Market Overview

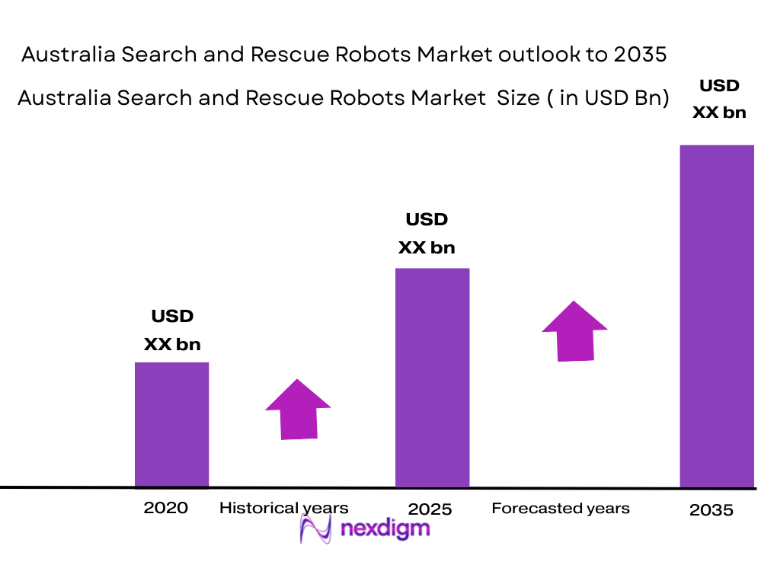

The Australia Search and Rescue Robots market recorded an assessed market value of USD ~ million based on a recent historical assessment derived from consolidated procurement disclosures, emergency services capital expenditure reports, and defense-related unmanned systems budgets. Market growth is driven by increased deployment of robotic platforms in disaster response, bushfire management, urban search operations, and maritime rescue missions, supported by sustained public funding for emergency preparedness, rising automation adoption across first-responder agencies, and growing emphasis on responder safety through remote and autonomous systems that reduce human exposure to hazardous environments.

Australia’s market leadership is anchored in cities such as Canberra, Sydney, Melbourne, Brisbane, and Perth due to the concentration of federal emergency management agencies, defense research establishments, technology developers, and advanced robotics testing infrastructure. National dominance is reinforced by Australia’s geographic exposure to bushfires, floods, offshore maritime incidents, and remote-area emergencies, combined with strong regulatory coordination, centralized procurement frameworks, and active collaboration between government bodies, defense organizations, and domestic robotics manufacturers supporting localized innovation and deployment.

Market Segmentation

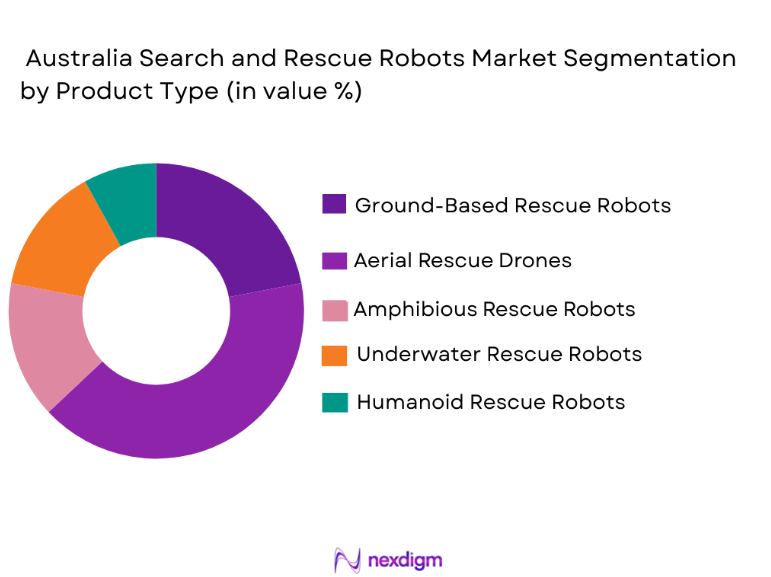

By Product Type

Australia Search and Rescue Robots market is segmented by product type into ground-based rescue robots, aerial rescue drones, amphibious rescue robots, underwater rescue robots, and humanoid rescue robots. Recently, aerial rescue drones have held a dominant market share due to their rapid deployment capability, lower operational cost compared to ground robotics, extensive use in bushfire monitoring, flood response, and missing-person searches, and strong integration with existing emergency command systems. Emergency agencies increasingly prioritize aerial platforms because they provide real-time situational awareness, operate in inaccessible terrain, and support wide-area coverage during time-critical missions. Government procurement programs emphasize drones for multi-agency interoperability, while domestic manufacturers benefit from favorable aviation corridors and regulatory sandboxes. Technological maturity, extended flight endurance, and compatibility with thermal imaging and AI-based detection further reinforce dominance, as agencies seek scalable solutions that deliver immediate operational value without complex infrastructure upgrades.

