Market Overview

Based on a recent historical assessment, the Australia small arms market recorded spending of approximately USD ~ billion, reflecting confirmed procurement by defense forces, law enforcement agencies, and licensed civilian channels. The market size is driven by infantry weapon modernization programs, replacement cycles for service rifles and pistols, enhanced training requirements, and sustained demand from law enforcement. Additional drivers include local manufacturing under sovereign defense initiatives, long-term sustainment contracts, and regulated civilian sporting demand operating within Australia’s strict firearms compliance framework.

Based on a recent historical assessment, Canberra, Melbourne, Sydney, and Brisbane dominate the Australia small arms market due to the concentration of defense command authorities, domestic manufacturing, and procurement agencies. Canberra leads through centralized defense acquisition and capability planning. Melbourne and Brisbane benefit from domestic production and sustainment facilities supporting military and police users. Sydney plays a key role through national law enforcement headquarters, training institutions, and licensed civilian distribution networks, reinforcing steady demand across regulated channels.

Market Segmentation

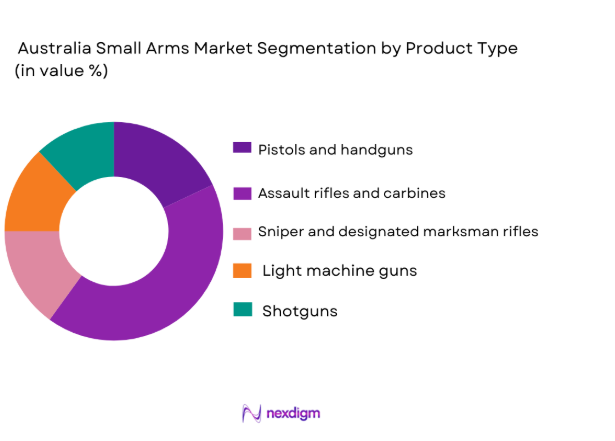

By Product Type

Australia small arms market is segmented by product type into pistols and handguns, assault rifles and carbines, sniper and designated marksman rifles, light machine guns, and shotguns. Recently, assault rifles and carbines had a dominant market share due to their extensive use as standard service weapons across the Australian Army and specialized units. These platforms are central to infantry modernization programs focused on improved lethality, ergonomics, and modularity. Assault rifles support diverse mission profiles including conventional combat, training, and security operations. Domestic production and licensed manufacturing enhance supply reliability. Long service life and continuous upgrade cycles sustain procurement. Compatibility with optics and accessories further reinforces dominance within defense and law enforcement users.

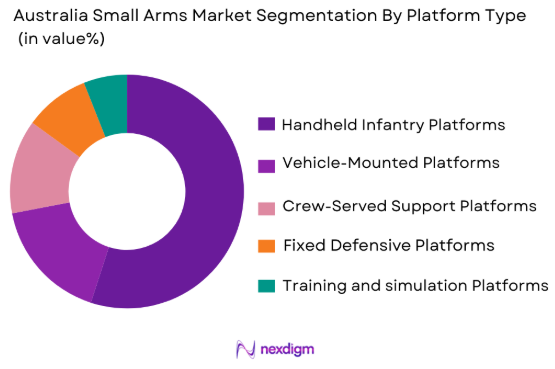

By Platform Type

Australia Small Arms Market is segmented by platform type into handheld infantry platforms, vehicle-mounted platforms, crew-served support platforms, fixed defensive platforms, and training and simulation platforms. Recently, handheld infantry platforms dominated market share due to their universal applicability across military, law enforcement, and licensed civilian segments, supported by consistent procurement volumes and broad operational use. These platforms align with individual soldier modernization programs, police force standardization, and civilian ownership frameworks, ensuring diversified demand streams. Handheld systems also benefit from easier logistics, lower lifecycle costs, and compatibility with domestic maintenance capabilities. Regulatory structures favor clearly classified handheld platforms, reducing procurement complexity, while ongoing training requirements sustain replacement demand, reinforcing their dominance across both institutional and regulated non-institutional channels.

