Market Overview

The Australia Stealth Technologies market current size stands at around USD ~ million, reflecting steady defense modernization momentum and platform upgrades. Demand growth is supported by increasing investments in advanced air, naval, and land systems, with steady procurement volumes observed during 2024 and 2025. Technology adoption remains focused on radar absorbent materials, electronic countermeasures, and signature reduction platforms. The market is shaped by long-term defense planning cycles, indigenous capability development, and alignment with allied defense standards. Program continuity and multiyear defense allocations continue influencing procurement consistency.

The market is concentrated across major defense and industrial hubs including New South Wales, Victoria, and Western Australia. These regions benefit from established defense manufacturing infrastructure, access to naval and air force bases, and proximity to research institutions. Demand is further strengthened by integration programs supporting indigenous production and maintenance. Mature supplier ecosystems and strong public–private collaboration frameworks reinforce adoption. Government-backed defense modernization programs and regional security priorities continue to shape technology deployment intensity.

Market Segmentation

By Platform Type

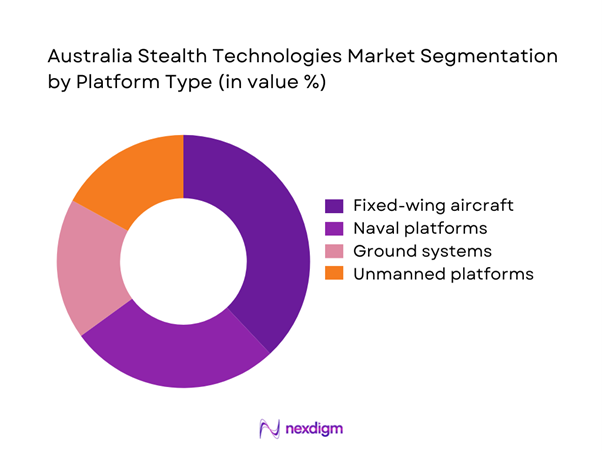

The platform-based segmentation is dominated by airborne and naval platforms due to Australia’s emphasis on air superiority and maritime surveillance. Fixed-wing aircraft remain the primary adopters, driven by stealth upgrades and next-generation fighter programs. Naval vessels represent a growing segment, supported by frigate and submarine modernization initiatives. Ground-based systems maintain moderate adoption, mainly for surveillance and electronic warfare roles. Unmanned platforms are gaining traction due to increased reconnaissance needs and lower operational risk. Platform-specific integration complexity continues to shape technology penetration rates across defense domains.

By Technology Type

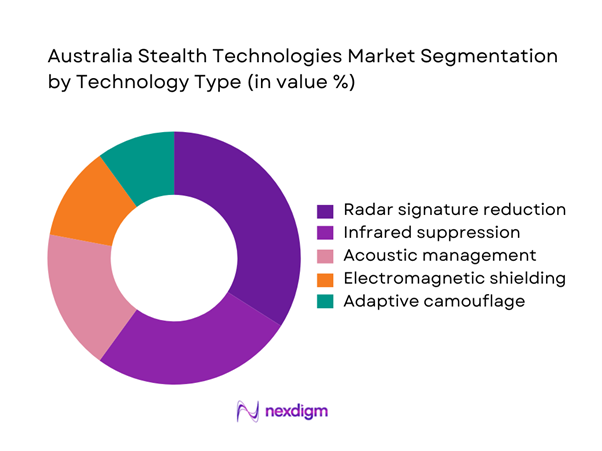

Technology segmentation is led by radar cross-section reduction solutions, reflecting high deployment across air and naval assets. Infrared suppression technologies follow closely, driven by evolving missile detection threats. Acoustic signature management is increasingly adopted within submarine and naval applications. Electromagnetic shielding and adaptive camouflage solutions represent emerging segments, supported by research programs. Integration complexity and system compatibility influence adoption speed across platforms. Technology upgrades are primarily linked to lifecycle extensions and capability enhancement programs.