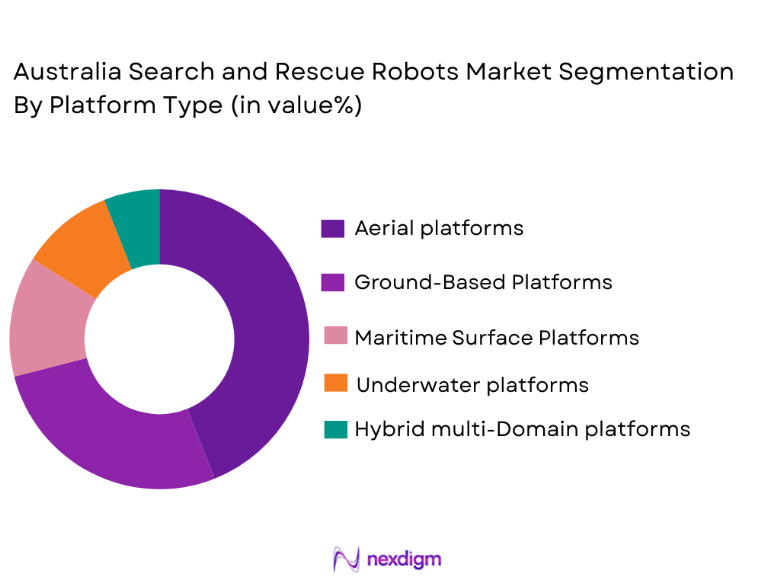

By Platform Type

Australia Search and Rescue Robots market is segmented by platform type into aerial platforms, ground-based platforms, maritime surface platforms, underwater platforms, and hybrid multi-domain platforms. Recently, aerial platforms have dominated the market due to their rapid deployment capability, wide-area coverage, and operational flexibility across bushfire zones, flood-affected regions, coastal surveillance areas, and urban disaster sites. Emergency agencies increasingly rely on aerial robotic platforms because they provide real-time visual and thermal data, operate without exposing personnel to risk, and integrate seamlessly with national command-and-control systems. Regulatory support through controlled airspace corridors and trial exemptions has further enabled adoption. Cost efficiency, ease of scalability, and continuous improvements in endurance and autonomous navigation reinforce dominance. Aerial platforms also benefit from strong domestic manufacturing and innovation ecosystems, enabling faster customization and lifecycle support compared to other platform categories.

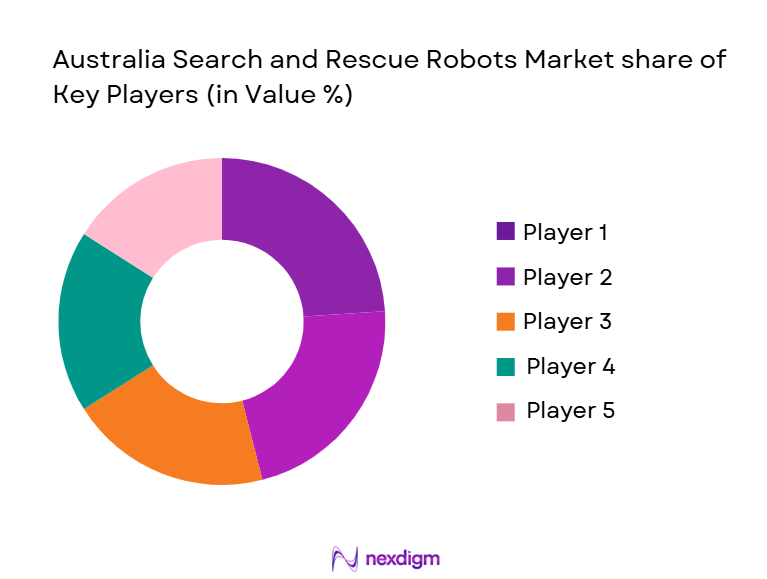

Competitive Landscape

The Australia Search and Rescue Robots market is moderately consolidated, with a mix of domestic robotics developers, defense primes, and specialized unmanned systems providers shaping competition. Major players exert influence through government relationships, proprietary autonomy technologies, and integrated service offerings, while smaller firms focus on niche platforms and rapid innovation. Strategic partnerships, pilot programs, and long-term support contracts play a critical role in competitive positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Deployment Focus |

