Market Overview

Based on a recent historical assessment, the Australia Search and Rescue Equipment Market is valued at approximately USD ~ billion, driven by sustained federal and state government expenditure on emergency preparedness, disaster response modernization, and replacement of aging rescue assets. Demand is supported by Australia’s exposure to bushfires, floods, cyclones, and maritime incidents, alongside strict aviation and maritime safety mandates. Continuous investments in advanced rescue vehicles, communication systems, medical equipment, and surveillance technologies further reinforce market activity across civil defense, coast guard, and emergency service agencies.

Based on a recent historical assessment, Australia dominates the Australia Search and Rescue Equipment Market due to its vast geographic coverage, dispersed population centers, and high-risk environmental conditions. Major cities such as Sydney, Melbourne, Brisbane, and Perth function as operational hubs due to dense infrastructure, centralized emergency command centers, and proximity to high-risk coastal and bushfire-prone regions. National coordination frameworks, strong inter-agency collaboration, and well-funded emergency response institutions further strengthen Australia’s leadership in large-scale deployment and sustained utilization of search and rescue equipment.

Market Segmentation

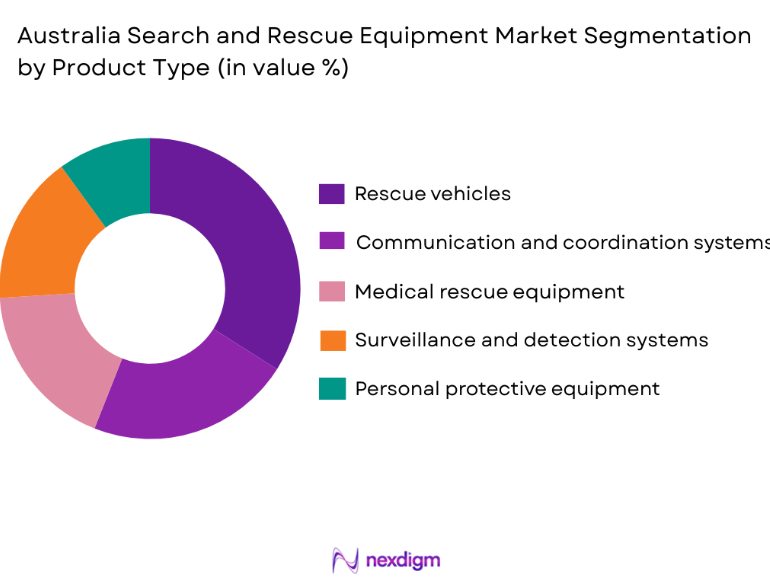

By Product Type

Australia Search and Rescue Equipment Market is segmented by product type into rescue vehicles, communication and coordination systems, personal protective equipment, medical rescue equipment, and surveillance and detection systems. Recently, rescue vehicles have had a dominant market share due to factors such as large-area coverage requirements, frequent deployment during natural disasters, and strong government preference for rapid mobility solutions. Australia’s challenging terrain and long-distance emergency response needs prioritize helicopters, all-terrain vehicles, rescue boats, and specialized fire and flood response vehicles. Strong domestic manufacturing support established procurement channels, and continuous fleet renewal programs further reinforce dominance. High utilization rates, integration with communication systems, and proven effectiveness during bushfires and floods drive sustained demand for rescue vehicles across federal and state emergency agencies.

