Market Overview

The Australia Sonobuoy market current size stands at around USD ~ million, reflecting steady procurement activity and fleet modernization programs. Demand is supported by ongoing maritime surveillance needs, rising underwater threat monitoring, and consistent replacement cycles across deployed systems. Operational deployments increased during recent periods due to enhanced naval readiness initiatives and expanded patrol missions. Procurement volumes remained stable, supported by defense allocations aligned with strategic maritime priorities. Technology upgrades and integration with airborne platforms continued to influence purchasing decisions and system refresh cycles.

The market is primarily concentrated around coastal defense hubs and naval aviation bases supporting long-range surveillance missions. Western and eastern seaboard regions dominate deployments due to operational proximity to strategic maritime routes. Strong defense infrastructure, skilled maintenance ecosystems, and established logistics networks support sustained adoption. Government-backed defense programs and allied interoperability requirements further strengthen regional demand concentration. Policy alignment with maritime security objectives continues to reinforce long-term procurement stability.

Market Segmentation

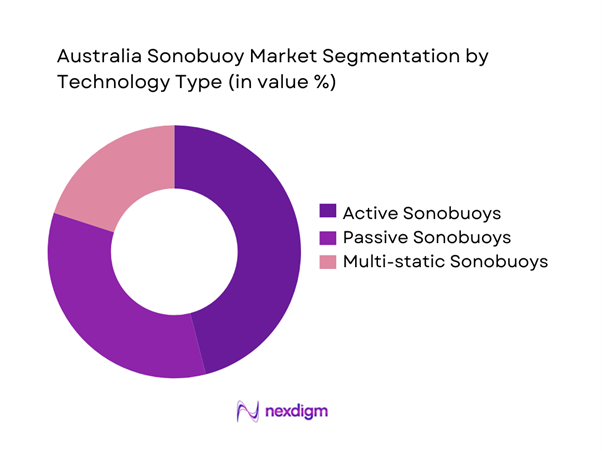

By Technology Type

The market is dominated by active and passive sonobuoy systems used for anti-submarine and surveillance missions. Active sonobuoys maintain higher deployment frequency due to real-time detection capabilities and operational reliability. Passive systems continue to hold relevance for covert monitoring and acoustic intelligence gathering. Hybrid systems combining multi-static capabilities are increasingly favored for complex threat environments. Technology selection is influenced by mission type, platform compatibility, and endurance requirements. Ongoing digitalization and sensor miniaturization continue to reshape deployment preferences across defense operators.

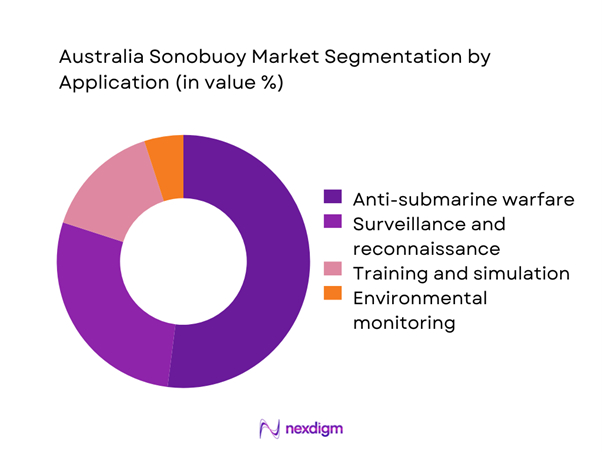

By Application

Anti-submarine warfare remains the dominant application segment driven by expanding maritime surveillance operations. Training and simulation applications maintain steady demand due to continuous skill development requirements. Surveillance and reconnaissance missions account for significant usage supported by regional security needs. Environmental monitoring remains a niche but growing application area. Demand is influenced by operational tempo, naval exercises, and interoperability requirements with allied forces.

