Market Overview

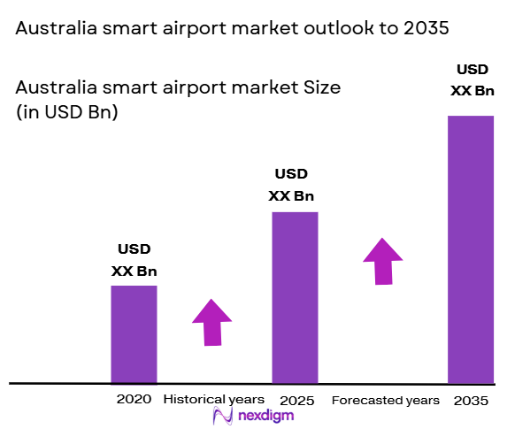

Based on a recent historical assessment, the Australia smart airport market generated approximately USD ~ billion in total system and solution spending. This market size is driven by large-scale airport infrastructure modernization programs, rising passenger throughput, and increasing adoption of digital technologies across terminals, airside, and landside operations. Investments are primarily directed toward biometric passenger processing, intelligent security systems, advanced baggage handling, and data-driven airport operations platforms. Government-backed infrastructure funding, combined with airport authority capital expenditure programs, continues to support sustained deployment of smart airport technologies nationwide.

Australia’s smart airport development is dominated by major metropolitan aviation hubs including Sydney, Melbourne, Brisbane, and Perth, supported by strong regulatory frameworks and advanced aviation infrastructure. These cities benefit from high international passenger volumes, complex airport operations, and strong financial capacity for technology investments. Regional airports in New South Wales, Victoria, and Queensland are also emerging as adopters due to federal connectivity programs and tourism-driven upgrades. Australia’s dominance is further reinforced by a stable aviation policy environment, high digital maturity, and strong participation from global technology providers.

Market Segmentation

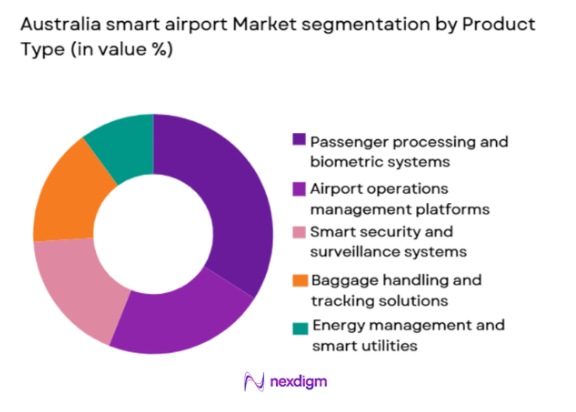

By Product Type:

Australia smart airport market is segmented by product type into passenger processing and biometric systems, airport operations management platforms, smart security and surveillance systems, baggage handling and tracking solutions, and energy management and smart utilities. Recently, passenger processing and biometric systems have a dominant market share due to sustained demand for seamless passenger flow, reduced congestion, and improved security compliance. Major airports prioritize biometric e-gates, facial recognition, and automated check-in to handle rising passenger volumes efficiently. Strong government endorsement of contactless travel, coupled with airline and airport collaboration, has accelerated deployments. Additionally, proven operational benefits such as reduced staffing pressure, faster throughput, and improved traveler experience support dominance. High integration compatibility with legacy systems and strong vendor presence further reinforce adoption across primary and secondary airports nationwide.

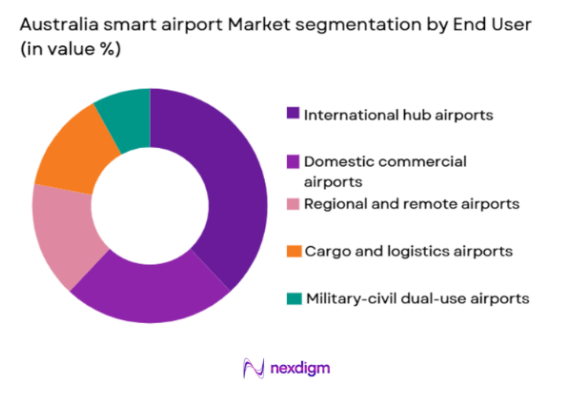

By End User:

Australia smart airport market is segmented by end user into international hub airports, domestic commercial airports, regional and remote airports, cargo and logistics airports, and military-civil dual-use airports. Recently, international hub airports hold the dominant market share due to higher operational complexity, larger passenger volumes, and stronger financial capability to deploy advanced digital solutions. These airports require integrated systems for passenger flow optimization, predictive maintenance, and real-time operational visibility. International connectivity standards and security requirements also necessitate advanced technology adoption. Long-term concession models and public–private partnerships further enable capital-intensive smart airport investments. Continuous terminal expansions and sustainability targets strengthen the leadership position of international hub airports.

