Market Overview

Based on a recent historical assessment, the Australia Sea-Based Military Electro-Optical and Infrared Systems market was valued at USD ~ billion, reflecting the global sea-based EO/IR systems valuation applied to Australian naval modernization and deployment programs. This market size is driven by sustained investment in maritime surveillance, growing integration of electro-optical and infrared sensors into naval combat systems, and heightened focus on persistent intelligence, surveillance, and reconnaissance capabilities. Demand is further reinforced by the need for day-and-night operational effectiveness, improved threat detection, and enhanced situational awareness across Australia’s expanding maritime operational environment.

Based on a recent historical assessment, Australia’s dominance within this market is centered on Canberra as the strategic defense procurement hub, supported by operational naval bases and shipbuilding centers in Adelaide, Perth, and Sydney. These locations benefit from proximity to Royal Australian Navy command structures, established defense shipyards, and long-term naval construction programs. Strong defense cooperation with the United States and the United Kingdom further strengthens technology access and system integration capabilities, while Australia’s vast maritime boundaries necessitate advanced sea-based sensing solutions to support continuous monitoring, deterrence, and mission readiness.

Market Segmentation

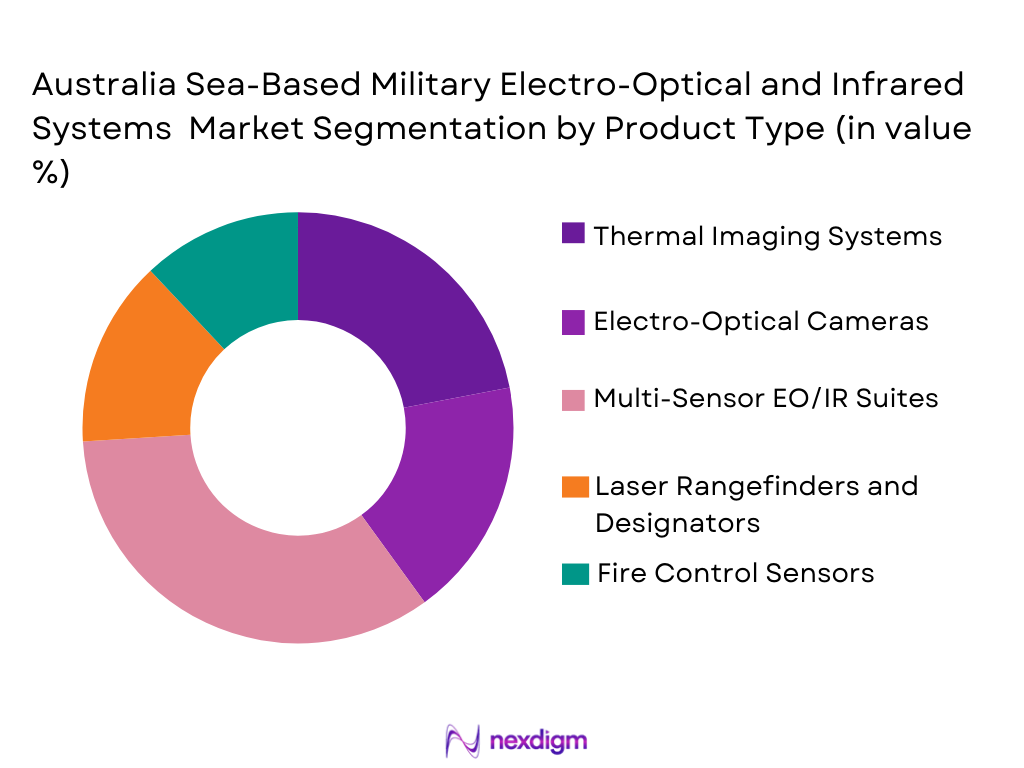

By Product Type

Australia Sea-Based Military Electro-Optical and Infrared Systems market is segmented by product type into thermal imaging systems, electro-optical cameras, multi-sensor EO/IR suites, laser rangefinders and designators, and fire control sensors. Recently, multi-sensor EO/IR suites have held a dominant market share due to their ability to combine infrared, visible spectrum, and laser-based technologies into a single stabilized platform. These systems offer superior target detection, identification, and tracking capabilities in complex maritime environments, supporting both surveillance and weapon guidance roles. Their compatibility with modern combat management systems, reduced operator workload, and effectiveness in all-weather conditions have increased adoption across surface combatants and patrol vessels, reinforcing their leadership within naval procurement programs.

