Market Overview

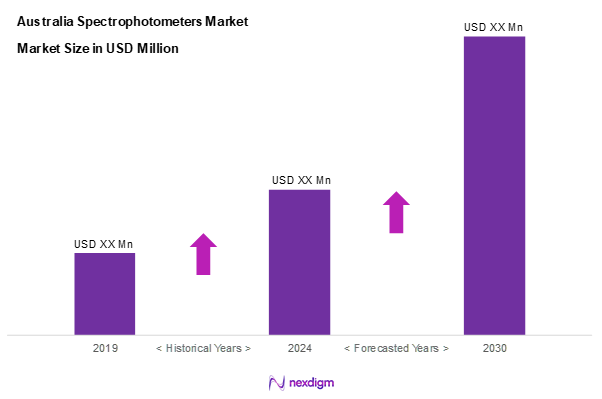

As of 2024, the Australia spectrophotometers market is valued at USD ~ million, with a growing CAGR of 5.4% from 2024 to 2030. The primary growth drivers include increasing demand from diverse industries such as pharmaceuticals, environmental testing, and food and beverage sectors, alongside the rising trend towards modernization in laboratory equipment. Continuous technological advancements and an emphasis on precision in measurements are fostering this growth in the spectrophotometer segment, leading to expectations of significant market activity.

The major cities driving the spectrophotometers market include Sydney, Melbourne, and Brisbane. These urban centres are pivotal due to their robust industrial bases and substantial investments in research and development. Additionally, a concentration of educational and research institutions in these cities contributes to a high demand for advanced analytical instruments, making them vital nodes in Australia’s market ecosystem.

Market Segmentation

By Product Type

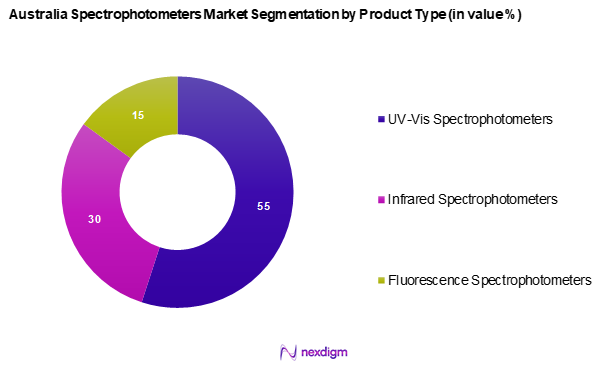

The Australia spectrophotometers market is segmented into UV-Vis spectrophotometers, infrared spectrophotometers, and fluorescence spectrophotometers. UV-Vis spectrophotometers hold a dominant market share due to their widespread application in various research and industry sectors, including academia, pharmaceuticals, and water quality testing. Their versatility in analysing a wide range of samples and user-friendly interface makes them popular among laboratory technicians, leading to a consistent demand driven by the necessity for precise and reliable data in analyses.

By Application

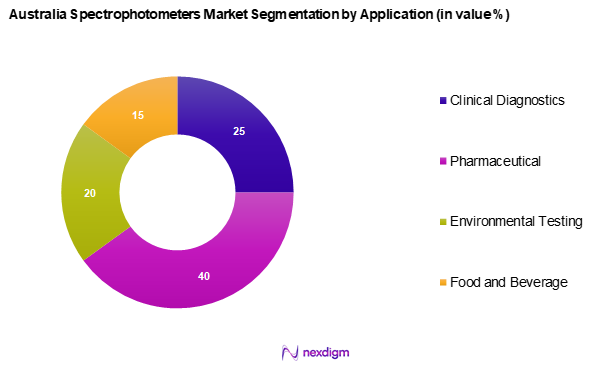

The Australia spectrophotometers market is segmented into clinical diagnostics, pharmaceutical, environmental testing, and food and beverage applications. The pharmaceutical sector is leading this segmentation due to the increasing focus on drug development and regulatory compliance that necessitates rigorous testing and quality control. Pharmaceutical companies leverage spectrophotometry to ensure the accuracy of drug compositions and effectiveness, thus solidifying the segment’s leading position in the overall market landscape.

Competitive Landscape

The Australia Spectrophotometers Market is characterized by a competitive landscape dominated by a few major players. Companies such as Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer lead the sector due to their strong brand reputation, innovative product offerings, and vast distribution networks. The consolidation of these key players significantly influences market dynamics and highlights the importance of research and development in gaining a competitive edge.

| Company | Establishment Year | Headquarters | Revenue

(USD Mn) |

Market Share | Strength | Weakness | Business Strategy |

| Thermo Fisher Scientific | 1956 | Massachusetts, USA | – | – | – | – | – |

| Agilent Technologies | 1999 | California, USA | – | – | – | – | – |

| PerkinElmer | 1937 | Massachusetts, USA | – | – | – | – | – |

| Shimadzu Corporation | 1875 | Kyoto, Japan | – | – | – | – | – |

| Horiba | 1945 | Kyoto, Japan | – | – | – | – | – |

Australia Spectrophotometers Market Analysis

Growth Drivers

Increasing R&D Investments

Research and development (R&D) investments are steadily increasing in Australia, reflecting the government’s commitment to fostering innovation and technological progress. This emphasis on enhancing laboratory capabilities fuels the demand for spectrophotometers, which play a crucial role in various analytical processes. As industries focus on R&D for product development and quality assurance, the market for spectrophotometers is expected to grow, driven by both public and private sector investments.

