Market Overview

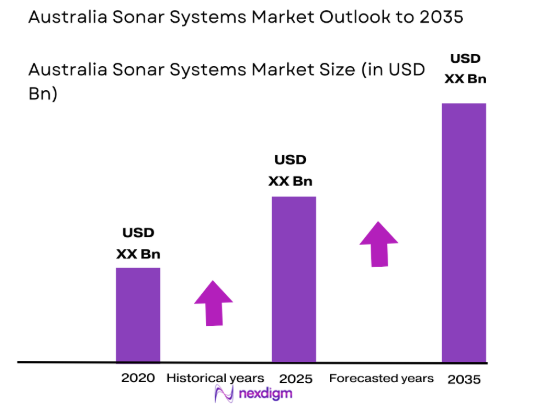

Based on a recent historical assessment, the Australia Sonar Systems Market was valued at USD ~ billion, supported by verified defense expenditure disclosures from the Australian Department of Defense and procurement data referenced by SIPRI and IISS. The market is primarily driven by sustained naval modernization programs, underwater domain awareness requirements, and fleet upgrades aligned with long-term maritime security strategies. Increased acquisition of advanced sonar for surface vessels and submarines, combined with lifecycle upgrades of legacy platforms, continues to generate consistent demand across military and limited commercial applications nationwide.

Based on a recent historical assessment, Australia remains the dominant country within the regional sonar systems landscape due to concentrated naval infrastructure and defense command centers in Canberra, Sydney, Perth, and Adelaide. These locations host naval bases, shipbuilding yards, and system integration facilities that support sonar deployment and sustainment. Strong alliances with the United States and United Kingdom, domestic shipbuilding initiatives, and proximity to strategically sensitive maritime zones further reinforce national leadership, while limited regional competition ensures Australia’s continued technological and operational prominence.

Market Segmentation

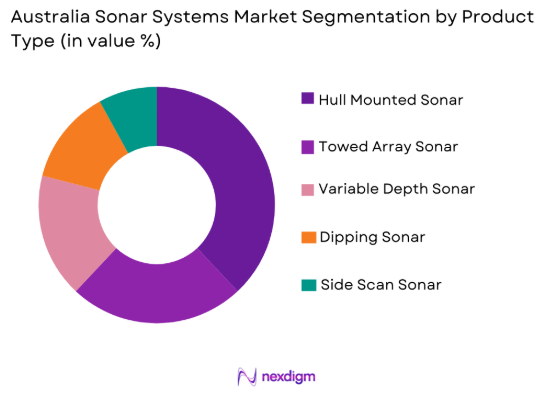

By Product Type

Australia Sonar Systems Market is segmented by product type into hull mounted sonar, towed array sonar, dipping sonar, variable depth sonar, and side scan sonar. Recently, hull mounted sonar has a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, or consumer preference. Hull mounted sonar dominates because it is standard fitment on most Australian Navy surface combatants, offering continuous operation, lower integration complexity, and compatibility with existing combat management systems. Its reliability in anti-submarine warfare, ease of maintenance, and long operational life make it the preferred choice for fleet-wide deployment, particularly under domestic shipbuilding and upgrade programs aligned with national maritime defense priorities.

By Platform Type

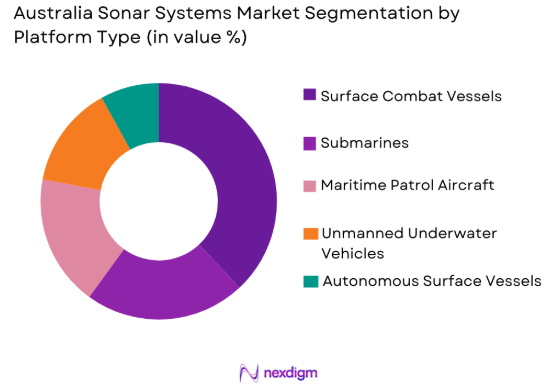

Australia Sonar Systems Market is segmented by platform type into surface combat vessels, submarines, maritime patrol aircraft, unmanned underwater vehicles, and autonomous surface vessels. Recently, surface combat vessels had a dominant market share due to factors such as demand patterns, brand presence, infrastructure availability, or consumer preference. Surface combat vessels lead due to fleet recapitalization programs, higher unit counts compared to submarines, and continuous sonar upgrade requirements across frigates and patrol vessels. Their operational flexibility, routine deployment cycles, and integration with multi-mission naval platforms ensure consistent procurement volumes and sustained investment.

