Market Overview

Based on a recent historical assessment, the Australia Software Defined Radio market was valued at USD ~ billion, supported by defense procurement disclosures from the Australian Department of Defence and capability investment summaries aligned with integrated communications modernization programs. The market is driven by sustained funding for network-centric warfare, secure tactical communications, and interoperability upgrades across land, air, and naval forces. Additional demand originates from border security, emergency response digitization, and aerospace communications programs. Technology refresh cycles, sovereign defense manufacturing priorities, and encrypted multi-band communication requirements continue reinforcing procurement volumes and vendor engagement nationally.

Based on a recent historical assessment, Canberra dominates the Australia Software Defined Radio market due to concentrated defense procurement authority, program management offices, and long-term capability planning functions. Adelaide plays a central role because of its defense industrial base, naval shipbuilding ecosystem, and electronics systems integration facilities. Melbourne contributes through aerospace engineering, advanced manufacturing, and testing infrastructure, while Sydney supports command, control, and cybersecurity integration activities. International collaboration with the United States, United Kingdom, and NATO-aligned partners strengthens technology access, compliance alignment, and operational interoperability, reinforcing national dominance without reliance on commercial consumer demand.

Market Segmentation

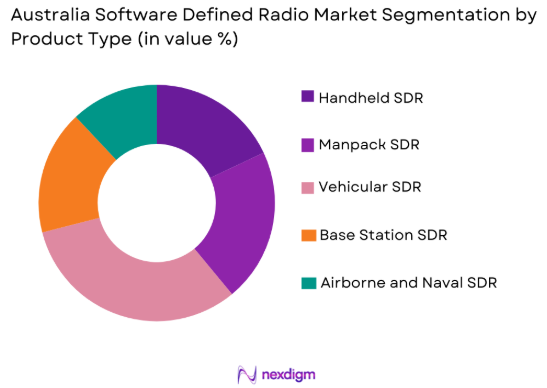

By Product Type

Australia Software Defined Radio market is segmented by product type into handheld SDR, manpack SDR, vehicular SDR, base station SDR, and airborne or naval SDR. Recently, vehicular SDR has a dominant market share due to its extensive deployment across armored vehicles, logistics fleets, and mobile command units operated by the Australian Defence Force. Vehicular platforms require continuous connectivity, encrypted voice and data transmission, and interoperability across joint operations, making SDR integration mission critical. Ongoing fleet modernization programs, combined with retrofit requirements for legacy vehicles, have increased unit volumes. Additionally, vehicular SDR systems support multi-role missions, including surveillance, command relay, and electronic protection, driving sustained procurement preference within defense budgets.

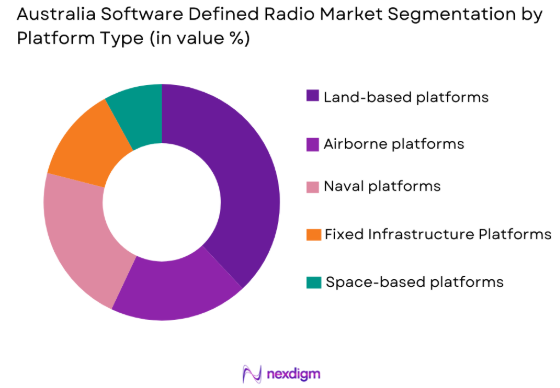

By Platform Type

Australia Software Defined Radio market is segmented by platform type into land-based platforms, naval platforms, airborne platforms, space-based platforms, and fixed infrastructure platforms. Recently, land-based platforms have a dominant market share due to extensive deployment across infantry units, armored brigades, border surveillance, and homeland security operations. Land forces require scalable, mobile, and resilient communication systems capable of operating in contested electromagnetic environments. Software defined radios enable waveform agility and interoperability during joint exercises and coalition missions. Continuous land force restructuring and increased emphasis on integrated battlefield awareness have reinforced procurement focus on land-based SDR solutions over other platforms.