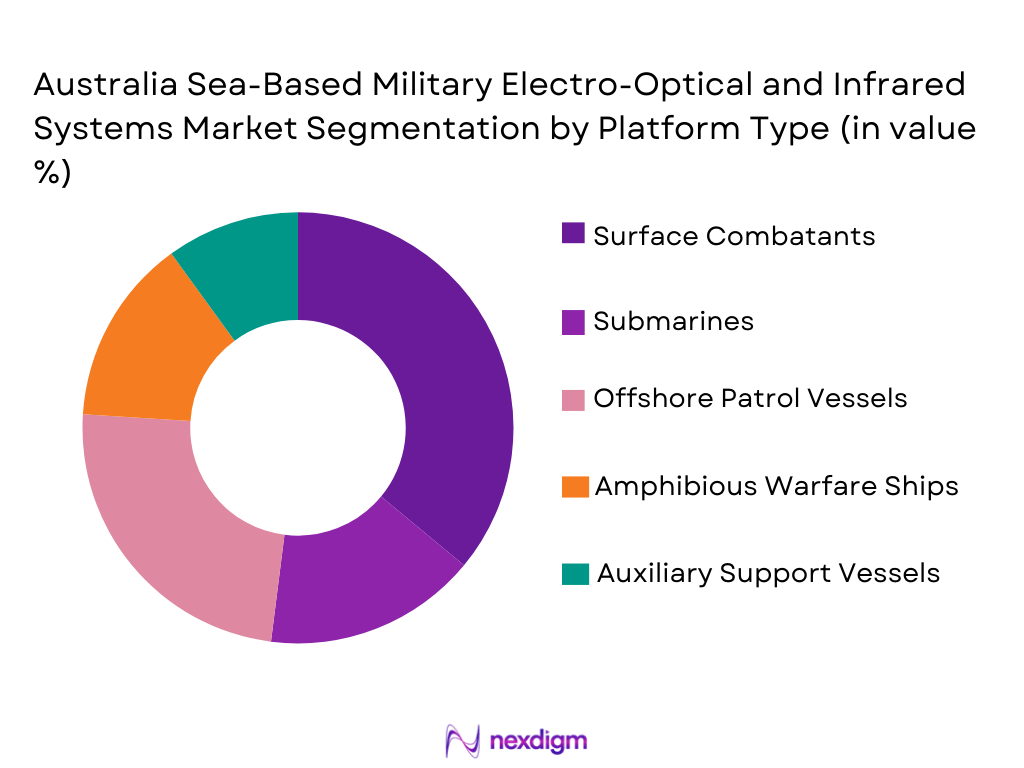

By Platform Type

Australia Sea-Based Military Electro-Optical and Infrared Systems market is segmented by platform type into surface combatant vessels, offshore patrol vessels, submarines, amphibious warfare ships, and auxiliary support vessels. Recently, surface combatant vessels have accounted for the dominant market share due to their central role in fleet operations, air and missile defense, and maritime security missions. These vessels require advanced EO/IR systems for long-range surveillance, target acquisition, and fire control integration. Ongoing upgrades to destroyers and frigates, combined with high operational deployment rates, have sustained strong demand for EO/IR installations on surface combatants, making them the leading platform category.