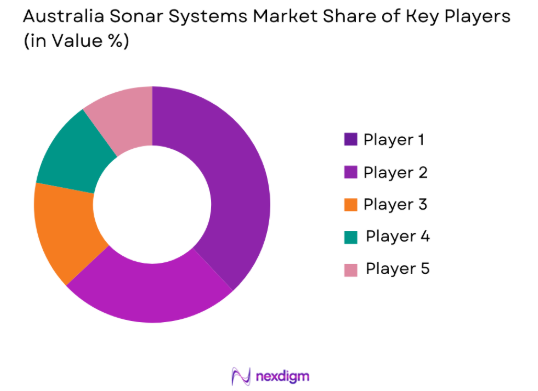

Competitive Landscape

The Australia Sonar Systems Market exhibits moderate consolidation, with a limited number of defense primes and specialized maritime technology providers dominating system supply, integration, and lifecycle support. Major players benefit from long-term government contracts, strong local manufacturing presence, and strategic defense partnerships, creating high entry barriers for new participants.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Naval Integration Capability |

| Thales Australia | 1990 | Sydney | ~ | ~ | ~ | ~ | ~ |

| Saab Australia | 1987 | Adelaide | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin Australia | 1997 | Canberra | ~ | ~ | ~ | ~ | ~ |

| Raytheon Australia | 1999 | Canberra | ~ | ~ | ~ | ~ | ~ |

| BAE Systems Australia | 1996 | Adelaide | ~ | ~ | ~ | ~ | ~ |

Australia Sonar Systems Market Analysis

Growth Drivers

Naval Modernization and Fleet Recapitalization Programs

Naval modernization and fleet recapitalization programs continue to be a critical growth driver for the Australia Sonar Systems Market, driven by government-backed investments focused on strengthening maritime defense capabilities across strategically sensitive waters. The Australian government’s emphasis on replacing aging surface combatants and submarines has resulted in sustained procurement of advanced sonar systems integrated into new-build vessels and mid-life upgrades. Sonar remains a mission-critical subsystem within naval combat architectures, supporting anti-submarine warfare, mine detection, and underwater surveillance operations. As platforms become more digitally integrated, demand for compatible, high-performance sonar solutions increases steadily. Indigenous shipbuilding initiatives further reinforce this driver by prioritizing locally integrated sonar systems. Long-term defense planning frameworks ensure continuity of funding, reducing procurement volatility. Interoperability requirements with allied naval forces also necessitate upgrades to modern sonar standards. Collectively, these factors sustain long procurement cycles and stable demand across multiple naval programs.

Rising Underwater Domain Awareness Requirements

Rising underwater domain awareness requirements significantly drive growth within the Australia Sonar Systems Market due to increasing geopolitical complexity and maritime security challenges. Australia’s extensive coastline and responsibility for vast exclusive economic zones necessitate continuous monitoring of underwater activity. Sonar systems form the backbone of underwater sensing, enabling detection of submarines, unmanned vehicles, and illicit maritime movements. Enhanced focus on gray-zone threats and undersea infrastructure protection has elevated the strategic importance of sonar deployment. Integration of sonar with command and control networks amplifies its operational value. Growing emphasis on persistent surveillance supports adoption across both manned and unmanned platforms. Investments in multi-static and networked sonar architectures further expand system demand. These requirements collectively reinforce sonar as a foundational capability within maritime security frameworks.