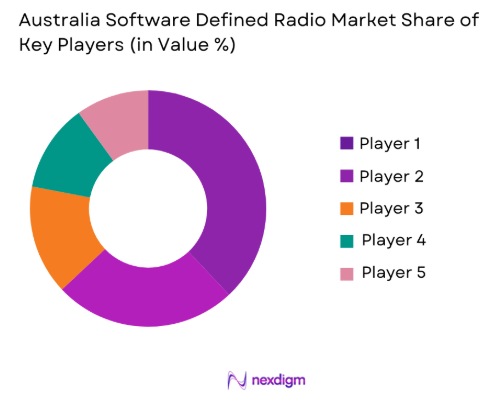

Competitive Landscape

The Australia Software Defined Radio market is moderately consolidated, with global defense primes and specialized communication system providers holding strong positions through long-term defense contracts and local subsidiaries. Competitive intensity is shaped by compliance capability, sovereign manufacturing alignment, and lifecycle support depth.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Thales Australia | 2006 | Australia | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1994 | Australia | ~ | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | United States | ~ | ~ | ~ | ~ | ~ |

| Raytheon Australia | 1999 | Australia | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1987 | Australia | ~ | ~ | ~ | ~ | ~ |

Australia Software Defined Radio Market Analysis

Growth Drivers

Defense Communication Modernization Programs

The Australia Software Defined Radio market is strongly driven by comprehensive defense communication modernization programs focused on replacing legacy analog and hardware-defined radios with flexible, software-driven architectures across all service branches. These programs are aligned with national defense strategies emphasizing network-centric warfare, joint operations, and secure data-centric command structures that require interoperable communication layers. Software-defined radios enable waveform adaptability, encryption upgrades, and multi-band operations without full hardware replacement, delivering long-term cost efficiency. The Australian Defense Force prioritizes resilient communications capable of operating under electronic warfare conditions, reinforcing SDR procurement. Integration with battlefield management systems and situational awareness platforms further elevates demand. International exercises and coalition commitments increase interoperability requirements. Domestic defense industry participation mandates local integration and sustainment. Long-term acquisition roadmaps ensure sustained demand continuity.

Secure and Interoperable Multi-Domain Operations

The increasing emphasis on multi-domain operations spanning land, air, sea, cyber, and space environments significantly drives the Australia Software Defined Radio market. Modern military operations demand seamless information exchange between platforms and forces operating across domains. SDR technology enables dynamic spectrum access, secure data exchange, and compatibility with allied communication standards. The need for encrypted voice, video, and data transmission in real time enhances SDR relevance. Interoperability with allied forces strengthens procurement justification. Cyber resilience and electronic protection features are prioritized. Mission adaptability without hardware changes improves operational readiness. These operational requirements collectively sustain high adoption momentum.

Market Challenges

High System Integration and Certification Complexity

The Australia Software Defined Radio market faces a persistent challenge arising from the high level of system integration complexity combined with stringent military certification requirements. Software-defined radios must operate seamlessly across multiple platforms while remaining interoperable with legacy communication systems already deployed within defense forces. Each system is required to meet demanding standards related to electromagnetic compatibility, cybersecurity assurance, encryption validation, and waveform compliance before approval for operational use. These certification processes involve extensive testing cycles and coordination with multiple defense authorities, which lengthens deployment timelines and increases program costs. Integration efforts are further complicated by the need to customize SDR configurations for land vehicles, naval vessels, airborne platforms, and fixed command infrastructure. Continuous software updates, which are a core advantage of SDR technology, also trigger additional validation and re-certification requirements. As a result, procurement schedules become extended, cost predictability decreases, and smaller domestic suppliers face barriers to entry due to resource-intensive compliance obligations.