Competitive Landscape

The Australia Sea-Based Military Electro-Optical and Infrared Systems market is moderately consolidated, characterized by the presence of global defense primes and specialized sensor manufacturers supplying advanced naval EO/IR technologies. Major players leverage long-term defense contracts, platform integration expertise, and strong relationships with government agencies to maintain competitive positioning, while local partnerships and technology transfer initiatives influence supplier selection.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Naval Integration Capability |

| Lockheed Martin Australia | 1997 | Australia | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1959 | Australia | ~ | ~ | ~ | ~ | ~ |

| Raytheon Australia | 1999 | Australia | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 1998 | Australia | ~ | ~ | ~ | ~ | ~ |

| Leonardo Australia | 2016 | Australia | ~ | ~ | ~ | ~ | ~ |

Australia Sea-Based Military Electro-Optical and Infrared Systems Market Analysis

Growth Drivers

Naval Fleet Modernization and Maritime Surveillance Expansion:

Naval fleet modernization and maritime surveillance expansion are central growth drivers shaping the Australia Sea-Based Military Electro-Optical and Infrared Systems market. The Royal Australian Navy continues to prioritize advanced sensing technologies to support surface, sub-surface, and joint maritime operations across vast territorial waters. EO/IR systems play a critical role in enhancing situational awareness, enabling persistent surveillance, and supporting precision targeting in complex operational environments. The increasing complexity of maritime threats, including asymmetric and low-signature targets, has elevated the importance of high-resolution electro-optical and infrared sensors capable of operating in all weather and low-visibility conditions. Integration of EO/IR systems with combat management systems allows real-time data fusion, improving command decision-making and reducing response times. Fleet recapitalization programs, including new destroyers, frigates, and patrol vessels, require advanced EO/IR solutions as standard mission equipment. These platforms increasingly rely on multi-sensor EO/IR suites for navigation support, force protection, and intelligence gathering. The need to maintain interoperability with allied naval forces further accelerates adoption of globally standardized EO/IR technologies. As maritime operational tempo increases, sustained demand for EO/IR systems continues to support long-term market growth.

Strategic Emphasis on Persistent Maritime Domain Awareness:

Strategic emphasis on persistent maritime domain awareness is a significant growth driver for the Australia Sea-Based Military Electro-Optical and Infrared Systems market. Australia’s extensive coastline and maritime jurisdiction require continuous monitoring to safeguard national security, trade routes, and offshore resources. EO/IR systems enable day-and-night surveillance, supporting identification of surface and aerial threats without reliance on active emissions. The growing need to counter illegal fishing, smuggling, and unauthorized maritime activity reinforces investment in passive sensing technologies. Naval and joint maritime forces increasingly depend on EO/IR systems for real-time intelligence collection and threat verification. These systems complement radar and sonar by providing visual confirmation and precision tracking. Technological advancements have enhanced sensor resolution, stabilization, and image processing, improving operational effectiveness in challenging sea states. Integration with network-centric warfare frameworks allows EO/IR data to be shared across platforms, increasing operational reach. As maritime security priorities intensify, persistent domain awareness remains a foundational requirement driving EO/IR system procurement and upgrades.

Market Challenges

High Lifecycle Costs and Integration Complexity:

High lifecycle costs and integration complexity represent a major challenge within the Australia Sea-Based Military Electro-Optical and Infrared Systems market. Advanced EO/IR systems require significant upfront investment, specialized installation, and long-term maintenance support. Costs associated with sensor calibration, software updates, and environmental hardening add to total ownership expenses. Integration with existing naval platforms, particularly legacy vessels, introduces technical challenges related to power management, data compatibility, and system interfaces. These complexities can extend deployment timelines and increase program risk. Budgetary constraints require defense planners to balance capability enhancement with cost efficiency, limiting procurement volumes. Additionally, reliance on imported components exposes programs to supply chain disruptions and foreign dependency concerns. Certification and testing requirements further increase development and deployment costs. These financial and technical barriers can slow adoption and constrain market expansion.

Dependence on Foreign Technology and Supply Chains:

Dependence on foreign technology and supply chains poses a structural challenge for the Australia Sea-Based Military Electro-Optical and Infrared Systems market. Many critical EO/IR components, including infrared detectors and advanced optics, are sourced from international suppliers. This reliance creates exposure to export controls, geopolitical tensions, and procurement delays. Efforts to develop sovereign capabilities require significant investment and long development cycles. Limited domestic manufacturing capacity for high-end EO/IR components restricts local sourcing options. Supply chain disruptions can impact system availability and maintenance schedules. Balancing national security objectives with global supplier dependence remains a persistent challenge influencing procurement strategies.