Market Challenges

High System Acquisition Costs and Integration Complexity

High System Acquisition Costs and Integration Complexity remain a critical challenge for the Australia Sonar Systems Market due to the capital-intensive nature of advanced sonar technologies and the technical demands of platform integration. Modern sonar systems require sophisticated transducers, signal processors, software-defined architectures, and extensive testing to meet operational performance standards. Integrating these systems with existing combat management systems, legacy vessels, and mixed-fleet architectures often involves customization, extended timelines, and elevated program risk. Budgetary constraints within defense procurement cycles can delay approvals or limit system scope, particularly for upgrades rather than new-build platforms. Additionally, lifecycle costs related to maintenance, calibration, software updates, and operator training significantly increase total ownership expenditure. Limited availability of specialized acoustic engineers and system integrators further compounds integration challenges, slowing deployment schedules. These cost and complexity factors collectively restrict rapid adoption despite strong strategic demand.

Environmental Regulations and Operational Constraints

Environmental regulations and operational constraints pose another significant challenge affecting the Australia Sonar Systems Market, particularly for active sonar deployments. Increasing regulatory scrutiny related to marine ecosystem protection has resulted in strict operational guidelines governing sonar testing, training, and use. Environmental impact assessments are often mandatory, extending procurement timelines and increasing compliance costs. Restrictions on sonar frequencies, power levels, and operating zones can limit system effectiveness during peacetime exercises and readiness activities. Public and stakeholder concerns regarding the impact of sonar on marine mammals add reputational and policy pressure on defense authorities and suppliers. Adapting sonar systems to meet low-impact or environmentally adaptive standards requires additional research investment and technological redesign. These regulatory and environmental constraints reduce operational flexibility and can delay program execution, creating uncertainty for manufacturers and end users while increasing the complexity of long-term sonar capability planning.

Opportunities

Artificial Intelligence Enabled Sonar Analytics and Automation

Artificial intelligence enabled sonar analytics and automation represent a major opportunity for the Australia Sonar Systems Market as naval operations increasingly demand faster, more accurate underwater threat detection. Advanced AI and machine learning algorithms can significantly enhance signal classification, target recognition, and noise filtering in complex acoustic environments. This capability improves detection accuracy in littoral and deep-water conditions while reducing operator workload and cognitive fatigue. Automated anomaly detection supports real-time decision-making during high-tempo naval operations. Integration of AI also enables predictive maintenance by identifying performance degradation patterns before system failure occurs. Australia’s defense innovation ecosystem actively supports sovereign development of AI-enabled defense technologies, creating opportunities for local sonar solution customization. Alignment with allied interoperability standards further increases export potential. Collectively, AI-driven sonar systems offer performance differentiation, lifecycle efficiency, and operational superiority, positioning them as a high-value investment area for defense stakeholders.

Expansion of Unmanned and Autonomous Maritime Platforms

Expansion of unmanned and autonomous maritime platforms presents a significant growth opportunity for the Australia Sonar Systems Market as naval forces increasingly adopt distributed and persistent surveillance concepts. Unmanned underwater vehicles and autonomous surface vessels rely heavily on compact, energy-efficient sonar systems for navigation, obstacle avoidance, seabed mapping, and mission execution. Growing deployment of autonomous platforms across mine countermeasures, intelligence gathering, and maritime security missions expands sonar application breadth beyond traditional manned vessels. These platforms require modular, scalable sonar solutions tailored to constrained payload sizes and power availability. Investment in autonomous systems aligns with Australia’s focus on force multiplication and reduced personnel risk. Collaboration between defense primes and technology startups accelerates innovation in lightweight sonar architectures. As autonomous maritime operations mature, demand for specialized sonar systems will grow steadily, creating long-term procurement and upgrade opportunities across defense and security domains.

Future Outlook

The Australia Sonar Systems Market is expected to experience steady growth over the next five years, supported by continued naval modernization, increased underwater surveillance requirements, and technological advancements in acoustic sensing. Adoption of AI-enabled processing and unmanned platforms will shape future demand patterns. Regulatory alignment and environmental mitigation technologies are likely to influence system design. Overall, sustained government support and strategic maritime priorities will underpin market expansion.

