Market Overview

Australia Sea-Based C4ISR Market is valued at USD ~ billion based on a recent historical assessment, supported by defense expenditure disclosures from the Australian Department of Defence, SIPRI naval electronics allocations, and publicly reported contract values from major defense primes. The market is driven by sustained naval modernization programs, integration of network-centric warfare doctrines, and rising investments in maritime domain awareness. Increased deployment of sensor fusion, secure naval communications, and real-time command systems across surface combatants and submarines further accelerates spending. Indigenous defense capability development and allied interoperability requirements also reinforce procurement momentum.

Australia dominates the regional Sea-Based C4ISR Market due to concentrated naval command infrastructure in Canberra, Sydney, and Perth, proximity to major fleet bases, and centralized defense procurement authority. Canberra leads system planning and command integration due to headquarters of defense agencies, while Sydney and Perth host major naval shipyards and fleet command centers supporting deployment and sustainment. Strong defense alliances with the United States and regional partners reinforce technology transfer and system upgrades. Strategic maritime routes and Indo-Pacific security priorities further position Australia as the core demand center.

Market Segmentation

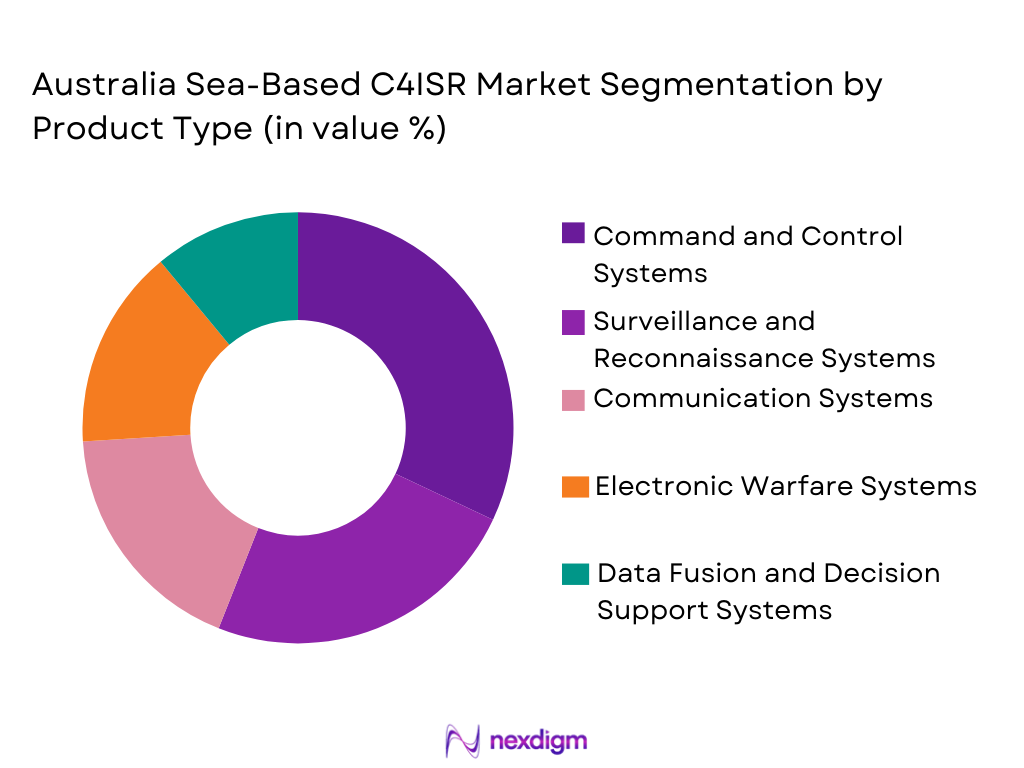

By Product Type

Australia Sea-Based C4ISR Market is segmented by product type into Command and Control Systems, Surveillance and Reconnaissance Systems, Communication Systems, Electronic Warfare Systems, and Data Fusion and Decision Support Systems. Recently, Command and Control Systems have a dominant market share due to their central role in coordinating multi-platform naval operations and integrating data from diverse sensors into actionable intelligence. These systems are prioritized because they directly enhance mission effectiveness, situational awareness, and decision-making speed for naval commanders. Australia’s naval modernization programs emphasize interoperable command architectures aligned with allied forces, increasing demand for advanced command and control solutions. The presence of established defense integrators and sustained upgrades of fleet combat management systems further reinforce dominance. High-value contracts, long lifecycle support requirements, and mandatory integration across all major naval platforms collectively sustain higher spending concentration in this sub-segment.