Competitive Landscape

The Australia small arms market is moderately consolidated, with dominance from domestic manufacturers supported by licensed international suppliers. Competitive positioning is shaped by strict regulatory compliance, local manufacturing capability, long-term defense contracts, and sustainment support. Domestic players benefit from sovereign manufacturing priorities, while global companies participate through imports, partnerships, and police tenders.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Role in Australia |

| Thales Australia | 1999 | Bendigo, Australia | ~ | ~ | ~ | ~ | ~ |

| Lithgow Arms | 1912 | Lithgow, Australia | ~ | ~ | ~ | ~ | ~ |

| NIOA Group | 1973 | Brisbane, Australia | ~ | ~ | ~ | ~ | ~ |

| Glock | 1963 | Deutsch-Wagram, Austria | ~ | ~ | ~ | ~ | ~ |

| FN Herstal | 1889 | Herstal, Belgium | ~ | ~ | ~ | ~ | ~ |

Australia Small Arms Market Analysis

Growth Drivers

Defense Force Infantry Modernization and Soldier Lethality Programs

Defense force infantry modernization and soldier lethality programs are a primary growth driver for the Australia small arms market as the Australian Defence Force prioritizes enhanced combat effectiveness, reliability, and interoperability across infantry units. Modernization programs focus on replacing aging rifles, machine guns, and supporting weapons with modular, lightweight, and ergonomically improved platforms. Small arms upgrades are closely linked to broader soldier system initiatives integrating optics, suppressors, and digital accessories. Continuous training and readiness requirements sustain recurring demand for weapons and spares. Standardization across units increases procurement scale. Domestic manufacturing capability supports supply continuity. Long-term sustainment contracts reinforce stable demand. These factors collectively drive sustained market expansion.

Law Enforcement Capability Enhancement and Training Requirements

Law enforcement capability enhancement and training requirements strongly drive demand as federal, and state agencies prioritize officer safety, accuracy, and operational readiness. Police forces require reliable pistols, carbines, and less-lethal compatible platforms for daily operations and specialized response units. Ongoing training mandates generate continuous ammunition and weapon replacement cycles. Counter-terrorism and rapid response capabilities increase demand for modern firearms. Standardization across jurisdictions supports bulk procurement. Regulatory compliance ensures structured acquisition cycles. Investment in training infrastructure reinforces sustained demand. These dynamics support long-term growth.

Market Challenges

Strict Firearms Regulation and Compliance Burden

Strict firearms regulation and compliance burden represent a major challenge for the Australia small arms market due to the country’s highly controlled legal and policy framework governing the manufacture, import, ownership, storage, and use of firearms. Compliance requirements involve extensive licensing, certification, auditing, and reporting obligations for manufacturers, distributors, and end users. These processes increase administrative complexity and significantly extend procurement and delivery timelines, particularly for defense and law enforcement contracts. Variations in federal and state-level regulations further add complexity for suppliers operating nationwide. Export controls and international compliance obligations introduce additional constraints for companies seeking regional or allied market access. High compliance costs raise barriers to entry and reduce commercial flexibility. Collectively, these factors limit rapid scaling, slow innovation cycles, and constrain market expansion despite steady underlying demand.

Limited Domestic Manufacturing Scale and Import Dependence

Limited domestic manufacturing scale and import dependence challenge the resilience and responsiveness of the Australia small arms market, especially for advanced weapon platforms and critical components. While Australia maintains some sovereign production capability, many modern small arms systems, subassemblies, and technologies rely on foreign suppliers. Import approval processes and international regulatory clearances extend lead times and reduce supply chain agility. Exposure to foreign exchange fluctuations increases cost volatility for imported weapons and components. Global supply disruptions can affect availability and scheduling. Expanding local manufacturing capacity requires significant capital investment, skilled labor development, and long-term government commitment. These constraints impact supply continuity and limit the ability to rapidly respond to changing operational requirements.

Opportunities

Expansion of Licensed Local Production and Assembly Programs

Expansion of licensed local production and assembly programs offers strong opportunities as Australia places increasing emphasis on sovereign defense capability and industrial self-reliance. Local assembly and manufacturing reduce dependence on foreign suppliers and improve supply chain security. Licensed production agreements facilitate technology transfer, workforce skill development, and long-term industrial capability building. Domestic production enhances responsiveness to defense and law enforcement requirements while supporting lifecycle sustainment and upgrades. Government incentives, defense industry policies, and long-term procurement commitments encourage private-sector investment. Local production can also improve cost control over time. In the long term, expanded manufacturing capability may enable export opportunities to allied and regional partners, supporting sustained market growth.

