Market Overview

The Australia Submarine Market current size stands at around USD ~ million, reflecting active naval modernization and fleet renewal initiatives. Recent activity indicates steady procurement momentum driven by strategic maritime priorities, rising defense preparedness, and long-term capability planning. The market shows consistent demand across conventional and nuclear-powered platforms, supported by multi-year acquisition programs. Increased focus on deterrence, surveillance, and underwater dominance has strengthened investment continuity. Industrial participation and local capability development have also influenced procurement cycles. Program phasing and infrastructure readiness remain central to near-term activity levels.

Australia’s submarine ecosystem is primarily concentrated in South Australia and Western Australia due to established naval infrastructure and shipbuilding capabilities. These regions benefit from proximity to naval bases, specialized labor pools, and long-term defense investment commitments. Strong policy backing and industrial participation agreements support ecosystem maturity. Collaboration with allied nations further enhances technology transfer and operational integration. The concentration of sustainment facilities and training centers reinforces regional dominance. Government-led procurement structures continue shaping market development.

Market Segmentation

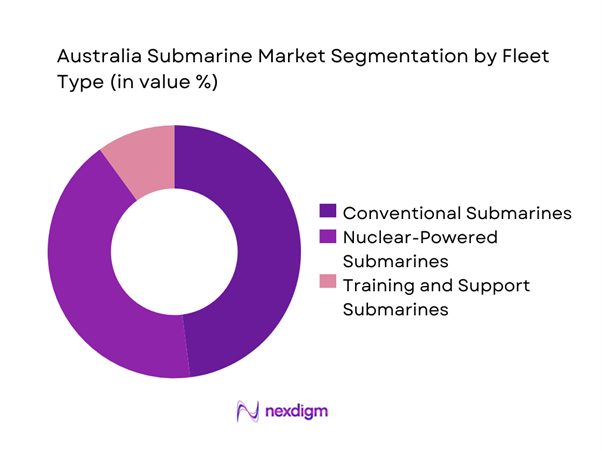

By Fleet Type

The fleet type segmentation is dominated by conventional and nuclear-powered submarines, reflecting Australia’s evolving defense posture and strategic maritime objectives. Conventional platforms remain relevant for coastal surveillance and training, while nuclear-powered submarines are gaining prominence under long-term defense partnerships. The shift toward nuclear capability is influencing procurement planning, workforce training, and infrastructure investment. This transition is also driving technological upgrades across propulsion, endurance, and combat systems. Fleet composition decisions are aligned with long-range deterrence strategies and interoperability requirements. Lifecycle sustainment considerations increasingly influence platform selection decisions.

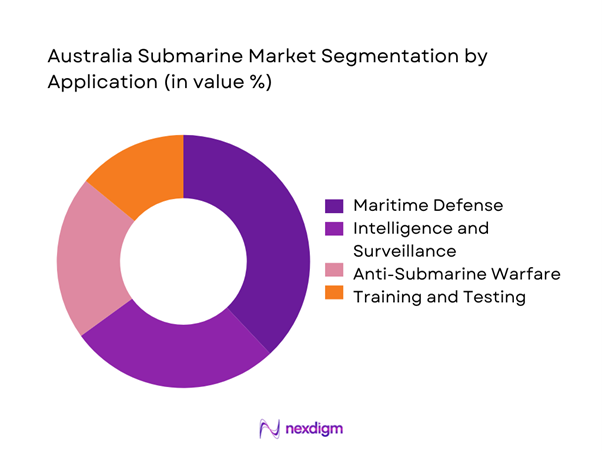

By Application

Application-based segmentation reflects strong emphasis on defense operations, surveillance, and maritime security. Anti-submarine warfare and intelligence gathering remain dominant use cases due to regional security dynamics. Training and readiness missions support sustained operational capability and personnel preparedness. Increasing reliance on integrated surveillance systems has expanded application scope. Multi-role deployment capability is now a key procurement criterion. The growing importance of joint operations has further diversified application requirements.