Rise in Pharmaceutical Sector

The Australian pharmaceutical sector has been experiencing significant expansion, with the industry playing a vital role in the national economy. This growth is driven by a shift towards personalized medicine and an increase in R&D activities. Pharmaceutical companies are heavily investing in drug formulations and testing, heightening the demand for precise analytical instruments such as spectrophotometers. As companies strive to maintain rigorous quality assurance and adhere to stringent regulations, the market for spectrophotometers is expected to witness sustained growth.

Market Challenges

High Cost of Equipment

The spectrophotometer market faces challenges due to the high upfront costs associated with advanced spectrophotometric instruments. The expenses involved can limit the adoption of these essential devices, particularly among smaller laboratories and emerging industries with restricted budgets. Financial constraints often lead organizations to delay investments in new technologies, potentially slowing market growth and technological advancements.

Maintenance and Calibration Issues

The efficiency of spectrophotometers is heavily reliant on regular maintenance and calibration to ensure accurate measurements. The costs and logistical challenges associated with calibration can be substantial, sometimes leading to operational downtimes that affect research timelines and laboratory productivity. These maintenance requirements can pose obstacles for organizations with limited budgets, influencing procurement decisions and impacting overall market adoption.

Opportunities

Technological Advancements in Spectrophotometers

Continuous advancements in spectrophotometer design and functionality present significant growth opportunities. The development of miniaturized and portable spectrophotometers has gained traction, catering to applications in field analysis and remote testing. These innovations reduce reliance on traditional laboratory settings and enhance the accessibility of real-time measurements across diverse environments. The shift towards more user-friendly and versatile devices is expected to expand the market significantly.

Expansion of Application Areas

The versatility of spectrophotometers is driving their adoption across new sectors such as environmental testing and food quality assurance. Increased regulatory focus on water quality and environmental monitoring has led to greater demand for precise analytical instruments. This expansion into diverse industries broadens the market while enabling manufacturers and vendors to cater to evolving industry needs. As more sectors recognize the importance of analytical precision, the spectrophotometer market is poised for further growth.

Future Outlook

Over the next five years, the Australia spectrophotometers market is expected to experience significant growth driven by increased investment in research and development, rising awareness regarding the importance of quality control across various industries, and advancements in spectrophotometer technology. Furthermore, the ongoing integration of automation and digital features into spectrophotometric instruments is poised to enhance user experience and facilitate more efficient data gathering.

Major Players in the Market

- Thermo Fisher Scientific

- Agilent Technologies

- PerkinElmer

- Shimadzu Corporation

- Horiba

- Jasco

- BioTek Instruments

- Beckman Coulter

- Mettler Toledo

- Bruker Corporation

- Hitachi High-Technologies

- Leco Corporation

- Waters Corporation

- ABB (Asea Brown Boveri)

- Malvern Instruments

Key Target Audience

- Pharmaceutical and Biotechnology Companies

- Environmental Testing Agencies

- Food and Beverage Manufacturers

- Research Institutions and Laboratories

- Quality Control Departments

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., National Measurement Institute, Therapeutic Goods Administration)

- Healthcare Facilities and Clinical Laboratories

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the Australia Spectrophotometers Market. This step relies on comprehensive desk research, utilizing a combination of secondary and proprietary databases to gather insightful industry-level information. The primary aim is to identify and define the critical variables that influence market dynamics, including technological trends, consumer behavior, and regulatory factors.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical data concerning the Australia Spectrophotometers Market. This includes evaluating market penetration, the balance between producers and service providers, and revenue generation. In-depth assessments of service quality metrics will also be conducted, ensuring that the revenue estimates are both reliable and accurate in reflecting current market conditions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through targeted consultations with industry experts representing various sectors of the market. This direct engagement will occur through interviews and surveys, allowing for valuable operational and financial insights directly from practitioners. Such expert opinions are crucial for refining and corroborating the collected market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct interaction with a diverse selection of manufacturers and industry stakeholders to gather detailed insights related to product segments, sales performance, consumer preferences, and other relevant factors. These interactions aim to verify and enhance the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Australia Spectrophotometers Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing R&D Investments

Rise in Pharmaceutical Sector - Market Challenges

High Cost of Equipment

Maintenance and Calibration Issues - Opportunities

Technological Advancements in Spectrophotometers

Expansion of Application Areas - Trends

Adoption of Miniaturized Devices

Integration of Smart Technology - Regulatory Framework

Equipment Standards

Compliance with Health and Safety Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type, (In Value %)

UV-Vis Spectrophotometers

Infrared Spectrophotometers

Fluorescence Spectrophotometers

Others - By Application, (In Value %)

Clinical Diagnostics

Pharmaceutical

Environmental Testing

Food and Beverage

Other Applications - By End-User, (In Value %)

Academia and Research Institutes

Pharmaceutical and Biotechnology Companies

Environmental Agencies

Food and Beverage Manufacturers - By Region, (In Value %)

New South Wales

Victoria

Queensland

Western Australia

South Australia

Others - By Distribution Channel, (In Value %)

Direct Sales

Third-party Distributors

Online Platforms

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategy, Recent Developments, Key Strengths, Weaknesses, Revenue Streams, Distribution Channels, Market Positioning, Product Innovations, Customer Engagement Strategies)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

Thermo Fisher Scientific

Agilent Technologies

PerkinElmer

Horiba

Jasco

Mettler Toledo

Beckman Coulter

Shimadzu Corporation

Bruker Corporation

BioTek Instruments

Sartorius AG

Hitachi High-Tech

Hitachi High-Tech

Leco Corporation

Agilent Technologies

Waters Corporation

Others

- Market Demand and Utilization Patterns

- Budget Allocation Strategies

- Regulatory and Compliance Requirements

- Needs and Challenges Identification

- Decision-Making Process Analysis

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030