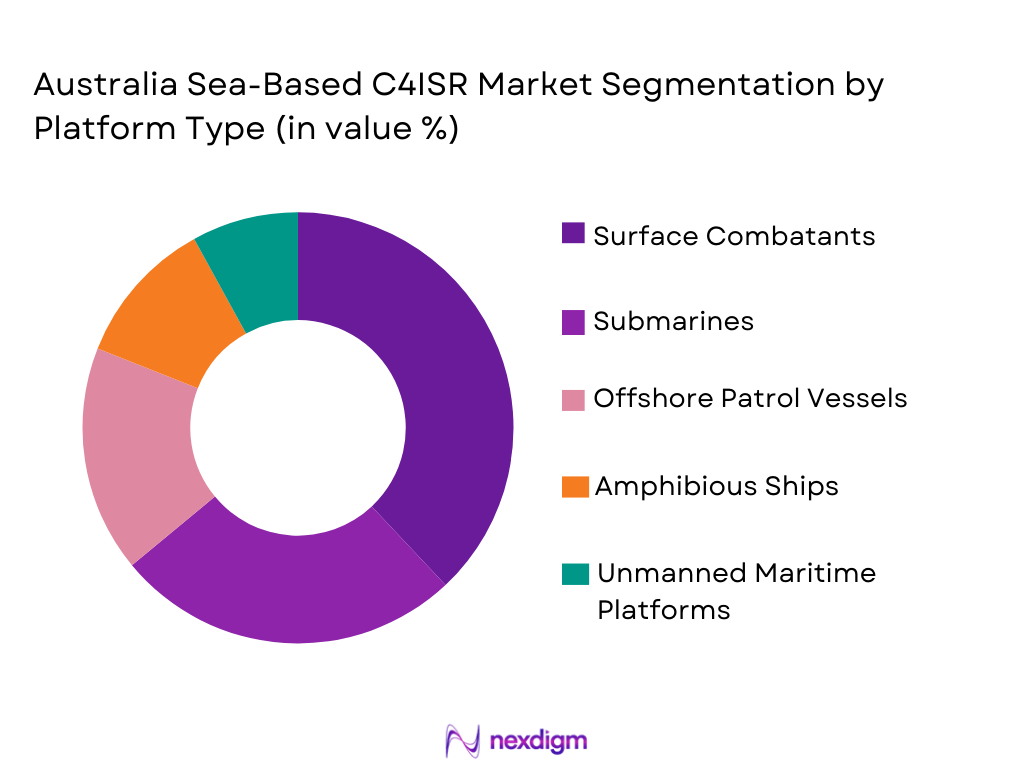

By Platform Type

Australia Sea-Based C4ISR Market is segmented by platform type into Surface Combatants, Submarines, Offshore Patrol Vessels, Amphibious Ships, and Unmanned Maritime Platforms. Recently, Surface Combatants have a dominant market share due to their operational versatility, higher system density, and priority role in maritime security missions. These platforms require comprehensive C4ISR suites to manage air, surface, and subsurface threats simultaneously, driving higher system integration value. Australia’s destroyer and frigate programs emphasize advanced combat systems and continuous upgrades, ensuring sustained investment. Surface combatants also serve as command hubs within naval task groups, necessitating superior communication and data fusion capabilities. Their longer deployment cycles and frequent modernization schedules result in greater cumulative spending compared to other platform categories.

Competitive Landscape

The Australia Sea-Based C4ISR Market is moderately consolidated, dominated by a mix of global defense primes and specialized naval electronics providers with strong local subsidiaries. Major players leverage long-term government contracts, indigenous partnerships, and proprietary technologies to maintain competitive positioning, while smaller firms compete through niche capabilities and subsystem integration.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Naval Specialization |

| Lockheed Martin Australia | 1997 | Canberra, Australia | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1959 | Adelaide, Australia | ~ | ~ | ~ | ~ | ~ |

| Raytheon Australia | 1999 | Canberra, Australia | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 1978 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1987 | Adelaide, Australia | ~ | ~ | ~ | ~ | ~ |

Australia Sea-Based C4ISR Market Analysis

Growth Drivers

Naval Modernization and Fleet Digitization Programs:

Naval Modernization and Fleet Digitization Programs are a primary growth driver for the Australia Sea-Based C4ISR Market because the Australian Navy is undergoing extensive transformation to align with network-centric and multi-domain warfare doctrines across the Indo-Pacific maritime environment. These programs focus on replacing legacy analog systems with fully digital, interoperable command architectures that enable real-time data sharing across ships, submarines, aircraft, and allied forces. The emphasis on integrated combat management systems increases demand for advanced command, control, and data fusion solutions capable of handling complex threat environments. Modern naval vessels require higher sensor density, secure communications, and resilient networks, all of which elevate the value of onboard C4ISR systems. Fleet digitization also extends to mid-life upgrades of existing platforms, creating sustained retrofit demand alongside new-build installations. Interoperability mandates with allied navies further require compliance with shared standards, driving procurement of certified systems from established suppliers. The long lifecycle of naval assets ensures recurring revenue through upgrades, maintenance, and software refreshes. Collectively, these factors expand both the scope and value of C4ISR procurement across Australia’s maritime forces.