Advanced Modular and Ergonomic Weapon Systems Adoption

Advanced modular and ergonomic weapon systems adoption presents significant opportunities as military and law enforcement users increasingly prioritize adaptability, user comfort, and lifecycle efficiency. Modular weapon designs allow configuration changes for different mission profiles without full system replacement, extending service life and reducing total ownership cost. Improved ergonomics enhances accuracy, handling, and operator endurance during extended operations. Compatibility with optics, suppressors, and digital fire-control accessories increases operational value. Demand from special forces and tactical police units accelerates adoption of advanced designs. Ongoing innovation in materials and design supports performance improvements. These trends drive technological advancement and create new growth avenues within the market.

Future Outlook

Over the next five years, the Australia small arms market is expected to grow steadily, supported by defense modernization, law enforcement upgrades, and sovereign manufacturing initiatives. Technological focus will shift toward modular platforms, improved ergonomics, and lifecycle sustainment. Regulatory stability will maintain structured demand. Replacement and training cycles will remain key demand drivers.

Major Players

- Thales Australia

- Lithgow Arms

- NIOA Group

- Glock

- FN Herstal

- SIG Sauer

- Heckler & Koch

- Beretta

- Colt Defense

- Smith & Wesson

- CZ Group

- BAE Systems

- Elbit Systems

- Rheinmetall Defence

- Saab Group

Key Target Audience

- Australian Defence Force

- Law enforcement agencies

- Border protection authorities

- Government and regulatory bodies

- Investments and venture capitalist firms

- Domestic defense manufacturers

- Licensed firearm distributors

- Security forces and training institutions

Research Methodology

Step 1: Identification of Key Variables

Key variables including defense procurement volumes, regulatory frameworks, modernization programs, and training requirements were identified. Demand and supply indicators were mapped.

Step 2: Market Analysis and Construction

Data from defense budgets, procurement disclosures, and industry sources were analyzed. Market segmentation and structure were constructed.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through consultations with defense and law enforcement experts. Assumptions were refined based on operational insights.

Step 4: Research Synthesis and Final Output

Validated data and insights were synthesized into structured outputs. Consistency and relevance checks were applied.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Defense force modernization and soldier lethality programs

Rising focus on special forces and rapid response units

Law enforcement capability enhancement initiatives

Training and replacement demand cycles

Indigenization and local manufacturing initiatives - Market Challenges

Strict firearm regulation and compliance requirements

Limited domestic manufacturing scale

High procurement and lifecycle costs

Import dependency for advanced weapon systems

Public policy and regulatory scrutiny - Market Opportunities

Local assembly and licensed production programs

Advanced modular and ergonomic weapon systems

Export opportunities to allied and regional partners - Trends

Adoption of modular and multi-caliber weapon platforms

Increased use of optics and fire-control accessories

Emphasis on lightweight and ergonomic weapon design

Integration of smart targeting and sighting systems

Focus on lifecycle sustainment and upgrades - Government Regulations & Defense Policy

National firearms legislation and licensing frameworks

Defense procurement and capability development policies

Export control and compliance regulations - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average Weapon Price, 2020-2025

- By Weapon Complexity Tier, 2020-2025

- By Weapon Type (In Value%)

Pistols and handguns

Assault rifles and carbines

Sniper and designated marksman rifles

Light machine guns

Shotguns and specialty firearms - By Caliber Type (In Value%)

Small caliber ammunition weapons

Medium caliber infantry weapons

non-lethal and training weapons

Special purpose calibers

multi-caliber modular weapon systems - By Fitment Type (In Value%)

New defense procurement programs

Weapon upgrade and modernization projects

Retrofit and refurbishment programs

Training and simulation weapon systems

R&D and trial acquisitions - By End User Segment (In Value%)

Australian Army

Special forces units

Law enforcement agencies

Border protection and internal security forces

Civilian sporting and licensed users - By Procurement Channel (In Value%)

Direct government defense procurement

Law enforcement procurement agencies

Licensed domestic manufacturers and distributors

Foreign military sales and imports

Commercial and civilian licensed sales channels

- Market share snapshot of major players

- Cross Comparison Parameters (weapon reliability, accuracy, ergonomics, modularity, lifecycle cost, local support capability, compliance readiness, customization options, supply continuity)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Thales Australia

Lithgow Arms

NIOA Group

Beretta

Heckler & Koch

FN Herstal

SIG Sauer

Glock

Smith & Wesson

CZ Group

Ruger

Remington Arms

Colt Defense

BAE Systems

Elbit Systems

- Army focus on standard infantry weapon modernization

- Special forces demand for precision and modular weapons

- Law enforcement emphasis on reliability and safety

- Civilian market driven by sport shooting and licensing frameworks

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by Weapon Type, 2026-2035

- Future Demand by End User Segment, 2026-2035