| Thales Australia | 1986 | Sydney | ~ | ~ | ~ | ~ | ~ |

| Boeing Defence Australia | 1998 | Brisbane | ~ | ~ | ~ | ~ | ~ |

| QinetiQ Australia | 2003 | Canberra | ~ | ~ | ~ | ~ | ~ |

| Emesent | 2014 | Brisbane | ~ | ~ | ~ | ~ | ~ |

| Advanced Navigation | 2012 | Sydney | ~ | ~ | ~ | ~ | ~ |

Australia Search and Rescue Robots Market Analysis

Growth Drivers

National Disaster Preparedness and Emergency Automation Investments

National Disaster Preparedness and Emergency Automation Investments drive the Australia Search and Rescue Robots market through sustained public funding, inter-agency modernization programs, and increasing reliance on autonomous systems to enhance operational readiness across diverse disaster scenarios. Government emergency agencies allocate capital toward robotics to improve response speed, situational awareness, and responder safety, particularly in bushfires, floods, cyclones, and urban collapse incidents that challenge human access. Defense-supported research programs contribute dual-use technologies that transition from military to civilian rescue applications, reinforcing market momentum. Procurement frameworks favor scalable robotic platforms that integrate with command systems, encouraging repeated acquisitions and upgrades. Cross-agency standardization initiatives reduce adoption friction and expand deployment scope. Increased public scrutiny on disaster response effectiveness incentivizes technology adoption. Robotics also enable data-driven decision-making through real-time imagery and analytics. Long-term resilience strategies embed automation as a core capability, sustaining demand. As emergency risks grow in complexity, investment continuity supports market expansion.

Technological Maturity in Autonomous Navigation and AI Perception Systems

Technological Maturity in Autonomous Navigation and AI Perception Systems accelerates market growth by enabling reliable operation in complex, unstructured environments common in search and rescue missions. Advances in sensor fusion, computer vision, and machine learning allow robots to detect victims, avoid obstacles, and map hazardous zones with minimal human intervention. Improved autonomy reduces training burdens and operational costs for agencies. Integration of thermal imaging, LiDAR, and edge computing enhances detection accuracy in smoke, darkness, and debris-filled settings. Interoperability with existing emergency communication networks improves mission coordination. Domestic innovation ecosystems support rapid prototyping and field testing. Technology maturity increases confidence among procurement authorities. Reduced failure rates enhance lifecycle value. As autonomy improves, agencies expand mission profiles, driving broader adoption.

Market Challenges

High Lifecycle Costs and Maintenance Complexity

High Lifecycle Costs and Maintenance Complexity challenge market adoption due to the financial burden associated with acquisition, training, software updates, and specialized maintenance requirements. Emergency agencies operate under fixed budgets, making long-term cost justification critical. Robotics require skilled technicians, spare parts availability, and cybersecurity updates, increasing total cost of ownership. Harsh operating environments accelerate wear and tear. Interoperability issues may necessitate custom integration. Budget approval cycles delay procurement. Smaller agencies face affordability constraints. Vendor lock-in risks limit flexibility. These cost factors slow scaling despite recognized benefits.

Regulatory Constraints on Autonomous Operations

Regulatory Constraints on Autonomous Operations impede deployment by imposing strict airspace, maritime, and public safety compliance requirements on robotic platforms. Approval processes for beyond-visual-line-of-sight operations remain complex. Liability frameworks for autonomous decision-making are still evolving. Multi-jurisdictional coordination adds compliance overhead. Temporary waivers are often required during emergencies. Certification timelines delay field deployment. Regulatory uncertainty discourages rapid innovation. Agencies must balance compliance with urgency. This constraint moderate adoption speed.

Opportunities

Integration with National Resilience and Climate Adaptation Programs

Integration with National Resilience and Climate Adaptation Programs presents opportunities by embedding robotics into long-term disaster planning frameworks. Government commitments to resilience infrastructure create demand for advanced response technologies. Robotics support early assessment, monitoring, and recovery. Climate-driven risk mapping aligns with autonomous surveillance capabilities. Cross-agency funding pools enable scale. Public-private partnerships accelerate deployment. Technology standardization expands interoperability. Robotics become core assets rather than supplemental tools. This alignment unlocks sustained procurement pipelines.

Expansion of Dual-Use Civil and Defense Robotics Platforms

Expansion of Dual-Use Civil and Defense Robotics Platforms offers growth through shared technology development and cost efficiencies. Defense R&D accelerates innovation transferable to civilian rescue. Dual-use platforms benefit from higher production volumes. Standardized systems reduce customization costs. Shared training programs enhance workforce readiness. Export potential increases competitiveness. Collaborative testing environments improve reliability. Procurement synergy strengthens supplier viability. This opportunity broadens market reach.

