Market Overview

Based on a recent historical assessment, the Australia simulator market was valued at USD ~ billion, supported by verified disclosures from defense budget allocations, civil aviation training expenditures, and procurement records published by the Australian Department of Defense and Civil Aviation Safety Authority. Market expansion is driven by sustained investments in defense readiness, mandatory simulator-based pilot certification, rising demand for cost-efficient training alternatives, and increasing reliance on virtual environments to reduce operational risk, fuel consumption, and asset wear across aviation, maritime, and land-based training ecosystems nationwide.

Based on a recent historical assessment, Sydney, Melbourne, Canberra, and Brisbane emerge as dominant hubs due to concentrated defense command structures, aviation training academies, and simulator manufacturing facilities. Australia dominates regionally due to centralized defense procurement, strong regulatory enforcement of simulator-based certification, and established aerospace and naval training infrastructure. Proximity to defense headquarters, skilled labor availability, and long-term modernization programs reinforce dominance, while stable government funding and private sector participation support sustained simulator adoption across military, commercial aviation, and emergency response training environments.

Market Segmentation

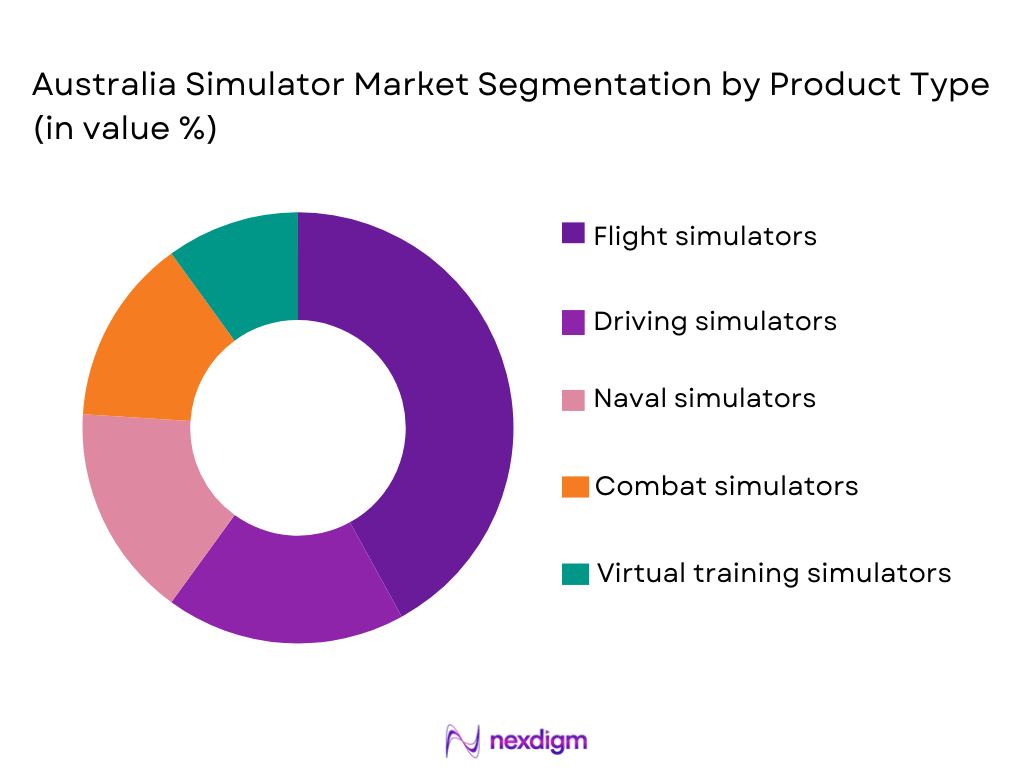

By Product Type

Australia Simulator market is segmented by product type into flight simulators, driving simulators, naval simulators, combat simulators, and virtual training simulators. Recently, flight simulators have a dominant market share due to mandatory pilot licensing requirements, high utilization rates in both military and civil aviation, strong brand presence of certified OEMs, and continuous demand from airline fleet expansion and defense pilot training pipelines. Flight simulators benefit from regulatory endorsement, long operational lifecycles, and recurring software upgrade demand, making them central to training infrastructure investments across Australia’s aviation ecosystem while maintaining consistent procurement momentum.

