Key players in the market include Emerson Electric, Honeywell International, Omega Engineering, WIKA Instruments, and Yokogawa Electric. These companies leverage technological innovations, strong brand recognition, and extensive distribution networks to maintain their competitive edge. Their continued investments in R&D, particularly in wireless and smart pressure gauges, further intensify the competition in the market.

| Company | Establishment Year | Headquarters | Technology | Market Reach | Product Range | Key Focus |

| Emerson Electric | 1890 | USA | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | USA | ~ | ~ | ~ | ~ |

| Omega Engineering | 1962 | USA | ~ | ~ | ~ | ~ |

| WIKA Instruments | 1946 | Germany | ~ | ~ | ~ | ~ |

| Yokogawa Electric | 1915 | Japan | ~ | ~ | ~ | ~ |

Australia Pressure Gauge Market Analysis

Growth Drivers

Increasing industrial automation and demand for precise pressure measurements

The Australian manufacturing sector has seen significant growth in automation, which is expected to continue as industries focus on improving efficiency and safety. Automation, combined with the need for precise pressure measurements in industries like mining, oil & gas, and chemical processing, has been driving the adoption of advanced pressure gauge systems. The industrial automation market in Australia has grown steadily, with the Australian government’s commitment to funding automation technology through initiatives like the Modern Manufacturing Strategy, which allocated USD ~ billion over four years starting in 2020. This drives the demand for pressure gauges, especially in critical operations where pressure control is vital for safety and operational performance. Moreover, the Australian manufacturing sector’s value added in 2023 was approximately USD ~billion, indicating the scale of industrial operations relying on pressure measurement solutions.

Rising adoption of advanced medical equipment

The adoption of advanced medical equipment in Australia has been increasing as the healthcare sector focuses on improving the accuracy of diagnostics and treatment, further driving demand for medical pressure gauges. According to the Australian Institute of Health and Welfare (AIHW), Australia’s healthcare expenditure was forecasted to reach USD ~billion in 2024. This growth in healthcare spending is driven by the increasing need for advanced medical technology, such as blood pressure monitoring equipment, ventilators, and other life-saving devices. As medical facilities seek more precise monitoring systems, the pressure gauge market in healthcare is expected to expand, with a notable demand for pressure gauges that offer high accuracy and reliability in medical settings. The rise of chronic diseases and aging populations further enhances the need for these technologies.

Market Challenges

High initial investment and maintenance costs

Pressure gauges, especially advanced models for industrial and medical applications, involve significant capital investment. For instance, highly accurate digital pressure gauges with IoT connectivity tend to have a higher initial purchase price due to advanced technology integration. The cost for installing and maintaining these devices, particularly in industries like oil and gas, can be substantial. For example, in the oil & gas sector, companies in Australia face operational costs exceeding AUD 1 billion for safety and compliance measures, where pressure monitoring systems are a crucial component. Maintenance of these systems requires periodic calibration, which adds to long-term costs. This represents a major barrier to entry for smaller companies in the market.

Regulatory barriers and certification requirements

Regulatory compliance is another challenge faced by the Australian pressure gauge market. With strict government regulations governing product standards, certification, and safety, the cost and time involved in achieving certification for pressure measurement systems can be a major hurdle. For instance, the National Measurement Institute (NMI) in Australia enforces stringent standards for measuring instruments, including pressure gauges, to ensure they comply with national and international safety standards. These regulations aim to ensure accuracy and reliability but can be a significant barrier for new market entrants, especially those focusing on innovative technologies such as wireless and smart pressure gauges. Furthermore, these regulatory barriers slow the adoption of new technologies, as it takes time to obtain the necessary certifications before market launch.

Market Opportunities

Development of wireless and smart pressure gauges

The development of wireless and smart pressure gauges represents a major opportunity for market growth, driven by the growing demand for connectivity and automation across industries. As industrial automation systems become more advanced, industries are increasingly adopting wireless pressure gauges for real-time data monitoring and control. Wireless pressure gauges provide improved monitoring and flexibility, allowing operators to remotely track pressure data, which is particularly useful in hazardous environments. With industries like oil and gas facing challenges in maintaining operational efficiency, the adoption of smart sensors and wireless technology is growing. The current trend is also reflected in the Australian Government’s initiatives to foster smart technologies under the “Smart Cities and Suburbs Program,” which allocated funding to support the integration of IoT technologies in various sectors, further contributing to the demand for smart pressure gauges.

