Market Overview

Based on a recent historical assessment, the Australia sea based remote weapon systems market was valued at USD ~ billion, supported by naval capability enhancement programs, surface combatant upgrades, and sustained investment in maritime force protection systems. Demand was driven by the requirement to improve ship survivability, reduce crew exposure during combat operations, and integrate precision firepower with modern naval combat management systems. Continuous fleet sustainment activities and indigenous defense manufacturing participation further reinforced procurement of advanced remotely operated naval weapon stations across multiple vessel classes.

Based on a recent historical assessment, Canberra, Adelaide, and Perth emerged as dominant centers within the Australia sea based remote weapon systems market due to concentration of naval command authorities, shipbuilding yards, and defense industrial infrastructure. Adelaide benefits from major surface combatant construction and systems integration activity, while Perth supports fleet basing and operational deployment across the Indian Ocean. Strong collaboration between the Royal Australian Navy, domestic defense primes, and international technology partners reinforces national leadership in sea based remote weapon system adoption.

Market Segmentation

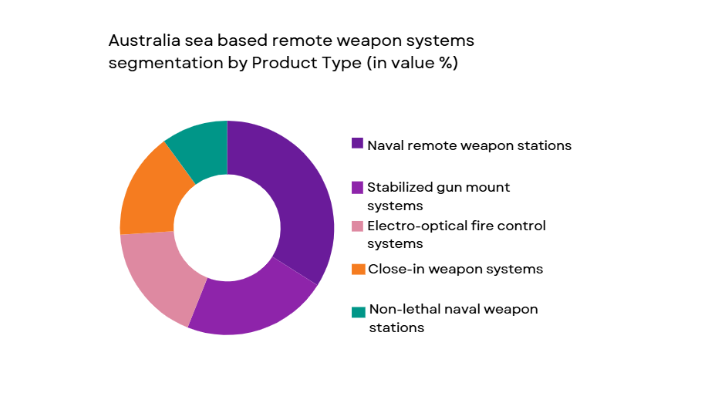

By Product Type

Australia sea based remote weapon systems market is segmented by product type into naval remote weapon stations, stabilized gun mount systems, electro-optical fire control systems, close-in weapon systems, and non-lethal naval weapon stations. Recently, naval remote weapon stations have a dominant market share due to their versatility across ship classes, compatibility with multiple weapon calibers, and ability to operate effectively in complex maritime environments. These systems support automated tracking, precision engagement, and seamless integration with ship combat management systems. Increased emphasis on crew safety and reduced topside manning has further strengthened adoption. Their modular design allows retrofit on existing platforms, extending service life and enhancing operational flexibility. Continuous upgrades in stabilization and sensor integration sustain dominance across fleet modernization programs.

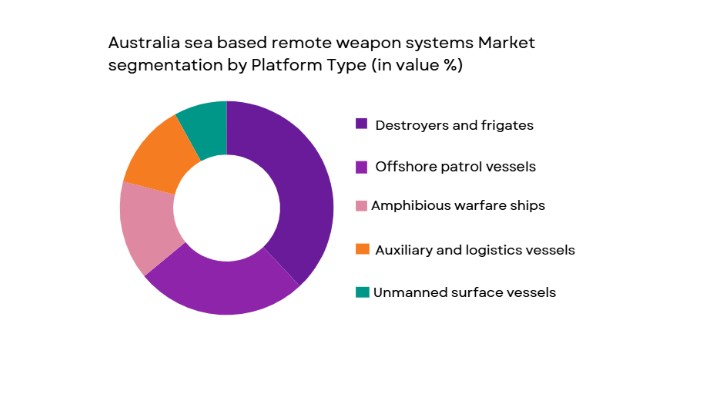

By Platform Type

Australia sea based remote weapon systems market is segmented by platform type into destroyers and frigates, offshore patrol vessels, amphibious warfare ships, auxiliary and logistics vessels, and unmanned surface vessels. Recently, destroyers and frigates have a dominant market share due to their central role in fleet combat operations and layered defense requirements. These vessels demand highly reliable and precise remote weapon systems for surface, asymmetric, and close-range threats. Integration with advanced sensors and combat systems is critical for mission effectiveness. Long operational deployments and high readiness standards further justify investment. Ongoing surface fleet upgrades and sustainment programs continue to support dominant adoption across major combatant platforms.