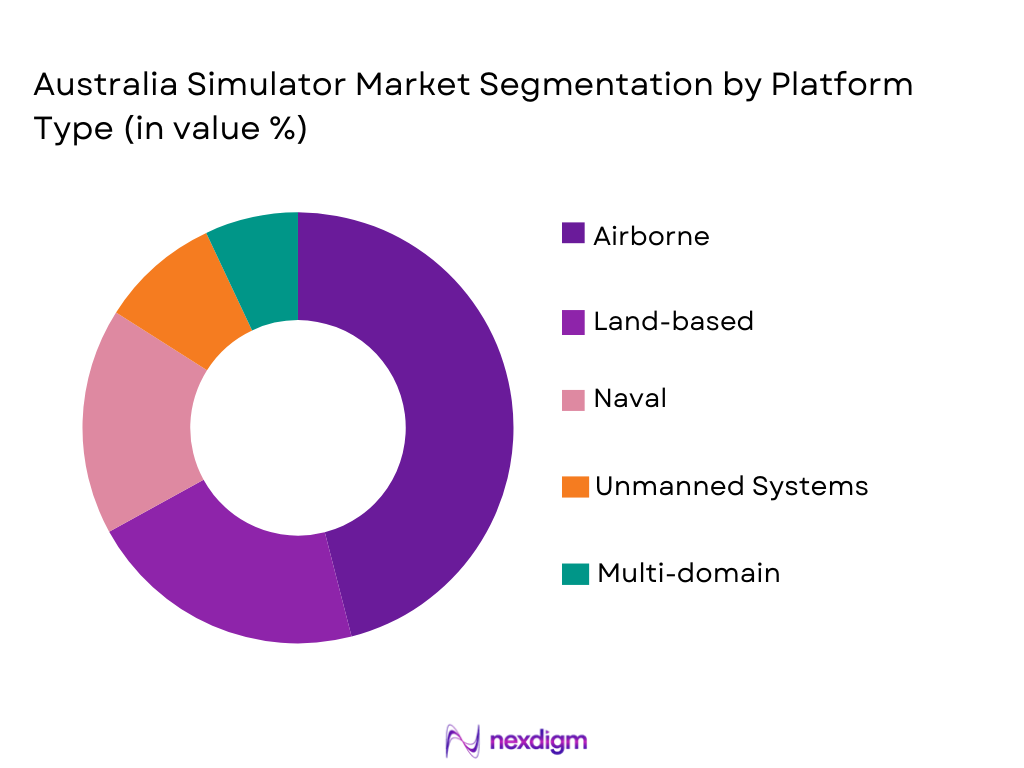

By Platform Type

Australia Simulator market is segmented by platform type into airborne, land-based, naval, unmanned systems, and multi-domain platforms. Recently, airborne platforms have a dominant market share due to extensive pilot training requirements, strict aviation safety regulations, high aircraft operating costs encouraging simulation, and concentration of airline and defense aviation assets. Airborne simulators receive sustained funding for mission rehearsal, emergency scenario replication, and fleet transition training, supported by established infrastructure and continuous certification cycles that reinforce their leading position within Australia’s simulator ecosystem.