Regional Maritime Security and Indo-Pacific Strategic Priorities:

Regional Maritime Security and Indo-Pacific Strategic Priorities significantly drive the Australia Sea-Based C4ISR Market by elevating the importance of persistent maritime surveillance, command coordination, and intelligence dominance across vast oceanic areas. Australia’s strategic location and responsibility for extensive maritime zones necessitate continuous monitoring and rapid response capabilities, which rely heavily on advanced C4ISR systems. Rising geopolitical complexity in surrounding sea lanes increases demand for systems capable of integrating intelligence from satellites, unmanned platforms, and allied assets. Naval task forces require robust command networks to coordinate joint and combined operations, reinforcing investment in secure communications and battle management systems. Strategic defense initiatives prioritize maritime domain awareness to safeguard trade routes and offshore resources. Enhanced intelligence sharing with partner nations further increases system sophistication requirements. These priorities translate into higher budget allocations for maritime C4ISR capabilities. As threats become more technologically advanced, the need for resilient, cyber-secure naval networks intensifies. This strategic context sustains long-term growth in system procurement and integration.

Market Challenges

Complex System Integration Across Multi-Vendor Platforms:

Complex System Integration Across Multi-Vendor Platforms presents a significant challenge for the Australia Sea-Based C4ISR Market because naval vessels often host systems sourced from multiple domestic and international suppliers. Achieving seamless interoperability between sensors, communication networks, and command software requires extensive customization and testing. Integration complexity increases project timelines and costs, creating risks for program delays. Legacy platforms undergoing upgrades pose additional challenges due to compatibility constraints with modern digital architectures. Differences in proprietary standards among vendors further complicate integration efforts. The need to align systems with allied interoperability frameworks adds another layer of technical requirement. Skilled workforce shortages in advanced naval systems engineering can limit integration efficiency. These challenges increase total cost of ownership and place pressure on procurement schedules. Managing integration risk remains a persistent obstacle for defense planners and suppliers.

Cybersecurity Risks in Network-Centric Naval Operations:

Cybersecurity Risks in Network-Centric Naval Operations challenge market growth as increased connectivity expands the attack surface of naval C4ISR systems. Highly networked platforms require continuous protection against cyber intrusion, data manipulation, and system disruption. Implementing robust cyber defenses adds complexity and cost to system design and certification. Compliance with stringent defense security standards can extend development timelines. The evolving nature of cyber threats necessitates frequent software updates and monitoring. Ensuring secure interoperability with allied systems introduces additional vulnerability considerations. Any perceived weakness in cybersecurity can delay procurement approvals. These factors complicate deployment and lifecycle management of advanced C4ISR solutions. Addressing cyber resilience is therefore a critical but resource-intensive requirement.

Opportunities

Integration of Unmanned Maritime Systems into Command Networks:

Integration of Unmanned Maritime Systems into Command Networks represents a major opportunity for the Australia Sea-Based C4ISR Market as naval forces increasingly deploy unmanned surface and underwater vehicles. These platforms generate valuable intelligence data that must be integrated into existing command and control frameworks. Demand is growing for systems capable of fusing unmanned sensor data with manned platform intelligence. This integration enhances situational awareness while reducing operational risk. Developing standardized interfaces and control architectures creates new revenue streams for C4ISR suppliers. Australia’s focus on autonomous systems within naval strategy further supports this opportunity. Interoperability with allied unmanned assets amplifies system requirements. Suppliers offering scalable, modular command solutions are well positioned. This trend expands both system complexity and market value.

Indigenous Development and Sovereign Defense Capability Initiatives:

Indigenous development and sovereign defense capability initiatives create opportunities by encouraging local design, integration, and sustainment of Sea-Based C4ISR systems. Government policies prioritize domestic industry participation to enhance supply chain security and technical sovereignty. Local partnerships and technology transfer agreements open avenues for long-term contracts. Indigenous development reduces dependence on foreign suppliers while enabling customization for national requirements. This approach also supports workforce development and innovation within Australia’s defense sector. C4ISR providers that invest in local facilities gain competitive advantage. Sovereign capability programs often include lifecycle support commitments, increasing revenue stability. These initiatives strengthen the domestic market ecosystem and growth potential.

Future Outlook

The Australia Sea-Based C4ISR Market is expected to maintain steady expansion over the next five years, supported by naval modernization, digital transformation, and heightened maritime security priorities. Technological advancements in sensor fusion, artificial intelligence, and secure communications will shape system evolution. Regulatory support for sovereign defense capability and allied interoperability will remain strong. Demand-side drivers include fleet upgrades, unmanned system integration, and cybersecurity enhancement across naval platforms.