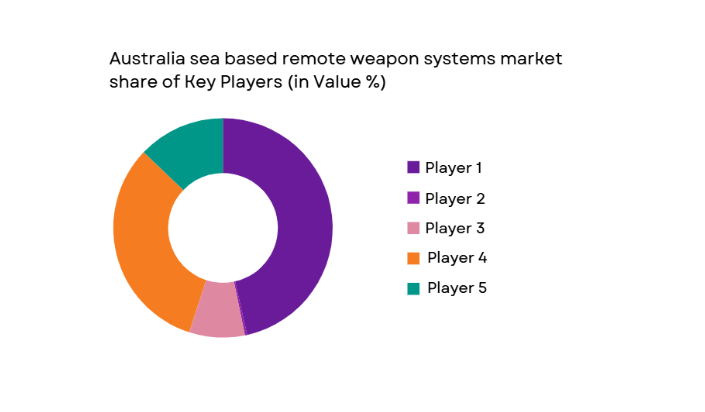

Competitive Landscape

The Australia sea based remote weapon systems market is moderately consolidated, with a limited number of established defense primes and specialized naval weapons suppliers dominating procurement. Market influence is driven by long-term naval contracts, proven system reliability, and integration expertise with Australian naval platforms, creating high entry barriers for new participants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Naval Integration Capability |

| BAE Systems Australia | 1996 | Adelaide, Australia | ~ | ~ | ~ | ~ | ~ |

| EOS Defence Systems | 1983 | Canberra, Australia | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1987 | Adelaide, Australia | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 2000 | Sydney, Australia | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall Defence Australia | 2010 | Brisbane, Australia | ~ | ~ | ~ | ~ | ~ |

Australia Sea Based Remote Weapon Systems Market Analysis

Growth Drivers

Naval Fleet Modernization and Force Protection Priorities:

Naval fleet modernization and force protection priorities strongly drive the Australia sea based remote weapon systems market as the Royal Australian Navy continues to enhance surface combatant survivability. Modern naval doctrine emphasizes layered defense and precise engagement of asymmetric threats. Remote weapon systems reduce crew exposure while maintaining high readiness levels. Integration with advanced sensors and combat management systems improves situational awareness. Continuous upgrades support long operational lifecycles. Government commitment to maritime security sustains procurement momentum. Indigenous manufacturing participation accelerates deployment. These combined factors reinforce consistent demand growth across the fleet.

Maritime Security Operations and Regional Stability Requirements:

Maritime security operations and regional stability requirements significantly influence the Australia sea based remote weapon systems market due to increased patrol and deterrence missions. Naval assets must address piracy, illegal trafficking, and regional security challenges. Remote weapon systems provide flexible response options without escalating force. High reliability under harsh maritime conditions is essential. Interoperability with allied naval forces enhances mission effectiveness. Training and doctrine alignment support system adoption. Sustained operational tempo drives continuous capability enhancement. These operational realities support long-term market expansion.

Market Challenges

High Integration Complexity and Lifecycle Sustainment Costs:

High integration complexity and lifecycle sustainment costs present a major challenge for the Australia sea based remote weapon systems market as systems must interface with diverse naval architectures. Custom integration increases engineering effort and timelines. Long-term maintenance and corrosion protection elevate costs. Budget constraints require prioritization across naval programs. Skilled technical workforce availability impacts sustainment. Certification and testing extend deployment schedules. Cost pressures affect procurement pacing. These challenges constrain rapid scaling.

Regulatory Compliance and Naval Safety Certification Requirements:

Regulatory compliance and naval safety certification requirements challenge market participants due to stringent standards governing shipboard weapon systems. Extensive testing is required for shock, vibration, and electromagnetic compatibility. Certification processes extend development cycles. Compliance costs increase total program expenditure. Any delays impact fleet readiness schedules. Alignment with allied standards adds complexity. Documentation requirements are extensive. These factors slow market entry.