Competitive Landscape

The Australia simulator market demonstrates moderate consolidation, with a limited number of global defense and aerospace firms controlling advanced simulator technologies while local integrators support deployment and lifecycle services. Major players influence procurement through long-term defense contracts, certified training solutions, and integrated hardware-software platforms, reinforcing entry barriers and strengthening supplier bargaining power.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Primary End-User |

| CAE Australia | 1947 | Sydney | ~ | ~ | ~ | ~ | ~ |

| Boeing Defence Australia | 1928 | Brisbane | ~

|

~

|

~

|

~

|

~

|

| Lockheed Martin Australia | 1997 | Canberra | ~

|

~

|

~

|

~

|

~

|

| Thales Australia | 1893 | Sydney | ~

|

~

|

~

|

~

|

~

|

| Saab Australia | 1937 | Adelaide | ~

|

~

|

~

|

~

|

~

|

Australia Simulator Market Analysis

Growth Drivers

Defense Training Modernization and Readiness Programs:

Defense Training Modernization and Readiness Programs are a primary driver of sustained growth in the Australia simulator market because national defense planning increasingly prioritizes preparedness, interoperability, and continuous skill enhancement across air, land, naval, and joint forces. Simulation systems allow defense agencies to conduct complex mission rehearsal and operational scenario training without deploying live assets, which significantly reduces fuel consumption, equipment wear, and safety risks while maintaining high training frequency. Australian defense procurement policies emphasize capability sustainment and long-term readiness, leading to multi-year contracts for high-fidelity simulators that ensure predictable demand. Modern warfare environments require rapid adaptation to evolving threat profiles, and simulators provide controlled environments to train personnel on new doctrines, platforms, and technologies without operational disruption. Networked simulation enables joint-force training across geographically dispersed units, aligning with national defense objectives focused on integrated operations. Simulator-based training also supports compliance with internal readiness benchmarks and international interoperability standards, reinforcing institutional reliance on advanced systems. Domestic industrial participation initiatives encourage localization of simulator integration and support services, further strengthening market depth. These combined factors ensure that defense modernization programs continue to anchor simulator demand through stable funding channels and long-term strategic commitments.

Civil Aviation Safety Compliance and Fleet Expansion Requirements:

Civil Aviation Safety Compliance and Fleet Expansion Requirements strongly drive the Australia simulator market as regulatory authorities mandate recurrent simulator-based training for pilot licensing, certification renewal, and type-rating transitions. Airlines and training academies rely on certified simulators to meet safety compliance obligations while minimizing aircraft downtime and operational costs associated with live training flights. Expansion of domestic and international air routes increases pilot training throughput requirements, making scalable simulator capacity essential for maintaining service continuity. Fleet modernization programs introduce new aircraft models that require dedicated simulator training, generating continuous demand for updated hardware and software configurations. Simulators enable airlines to address pilot shortages efficiently by accelerating training cycles without compromising safety standards. Advanced simulation technology improves training realism, allowing crews to rehearse rare emergency scenarios that cannot be safely replicated in real aircraft. Training organizations prefer simulators due to predictable operating costs and reduced exposure to fuel price volatility. Collectively, regulatory enforcement, airline expansion strategies, and operational efficiency imperatives sustain robust simulator adoption across Australia’s civil aviation ecosystem.

Market Challenges

High Capital Expenditure and Long Lifecycle Cost Burden:

High Capital Expenditure and Long Lifecycle Cost Burden represents a significant challenge for the Australia simulator market because advanced simulation systems require substantial upfront investment in hardware, software, motion platforms, visual systems, and regulatory certification. Acquisition costs are compounded by long development and installation timelines, which delay return on investment and place financial pressure on smaller training providers and regional operators. Beyond procurement, simulators incur ongoing lifecycle expenses related to maintenance, calibration, software updates, spare parts replacement, and periodic recertification to remain compliant with evolving regulatory standards. These recurring costs often increase over time as systems age and original components become obsolete or unsupported. Budget constraints within public sector organizations can result in deferred upgrades, limiting technological advancement and operational realism. Private sector operators face financing challenges, as simulator assets have long depreciation cycles that restrict balance sheet flexibility. Import dependency for high-end components exposes buyers to currency fluctuations and supply chain disruptions, further increasing total ownership costs. Collectively, these financial barriers slow adoption rates, concentrate ownership among large institutions, and limit market accessibility for emerging training providers.