Competitive Landscape

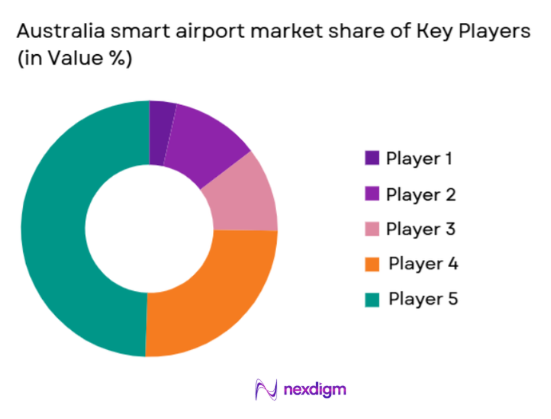

The Australia smart airport market exhibits moderate consolidation, with a mix of global aviation technology leaders and strong regional system integrators. Major players influence standards adoption, large-scale system integration, and long-term service contracts. Competitive advantage is shaped by technology breadth, cybersecurity compliance, integration capability, and local delivery presence. Strategic partnerships with airport authorities and government agencies play a critical role in winning large tenders, while recurring software and services revenues strengthen long-term market positioning.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| SITA | 1949 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Thales Australia | 2006 | Australia | ~ | ~ | ~ | ~ | ~ |

| Indra Australia | 1992 | Australia | ~ | ~ | ~ | ~ | ~ |

| Siemens Mobility | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Honeywell Aerospace | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

Australia Smart Airport Market Analysis

Growth Drivers

Passenger Traffic Growth and Airport Capacity Expansion:

Passenger traffic growth and airport capacity expansion is a primary growth driver for the Australia smart airport market as major hubs experience sustained increases in domestic and international travel demand. Airports are under pressure to handle higher passenger volumes without proportional increases in physical infrastructure or staffing, driving demand for automation and digital optimization. Smart airport technologies enable faster passenger processing, predictive congestion management, and real-time operational control across terminals. Biometric identification and self-service systems significantly reduce queue times and improve throughput efficiency. Airlines and airport operators increasingly collaborate on integrated digital journeys to maintain service quality. Expansion projects at major airports require embedded smart systems from design stages. Regional airport upgrades linked to tourism growth further amplify demand. These combined factors sustain long-term investment momentum.

Government Infrastructure Investment and Digital Aviation Policy:

Government infrastructure investment and digital aviation policy strongly support market growth by providing funding certainty and regulatory alignment. Federal and state governments allocate substantial budgets toward airport modernization, regional connectivity, and technology-enabled security improvements. Smart airport adoption aligns with national digital transformation and cybersecurity strategies. Policy support for contactless travel, sustainability, and emissions reduction encourages advanced system deployment. Government-backed public–private partnerships reduce financial risk for airports. Clear regulatory frameworks accelerate procurement cycles. National resilience planning also promotes digital monitoring and operational continuity systems. These policy-driven enablers reinforce steady market expansion.

Market Challenges

High Capital Expenditure and Integration Complexity:

High capital expenditure and integration complexity present significant challenges for Australia smart airport projects. Smart systems require substantial upfront investment in hardware, software, and systems integration. Airports often operate mixed legacy environments, increasing deployment complexity and risk. Integration with airline systems, border control platforms, and air traffic management adds technical challenges. Long approval cycles and procurement processes can delay implementation. Smaller regional airports face budget constraints and limited technical resources. Lifecycle costs including upgrades and cybersecurity maintenance add financial pressure. These factors can slow adoption timelines despite clear operational benefits.

Cybersecurity and Data Privacy Risks:

Cybersecurity and data privacy risks are critical challenges due to increasing reliance on interconnected digital systems. Smart airports process large volumes of sensitive passenger and operational data. Cyber threats can disrupt operations, compromise safety, and damage public trust. Compliance with national data protection laws increases system design complexity. Airports must invest continuously in security monitoring and updates. Integration of third-party platforms introduces additional vulnerabilities. Skills shortages in cybersecurity expertise further heighten risk exposure. Managing these risks is essential to sustain long-term smart airport operations.

Opportunities

AI-Driven Predictive Airport Operations:

AI-driven predictive airport operations represent a major opportunity as airports seek proactive decision-making capabilities. Advanced analytics enable predictive maintenance, demand forecasting, and dynamic resource allocation. AI reduces downtime and improves asset utilization across airside and terminal operations. Integration with digital twins enhances planning accuracy. Airports adopting AI gain operational resilience and cost savings. Vendors offering scalable AI platforms can capture long-term service revenues. Regulatory acceptance of AI in aviation supports deployment. This opportunity aligns with broader digital transformation strategies.