Dependence on Specialized Components and Global Supply Chains

Another major challenge for the Australia Software Defined Radio market is its dependence on specialized electronic components sourced through global supply chains. Advanced SDR systems rely on high-performance semiconductors, radio frequency modules, encryption hardware, and programmable logic devices that are often imported and subject to export controls. Disruptions in global supply networks, whether due to geopolitical tensions or manufacturing bottlenecks, can directly delay production and system delivery. Limited supplier diversity for defense-grade components increases exposure to single-source risks and price volatility. Domestic manufacturing capability for advanced microelectronics remains constrained, limiting rapid localization of critical subsystems. This dependence complicates long-term procurement planning for defense agencies and primes, as lead times can extend unpredictably. Inventory buffering increases capital requirements for vendors, while compliance with foreign licensing regimes introduces additional administrative burden. Together, these supply chain constraints reduce flexibility, increase lifecycle costs, and challenge the resilience objectives of national defense communication programs.

Opportunities

Expansion of Indigenous Defense Electronics and Sovereign Capability

The Australia Software Defined Radio market presents a substantial opportunity through the expansion of indigenous defense electronics development aligned with sovereign capability objectives. National defense policy increasingly prioritizes local design, manufacturing, and sustainment of critical communication systems to reduce dependence on foreign suppliers. Software defined radio platforms are well suited to this objective because their value is driven not only by hardware but also by software, waveforms, and system integration expertise that can be developed domestically. Australian defense primes and mid-tier firms can leverage this shift to build locally controlled intellectual property, customized waveforms, and mission-specific configurations tailored to national operational doctrines. Increased local content requirements in defense procurement further strengthen this opportunity by favoring suppliers with Australian manufacturing, engineering, and lifecycle support footprints. Collaboration between global primes and domestic firms enables technology transfer while retaining sovereign control over sensitive capabilities. Over time, this can support export opportunities to allied nations seeking trusted partners with interoperable systems, positioning Australia as a regional hub for secure tactical communication solutions.

Adoption of Cognitive and AI-Enabled Software Defined Radio Systems

Another significant opportunity for the Australia Software Defined Radio market lies in the integration of cognitive radio and artificial intelligence capabilities into next-generation SDR platforms. Advances in machine learning enable radios to dynamically sense spectrum conditions, autonomously select optimal waveforms, and adapt transmission parameters in real time to counter interference or jamming. These capabilities are increasingly aligned with modern defense operational concepts that emphasize resilience in contested electromagnetic environments. AI-enabled SDR systems reduce operator workload while improving communication reliability and spectrum efficiency across multi-domain operations. Australian defense research programs and experimentation initiatives provide a supportive environment for testing and deploying such advanced technologies. Integration of cognitive SDR with command, control, and intelligence systems further enhances situational awareness and decision-making speed. As electronic warfare threats become more sophisticated, demand for adaptive and intelligent communication systems is expected to rise. This creates opportunities for vendors to differentiate through software innovation, long-term upgrade pathways, and high-value sustainment services rather than hardware-only competition.

Future Outlook

The Australia Software Defined Radio market is expected to experience sustained expansion over the next five years driven by defense modernization priorities, multi-domain operational requirements, and secure communication mandates. Technological advancements in cognitive radio, encryption, and software-defined architectures will enhance system capability. Regulatory support for sovereign defense manufacturing will strengthen domestic participation. Demand-side momentum will remain anchored in defense, homeland security, and emergency response modernization programs nationwide.

Major Players

- Thales Australia

- BAE Systems Australia

- L3Harris Technologies

- Raytheon Australia

- Saab Australia

- Northrop Grumman Australia

- Lockheed Martin Australia

- Elbit Systems Australia

- Rohde & Schwarz Australia

- Codan Communications

- CEA Technologies

- EOSDefenceSystems

- Ultra Electronics Australia

- Leonardo Australia

- Kongsberg Defence Australia

Key Target Audience

- Defense ministries

- Armed forces procurement agencies

- Homeland security departments

- Emergency services authorities

- Aerospace and defense manufacturers

- Defense system integrators

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables including platform demand, defense budgets, procurement cycles, and technology adoption drivers were identified through policy documents and industry publications. These variables defined market structure. Dependencies between demand and regulation were mapped. Initial assumptions were validated through secondary sources.