Regulatory Certification Complexity and System Integration Constraints:

Regulatory Certification Complexity and System Integration Constraints pose persistent challenges due to stringent approval requirements imposed by aviation, maritime, and defense authorities governing simulator fidelity and operational use. Certification processes often involve extensive documentation, validation testing, and iterative audits, extending project timelines and increasing compliance costs for both manufacturers and operators. Integration with existing legacy training systems introduces additional technical complexity, requiring customized interfaces and software adaptations to ensure interoperability. Changes in regulatory standards can necessitate system revalidation, forcing operators to temporarily suspend training activities or invest in unplanned upgrades. Multi-agency oversight further complicates deployment, particularly for simulators intended for joint military or dual-use applications. Smaller vendors may lack the specialized regulatory expertise required to navigate certification frameworks efficiently, limiting competition and innovation. Cybersecurity and data protection requirements add another layer of compliance complexity, especially for networked and cloud-enabled simulation environments. These combined factors restrict scalability, delay market entry for new solutions, and increase reliance on established suppliers with proven certification capabilities.

Opportunities

Unmanned Systems and Autonomous Platform Training Expansion:

Unmanned Systems and Autonomous Platform Training Expansion represents a substantial opportunity for the Australia simulator market as defense forces and commercial operators increasingly deploy remotely piloted aircraft, autonomous ground vehicles, and unmanned maritime systems across surveillance, logistics, and combat support missions. These platforms require specialized training environments that cannot be effectively supported through live operations due to safety risks, airspace restrictions, and limited asset availability. Simulators enable operators to practice command, control, mission planning, and failure response scenarios in controlled conditions while supporting rapid skill acquisition. Australian defense capability development places growing emphasis on integrating unmanned systems alongside crewed platforms, increasing demand for interoperable and networked simulation environments. Regulatory acceptance of simulator-based training hours for unmanned system operators further strengthens adoption potential. Domestic development and customization of unmanned simulators align with national objectives to reduce reliance on foreign suppliers and enhance sovereign capability. Training requirements extend beyond military users to border security, emergency response, mining, and offshore energy operators adopting autonomous platforms. As unmanned systems proliferate across sectors, dedicated simulation solutions offer scalable, high-margin growth opportunities for technology providers and integrators.

Virtual Reality and Artificial Intelligence Enabled Simulation Solutions:

Virtual Reality and Artificial Intelligence Enabled Simulation Solutions present a strong opportunity by transforming traditional simulator economics and accessibility within the Australia simulator market. Advances in immersive virtual reality reduce reliance on expensive physical motion platforms while maintaining high levels of training realism, enabling broader adoption among smaller operators and regional training centers. Artificial intelligence enhances adaptive training by dynamically adjusting scenarios based on trainee performance, improving learning outcomes and training efficiency. These technologies support modular deployment models, allowing organizations to scale training capacity without significant infrastructure expansion. Cloud-enabled simulation environments facilitate remote and distributed training, addressing geographic constraints across Australia’s vast territory. Integration of data analytics and machine learning enables detailed performance assessment and predictive training optimization, adding value beyond basic compliance. Civil sectors such as emergency services, industrial safety, and healthcare increasingly adopt VR-based simulation, expanding addressable market scope. As technology costs decline and regulatory frameworks adapt to recognize advanced digital simulation, VR and AI-enabled solutions offer long-term growth pathways and diversification potential for simulator providers.

Future Outlook

The Australia simulator market is expected to maintain steady expansion over the next five years as defense modernization initiatives, aviation safety mandates, and digital transformation of training ecosystems continue to reinforce simulator adoption. Ongoing investment in advanced military capabilities will sustain demand for high-fidelity, networked simulators supporting joint and multi-domain operations. In civil aviation, regulatory emphasis on recurrent simulator-based training and fleet transitions will keep utilization rates high across training centers. Technological developments in virtual reality, artificial intelligence, and data-driven training analytics are expected to improve realism while lowering deployment barriers for smaller operators. Regulatory frameworks are likely to evolve to formally recognize advanced digital and remote simulation models, further widening adoption. On the demand side, emerging requirements from unmanned systems operations, emergency services, and industrial safety training are anticipated to diversify application areas. Together, these factors position the market for structurally resilient growth supported by both public and private sector demand.