Competitive Landscape

The competitive landscape is characterized by a mix of international defense primes and domestic shipbuilding entities. Market competition is shaped by long-term contracts, technological specialization, and government alignment. Entry barriers remain high due to regulatory requirements and capital intensity. Strategic partnerships and local manufacturing commitments strongly influence competitive positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Naval Group | 1999 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Thyssenkrupp Marine Systems | 2005 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab Group | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

Australia Submarine Market Analysis

Growth Drivers

Modernization of Royal Australian Navy fleet

Modernization programs continue expanding naval capabilities through replacement of aging platforms and enhanced underwater warfare readiness. Fleet upgrades have accelerated following increased strategic emphasis on maritime security and regional stability. Investment planning during 2023 and 2024 prioritized endurance, stealth, and mission versatility. Operational readiness requirements have driven adoption of advanced combat and navigation systems. Workforce development initiatives supported platform integration and sustainment activities nationwide. Modernization efforts are aligned with long-term defense capability roadmaps and operational resilience objectives. Modernization initiatives also emphasize interoperability with allied naval forces operating across the Indo-Pacific region. Integration of advanced sensors and command systems enhances situational awareness across maritime domains. Domestic industrial participation strengthens supply chain reliability and program continuity. Government-backed funding mechanisms support phased capability enhancement programs. Infrastructure upgrades at naval bases facilitate expanded deployment capabilities. Overall modernization remains a foundational growth catalyst shaping procurement and investment decisions.

AUKUS-driven nuclear submarine acquisition program

The AUKUS framework significantly reshaped Australia’s submarine acquisition strategy and long-term naval planning priorities. Nuclear-powered submarine adoption represents a transformational shift in operational endurance and deterrence capabilities. Program development accelerated during 2023 and 2024 with expanded trilateral coordination. Infrastructure planning now includes nuclear stewardship, training, and regulatory compliance systems. Workforce upskilling initiatives are aligned with nuclear engineering and operational requirements. This program continues to redefine procurement scale and technological expectations. The AUKUS initiative has also strengthened international collaboration and technology sharing frameworks. Supply chain localization efforts aim to reduce dependency risks while enhancing sovereign capability. Long-term sustainment planning has become central to program execution strategies. Defense policy alignment ensures continuity across political and budgetary cycles. Industrial participation agreements support domestic manufacturing and systems integration. The initiative remains a cornerstone of Australia’s future maritime defense posture.

Challenges

High capital and lifecycle costs

Submarine acquisition and sustainment require substantial long-term financial commitments across multiple program phases. Capital intensity increases due to advanced propulsion, materials, and combat systems integration. Lifecycle maintenance expenses significantly influence procurement planning decisions. Budget allocation complexity increases when balancing new builds and fleet sustainment needs. Cost escalation risks remain prevalent due to extended development timelines. Financial planning must account for training, infrastructure, and decommissioning obligations. High cost structures also limit flexibility in fleet expansion or rapid capability upgrades. Procurement cycles are heavily influenced by fiscal policy stability and defense budget prioritization. Cost overruns can impact broader defense modernization programs. Long-term funding certainty is essential for program continuity and supplier confidence. Financial risk mitigation strategies increasingly involve phased investments and strategic partnerships. Cost management remains a critical challenge across all submarine programs.

Long development and delivery timelines

Submarine programs inherently involve extended development and construction periods spanning multiple years. Design complexity and customization requirements prolong engineering and validation phases. Supply chain dependencies further contribute to schedule uncertainties. Workforce training timelines add additional constraints to delivery schedules. Regulatory approvals and safety certifications extend overall project duration. These factors collectively impact operational readiness timelines. Extended delivery schedules also affect fleet replacement planning and capability gaps. Delays can increase reliance on aging platforms and interim upgrades. Program management complexity grows with multi-stakeholder involvement. Schedule slippage risks intensify cost pressures and operational uncertainty. Strategic planning increasingly incorporates buffer periods to address timeline variability. Delivery efficiency remains a critical performance indicator for future programs.

Opportunities

Local manufacturing and supply chain localization

Localization initiatives present strong opportunities for expanding domestic industrial participation. Local manufacturing enhances supply security and reduces dependency on external suppliers. Investment in shipbuilding infrastructure supports long-term employment growth. Domestic sourcing improves responsiveness to maintenance and upgrade requirements. Government policies increasingly favor local content and technology transfer. These trends strengthen national industrial resilience. Supply chain localization also fosters innovation through collaboration between defense firms and local suppliers. Knowledge transfer enhances technical capability across multiple tiers. Increased domestic participation supports economic development objectives. Localization initiatives align with broader defense self-reliance strategies. Expanded supplier ecosystems improve long-term sustainability of submarine programs. This opportunity remains central to national defense planning.

Advanced propulsion and stealth technology integration

Technological advancement in propulsion and stealth systems offers significant performance enhancements. Improved acoustic management increases survivability and operational effectiveness. Advanced energy systems extend mission endurance and operational reach. Integration of next-generation materials reduces detectability and maintenance requirements. Research investment continues to focus on propulsion efficiency and noise reduction. Adoption of advanced technologies also enhances interoperability with allied naval forces. Continuous innovation supports capability differentiation in complex maritime environments. Technology integration programs stimulate domestic research and engineering development. Collaboration with international partners accelerates knowledge acquisition. These advancements position the market for sustained long-term growth.