Competitive Landscape

The competitive landscape is characterized by a mix of global defense contractors and specialized technology providers operating through local subsidiaries. Competition is driven by technological depth, integration capability, and compliance with defense procurement standards. Long-term contracts and platform-specific customization define supplier positioning. Market participants focus on innovation, partnership development, and lifecycle support to strengthen competitive advantage.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Stealth Technologies Market Analysis

Growth Drivers

Rising defense modernization and air superiority programs

Australia continues expanding defense modernization programs to strengthen air dominance and regional deterrence capabilities. New aircraft procurement and upgrades increased during 2024 and 2025 across multiple operational fleets. Defense planners prioritize low observable technologies to enhance survivability and mission effectiveness. Integration of stealth solutions supports multirole mission profiles across contested environments. Indigenous capability development further accelerates localized production and technology adaptation. Long-term defense planning ensures sustained funding continuity for advanced stealth platforms. Collaborative programs with allied nations strengthen technology transfer and interoperability. Increased focus on deterrence elevates demand for next-generation stealth integration. Strategic defense outlook reinforces sustained platform upgrades across service branches. These factors collectively support steady market expansion.

Increasing geopolitical tensions in the Indo-Pacific region

Heightened regional security concerns have increased emphasis on surveillance and deterrence capabilities. Australia’s strategic positioning drives adoption of advanced stealth technologies across air and naval domains. Rising maritime security operations increase demand for low-observable platforms. Cross-border security dynamics reinforce investment in early detection avoidance systems. Defense planners prioritize technological superiority to maintain regional stability. Modernization programs emphasize survivability in contested operational environments. Multilateral defense exercises accelerate technology validation and deployment. Enhanced threat perception drives faster acquisition cycles. Defense budgets increasingly align with stealth capability enhancement. Regional instability continues reinforcing long-term demand growth.

Challenges

High development and integration costs

Stealth technology development requires extensive testing, specialized materials, and complex engineering processes. High research and development intensity elevates overall system costs significantly. Integration into existing platforms presents technical compatibility challenges. Long testing cycles delay deployment timelines and increase program risk exposure. Cost overruns impact procurement scalability across multiple defense segments. Limited domestic manufacturing scale further increases dependency on imports. Advanced materials require specialized supply chains and quality assurance. Budget constraints limit widespread adoption across all platform categories. Cost sensitivity remains a key barrier for program expansion. These factors collectively restrain rapid market penetration.

Stringent export controls and technology transfer restrictions

International regulations restrict the transfer of advanced stealth technologies across borders. Export control compliance increases administrative and approval timelines. Collaborative programs often face delays due to regulatory clearance requirements. Technology-sharing limitations impact localization of advanced systems. Security classification constraints restrict broader industrial participation. Regulatory oversight increases documentation and certification burdens. Compliance costs affect supplier pricing strategies. Restricted access to core technologies limits domestic innovation. Policy-driven constraints reduce flexibility in procurement planning. These limitations collectively challenge market scalability.

Opportunities

Expansion of sovereign defense capability initiatives

National defense policies increasingly prioritize domestic manufacturing and technology development. Government incentives support indigenous production of stealth-related components. Local industry participation enhances supply chain resilience. Sovereign capability programs reduce dependency on foreign suppliers. Investment in domestic research facilities accelerates innovation cycles. Workforce development initiatives support skill enhancement in advanced engineering. Policy alignment encourages long-term industry participation. Increased funding enables prototype development and testing. Collaboration between defense agencies and industry strengthens capability maturity. These factors create sustained growth opportunities.

Increased funding for next-generation combat platforms

Defense allocations increasingly emphasize next-generation aircraft and naval platforms. These platforms require integrated stealth architectures for operational effectiveness. Funding allocation supports research, prototyping, and system integration activities. Platform modernization programs create recurring demand cycles. Emphasis on survivability enhances stealth technology adoption. Advanced sensors and electronic warfare integration drive innovation. Multi-domain operations increase stealth requirements across platforms. Budget continuity supports long-term supplier engagement. Technological upgrades enhance operational readiness. These trends collectively expand market potential.

Future Outlook

The Australia Stealth Technologies market is expected to maintain steady growth through the forecast period, supported by sustained defense modernization initiatives. Increasing focus on indigenous capability development and next-generation platforms will drive technology adoption. Integration of advanced materials and electronic systems will further enhance platform performance. Regional security dynamics will continue influencing procurement priorities. Long-term defense planning ensures continued investment momentum.