Major Players

- CAE Australia

- Boeing Defence Australia

- Lockheed Martin Australia

- Thales Australia

- Saab Australia

- Raytheon Australia

- L3Harris Australia

- Elbit Systems of Australia

- RheinmetallDefenceAustralia

- BAE Systems Australia

- CubicDefenceAustralia

- Collins Aerospace Australia

- Indra Australia

- QinetiQ Australia

- Leonardo Australia

Key Target Audience

- Defense ministries

- Aviation authorities

- Airline operators

- Naval forces

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace OEMs

- Training service providers

Research Methodology

Step 1: Identification of Key Variables

Key demand, supply, regulatory, and technology variables were identified through secondary research. Public defense budgets and aviation data were analyzed. Variables were screened for relevance. Only validated indicators were retained.

Step 2: Market Analysis and Construction

Data was structured by segment and platform. Historical procurement trends were examined. Industry benchmarks were applied. Market relationships were established.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interviews. Assumptions were stress-tested. Conflicting data points were reconciled. Consensus benchmarks were finalized.

Step 4: Research Synthesis and Final Output

Validated data was synthesized into structured insights. Analytical consistency checks were applied. Outputs were reviewed for compliance. Final results were consolidated.

- Executive Summary

- Australia Simulator Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Expansion of defense training modernization programs

Rising demand for pilot and crew training capacity

Increased use of simulation for cost efficient training

Adoption of advanced virtual and augmented reality technologies

Integration of multi domain and joint force training environments - Market Challenges

High capital investment and lifecycle maintenance costs

Complex certification and regulatory compliance requirements

Integration challenges with legacy training systems

Shortage of specialized technical expertise

Cybersecurity risks in networked simulation systems - Market Opportunities

Growing demand for unmanned systems training simulators

Partnerships between defense and commercial training providers

Localization and indigenous development of simulation technologies - Trends

Increased use of immersive virtual reality environments

Shift toward networked and distributed simulation

Integration of artificial intelligence for adaptive training

Use of data analytics for performance assessment

Expansion of simulation beyond defense into civilian sectors - Government Regulations & Defense Policy

Defense procurement and capability development policies

Aviation and maritime training certification standards

Cybersecurity and data protection regulations for defense systems - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Flight simulators

Vehicle and driving simulators

Naval and maritime simulators

Combat and tactical simulators

Training and mission rehearsal simulators - By Platform Type (In Value%)

Airborne platforms

Land-based platforms

Naval platforms

Unmanned systems platforms

Integrated multi-domain platforms - By Fitment Type (In Value%)

Fixed installation simulators

Mobile simulators

Containerized simulators

Networked simulator suites

Virtual and augmented reality setups - By EndUser Segment (In Value%)

Defense and armed forces

Commercial aviation training centers

Automotive testing and training

Maritime training institutions

Industrial and emergency services training - By Procurement Channel (In Value%)

Direct government procurement

Defense prime contractors

System integrators

Public private partnerships

Commercial off the shelf procurement - By Material / Technology (in Value %)

Full motion platforms

Visual display and projection systems

Virtual reality technology

Augmented reality technology

Artificial intelligence based simulation software

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (system complexity, technology integration, platform coverage, customization capability, regulatory compliance, lifecycle support, training realism, scalability, cybersecurity robustness) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

CAE Australia

Boeing Defence Australia

Lockheed Martin Australia

Thales Australia

L3Harris Australia

Saab Australia

Raytheon Australia

Elbit Systems of Australia

Rheinmetall Defence Australia

BAE Systems Australia

Cubic Defence Australia

Collins Aerospace Australia

Indra Australia

QinetiQ Australia

Leonardo Australia

- Defense forces prioritizing mission readiness and interoperability

- Aviation training organizations focusing on safety and compliance

- Industrial users adopting simulation for risk reduction

- Emergency services leveraging simulators for scenario based training

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035