Opportunities

Integration of Remote Weapon Systems on Unmanned Surface Vessels:

Integration of remote weapon systems on unmanned surface vessels represents a significant opportunity within the Australia sea based remote weapon systems market as naval autonomy programs expand. Armed unmanned platforms enhance maritime surveillance and deterrence. Remote systems enable safe weaponization without onboard crews. Modular designs support rapid integration. Operational flexibility increases across contested environments. Research investment accelerates innovation. Export potential rises. This opportunity supports future growth.

Advancement of AI-Enabled Targeting and Fire Control:

Advancement of AI-enabled targeting and fire control creates new opportunities by enhancing engagement accuracy and reducing operator workload. AI improves threat classification and tracking. Faster decision cycles improve combat effectiveness. Integration with existing systems is feasible. Continuous learning enhances performance over time. Domestic technology expertise supports development. These benefits encourage system upgrades and new procurement.

Future Outlook

The Australia sea based remote weapon systems market is expected to demonstrate steady growth over the next five years, supported by surface fleet upgrades and sustained maritime security commitments. Technological advancements in automation, sensor fusion, and AI-enabled fire control will enhance system effectiveness. Government support for domestic naval manufacturing and system integration will strengthen supply chains. Growing demand for unmanned and modular naval platforms will further expand adoption of advanced remote weapon systems.

Major Players

- BAE Systems Australia

- EOS Defence Systems

- Saab Australia

- Thales Australia

- Rheinmetall Defence Australia

- Lockheed Martin Australia

- Elbit Systems Australia

- Leonardo Australia

- Kongsberg Defence Australia

- Northrop Grumman Australia

- L3Harris Australia

- RTX Australia

- Navantia Australia

- ASELSAN Australia

- Hanwha Defence Australia

Key Target Audience

- Naval procurement agencies

- Defense ministries

- Maritime security agencies

- Shipbuilding and shipyard operators

- Defense system integrators

- Offshore patrol authorities

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key demand drivers, technology parameters, procurement policies, and operational requirements were identified through structured secondary research and expert consultation.

Step 2: Market Analysis and Construction

Data were analyzed to construct market structure, segmentation, and competitive positioning using validated analytical models.

Step 3: Hypothesis Validation and Expert Consultation

Findings were reviewed with naval experts, defense engineers, and industry stakeholders to validate assumptions and insights.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a comprehensive report with cross-verification to ensure reliability and clarity.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Naval fleet modernization and expansion programs

Rising maritime security and border surveillance needs

Integration of autonomous and unmanned naval platforms - Market Challenges

High system integration and lifecycle costs

Complex certification and naval safety standards - Market Opportunities

Expansion of unmanned and optionally crewed vessels

Adoption of AI-assisted targeting and tracking systems - Trends

Shift toward modular and scalable weapon stations

Growing demand for multi-role naval weapon systems - Government Regulations & Defense Policy

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Naval remote weapon stations

Stabilized gun mount systems

Electro-optical fire control systems - By Platform Type (In Value%)

Destroyers and frigates

Offshore patrol vessels

Amphibious warfare ships - By Fitment Type (In Value%)

New naval shipbuilding programs

Mid-life upgrade retrofits

Mission-specific modular fitments

Temporary operational deployments - By End User Segment (In Value%)

Royal Australian Navy

Border protection and coast guard forces

Maritime security agencies - By Procurement Channel (In Value%)

Government-to-OEM defense contracts

Naval shipyard integration contracts

System integrator led procurement

Foreign military sales frameworks

- Market share of major players

- Cross Comparison Parameters (Weapon Caliber Compatibility, Stabilization Accuracy, Sensor Integration Level, Automation Capability, System Weight, Corrosion Resistance, Interoperability Standards, Lifecycle Support, Cost Efficiency)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

BAE Systems Australia

EOS Defence Systems

Saab Australia

Thales Australia

Lockheed Martin Australia

Rheinmetall Defence Australia

Elbit Systems Australia

Leonardo Australia

Kongsberg Defence Australia

Northrop Grumman Australia

L3Harris Australia

RTX Australia

Navantia Australia

ASELSAN Australia

Hanwha Defence Australia

- Operational focus on force protection and survivability

- Preference for stabilized and automated weapon systems

- Demand for compatibility with existing naval combat suites

- Increasing role of remote systems in maritime missions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035