Major Players

- Lockheed Martin

- BAE Systems

- Northrop Grumman

- Raytheon Technologies

- Saab AB

- Thales Group

- Boeing Defence Australia

- Leonardo

- Elbit Systems

- L3Harris Technologies

- Rheinmetall Defence

- QinetiQ

- Hensoldt

- C4i Systems

- General Dynamics

Key Target Audience

- Defense ministries and armed forces

- Government and regulatory bodies including Department of Defence Australia

- Defense procurement agencies

- Aerospace and naval system integrators

- Defense technology manufacturers

- System integrators and OEMs

- Investments and venture capital firms

- Defense modernization program managers

Research Methodology

Step 1: Identification of Key Variables

Key variables including platform types, technology categories, and deployment environments were identified through industry mapping. Emphasis was placed on defense procurement structures and operational requirements. Data points were aligned with defense capability development priorities.

Step 2: Market Analysis and Construction

Market structure was developed through analysis of platform deployment trends and technology integration patterns. Segmentation was validated using defense acquisition frameworks and industrial participation data. Qualitative and quantitative indicators were combined for consistency.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert consultations with defense analysts and industry stakeholders. Assumptions were tested against operational requirements and procurement cycles. Feedback loops ensured accuracy and relevance.

Step 4: Research Synthesis and Final Output

All insights were consolidated into a structured framework. Data consistency checks were applied across sections. Final outputs were aligned with defense market reporting standards and strategic analysis objectives.

- Executive Summary

- Research Methodology (Market Definitions and defense stealth technology scope alignment, Platform and subsystem-level segmentation framework, Bottom-up defense expenditure and program-based market sizing, Revenue attribution by technology maturity and deployment phase, Primary validation through defense OEMs and government stakeholders)

- Definition and Scope

- Market evolution

- Usage and operational integration in defense platforms

- Ecosystem structure

- Supply chain and procurement framework

- Regulatory and defense compliance environment

- Growth Drivers

Rising defense modernization and air superiority programs

Increasing geopolitical tensions in the Indo-Pacific region

Expansion of indigenous defense manufacturing capabilities

Advancements in materials science and radar evasion technologies

Growing investments in next-generation fighter and naval platforms

Integration of stealth with unmanned and autonomous systems - Challenges

High development and integration costs

Stringent export controls and technology transfer restrictions

Complex certification and testing requirements

Limited domestic manufacturing scale

Long procurement and validation cycles

Dependence on foreign technology partnerships - Opportunities

Expansion of sovereign defense capability initiatives

Increased funding for next-generation combat platforms

Development of indigenous stealth materials

Collaborations with allied defense technology providers

Growth in unmanned and autonomous stealth systems

Retrofitting opportunities for existing fleets - Trends

Shift toward multi-spectral stealth solutions

Integration of AI-driven signature management

Growing focus on low-observable naval platforms

Adoption of advanced composite materials

Emphasis on lifecycle cost optimization

Increased collaboration between defense and academia - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Fixed-wing aircraft

Rotary-wing platforms

Naval vessels

Ground combat vehicles

Unmanned systems - By Application (in Value %)

Radar cross-section reduction

Infrared signature suppression

Acoustic signature management

Electronic warfare and counter-detection

Multispectral camouflage - By Technology Architecture (in Value %)

Shaping and design-based stealth

Radar absorbing materials

Active signature management systems

Thermal management systems

Electromagnetic cloaking technologies - By End-Use Industry (in Value %)

Defense air forces

Naval forces

Land forces

Homeland security agencies

Defense R&D organizations - By Connectivity Type (in Value %)

Standalone stealth systems

Network-integrated stealth platforms

Sensor-fused stealth architectures - By Region (in Value %)

New South Wales

Victoria

Queensland

Western Australia

Rest of Australia

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (Technology depth, Platform compatibility, Defense certifications, R&D intensity, Local manufacturing presence, Contract portfolio strength, Pricing competitiveness, Strategic partnerships)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Lockheed Martin

Northrop Grumman

BAE Systems

Raytheon Technologies

Saab AB

Thales Group

Boeing Defence Australia

Leonardo S.p.A.

Elbit Systems

RTX Australia

QinetiQ

Hensoldt

L3Harris Technologies

Rheinmetall Defence

C4i Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035