Sustainable and Energy-Efficient Smart Airport Solutions:

Sustainable and energy-efficient smart airport solutions offer strong growth opportunities as airports commit to net-zero and emissions reduction targets. Smart energy management systems optimize power consumption and reduce operating costs. Integration of renewable energy monitoring enhances sustainability reporting. Regulatory incentives encourage adoption of green technologies. Passengers increasingly favor environmentally responsible airports. Technology providers specializing in sustainability solutions gain competitive advantage. This opportunity supports long-term infrastructure modernization goals.

Future Outlook

Over the next five years, the Australia smart airport market is expected to experience steady expansion driven by passenger recovery, infrastructure upgrades, and digital transformation priorities. Advanced analytics, biometrics, and AI will become core operational tools. Regulatory support for cybersecurity and sustainability will shape procurement. Demand will extend beyond major hubs to regional airports. Long-term service and software-based models will dominate vendor strategies.

Major Players

- SITA

- Thales Australia

- Indra Australia

- Siemens Mobility Australia

- Honeywell Aerospace

- Amadeus IT Group

- NEC Australia

- Cisco Systems Australia

- IBM Australia

- Accenture Australia

- Leidos Australia

- DXC Technology Australia

- Fujitsu Australia

- ABB Australia

- Schneider Electric Australia

Key Target Audience

- Airport authorities and operators

- Airlines and aviation service providers

- Government and regulatory bodies

- Infrastructure investment funds

- Smart city solution providers

- Airport system integrators

- Technology and software vendors

- Investments and venture capitalist firms

Research Methodology

Step 1: Identification of Key Variables

Market variables including technology adoption, infrastructure spending, passenger throughput, and regulatory drivers were identified. Data sources included government aviation reports, airport authority disclosures, and industry publications.

Step 2: Market Analysis and Construction

Qualitative and quantitative data were analyzed to map value chains, segment structures, and competitive dynamics. Market sizing was validated using multiple secondary data points.

Step 3: Hypothesis Validation and Expert Consultation

Findings were cross-verified through expert interviews with airport operators, technology providers, and aviation consultants to ensure accuracy and relevance.

Step 4: Research Synthesis and Final Output

All insights were synthesized into a structured report, ensuring consistency, validation, and alignment with market realities.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising air passenger traffic and capacity expansion

Government investment in airport modernization programs

Adoption of biometric and contactless passenger processing

Operational efficiency and cost optimization requirements

Sustainability and energy efficiency initiatives - Market Challenges

High capital expenditure and integration costs

Cybersecurity and data privacy risks

Legacy infrastructure compatibility issues

Regulatory and compliance complexity

Skilled workforce and technology adoption gaps - Market Opportunities

Expansion of smart regional and secondary airports

Deployment of AI-driven predictive airport operations

Integration of sustainability focused smart technologies - Trends

Biometric based seamless passenger journeys

AI-enabled predictive maintenance systems

Digital twin adoption for airport planning

Contactless and touchless airport ecosystems

Green and energy efficient smart airport solutions - Government Regulations & Defense Policy

National aviation infrastructure modernization policies

Cybersecurity and data protection regulations

Sustainability and emissions reduction mandates - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

By Market Value, 2020-2025

By Installed Units, 2020-2025

By Average System Price, 2020-2025

By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Passenger processing and biometric systems

Airport operations management platforms

Smart security and surveillance systems

Baggage handling and tracking solutions

Energy management and smart utilities - By Platform Type (In Value%)

Cloud-based smart airport platforms

On-premise airport IT systems

Hybrid cloud airport solutions

IoT-enabled airport infrastructure platforms

AI and analytics platforms - By Fitment Type (In Value%)

Greenfield smart airport deployments

Brownfield airport modernization

Terminal expansion integrations

Airside digital retrofits

Landside infrastructure upgrades - By EndUser Segment (In Value%)

International hub airports

Domestic commercial airports

Regional and remote airports

Cargo and logistics airports

Military-civil dual use airports - By Procurement Channel (In Value%)

Direct government procurement

Public private partnership contracts

Airport authority tenders

System integrator led procurement

Technology vendor direct sales - By Material / Technology (in Value %)

Artificial intelligence and machine learning

Internet of Things sensors

Biometric identification technologies

Big data and predictive analytics

Digital twin and simulation technologies

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (technology maturity, integration capability, cybersecurity compliance, scalability, lifecycle cost, deployment timeline, regional presence, partnership ecosystem, sustainability alignment)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

SITA

Thales Australia

Indra Australia

Siemens Mobility Australia

Honeywell Aerospace

Amadeus IT Group

NEC Australia

Cisco Systems Australia

IBM Australia

Accenture Australia

Leidos Australia

DXC Technology Australia

Fujitsu Australia

ABB Australia

Schneider Electric Australia

- International airports focusing on passenger experience optimization

- Regional airports adopting scalable smart solutions

- Cargo airports integrating automated handling systems

- Airport authorities prioritizing operational resilience

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035