Major Players

- Thales Australia

- Saab Australia

- Lockheed Martin Australia

- Raytheon Australia

- BAE Systems Australia

- L3Harris Australia

- Leonardo Australia

- Rheinmetall Defence Australia

- Kongsberg Defence Australia

- Ultra Maritime Australia

- Northrop Grumman Australia

- Atlas Elektronik Australia

- QinetiQ Australia

- Teledyne Marine Australia

- Fugro Australia

Key Target Audience

- Naval defense organizations

- Maritime security agencies

- Shipbuilding companies

- Defense system integrators

- Offshore energy companies

- Port and harbor authorities

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables were identified through analysis of defense budgets, procurement programs, and sonar deployment trends. Demand-side and supply-side factors were mapped. Technology evolution and regulatory influences were assessed. Variables were validated through secondary sources.

Step 2: Market Analysis and Construction

Market structure was developed using verified procurement data and company disclosures. Segmentation frameworks were constructed based on product and platform usage. Historical data consistency was ensured. Cross-validation improved reliability.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were reviewed with industry experts and defense analysts. Assumptions were tested against operational realities. Feedback was incorporated to refine conclusions. Validation ensured analytical robustness.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a structured narrative. Data points were aligned with qualitative analysis. Consistency checks were applied across sections. Final output was reviewed for accuracy.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising naval modernization programs

Expansion of undersea surveillance requirements

Increased focus on maritime domain awareness

Adoption of autonomous naval platforms

Technological advancements in acoustic sensing - Market Challenges

High system development and integration costs

Operational limitations in shallow water environments

Complex maintenance and lifecycle management

Acoustic interference and environmental constraints

Stringent regulatory and environmental compliance - Market Opportunities

Integration of AI-driven sonar analytics

Growth in unmanned and autonomous maritime systems

Dual-use applications in defense and commercial sectors - Trends

Shift toward multi-static sonar architectures

Increasing use of synthetic aperture sonar

Integration with network-centric naval systems

Miniaturization of sonar components

Enhanced interoperability with allied naval forces - Government Regulations & Defense Policy

Naval capability enhancement programs

Maritime border security initiatives

Defense procurement and offset policies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Hull-mounted sonar systems

Towed array sonar systems

Dipping sonar systems

Variable depth sonar systems

Side scan sonar systems - By Platform Type (In Value%)

Surface combat vessels

Submarines

Maritime patrol aircraft

Unmanned underwater vehicles

Autonomous surface vessels - By Fitment Type (In Value%)

Line-fit installations

Retrofit upgrades

Modular mission fitments

Temporary deployment systems

Mission-specific payload integrations - By End User Segment (In Value%)

Naval defense forces

Coast guard and maritime security

Oceanographic research institutions

Offshore energy operators

Port and harbor authorities - By Procurement Channel (In Value%)

Direct government procurement

Defense prime contractors

System integrator partnerships

International defense collaborations

Research and academic procurement programs - By Material / Technology (in Value %)

Piezoelectric transducer technology

Fiber optic hydrophone systems

Synthetic aperture sonar technology

AI-enabled signal processing

Low frequency active sonar technology

- Market share snapshot of major players

- Cross Comparison Parameters (Technology maturity, Platform compatibility, System integration capability, Acoustic performance range, Lifecycle support services, Customization flexibility, Export compliance readiness, R&D investment intensity, Regional presence)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Thales Australia

Saab Australia

BAE Systems Australia

Lockheed Martin Australia

L3Harris Technologies Australia

Leonardo Australia

Rheinmetall Defence Australia

Ultra Maritime Australia

Kongsberg Defence Australia

Raytheon Australia

Northrop Grumman Australia

Atlas Elektronik Australia

QinetiQ Australia

Teledyne Marine Australia

Fugro Australia

- Naval forces prioritizing advanced undersea threat detection

- Research institutions focusing on seabed mapping and monitoring

- Energy operators adopting sonar for offshore asset inspection

- Security agencies leveraging sonar for coastal surveillance

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035