Competitive Landscape

The competitive landscape is characterized by a limited number of technologically advanced suppliers with strong defense integration capabilities. Market participation is shaped by long procurement cycles, stringent certification requirements, and close alignment with naval operational standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| L3Harris Technologies | 1895 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| RTX Corporation | 1922 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Ultra Maritime | 2019 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Sonobuoy Market Analysis

Growth Drivers

Rising maritime surveillance requirements in Indo-Pacific

Increasing maritime surveillance intensity is driving sustained procurement of sonobuoy systems across defense operations. Naval forces are prioritizing underwater domain awareness to address evolving submarine threats. Expansion of patrol missions has elevated deployment frequency across multiple platforms. Modern naval doctrines emphasize early detection and persistent acoustic monitoring capabilities. Strategic defense cooperation further reinforces demand for advanced surveillance technologies. Fleet modernization programs continue to integrate updated acoustic sensing equipment. Increased joint exercises contribute to recurring usage and replacement cycles. Operational readiness requirements maintain consistent procurement planning. Enhanced situational awareness needs drive technological upgrades. These combined factors sustain long-term growth momentum.

Modernization of Royal Australian Navy and RAAF fleets

Fleet modernization programs are accelerating adoption of advanced sonobuoy technologies across aerial platforms. Replacement of aging assets increases compatibility with next-generation acoustic systems. Procurement strategies emphasize interoperability and digital integration. New aircraft acquisitions require compatible surveillance payloads for mission readiness. Lifecycle extension programs further support system upgrades. Modern fleets demand higher data accuracy and faster processing capabilities. Interoperability with allied forces remains a strategic priority. Modernization initiatives improve operational efficiency and surveillance coverage. Technology refresh cycles drive recurring procurement demand. Long-term defense planning sustains consistent investment levels.

Challenges

High unit cost and limited domestic manufacturing

High unit costs constrain procurement volumes and limit operational flexibility across defense programs. Dependence on imported components increases exposure to supply chain disruptions. Limited domestic manufacturing capabilities restrict rapid scaling during demand surges. Cost pressures impact long-term sustainment planning and inventory levels. Budget allocation challenges affect replacement cycles and modernization timelines. Procurement delays can occur due to extended supplier lead times. Local industry participation remains comparatively limited. Cost sensitivity influences technology selection decisions. Maintenance expenses add to overall lifecycle burden. These factors collectively challenge market expansion.

Supply chain dependence on foreign OEMs

Reliance on foreign original equipment manufacturers creates vulnerabilities in availability and delivery schedules. Geopolitical factors may influence export approvals and shipment timelines. Limited supplier diversity restricts competitive pricing dynamics. Extended lead times affect operational readiness planning. Customization requirements further complicate procurement processes. Logistics coordination remains complex due to international sourcing. Exchange rate fluctuations influence procurement budgeting. Maintenance support often requires overseas coordination. Supply disruptions can delay training and deployment cycles. These dependencies increase operational risk exposure.

Opportunities

Development of indigenous sonobuoy manufacturing

Domestic manufacturing initiatives present opportunities to enhance supply security and reduce dependency. Local production supports faster response times and customized system development. Government incentives encourage defense industry participation and technology transfer. Indigenous manufacturing strengthens sovereign defense capabilities. Localized production improves lifecycle support and maintenance efficiency. Industry collaboration fosters innovation and skills development. Increased local content aligns with national defense objectives. Export potential improves with established manufacturing capabilities. Long-term cost efficiencies become achievable. These factors create strong growth opportunities.

Integration with unmanned maritime systems

Integration with unmanned platforms expands operational flexibility and surveillance coverage. Autonomous systems increase deployment efficiency across extended maritime zones. Sonobuoys complement unmanned aerial and surface vehicles effectively. Data integration enhances real-time situational awareness capabilities. Emerging doctrines emphasize unmanned asset deployment. Technology compatibility improvements enable seamless integration. Operational costs may reduce through autonomous deployments. Enhanced persistence improves mission success rates. Research programs increasingly focus on unmanned integration. This trend supports long-term market expansion.

Future Outlook

The Australia Sonobuoy market is expected to maintain steady momentum driven by sustained defense modernization and regional security priorities. Increased integration with unmanned systems and digital surveillance platforms will shape future deployments. Technological advancements will enhance detection accuracy and operational efficiency. Domestic capability development is likely to strengthen supply resilience. Long-term defense planning will continue supporting consistent procurement activity.