Step 2: Market Analysis and Construction

Market structure was constructed using procurement data, defense disclosures, and vendor contract analysis. Demand segmentation was aligned to platform and product categories. Technology adoption patterns were assessed. Cross-validation ensured internal consistency.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were validated through consultation with defense communication specialists and system integrators. Feedback refined assumptions. Risk factors were stress tested. Final validation ensured practical relevance.

Step 4: Research Synthesis and Final Output

All findings were synthesized into a structured framework. Quantitative and qualitative insights were aligned. Market narratives were finalized. Output was reviewed for coherence and accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Defense modernization and network-centric warfare programs

Rising demand for interoperable and multi-band communication systems

Expansion of joint military operations and coalition interoperability

Increased adoption of software-upgradable communication platforms

Government investment in secure and resilient communications infrastructure - Market Challenges

High system integration and certification complexity

Cybersecurity and electronic warfare vulnerability risks

Dependence on imported critical electronic components

Long procurement cycles and budget approval processes

Interoperability challenges across legacy communication systems - Market Opportunities

Development of indigenous SDR technologies and local manufacturing

Integration of AI-driven cognitive radio capabilities

Expansion into civil emergency and disaster response communications - Trends

Shift toward open architecture and modular SDR designs

Growing emphasis on spectrum efficiency and dynamic frequency use

Integration of SDR with satellite and space-based communications

Adoption of multi-domain command and control frameworks

Increased focus on secure and jam-resistant waveforms - Government Regulations & Defense Policy

Defense communication standardization initiatives

Spectrum allocation and electromagnetic compatibility regulations

Policies supporting domestic defense electronics development

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Handheld SDR Systems

Manpack SDR Systems

Vehicular SDR Systems

Base Station SDR Systems

Airborne and Naval SDR Systems - By Platform Type (In Value%)

Land-Based Platforms

Naval Platforms

Airborne Platforms

Space-Based Platforms

Fixed Infrastructure Platforms - By Fitment Type (In Value%)

New Platform Fitment

Retrofit and Upgrade Fitment

Mission-Specific Modular Fitment

Network-Centric Integration Fitment

Ruggedized Tactical Fitment - By End User Segment (In Value%)

Defense Forces

Homeland Security Agencies

Emergency Services and Public Safety

Aerospace and Aviation Operators

Research and Academic Institutions - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Prime Contractors

System Integrators

OEM Direct Sales

Technology Partnerships and Alliances - By Material / Technology (in Value %)

FPGA-Based SDR Architecture

DSP-Based SDR Architecture

Software-Centric Virtualized SDR

AI-Enabled Adaptive Waveforms

Secure Encryption and Anti-Jamming Technology

- Market share snapshot of major players

- Cross Comparison Parameters (System Complexity, Waveform Flexibility, Security Features, Platform Compatibility, Upgradeability, Integration Capability, Compliance Standards, Cost Structure)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

BAE Systems Australia

Thales Australia

L3Harris Technologies Australia

Northrop Grumman Australia

Raytheon Australia

Lockheed Martin Australia

Elbit Systems Australia

Saab Australia

Rohde & Schwarz Australia

Codan Communications

EOS Defence Systems

CEA Technologies

Ultra Electronics Australia

Leonardo Australia

Kongsberg Defence Australia

- Defense users prioritize secure, interoperable, and mission-flexible communication

- Public safety agencies demand rapid deployment and reliability in emergencies

- Aerospace operators focus on lightweight and high-bandwidth SDR solutions

- Research institutions emphasize reconfigurability and waveform experimentation

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035