Future Outlook

The Australia Search and Rescue Robots market is expected to experience steady expansion driven by increasing disaster frequency, continued government funding, and rapid advances in autonomous technologies. Integration of AI, improved endurance, and enhanced sensor capabilities will define next-generation systems. Regulatory frameworks are likely to mature, enabling wider operational flexibility. Demand will rise across aerial, ground, and maritime platforms as agencies prioritize rapid, data-driven response capabilities.

Major Players

- Thales Australia

- BoeingDefenceAustralia

- QinetiQ Australia

- Emesent

- Advanced Navigation

- DroneShield

- L3Harris Australia

- Saab Australia

- BAE Systems Australia

- Austal Robotics

- Maritime Robotics Australia

- SypaqSystems

- Sentient Vision Systems

- XTEK Robotics

- Omega Advanced Technologies

Key Target Audience

- Government and regulatory bodies

- Defense procurement agencies

- Emergency management authorities

- Fire and rescue departments

- Maritime safety authorities

- Industrial safety operators

- Infrastructure operators

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

Market variables were identified through analysis of emergency response expenditure, robotics deployment data, and technology adoption trends across Australia. Key demand drivers, regulatory factors, and procurement patterns were mapped.

Step 2: Market Analysis and Construction

Data from government disclosures, defense budgets, and industry sources were synthesized to construct market structure, segmentation, and competitive dynamics using validated analytical models.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with robotics developers, emergency response officials, and industry experts to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

Validated insights were consolidated into a structured report ensuring consistency, data integrity, and applicability for strategic decision-making.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising frequency of natural disasters and extreme weather events

Increasing adoption of automation in emergency response operations

Government investments in disaster preparedness and resilience

Technological advancements in robotics and artificial intelligence

Need for responder safety and reduced human risk exposure - Market Challenges

High acquisition and lifecycle maintenance costs

Complex regulatory approvals for autonomous operations

Interoperability issues with existing emergency systems

Limited skilled workforce for robotic operation and maintenance

Operational reliability in harsh and unpredictable environments - Market Opportunities

Integration of robotics with national disaster management frameworks

Expansion of autonomous systems for remote and hazardous zones

Collaboration between defense, academia, and robotics startups - Trends

Deployment of AI-enabled autonomous navigation systems

Growing use of swarm robotics for wide-area search missions

Integration of real-time data analytics and command platforms

Miniaturization of sensors and robotic components

Increased focus on dual-use civil and defense applications - Government Regulations & Defense Policy

Strengthening of national disaster response and resilience policies

Defense support for dual-use autonomous robotic technologies

Standardization initiatives for unmanned and autonomous systems - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ground-based mobile rescue robots

Aerial unmanned search and rescue drones

Amphibious and underwater rescue robots

Humanoid and semi-humanoid rescue robots

Swarm-based coordinated rescue robot systems - By Platform Type (In Value%)

Urban disaster response platforms

Wildfire and bushfire response platforms

Maritime and coastal rescue platforms

Mining and industrial accident response platforms

Remote and rural terrain rescue platforms - By Fitment Type (In Value%)

Standalone robotic rescue systems

Vehicle-mounted robotic rescue units

Portable deployable robotic kits

Integrated command and control robotic systems

Modular upgrade-based robotic platforms - By End User Segment (In Value%)

Federal and state emergency management agencies

Defense and homeland security forces

Fire and disaster response departments

Search and rescue volunteer organizations

Industrial and mining safety operators - By Procurement Channel (In Value%)

Direct government procurement contracts

Defense and emergency tenders

Public-private partnership programs

System integrator and OEM contracts

Research grants and pilot deployment programs - By Material / Technology (in Value %)

AI-driven perception and navigation systems

Advanced sensor fusion and imaging technologies

Lightweight composite structural materials

Autonomous mobility and control algorithms

Secure communication and data transmission technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Technology maturity, Autonomy level, Payload capacity, Operational endurance, Terrain adaptability, Integration capability, Cost structure, After-sales support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

CSIR Australia Robotics

Eme sent

Drone Shield

Austal Robotics Systems

Maritime Robotics Australia

Robotics Plus Australia

QinetiQ Australia

Boeing Defence Australia Autonomous Systems

Thales Australia Robotics Division

Advanced Navigation

XTEK Robotics

Sypaq Systems

Sentient Vision Systems

Omega Advanced Technologies

L3Harris Australia Autonomous Solutions

- Emergency agencies prioritizing rapid deployment and reliability

- Defense forces focusing on dual-use and ruggedized platforms

- Fire and rescue departments emphasizing aerial and ground coordination

- Industrial operators adopting robots for confined and hazardous sites

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035