Major Players

- L3Harris Technologies

- RTX Corporation

- Ultra Maritime

- Thales Group

- Saab AB

- Lockheed Martin

- General Dynamics

- Leonardo

- Elbit Systems

- Kongsberg Defence

- Atlas Elektronik

- ASELSAN

- Sparton Corporation

- Teledyne Technologies

- Rohde & Schwarz

Key Target Audience

- Naval defense forces

- Air force maritime patrol units

- Defense procurement agencies

- Maritime security agencies

- Defense system integrators

- Government and regulatory bodies including Department of Defence Australia

- Investments and venture capital firms

- Defense technology suppliers

Research Methodology

Step 1: Identification of Key Variables

Key operational parameters, deployment platforms, and technology categories were identified through defense documentation review. Emphasis was placed on understanding procurement structures and mission requirements. Data points were aligned with operational usage patterns and lifecycle considerations.

Step 2: Market Analysis and Construction

Market structure was developed using deployment data, platform penetration, and technology adoption trends. Segmentation logic was refined through analysis of application use cases and procurement behavior. Cross-validation ensured consistency across datasets.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were validated through discussions with defense professionals and system integrators. Insights focused on operational trends, technology adoption, and procurement dynamics. Feedback helped refine growth and constraint assumptions.

Step 4: Research Synthesis and Final Output

All findings were consolidated and reviewed for consistency and logical coherence. Data was normalized to ensure comparability across segments. Final insights were structured to support strategic decision-making.

- Executive Summary

- Research Methodology (Market Definitions and operational scope of sonobuoy systems in Australian maritime defense, platform-based segmentation and mission taxonomy development, bottom-up and top-down market sizing using defense procurement and deployment data, fleet data, and import-export statistics, assumptions related to classified procurement cycles and deployment confidentiality)

- Definition and Scope

- Market evolution

- Operational and mission usage landscape

- Ecosystem and value chain structure

- Supply chain and procurement framework

- Regulatory and defense compliance environment

- Growth Drivers

Rising maritime surveillance requirements in Indo-Pacific

Modernization of Royal Australian Navy and RAAF fleets

Increased submarine detection and ASW readiness

Expansion of joint naval exercises and alliances

Growing investment in underwater domain awareness - Challenges

High unit cost and limited domestic manufacturing

Short operational life and frequent replenishment needs

Supply chain dependence on foreign OEMs

Data security and encryption compliance issues

Complex integration with legacy platforms - Opportunities

Development of indigenous sonobuoy manufacturing

Integration with unmanned maritime systems

Advancements in digital and AI-enabled acoustic processing

Export potential to allied navies

Upgrades driven by AUKUS collaboration - Trends

Shift toward multi-static and networked sonobuoy systems

Increased use of low-frequency active sonobuoys

Adoption of environmentally compliant materials

Growing demand for extended-life batteries

Integration with real-time data analytics platforms - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing maritime patrol aircraft

Rotary-wing naval helicopters

Unmanned aerial systems

Surface vessel deployed systems - By Application (in Value %)

Anti-submarine warfare

Surveillance and reconnaissance

Training and simulation

Environmental and oceanographic monitoring - By Technology Architecture (in Value %)

Active sonobuoys

Passive sonobuoys

Directional frequency analysis sonobuoys

Multi-static and networked sonobuoys - By End-Use Industry (in Value %)

Naval defense forces

Maritime border security agencies

Defense research organizations

Allied joint operation units - By Connectivity Type (in Value %)

Radio frequency analog

Digital RF transmission

Satellite-assisted communication

Encrypted data link systems - By Region (in Value %)

New South Wales

Victoria

Western Australia

Queensland

Rest of Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Product portfolio depth, technology maturity, platform compatibility, pricing strategy, regional presence, defense certifications, production capacity, after-sales support)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Ultra Electronics

Sparton Corporation

RTX Corporation

L3Harris Technologies

Thales Group

General Dynamics Mission Systems

Leonardo S.p.A.

Lockheed Martin

SAAB AB

Kongsberg Defence & Aerospace

Atlas Elektronik

Elbit Systems

ASELSAN

Sparton DeLeon Springs

Ultra Maritime

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035