Growth in the aerospace and defense sectors

The aerospace and defense sectors in Australia continue to grow, creating an opportunity for pressure gauge manufacturers. The Australian Government’s defense budget has increased substantially, with defense expenditure forecasted to reach AUD ~billion in 2024. With the increase in defense activities, especially in aircraft manufacturing, pressure gauges are essential for ensuring the safety and efficiency of aerospace systems. The Australian defense sector’s push for modernization and integration of new technologies presents an ideal opportunity for the growth of specialized pressure gauges used in aircraft, marine vessels, and defense equipment. Furthermore, Australia’s role as a strategic partner in international defense initiatives increases the demand for high-quality pressure measurement solutions in both defense and commercial aerospace applications.

Future Outlook

Over the next 5 years, the Australian pressure gauge market is expected to show moderate growth driven by advancements in pressure gauge technology, including wireless systems, smart sensors, and IoT integration. As industries, particularly in the oil and gas, automotive, and healthcare sectors, continue to evolve toward more automated and efficient processes, the demand for accurate and reliable pressure measurement systems will increase. Government regulations pushing for more precise and reliable measurement equipment in industrial processes further support this market growth. Additionally, innovations aimed at reducing costs and improving ease of use will be pivotal in maintaining market momentum.

15 Major Players

- Emerson Electric

- Honeywell International

- Omega Engineering

- WIKA Instruments

- Yokogawa Electric

- Danfoss

- Endress+Hauser

- KROHNE

- Schneider Electric

- Ashcroft

- Siemens

- Riko Instruments

- Testo

- Fluke Corporation

- Druck

Key Target Audience

- Industrial Equipment Manufacturers

- Oil and Gas Companies

- Aerospace and Defense Contractors

- Automotive Manufacturers

- Healthcare Providers and Hospitals

- Energy and Utilities Companies

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

Research Methodology

Step 1: Identification of Key Variables

This step involves creating a comprehensive ecosystem map to identify all major stakeholders in the Australian pressure gauge market. Desk research, secondary sources, and proprietary databases are used to gather data on industry dynamics and variables influencing the market.

Step 2: Market Analysis and Construction

Historical data on pressure gauge usage and market penetration across various sectors, such as oil and gas, automotive, and healthcare, will be compiled. This data will be assessed for service provider penetration, marketplace ratios, and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market growth drivers and challenges will be validated through interviews with industry experts across key sectors. These consultations will provide real-time insights into operational and financial factors affecting the market.

Step 4: Research Synthesis and Final Output

Data collected from various sources, including industry reports and expert interviews, will be synthesized into a comprehensive analysis. This final output will offer a detailed assessment of the current state and future outlook of the Australian pressure gauge market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing industrial automation and demand for precise pressure measurements

Rising adoption of advanced medical equipment

Expanding infrastructure in oil & gas and automotive sectors - Market Challenges

High initial investment and maintenance costs

Regulatory barriers and certification requirements

Technical challenges in high-pressure applications - Trends

Integration of IoT with pressure gauge systems

Miniaturization of pressure gauge technologies

Shift towards energy-efficient and eco-friendly products

- Market Opportunities

Development of wireless and smart pressure gauges

Growth in the aerospace and defense sectors

Expansion of industrial applications in emerging markets - Government regulations

Regulations on pressure gauge calibration and accuracy

Safety standards for medical-grade pressure gauges

Environmental regulations on the disposal of industrial pressure systems - SWOT analysis

Technological advancements driving competitive advantage

High cost of advanced systems impacting market growth

Increasing demand from end-users fostering new product development - Porters 5 forces

Bargaining power of suppliers in the manufacturing of pressure gauge components

Threat of new entrants due to high capital requirements

Intensity of competitive rivalry among existing players

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-202

- By System Type (In Value%)

Industrial Pressure Gauges

Medical Pressure Gauges

Aerospace Pressure Gauges

Automotive Pressure Gauges

Hydraulic Pressure Gauges - By Platform Type (In Value%)

Industrial Platforms

Medical Platforms

Automotive Platforms

Marine Platforms

Aerospace Platforms

- By Fitment Type (In Value%)

Fixed Fitment

Portable Fitment

Panel Mounted Fitment

Wall Mounted Fitment

Handheld Fitment - By EndUser Segment (In Value%)

Manufacturing Industry

Oil & Gas Industry

Automotive Industry

Healthcare Industry

Aerospace Industry - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Sales

Retail Outlets

B2B Sales

- Market Share Analysis

- CrossComparison Parameters(Price, System Complexity, Platform Compatibility, After-Sales Support, Innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Emerson Electric

Honeywell International

Omega Engineering

Schlumberger

Yokogawa Electric

KROHNE

WIKA Instruments

Danfoss

Endress+Hauser

Viatron

Schenck Process

Testo

Riko Instruments

Ashcroft

Siemens

Nagano Keiki

- Rising demand for pressure gauges in the healthcare sector

- Increasing applications in automotive testing and diagnostics

- Focus on high-performance solutions in industrial sectors

- Cost sensitivity influencing procurement decisions in manufacturing

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035