Opportunities

Expansion of Indigenous Naval Sensor Manufacturing and Integration Capabilities:

Expansion of indigenous naval sensor manufacturing and integration capabilities represents a major opportunity for the Australia Sea-Based Military Electro-Optical and Infrared Systems market as national defense policy increasingly emphasizes sovereign capability development and reduced reliance on foreign suppliers. Government-backed shipbuilding and defense industrial programs encourage localization of system assembly, testing, integration, and long-term sustainment activities for advanced EO/IR solutions. This creates favorable conditions for international OEMs to establish joint ventures, local subsidiaries, and technology transfer arrangements with Australian defense manufacturers. Indigenous integration capabilities allow EO/IR systems to be tailored specifically for Australian maritime operating conditions, including extended patrol ranges, harsh sea environments, and diverse mission profiles. Local manufacturing also improves supply chain resilience by reducing exposure to geopolitical restrictions, export controls, and overseas logistics delays. As sustainment and lifecycle support become critical procurement criteria, domestically supported EO/IR systems gain competitive advantage. Workforce development initiatives further strengthen engineering and systems integration expertise within Australia. These factors collectively position sovereign manufacturing expansion as a long-term growth avenue for suppliers. Over time, localized EO/IR capabilities may also support export opportunities to allied naval forces operating similar platforms. This opportunity aligns economic development objectives with strategic defense requirements.

Integration of Artificial Intelligence and Multi-Domain Sensor Fusion Technologies:

Integration of artificial intelligence and multi-domain sensor fusion technologies presents a high-impact opportunity within the Australia Sea-Based Military Electro-Optical and Infrared Systems market as naval operations become increasingly data-centric and network-driven. AI-enabled EO/IR systems enhance automated target detection, classification, and tracking, reducing operator workload and improving reaction times during complex maritime missions. Sensor fusion capabilities allow EO/IR data to be combined with radar, sonar, and electronic warfare inputs, creating a unified operational picture for commanders. This improves threat assessment accuracy and supports coordinated responses across air, surface, and sub-surface domains. The Australian Navy’s focus on integrated combat systems and joint force interoperability supports demand for intelligent EO/IR solutions. Advances in machine learning algorithms and onboard processing power enable real-time analytics at the sensor level. These technologies are particularly valuable in congested maritime environments where manual identification is challenging. Suppliers offering AI-enhanced EO/IR systems can differentiate through performance, reliability, and adaptability. As digital transformation accelerates across defense platforms, demand for advanced sensor intelligence is expected to rise. This opportunity supports both new system procurement and upgrade programs across existing fleets.

Future Outlook

The Australia Sea-Based Military Electro-Optical and Infrared Systems market is expected to experience sustained development over the next five years, supported by naval modernization programs and increasing maritime security priorities. Technological advancements in sensor resolution, artificial intelligence, and system integration will enhance operational effectiveness. Regulatory support for sovereign defense manufacturing will influence procurement strategies. Growing demand for persistent maritime surveillance and interoperable naval systems will continue to shape market evolution.

Major Players

- Lockheed Martin Australia

- BAE Systems Australia

- Raytheon Australia

- Thales Australia

- Leonardo Australia

- Northrop Grumman Australia

- L3Harris Technologies Australia

- Safran Electronics & Defense

- HENSOLDT Australia

- Elbit Systems of Australia

- RheinmetallDefenceAustralia

- Ultra Maritime Australia

- EOSDefenceSystems

- Teledyne FLIR Defense

- Saab Australia

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Naval defense contractors

- Shipbuilding companies

- Defense electronics manufacturers

- Maritime security agencies

- System integrators

- Defense procurement authorities

Research Methodology

Step 1: Identification of Key Variables

The research process began with identification of core market variables influencing the Australia Sea-Based Military Electro-Optical and Infrared Systems market. Demand drivers, procurement programs, and technology trends were analyzed. Data sources included defense publications and industry disclosures. Variables were validated through cross-referencing multiple sources.