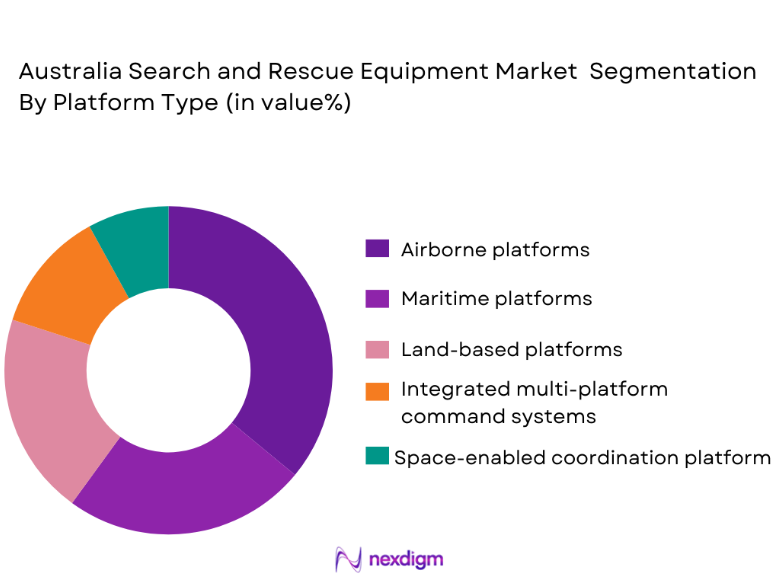

By Platform Type

Australia Search and Rescue Equipment Market is segmented by platform type into airborne platforms, maritime platforms, land-based platforms, space-enabled coordination platforms, and integrated multi-platform command systems. Recently, airborne platforms had a dominant market share due to Australia’s vast geography, limited accessibility in remote regions, and the critical need for rapid long-distance response during bushfires, floods, cyclones, and maritime incidents. Helicopters and fixed-wing aircraft enable fast deployment of rescue teams, medical evacuation, aerial surveillance, and supply drops across inland, coastal, and offshore environments. Strong government investment in aviation-based emergency response, well-developed airbase infrastructure, and high operational reliance during large-scale disasters reinforce dominance. Continuous upgrades to avionics, sensors, and mission systems further support sustained utilization of airborne platforms across federal and state emergency agencies.

Competitive Landscape

The Australia Search and Rescue Equipment Market is moderately consolidated, with a mix of global defense contractors and specialized domestic manufacturers supplying mission-critical equipment under long-term government frameworks. Market influence is shaped by technological capability, reliability, compliance with Australian safety standards, and established relationships with federal and state procurement authorities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End-User |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Saab | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ |

| Thales | 1893 | France | ~ | ~ | ~ | ~ | ~ |

| L3Harris | 1895 | USA | ~ | ~ | ~ | ~ | ~ |

Australia Search and Rescue Equipment Market Analysis

Growth Drivers

Escalating Frequency and Severity of Natural Disasters

Escalating frequency and severity of natural disasters is a major growth driver in the Australia Search and Rescue Equipment Market as emergency response agencies face increasing operational demands across bushfires, floods, cyclones, and extreme weather events. Australia’s climatic conditions require continuous readiness and rapid deployment of advanced rescue equipment across vast and often inaccessible regions. Government authorities prioritize investment in modern rescue vehicles, communication systems, and medical response tools to minimize casualties and infrastructure damage. Disaster response frameworks mandate equipment standardization and interoperability, reinforcing recurring procurement cycles. Increased public safety expectations further pressure agencies to upgrade capabilities. Advanced detection and monitoring technologies are increasingly integrated into rescue operations. Federal funding programs ensure sustained capital allocation. This driver ensures long-term demand stability rooted in risk mitigation rather than discretionary spending.

Expansion of Integrated Emergency Response Infrastructure

Expansion of integrated emergency response infrastructure strongly drives growth in the Australia Search and Rescue Equipment Market as agencies adopt unified command, control, and communication systems. Centralized coordination improves response efficiency during multi-agency operations. Investments in digital communication platforms enable real-time situational awareness. Equipment compatibility across jurisdictions is increasingly mandated. Advanced data-sharing systems enhance decision-making during crises. Infrastructure upgrades require complementary equipment procurement. Long-term modernization programs support continuous spending. This integration-focused approach strengthens market expansion.