Future Outlook

The Australia submarine market is expected to maintain steady expansion driven by long-term defense commitments and strategic partnerships. Continued focus on fleet modernization and nuclear capability development will shape investment priorities. Industrial participation and workforce development will remain critical enablers. Policy stability and allied cooperation are expected to support sustained market momentum.

Major Players

- BAE Systems

- Lockheed Martin

- Naval Group

- Thyssenkrupp Marine Systems

- Saab Group

- General Dynamics Electric Boat

- Huntington Ingalls Industries

- L3Harris Technologies

- Raytheon Technologies

- Northrop Grumman

- Thales Group

- Leonardo S.p.A.

- Kongsberg Gruppen

- ASC Pty Ltd

- Austal Limited

Key Target Audience

- Royal Australian Navy

- Department of Defence Australia

- Australian Submarine Agency

- Naval shipbuilding contractors

- Defense system integrators

- Maritime technology suppliers

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Market scope, platform categories, and operational parameters were defined through structured defense capability assessment. Key demand indicators and procurement drivers were mapped to current naval strategies.

Step 2: Market Analysis and Construction

Segment-level analysis was conducted using platform deployment trends, program timelines, and industrial participation frameworks. Comparative evaluation supported market structure development.

Step 3: Hypothesis Validation and Expert Consultation

Insights were validated through consultations with defense industry professionals and naval procurement specialists. Assumptions were refined based on operational feasibility and policy alignment.

Step 4: Research Synthesis and Final Output

Findings were consolidated into a coherent market framework. Cross-validation ensured consistency across segments, trends, and strategic outlooks.

- Executive Summary

- Research Methodology (Market Definitions and naval submarine platform scope mapping, Australia-specific fleet segmentation and taxonomy design, bottom-up program-based market sizing and valuation modeling, contract value allocation and lifecycle cost attribution, primary interviews with naval procurement officials and defense contractors, triangulation using defense budgets shipyard data and classified program disclosures, assumptions on build cycles sustainment timelines and capability upgrades)

- Definition and Scope

- Market evolution

- Usage and operational deployment framework

- Defense ecosystem structure

- Supply chain and industrial base structure

- Regulatory and defense procurement environment

- Growth Drivers

Modernization of Royal Australian Navy fleet

AUKUS-driven nuclear submarine acquisition program

Rising Indo-Pacific maritime security concerns

Increased defense budget allocation

Technological advancements in underwater warfare

Expansion of domestic shipbuilding capabilities - Challenges

High capital and lifecycle costs

Long development and delivery timelines

Skilled labor shortages in naval engineering

Technology transfer and sovereignty constraints

Regulatory and environmental compliance complexity

Program execution and schedule risks - Opportunities

Local manufacturing and supply chain localization

Advanced propulsion and stealth technology integration

Expansion of sustainment and MRO services

Strategic defense collaborations and partnerships

Export potential of subsystems and components

Digitalization and autonomous system integration - Trends

Shift toward nuclear-powered submarine platforms

Increased focus on long-range stealth capabilities

Digital combat systems integration

Lifecycle extension and upgrade programs

Greater emphasis on interoperability with allied navies

Growth in simulation and training systems - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Conventional diesel-electric submarines

Nuclear-powered attack submarines

Training and support submarines - By Application (in Value %)

Maritime defense and deterrence

Intelligence surveillance and reconnaissance

Anti-submarine warfare

Sea lane protection

Training and testing - By Technology Architecture (in Value %)

Conventional propulsion systems

Nuclear propulsion systems

Air-independent propulsion systems

Combat management systems

Sonar and sensor suites - By End-Use Industry (in Value %)

Royal Australian Navy

Defense research and testing agencies

Allied joint operations - By Connectivity Type (in Value %)

Satellite communication systems

Underwater acoustic communication

Integrated naval combat networks - By Region (in Value %)

New South Wales

South Australia

Western Australia

Victoria

Other regions

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (fleet capability, contract value, technology depth, local manufacturing presence, lifecycle support strength, R&D investment, strategic partnerships, delivery timelines)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

BAE Systems

Lockheed Martin

Naval Group

Thyssenkrupp Marine Systems

Huntington Ingalls Industries

Saab Group

L3Harris Technologies

Raytheon Technologies

General Dynamics Electric Boat

ASC Pty Ltd

Thales Group

Leonardo S.p.A.

Kongsberg Gruppen

Northrop Grumman

Austal Limited

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035