Major Players

- Lockheed Martin Australia

- BAE Systems Australia

- Raytheon Australia

- Thales Australia

- Saab Australia

- Northrop Grumman Australia

- L3Harris Australia

- Elbit Systems Australia

- Leonardo Australia

- Rheinmetall Defence Australia

- Boeing Defence Australia

- Cubic Mission Solutions Australia

- Ultra Maritime Australia

- Kongsberg Defence Australia

- Indra Australia

Key Target Audience

- Naval procurement authorities

- Defense ministries

- Investments and venture capitalist firms

- Government and regulatory bodies

- Shipbuilding and naval shipyard companies

- Defense system integrators

- Maritime security and border protection agencies

- Strategic defense policy organizations

Research Methodology

Step 1: Identification of Key Variables

Key variables were identified through analysis of naval procurement programs, defense budgets, and system requirements. Market boundaries were defined by platform type and system functionality. Demand drivers and constraints were mapped. Data relevance was validated against defense planning documents.

Step 2: Market Analysis and Construction

Quantitative and qualitative data were compiled from public defense disclosures and industry reports. Market structure was constructed by segment and platform. Competitive dynamics were assessed. Data consistency checks were applied.

Step 3: Hypothesis Validation and Expert Consultation

Initial findings were validated through consultation with defense analysts and naval systems experts. Assumptions were reviewed against operational requirements. Discrepancies were resolved through secondary verification. Insights were refined for accuracy.

Step 4: Research Synthesis and Final Output

Validated data were synthesized into structured analysis. Trends and insights were integrated coherently. Market narratives were finalized. The report was reviewed for methodological consistency.

- Executive Summary

- Australia Sea-Based C4ISR Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of maritime domain awareness requirements

Modernization of naval command and control infrastructure

Rising integration of joint and allied naval operations

Increasing deployment of network-centric naval warfare doctrines

Adoption of advanced ISR and electronic warfare capabilities - Market Challenges

High system integration and lifecycle maintenance costs

Complex interoperability requirements across allied forces

Cybersecurity risks in networked naval systems

Long defense procurement and approval cycles

Dependence on foreign technology suppliers - Market Opportunities

Upgrades of legacy naval platforms with digital C4ISR suites

Integration of unmanned systems into maritime command networks

Indigenous development under sovereign defense initiatives - Trends

Growing use of artificial intelligence in command decision-making

Shift toward open-architecture naval combat systems

Increased reliance on real-time data fusion from multiple sensors

Expansion of satellite-enabled maritime communications

Emphasis on cyber-hardened naval mission systems - Government Regulations & Defense Policy

Naval capability development aligned with national defense strategy

Emphasis on sovereign defense industrial capability programs

Strengthening of allied interoperability and information sharing - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and control management systems

Surveillance and reconnaissance systems

Communication and data link systems

Electronic warfare and signal intelligence systems

Battle management and decision support systems - By Platform Type (In Value%)

Surface combatants

Submarines

Offshore patrol vessels

Amphibious warfare ships

Unmanned surface and underwater vehicles - By Fitment Type (In Value%)

Line-fit on new naval platforms

Retrofit and upgrade installations

Modular mission-based fitments

Portable and containerized systems

Joint-force interoperable fitments - By EndUser Segment (In Value%)

Royal Australian Navy

Joint maritime task forces

Coast guard and border protection units

Naval intelligence and surveillance commands

Maritime joint operations centers - By Procurement Channel (In Value%)

Direct government procurement

Defense prime contractor integration

Public-private partnership programs

Foreign military sales and cooperation programs

Technology transfer and licensed production - By Material / Technology (in Value %)

AI-enabled command analytics

Sensor fusion and data integration software

Secure naval communication networks

Satellite-enabled maritime ISR technologies

Cyber-resilient mission systems

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (System Integration Capability, Naval Platform Compatibility, Cybersecurity Strength, Interoperability Standards, Lifecycle Support, Indigenous Content Level, AI and Data Analytics Capability, Program Management Expertise, Cost Efficiency) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin Australia

BAE Systems Australia

Raytheon Australia

Northrop Grumman Australia

Thales Australia

Saab Australia

L3Harris Australia

Elbit Systems of Australia

Leonardo Australia

Rheinmetall Defence Australia

Boeing Defence Australia

Cubic Mission and Performance Solutions Australia

Ultra Maritime Australia

Kongsberg Defence Australia

Indra Australia

- Operational demand for real-time maritime situational awareness

- Need for interoperable systems across joint naval missions

- Focus on resilience and redundancy in mission-critical networks

- Preference for scalable and upgradeable C4ISR architectures

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035