Market Challenges

High Capital Intensity and Budget Allocation Constraints

High capital intensity and budget allocation constraints pose a significant challenge in the Australia Search and Rescue Equipment Market due to the high cost of acquiring technologically advanced rescue platforms and building supporting operational infrastructure. Procurement of specialized vehicles, aircraft, vessels, communication networks, and command systems requires substantial upfront capital commitments from federal and state governments. Ongoing maintenance, spare parts availability, software upgrades, and compliance-driven inspections significantly elevate total lifecycle costs. Specialized training for pilots, operators, medical personnel, and technical staff further increases long-term expenditure. Budget competition with critical public sectors such as healthcare, education, transport, and social services limits financial flexibility for rapid upgrades. Lengthy procurement and approval cycles delay capability enhancement and replacement of aging assets. Inflationary pressures and supply chain disruptions raise equipment pricing and sustainment costs. Expanding coverage into rural and remote regions further amplifies financial strain. These combined factors constrain fleet expansion, slow modernization timelines, and require careful prioritization of investments.

Operational Complexity Across Vast Geographic Areas

Operational complexity across vast geographic areas challenges the Australia Search and Rescue Equipment Market as agencies are required to maintain high readiness levels across remote, sparsely populated, and environmentally demanding regions. Equipment deployment logistics are demanding due to long travel distances, limited road access, and dependence on air or maritime transport to reach incident locations. Maintenance and technical support in remote areas are constrained by workforce shortages, limited-service facilities, and delayed supply delivery. Communication coverage gaps persist across inland deserts, mountainous regions, and offshore zones, hindering real-time coordination and situational awareness. Inter-agency coordination involving federal, state, volunteer, defense, and maritime authorities require extensive planning and standardized procedures. Training consistency across regions is difficult to maintain due to geographic dispersion and uneven operational exposure. Extreme weather variability, including heatwaves, floods, cyclones, and bushfires, further complicated mission planning. These challenges reduce operational efficiency, increase response times, and elevate overall operational costs.

Opportunities

Adoption of Advanced Digital and Sensor-Based Rescue Technologies

Adoption of advanced digital and sensor-based rescue technologies presents a strong opportunity in the Australia Search and Rescue Equipment Market as emergency response agencies increasingly prioritize higher operational accuracy, faster response times, and improved mission effectiveness. Integration of advanced sensors such as thermal imaging, radar, acoustic detection, and geolocation technologies significantly enhances victim identification in low-visibility and complex environments. Data analytics platforms support more effective mission planning, resource allocation, and post-incident assessment. AI-enabled systems enable predictive deployment by analyzing historical incident patterns and environmental data. Interoperable digital platforms improve coordination across air, land, and maritime rescue assets. Continuous technology upgrades extend equipment lifespan and reduce long-term maintenance costs. Government-backed innovation and modernization funding supports accelerated adoption of digital rescue solutions. This opportunity is driving next-generation procurement focused on intelligence-led and technology-enabled rescue operations.

Expansion of Public–Private Partnerships in Emergency Services

Expansion of public–private partnerships create substantial opportunities in the Australia Search and Rescue Equipment Market by combining public sector operational authority with private sector innovation, efficiency, and capital investment. Outsourced equipment maintenance and fleet management services improve operational uptime and cost efficiency for government agencies. Private providers enhance surge capacity during large-scale disasters and peak demand periods. Shared investment models reduce fiscal pressure on public budgets while enabling access to advanced technologies. Technology transfer agreements accelerate modernization of rescue platforms and systems. Contractual flexibility allows rapid scaling of services in response to emergency needs. Evolving regulatory frameworks increasingly supports collaboration with private operators. This partnership-driven approach broadens market participation and strengthens long-term capability development.

Future Outlook

Over the next five years, the Australia Search and Rescue Equipment Market is expected to grow steadily, supported by disaster preparedness funding, technology modernization, and regulatory emphasis on public safety. Digital systems, sensor integration, and interoperable platforms will shape procurement priorities. Government-led initiatives will remain the primary demand driver.