Step 2: Market Analysis and Construction

Market structure was developed by analyzing platform types, product categories, and procurement channels. Historical deployment patterns and contract activities were examined. Data normalization ensured consistency across sources. Analytical frameworks were applied to structure insights.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultation with defense industry experts and subject matter specialists. Assumptions were tested against operational realities. Feedback refined market segmentation and dynamics. This step ensured analytical accuracy.

Step 4: Research Synthesis and Final Output

Validated data and insights were synthesized into a structured report format. Qualitative and quantitative findings were integrated coherently. Consistency checks were performed across sections. The final output reflects a comprehensive market assessment.

- Executive Summary

- Australia Sea-Based Military Electro-Optical and Infrared Systems Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising maritime surveillance requirements across Australia’s extended exclusive economic zone

Modernization of naval fleets with advanced sensor and situational awareness capabilities

Increased emphasis on asymmetric threat detection in littoral and blue-water operations

Integration of EO/IR systems with combat management and C4ISR architectures

Growing defense budget allocations toward naval capability enhancement - Market Challenges

High acquisition and lifecycle costs of advanced EO/IR sensor systems

Complex integration requirements with legacy naval platforms

Dependence on imported critical sensor components and technologies

Stringent military certification and environmental qualification standards

Limited domestic manufacturing base for high-end infrared detector technologies - Market Opportunities

Expansion of indigenous defense manufacturing under national shipbuilding initiatives

Rising demand for modular and upgradeable EO/IR systems across existing fleets

Collaboration opportunities between global OEMs and Australian defense firms - Trends

Adoption of multi-sensor fusion for enhanced maritime situational awareness

Increased use of artificial intelligence for automated target recognition

Shift toward compact and lightweight EO/IR systems for smaller vessels

Growing focus on all-weather and day-night operational capability

Lifecycle extension programs driving retrofit demand - Government Regulations & Defense Policy

Naval capability development priorities under Australian defense white papers

Emphasis on sovereign defense industrial capability and local content requirements

Compliance with allied interoperability and export control frameworks - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Thermal Imaging Systems

Electro-Optical Surveillance Cameras

Multi-Sensor EO/IR Suites

Laser Rangefinder and Designator Systems

Target Acquisition and Fire Control Sensors - By Platform Type (In Value%)

Surface Combatant Vessels

Offshore Patrol Vessels

Submarines

Amphibious Warfare Ships

Auxiliary and Support Vessels - By Fitment Type (In Value%)

New Build Installations

Retrofit and Upgrade Programs

Modular Mission Payloads

Mast-Mounted Sensor Systems

Hull-Integrated Sensor Systems - By EndUser Segment (In Value%)

Royal Australian Navy Surface Fleet

Royal Australian Navy Submarine Fleet

Joint Maritime Task Forces

Coastal Surveillance Units

Special Operations Maritime Units - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Prime Contractor Integration

OEM Direct Sales

System Upgrade and Modernization Contracts

Maintenance and Support Agreements - By Material / Technology (in Value %)

Cooled Infrared Detectors

Uncooled Infrared Detectors

Visible Spectrum CMOS Sensors

Advanced Image Processing Algorithms

Stabilized Gimbal and Turret Systems

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (System performance range, Sensor resolution capability, Stabilization accuracy, Integration compatibility, Lifecycle support offerings, Local content participation, Technology upgrade flexibility, Cost of ownership, Delivery and integration timelines) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin Australia

BAE Systems Australia

Raytheon Australia

Northrop Grumman Australia

Thales Australia

Safran Electronics & Defense

Leonardo Australia

Elbit Systems of Australia

L3Harris Technologies Australia

HENSOLDT Australia

Teledyne FLIR Defense

Rheinmetall Defence Australia

Ultra Maritime Australia

EOS Defence Systems

CETC Australia

- Naval operators prioritize high-reliability systems capable of continuous maritime deployment

- End users demand seamless integration with shipborne combat and navigation systems

- Training and maintenance support are critical factors influencing procurement decisions

- Operational feedback increasingly shapes requirements for future sensor upgrades

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035