Major Players

- Airbus

- Leonardo

- Saab

- Thales

- L3Harris

- Boeing

- Lockheed Martin

- Northrop Grumman

- Honeywell

- Dassault Aviation

- Bell Helicopter

- Sikorsky

- General Dynamics

- Rheinmetall

- BAE Systems

Key Target Audience

- Government and regulatory bodies

- Defense ministries

- State emergency services

- Maritime safety agencies

- Fire and rescue departments

- Disaster management authorities

- Investments and venture capitalist firms

- Aerospace and defense procurement agencies

Research Methodology

Step 1: Identification of Key Variables

Key variables such as disaster frequency, fleet size, procurement programs, and regulatory requirements were identified. Data sources included government publications and emergency service disclosures. Market boundaries were defined accordingly.

Step 2: Market Analysis and Construction

Demand drivers, technology adoption, and procurement trends were analyzed. Quantitative and qualitative data were synthesized. Cross-checks ensured internal consistency.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts and emergency response professionals validated assumptions. Operational insights refined analysis. Feedback improved accuracy.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a structured report. Data verification checks were applied. Output reflects validated market insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising frequency of natural disasters and extreme weather events

Expansion of maritime trade and offshore energy operations

Government focus on national resilience and emergency preparedness

Modernization of aging rescue fleets and legacy systems

Integration of advanced sensing and communication technologies - Market Challenges

High acquisition and lifecycle costs of advanced rescue systems

Complex certification requirements across aviation and maritime domains

Maintenance and logistics challenges in remote regions

Interoperability limitations between legacy and new platforms

Budgetary constraints within public sector procurement cycles - Market Opportunities

Deployment of unmanned and autonomous systems for extended coverage

Integration of satellite and space-based assets for long-range detection

Development of modular and rapidly deployable rescue solutions - Trends

Increased use of unmanned aerial systems for situational awareness

Greater reliance on data-driven command and control platforms

Shift toward lightweight and portable rescue equipment

Adoption of multi-mission and cross-domain systems

Expansion of training-linked and simulation-enabled equipment - Government Regulations & Defense Policy

Strengthening of national disaster management frameworks

Alignment with international aviation and maritime safety standards

Defense support to civil authorities during large-scale emergencies - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communication and distress signaling systems

Search sensors and detection equipment

Rescue and recovery tools

Survival and medical support equipment

Command, control, and coordination systems - By Platform Type (In Value%)

Aerial search and rescue platforms

Maritime search and rescue platforms

Land-based rescue vehicles and teams

Unmanned and remotely operated systems

Fixed command and monitoring installations - By Fitment Type (In Value%)

Vehicle-mounted equipment

Portable and handheld systems

Wearable rescue devices

Containerized modular units

Fixed-site installed systems - By EndUser Segment (In Value%)

National and state emergency services

Maritime safety and coast guard agencies

Aviation rescue and firefighting units

Defense and border protection forces

Volunteer and non-government rescue organizations - By Procurement Channel (In Value%)

Direct government procurement

Defense and security tenders

Long-term framework agreements

Emergency and rapid response purchases

Public-private partnership programs - By Material / Technology (in Value %)

Advanced composite materials

Thermal and infrared sensing technology

Satellite-based communication systems

Artificial intelligence enabled analytics

Ruggedized electronics and power solutions

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System performance range, Technology integration level, Compliance certifications, Deployment speed, Lifecycle support capability, Cost efficiency, Platform compatibility, Local manufacturing presence)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Elbit Systems Australia

Thales Australia

Saab Australia

Leonardo Australia

L3Harris Australia

Raytheon Australia

BAE Systems Australia

Lockheed Martin Australia

Northrop Grumman Australia

Honeywell Aerospace Australia

Cobham Australia

Rheinmetall Defence Australia

Airbus Defence Australia

Ultra Electronics Australia

EOS Defence Systems

- Emergency services emphasize rapid deployment and interoperability

- Maritime agencies prioritize long-endurance detection and communication

- Aviation rescue units focus on all-weather precision capability

- Volunteer organizations demand cost-effective and rugged equipment

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035